Digital advertising is a multi-billion dollar industry. Despite all the calamities across the markets, it’s also unlikely to dip any time soon.

As of Q4 2022, the median AdTech company had a gross margin of 64% — a number few other industries can top. At the same time, global digital ad spending is set to increase by 10.5% year over year in 2023 and reach $696 billion.

As a result, players in adjacent sectors, including media and entertainment companies, retailers, and mobile app publishers, are entering the AdTech space. Dissatisfaction with ad measurement accuracy and a lack of transparency in the supply chain have also prompted many publishers to explore building their own proprietary DSPs, leveraging their first-party data for ad targeting and attribution.

At the same time, many players have accumulated massive first-party data stockpiles they feel reluctant to share with AdTech partners. Instead, they are looking for ways to layer ad impressions atop their own data to facilitate ad attribution, measurement, and targeting, which inevitably leads to discussions around demand-side platform (DSP) development.

In this post, we discuss the following:

- The current state of the DSP market and its key players

- Who’s moving forward with new DSP products and features

- The three ways to enter the DSP market as an “outsider”.

The DSP market trends: Evolution beyond AdTech

DSP market size stood at $20.77 billion in 2022 and is set to hit $92.12 billion by 2029. This estimate, however, doesn’t factor in growth driven by new entrants looking to enter the DSP advertising space.

Between retailers and media & entertainment companies, plenty of new players plan to (or already did) diversify into digital advertising.

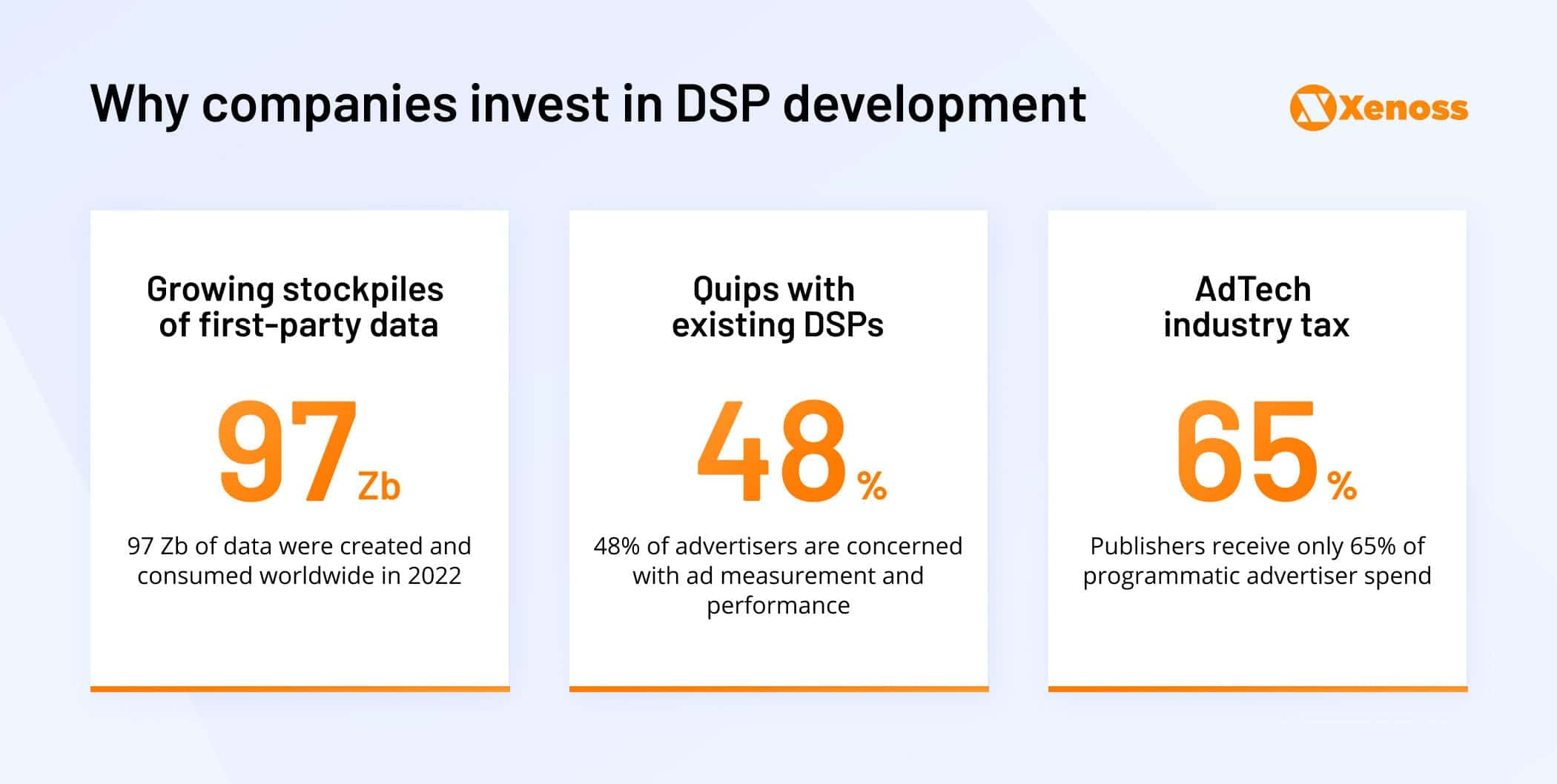

Why companies invest in DSP development

- Growing stockpiles of first-party data

97 Zb of data were created and consumed worldwide in 2022. - Quips with existing DSPs

48% of advertisers are concerned with ad measurement and performance. - AdTech industry tax

Publishers receive only 65% of programmatic advertiser spend.

Players beyond AdTech (retailers, media, gaming, and mobile companies) have accumulated major first-party data reserves. The privacy lobby, paired with ongoing concerns with DSPs/SSPs efficiency, prompts leaders to re-enter the programmatic industry on their own terms — and with an owned DSP.

Existing demand-side platforms (DSPs) also feel the pressure of the cookieless future, especially as new market entrants undercut them with privacy-first infrastructure.

We captured these changes in the DSP market as six upcoming trends related to product development, new channel adoption, and cross-industry partnerships.

Established DSPs pivot to first-party data infrastructure

The digital advertising space is going through a bit of reckoning and is preparing to part ways with the beloved third-party cookies and mobile ad IDs. As a result, DSPs are facing new challenges in maintaining audience targeting at scale. To succeed in this new environment, DSPs need new capabilities that can help them make sense of scattered data and enrich bid requests.

With the old “crutch” soon to be gone, the AdTech industry can build out a better alternative. But what would it be?

Multiple alternatives to third-party cookies are on the platter:

- The Trade Desk, along with other DSP/SSP partners, is building out Unified ID 2.0 (UID2) — a new (and likely better!) cross-platform identifier.

- Amazon accelerated investment in its Marketing Cloud and data clean room solution to help users maximize Amazon DSP performance.

- Google continues to experiment with various third-party cookie alternatives as part of its Privacy Sandbox, such as FLEDGE and Topics API.

Neither option has been mass-accepted (yet), but one thing is certain: It would be based on first-party data — information companies first-handily collect. This transition from “supplied” to “owned” data has given the upper hand to brands, publishers, and retailers, aka entities with large customer data stockpiles. So instead of plugging that data into a third-party DSP, many choose to enter DSP programmatic advertising on their own terms and with their own technology.

However, media owners would need privacy-enhancing technologies to activate this first-party data in different environments while staying privacy compliant. According to Puneet Gangrade, Customer Success Engineer at Habu:

As established DSPs pivot to first-party data infrastructure, it is important to understand the significance of data clean rooms in maintaining privacy compliance. Learn more about data clean rooms and their role in programmatic advertising in our article: “Data clean room: A silver bullet to a post-cookie transition?”.

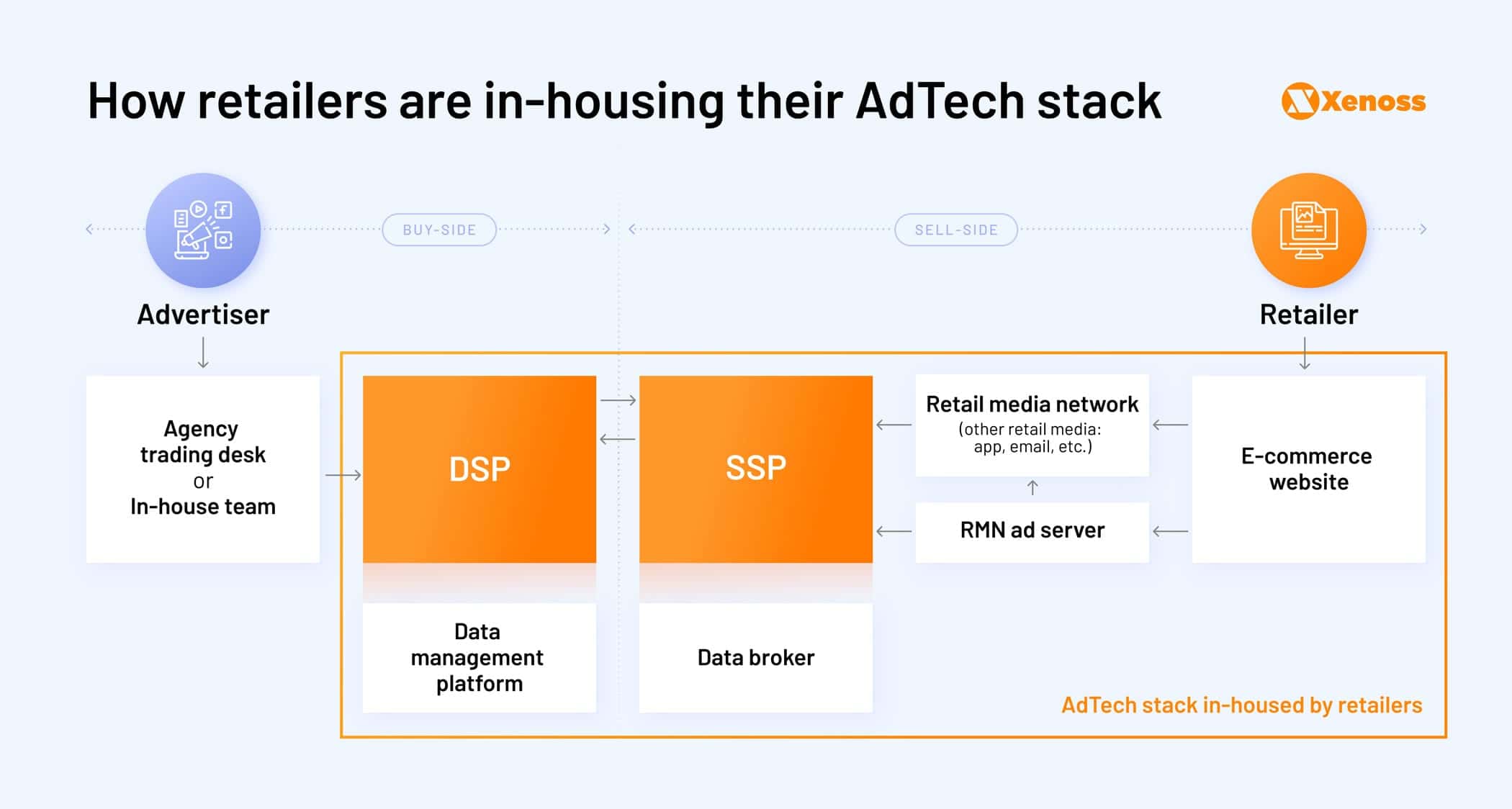

Retailers launch owned ad networks

A DSP advertising company owns a key part of the digital ad purchase process — the buy side. Larger retailers used to sit only on the supply side. They supplied audience data and available ad placement information to a connected supply-side platform (SSP), which then liaised with the connected DSPs to broker a deal.

Now retailers are taking over a bigger chunk of the supply chain.

Since 2020, some 12+ new retail media networks (RMNs) have emerged. Walmart launched a self-serve ad platform in 2020 with basic functionality. In mid-2021, Walmart DSP was presented as the best breed of The Trade Desk AdTech functionality, augmented by Walmart’s first-party omnichannel data. As for the supply-side solutions tech, Walmart acquired the SSP Polymorph Labs and the ad server Thunder. With in-housing the entire ad tech stack, by 2022 Walmart was pulling over $2.1 billion from its ad arm. At present, Walmart’s RMN supports display, search, and in-store ads. The company also plans to push into social media and CTV ads this year.

Lowe’s took a similar route. The retailer launched its Roof Media Network (together with Criteo and CitrusAds) in late 2021 to pitch data-based consumer insights and customizable ad products to media buyers. The company also allowed brands to leverage its first-party data to target users outside of owned properties. In 2022, the retailer integrated Yahoo’s DSP and identity solution (Yahoo ConnectID) to enter new channels like CTV and digital out-of-home (DOOH) ads.

Yet, in January 2023, Lowe’s decided to pull its network in-house, likely to deepen its existing connections with advertisers and eliminate AdTech partners from revenue sharing.

Many brands originally launched their RMNs on the partner’s infrastructure, which allowed fast time-to-market. Yet, operating in tandem often poses limitations in feature customization, requires (perhaps inequitable) revenue share, and comes with a high operating bill.

Established retailers appear to be ready to give up the “crutches”, offered by AdTech vendors, and pursue independent DSP development. As spending on retail media advertising is set to grow by 2X-3X in the next two years, that’s a logical move.

That said, retail media advertising is a complex space with technical issues to overcome. Namely, siloed first-party data, customer privacy concerns, and well-familiar with AdTech company’s issues with cross-channel ad attribution and measurement.

The growing pains for brands with retail media is that there is limited supply making CPMs expensive, lack of transparency on the mark-ups of the media, lack of self-serve capabilities, lack of real-time reporting, lack of standardization across retailers (ad formats, how to buy, reporting metrics), and lack of transparency on whether the media is driving incremental sales

Rachel Tipograph, founder and CEO of MikMak

Media buyers want better ad-buying experiences. Retailers who’d be able to deliver such will capture a bigger share of the growing ad budgets.

Brand-led DSPs for in-game advertising

In-game advertising is another high-growth ad channel. The Trade Desk DSP expects to pocket an extra $100 million from its newly set video game advertising division. Omnicom Media Group and Publicis also presented new gaming offers.

Yet bigger growth will be orchestrated by game publishers. Azerion and Activision Blizzard already operate owned ad networks, along with a slew of other innovative in-game advertising companies.

Microsoft, in turn, is said to be building an ad solution for Xbox to sell in-game ads in free-to-play Xbox titles. Sony is reportedly also considering in-game ad placements like virtual billboards and rewarded video ads for PlayStation games. Roblox, in turn, already went public with its plans to launch “immersive” ads on its game-building platform.

At the same time, new DSP platforms emerge to cater exclusively to in-game advertising. At the end of November 2022, iion, a mobile ad exchange platform, launched Immersion — a self-serve game audience targeting platform with advanced campaign builders.

Engagement levels with in-game ads hoover at higher averages than other forms of digital ads. Per the Entertainment Software Association, 41% of gamers pay attention to ads in mobile games vs 17% for display web advertising. In-game ads can also be better personalized, using first-party gamers’ data that big publishers have aplenty. DSP development allows gaming companies to monetize their audiences on their own terms, brokered with advertisers directly.

Mobile is the next DSP frontier

In 2022, mobile advertising spending reached a record of $327.1 billion worldwide. In-game advertising contributed a lot to this figure, of course — and will continue to do so. So new DSP companies were soon to occupy the growing market segment.

Dataseat (now part of Verve Group), for instance, pioneered a mobile-first DSP based on first-party data. The solution, developed by Xenoss, includes a lightweight advertising SDK and ad bidder, which allows advertisers to get full access to data and train custom bidding algorithms for standard, retargeting, and cross-promotion campaigns.

On the other hand, publishers are looking for ways to improve their mobile game monetization strategies and broker direct deals with advertisers. For instance, Voodoo, a leading mobile publisher and Xenoss client, has been building out its in-house AdTech stack via acquisitions (Bidshake), custom DSP development, and strategic partnerships with other players (Storms, Mobile Premier League (MPL), Electric Manta, etc).

Finally, mobile OS and device manufacturers are also sizing up the AdTech market. In 2021, HUAWEI launched its Petal Ads ecosystem — a dual SSP/DSP offering with real-time bidding. The platform includes a separate monetization tool for app publishers, distributing products via AppGallery.

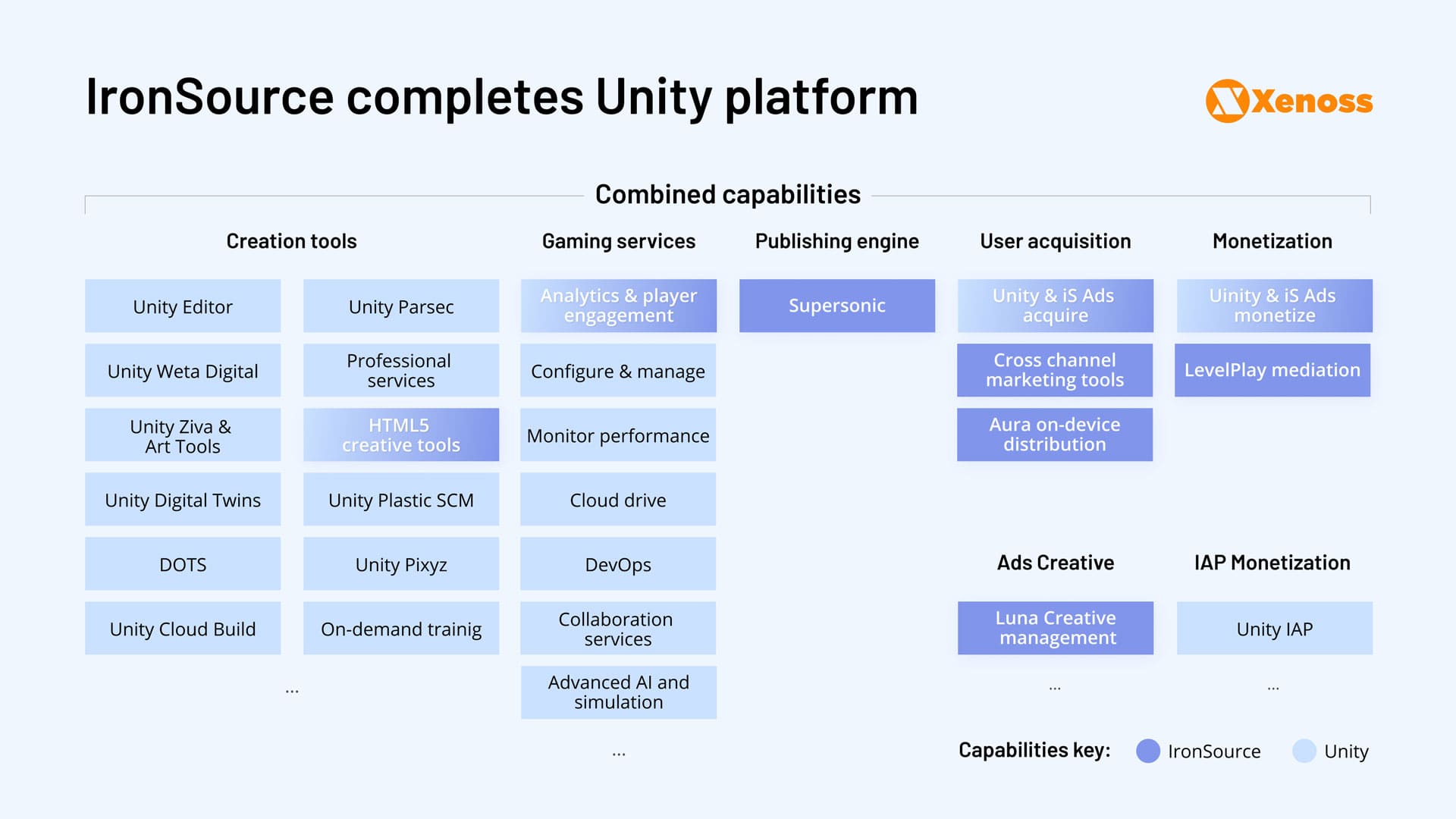

Unity, the world’s leading game engine, has entered into a strategic partnership with IronSource, a mobile monetization and marketing platform, to create a more integrated mobile in-app ecosystem. The partnership aims to combine the strengths of both companies, with Unity providing the game engine and IronSource offering its advanced monetization and user acquisition tools.

Furthermore, the partnership between Unity and IronSource could have an impact on the mobile DSP market, as it presents an opportunity for the companies to develop a proprietary demand-side platform for in-app advertising. This would enable Unity and IronSource to have more control over the advertising ecosystem and could lead to increased competition with existing DSPs.

Apple is rumored to be building a demand side platform, which would “deliver advertising auctions to match supply (customers) with demand (advertisers), focusing on technical components including Campaign Management, Bidding, Incrementality, Dynamic Creative Optimization, Matching, Auctions, and Experimentation”. Though the company remains tight-lipped on any further comments.

Android users in the APAC region already get pitched with ads on the locked screens. The new ad placement may be coming to the US this year. This indicates that Google will likely continue to monetize its OS with every means available.

The ATT framework and upcoming cookie deprecation on Android curtail access to mobile data. Yet, alternative solutions are already in the works. Mobile media and gaming companies can profit from available first-party audience data by inviting buyers to transact with them directly via an owned DSP. New AdTech market entrants, in turn, can create a better ecosystem for exchanging first-party insights between all the ad chain players.

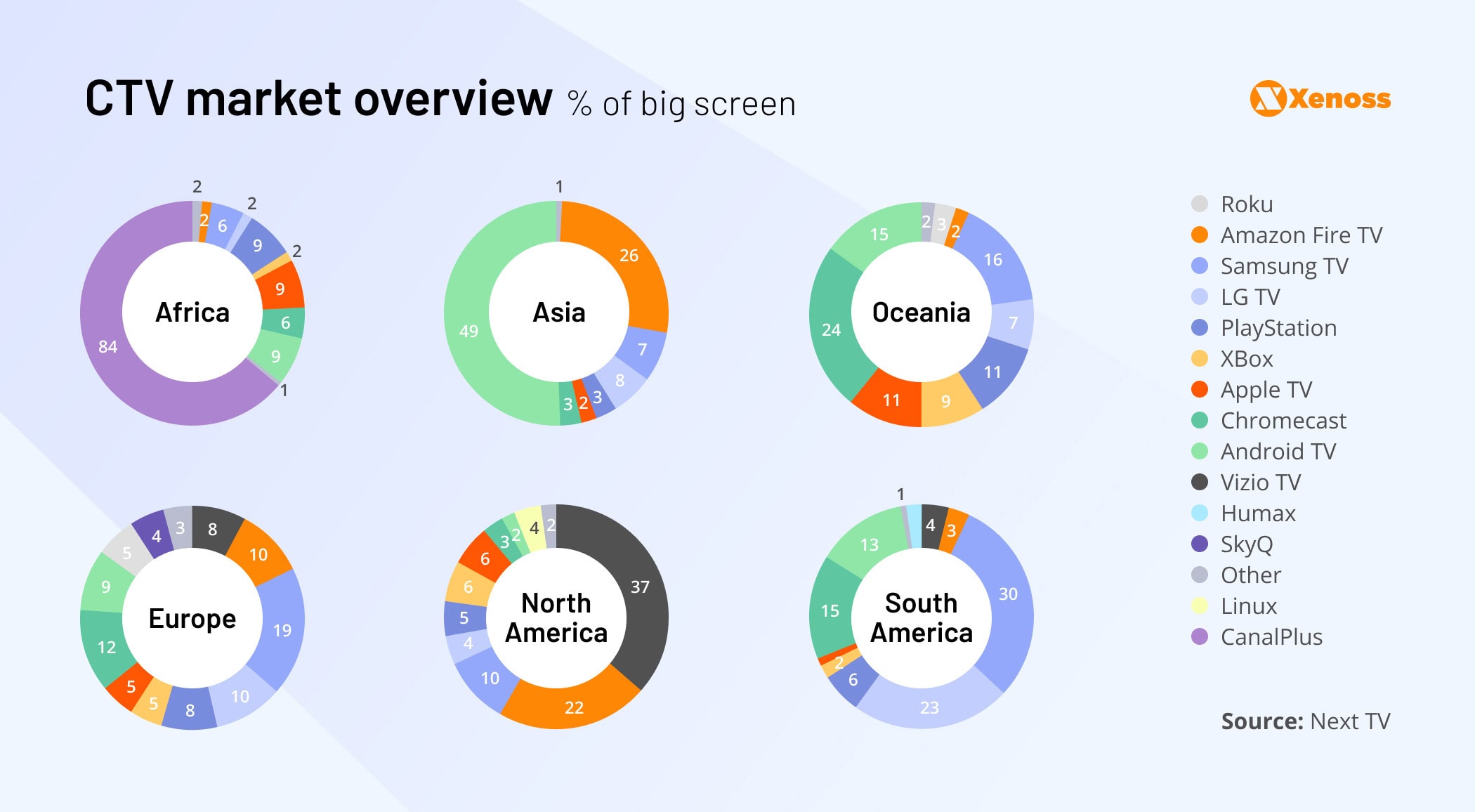

Programmatic DSPs emerge in CTV space

Spending on CTV ads surged around 2020 (proportionally to the viewership rates) and is expected to grow further by 23% globally in 2023.

The data isn’t surprising, given how many “big names” now stomp the CTV ad grounds.

Google gave its former Android TV platform a major lift, plus released new CTV ad features like Audience guarantees based on Nielsen Digital Ad Ratings (DAR). Google DV360 users can also bring first-party data (via Ad Data Hub) for CTV targeting.

Samsung launched a DSP platform in 2020. It provides advertisers with proprietary data from 45 million households and the opportunity to programmatically bid for video inventory across linear TV, CTV, and mobile/desktop.

Netflix has already launched an ad-supported tier in several regions and is now busy building its advertising arm, together with Microsoft/Xandr as a tech partner. Xandr is a long-standing leader in the DSP/SSP space — and provides the technology both players need to deliver programmatic brand-safe advertising with the right frequency caps.

Roku, in turn, runs OneView — a proprietary demand-side platform powered by first-party insights from Roku Audiences. The wider Roku ad ecosystem is powered by a device graph for ad measurement and deduplication (via dataxu acquisition), as well as the recent acquisition of Nielsen’s Advanced Video Advertising unit. Roku is also building a proprietary data clean room solution for CTV, which should address the “messy measurement” problem plaguing the industry.

CTV measurement is complex due to TV OS market fragmentation, as well as technical factors like:

- Lack of common cross-platform identifiers

- Multiple measurement methodologies

- Complex device ID process

- High rates of CTV ad fraud (resulting from the above)

Many players are overcoming this with custom CTV advertising platform development, as well as the adoption of a multi-DSP model.

Big players like Amazon and Roku push for their own bidders, Media & entertainment companies (which supply them with content), as well as new AdTech companies, circumnavigate this constraint by connecting multiple DSPs to their setup. Since not all DSPs can access the same inventory or use the same audience data from the OS, savvier players pitch media buyers with an option to shop across multiple CTV DSPs and coordinate campaign types across bidders.

Digital audio DSPs pick up growth

Just like video, audio content consumption is on the rise, with more listeners tuning in via the Internet. In 2022, 3 out of 4 Internet users listened to digital audio content every month (76.3%).

A growing user base attracts bigger media budgets. Podcast advertising revenues in the US reached $2 billion in 2022 and are expected to almost triple by 2024 to over $4 billion.

To capitalize on the growth momentum, audio media owners are looking to bring more programmatic buying into the domain.

Spotify runs one of the most advanced programmatic ad marketplaces (Spotify Audience Network) with competitive features for demographic-based targeting (based on age, gender, and location), behavioural targeting, and contextual targeting.

Similar to emerging contextual targeting in CTV, audio contextual ads can be played during episodes covering particular topics (personal finance, sports regimes, or marketing). Spotify employs AI-based transcription technology to analyze the language, sentiment, and context of the audio conversations. Then pitch optimal ad placements to buyers.

As of Q3 2022, Spotify earned over €385 million from ads (equivalent to 13% of its total revenue ).

Other players are also eyeing up the audio domain. iHeart, an Internet radio network, launched a self-service audio advertising platform in 2022. iHeart AdBuilder offers inventory from the iHeartRadio database and several other publishers across streaming and podcasting.

Basis Technologies (former Centro) incorporated programmatic audio into its DSP in 2019. Google made audio ads available to all advertisers in 2022. SmartyAds — a full-stack programmatic platform — added programmatic audio buying to its roster of channels at the beginning of 2022.

Many media companies already have a selection of audio content. Yet few are fully profiting from it. By developing a custom DSP with competitive features for IP-based, location-based, contextual, and first-party data-based targeting, audio owners can attract more eager buyers, looking to spend extra on premium inventory.

Entering the DSP market vertical: Three options

Ownership of the DSP side of the AdTech chain shifts the industry balance. By taking stock of the bidding and campaign planning side, operators can gain control over the underlying technology (bidder, ad trackers, analytics) and processed data (first-party owned and partner-supplied audience insights).

Meanwhile, brands can cut the “AdTech tax” — often an unattributable commission collected by parties involved in programmatic ad sales. In some cases, DSPs and SSPs can devour up to 98% of a media buyer’s bid.

Lastly, your company gets into the driver’s seat of product development. You get to decide on the next feature development (based on the users’ feedback) and venture out into adjacent niches — be it contextual ads or in-gaming ads.

New market entrants have three options to enter the DSP space:

- White-label a third-party solution

- Purchase and integrate a DSP

- Build a custom demand-side platform

DSP white-labeling

A white-label deal means that you license the necessary technologies from another DSP advertising company and operate it as your own product. Infrastructure suppliers allow extensive interface customizations to match your brand, as well as extra feature development.

White-label DSP deals are common. Best Buy opted for Criteo’s new DSP to enable programmatic ad buying. Walmart chose to customize The Trade Desk DSP, and countless other alliances. Game publisher Azerion partnered with MediaMath to launch an AAA gaming marketplace.

“Leasing” instead of building a DSP has its advantages but also a list of shortcomings.

Pros

- Fast time-to-market

- Lower development costs

- On-brand user experience

- Access to pre-existing integrations

- Exclusive data deals with the provider

Cons

- Vendor lock-in and high dependency

- No ownership over source code

- Limited scalability potential

- Low control over the product roadmap

DSP acquisition & integration

Buying up an existing DSP platform and integrating it into your ecosystem is another common route. Independent small-scale DSPs face mounting operating costs while losing the market share. Industry “outsiders”, in turn, see the acquisition as a faster route to acquiring the tech and the expertise they need to enter the programmatic space.

So M&A activity remained strong in 2022 (despite all the market calamities). Back in 2010, Google bought Invite Media to get its demand-side capabilities (and snatched Admeld the next year to get the SSP stack). Amazon bought Sizmek ad server in 2019 to double down on its AdTech market expansion.

Microsoft bought Xandr in 2021 to gain access to its first-party data-centred buying platform (and is almost done buying Activision Blizzard with its in-game advertising arm). AdTech platform Index Exchange acquired Rivr — a startup offering AI-driven tools for bidding optimization.

The acquisition route assumes that you’re good on cash and have the expertise to integrate the purchased technology into your stack to get tangible ROI.

Pros

- Knowledge transfer

- Full intellectual property (IP) rights

- Growth through economies of scale

- Protection against market share erosion

Cons

- Potentially high acquisition costs

- Legal and compliance hurdles

- Integration challenges

- Relatively slow time-to-market

Custom DSP development

Building your own DSP is the third path. Some view it as a longer one, but it isn’t always the case. With Xenoss’ help, Dataseat launched an MVP version of its mobile DSP in 14 weeks. Another client of ours, Venatus released a high-load in-game advertising platform in just 4 months. Video Intelligence launched an MVP version of its DSP for its global video-on-demand service in 7 months and did the full release in 11 months total.

Their secret? Utilizing Xenoss’ multi-year experience with DSP development. Our AdTech engineering teams not only know the blocks of building robust AdTech from the ground up. We actually create them. Having worked with the most innovative AdTech startups, we have created our own modular low-code framework of AdTech system components.

New entrants can launch product MVPs or add new competitive features to existing AdTech platforms twice as fast as by starting from scratch with our framework. At the same time, you retain full IP rights over the final product, as well as the source code. Think of it as your SaaS website builder, but for AdTech and without any limits on customization or functionality.

To fully understand the advantages of component-based development over white-label and custom development, we invite you to read our in-depth analysis in our article “Why You shouldn’t use white label for AdTech development”. In the article, we break down the differences between these approaches and explore the benefits of component-based development for businesses looking to build a more flexible and scalable AdTech solution.

Pros

- Complete customization

- Proactive product development

- Unique features for market differentiation

- Full control over data management and processing

- Native Integration with other products in your ecosystem

Cons

- Higher initial investment into supporting infrastructure

- Slower time-to-market (unless you go with Xenoss)

- Relationship brokering with industry partners

Conclusion

Just like ads have become sweepingly present across every channel, ad revenues will soon become a “standard” line in the companies’ P&L statements. With ample user data reserves, strong data processing infrastructure, and supply-side technologies, players from adjacent industries are already halfway to capturing the remainder of the AdTech chain (and the revenues it generates).

Even better news? DSP development is no longer a several-year-long, multi-billion dollar affair. With the right tech partner, you can set up all the necessary infrastructure for operating an advertising business in a matter of months.

At Xenoss, we’d be glad to walk you through your options for launching a DSP and provide a preliminary timeline for an MVP launch. Contact us.