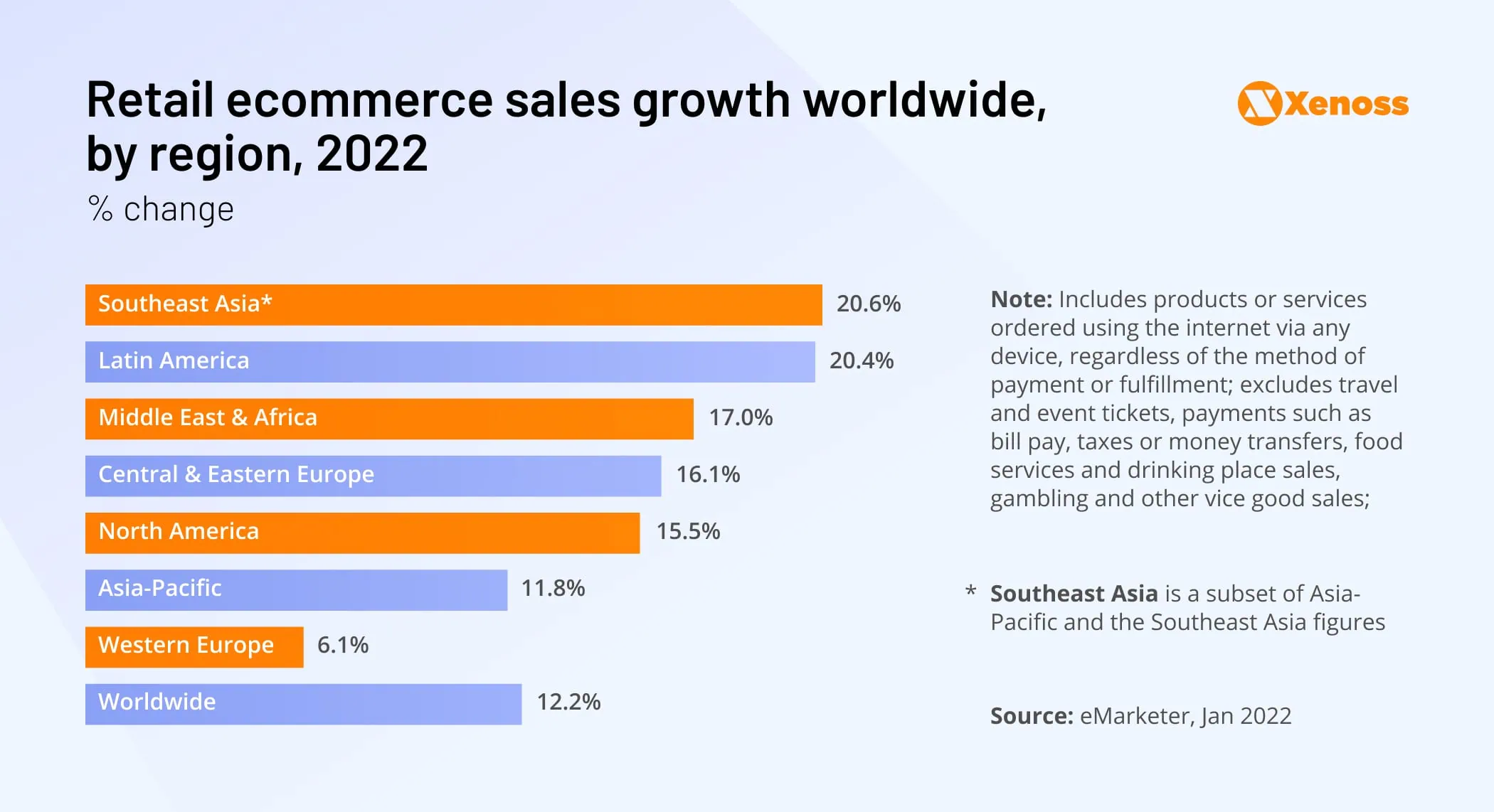

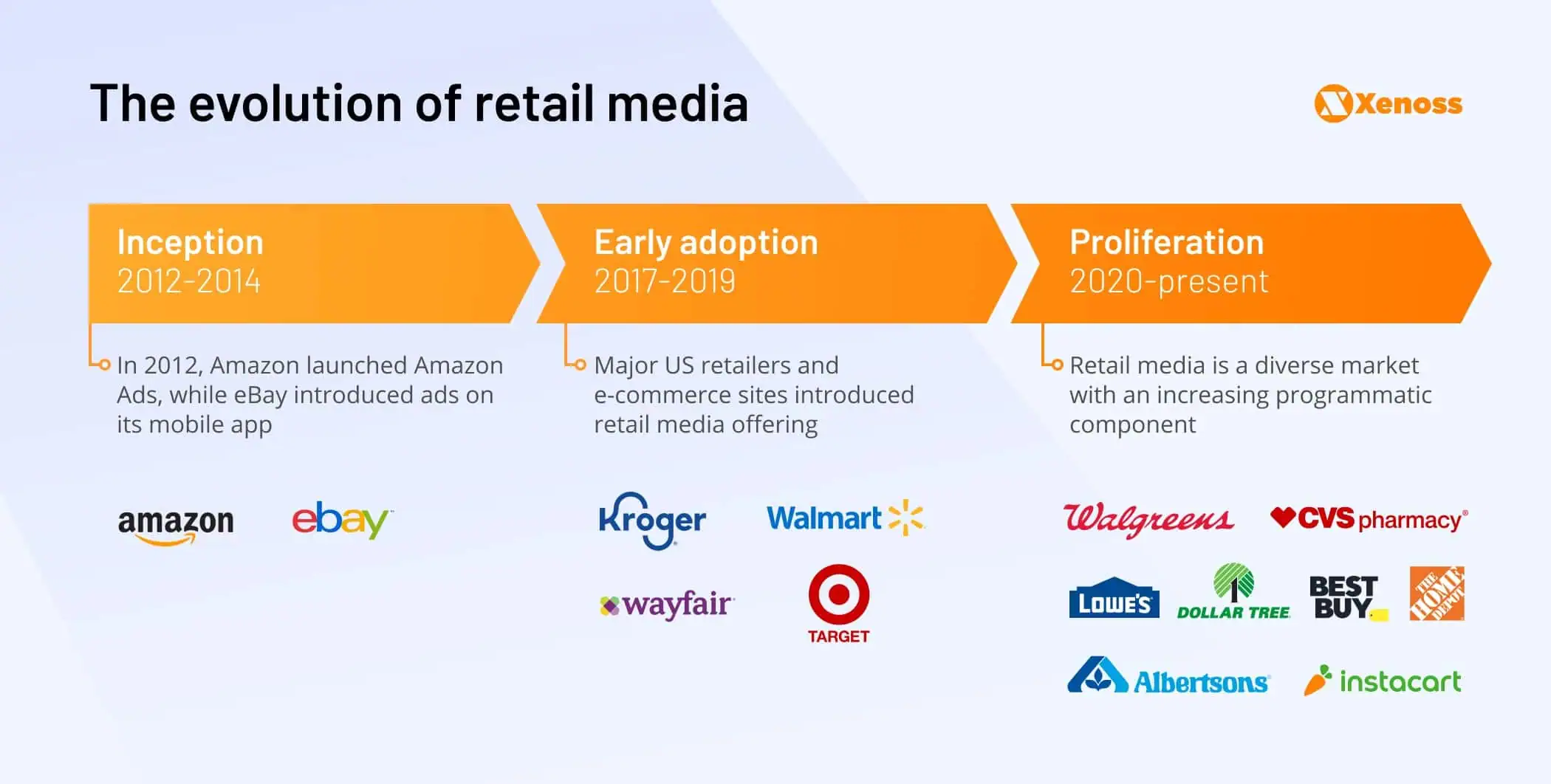

Retail shopping is increasingly migrating to digital. Ecommerce sales are surging worldwide, and with the advances in the delivery service, it now encompasses any possible product category from electronics to groceries and quickly perishable goods.

With this shift in shopper habits, e-retail sites are becoming the main gateway for brand advertising, providing the opportunity to reach customers at the point of sale. In light of the new privacy policies, which crash existing segmentation and retention scenarios, it is not just a new potent advertising channel but a necessity for many brands.

With the phase-out of cookies and depreciation of MAIDs, it will be harder for digital ad platforms to determine what actions a consumer takes after seeing an ad. Retail media, on the contrary, have the unique advantage of offering closed-loop marketing that directly ties ad spending to digital sales. The retail media networks are a critical part of the post-cookie digital advertising landscape. eMarketer predicts that US Retail Media Networks will exceed $52 billion in ad sales by 2023.

However, most of the retail media have rudimentary advertising capabilities, and to seize the benefits of the moment, retail needs to promptly breach the technological gap. Retail media M&A soared 50% in the last two years, showing the demand for AdTech companies that help merchants sell on third-party marketplaces.

Transformation of the scattered retail media properties into the full-blown retail media networks and connecting them to the programmatic marketplace is the new frontier for AdTech.

In our guide we will cover:

- what retail media advertising is

- what a retail media network is

- how the changes in the privacy landscape benefit retail media networks

- how retail media network functions

- market overview of retail media networks

- programmatic adoption among retail media networks

- benefits of retail media networks

- challenges of building retail media networks

- best practices for building retail media networks

What is retail media advertising?

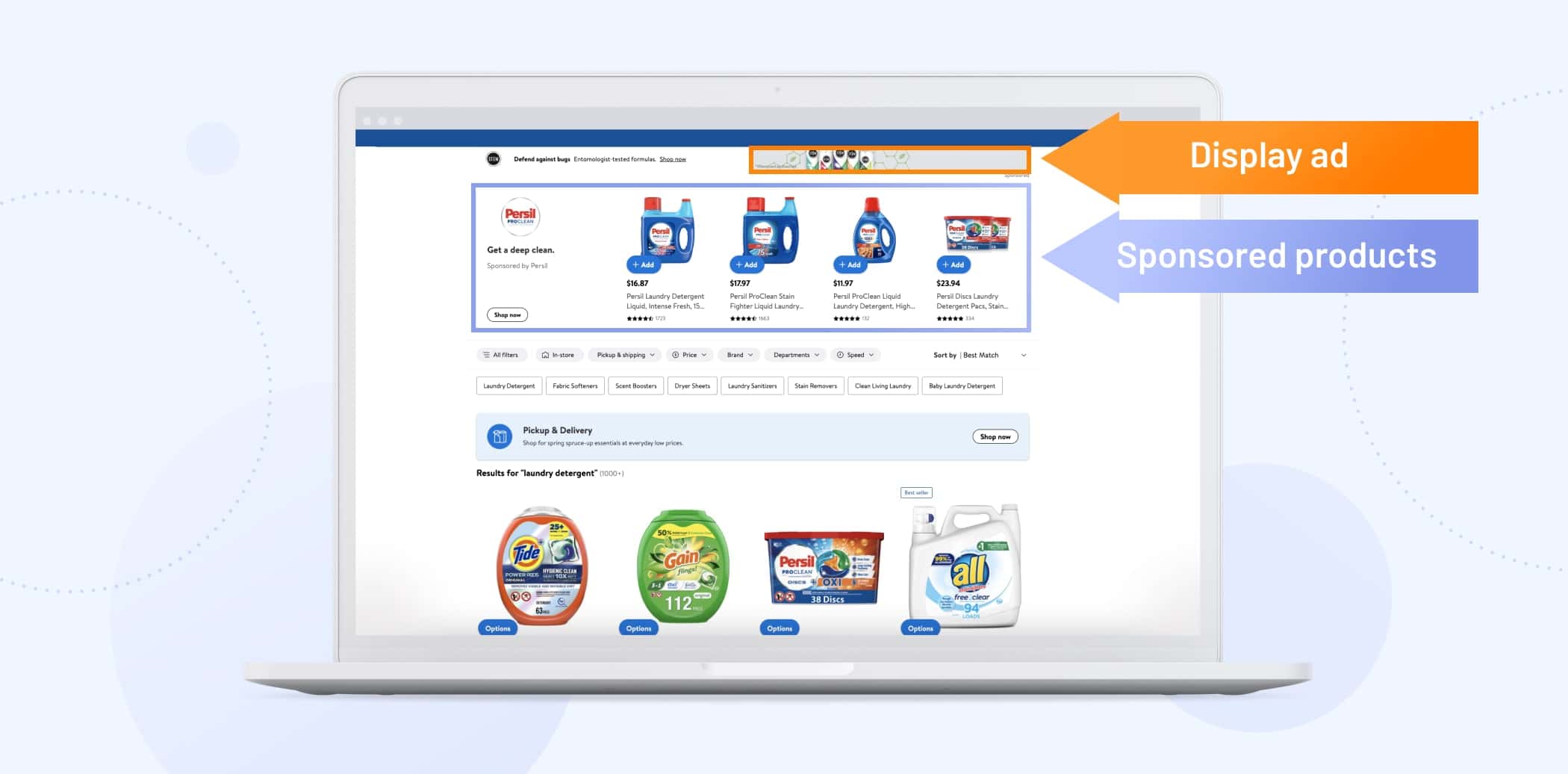

Retail media advertising is a form of promotion on the media inventory of the retailer, with advertisers paying a platform or marketplace to showcase their products at or near the point of sale. Let’s see how it looks.

Here’s an example from the Walmart search page. Here you can notice two types of retail media advertising before you even get to your search query, a banner for bug spray and a sponsored product listing by Persil. Walmart disclosed that its ad network had sold $2.1 billion in ads in 2021, a timely transition for this mostly brick-and-mortar retail giant.

There are mainly two types of retail media advertising, let’s review each of them.

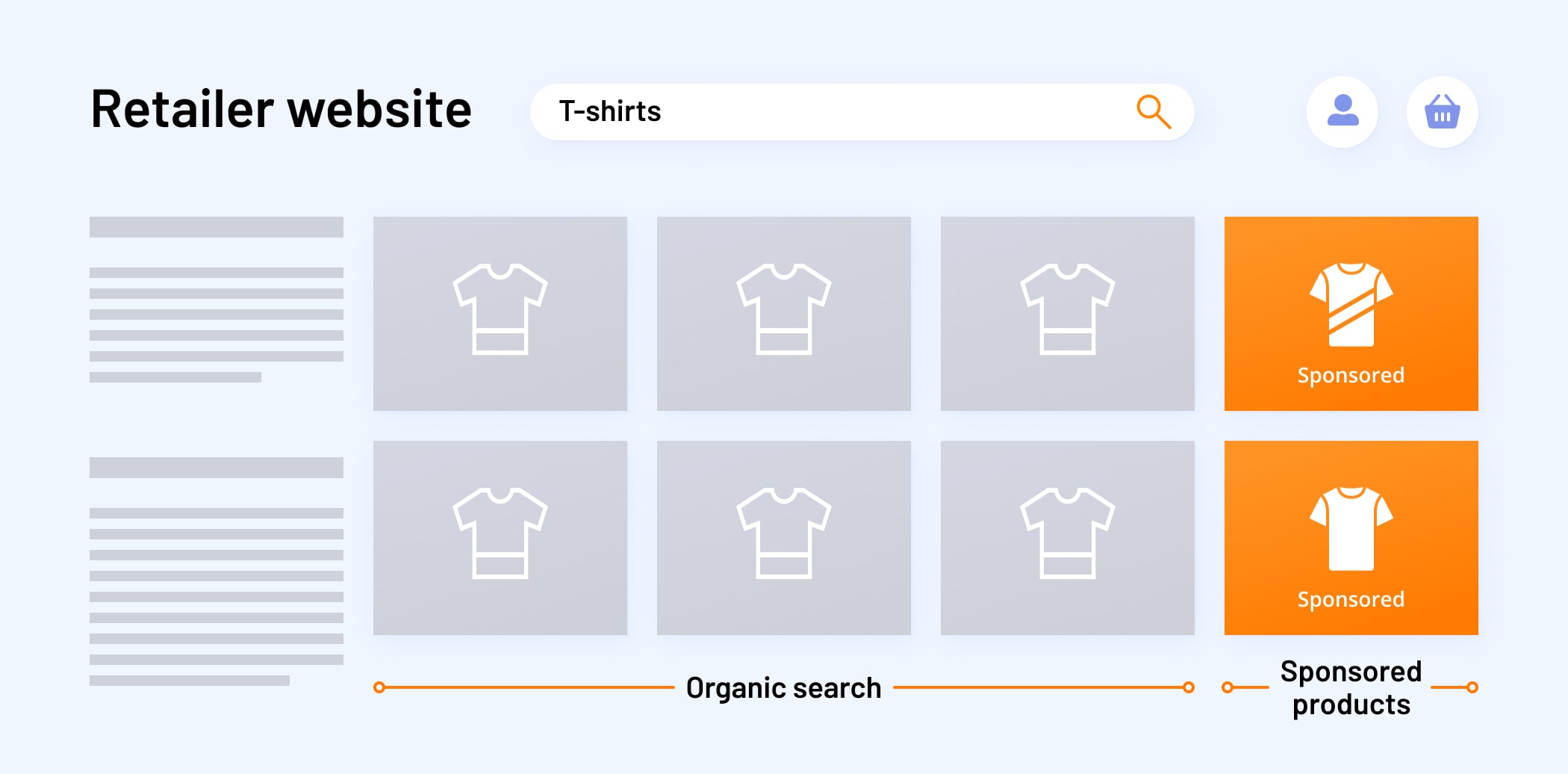

Sponsored products

Sponsored products are the main form of retail media advertising. Native ads are the ones that usually appear organically among search results and match retailer sites or apps. These ads are displayed when the shopper searches using similar terms. Different retailers have different relevance criteria for organic and sponsored products and can deliver different search results.

Sponsored product is a lower-funnel marketing activity directed at grabbing the attention of the customer and driving conversation. It can be placed on a variety of pages on the retailer’s site, including:

- search results pages

- homepages

- product detail pages

Sponsored products are assembled from the existing listings in the retailer catalog and do not require a separate creative asset.

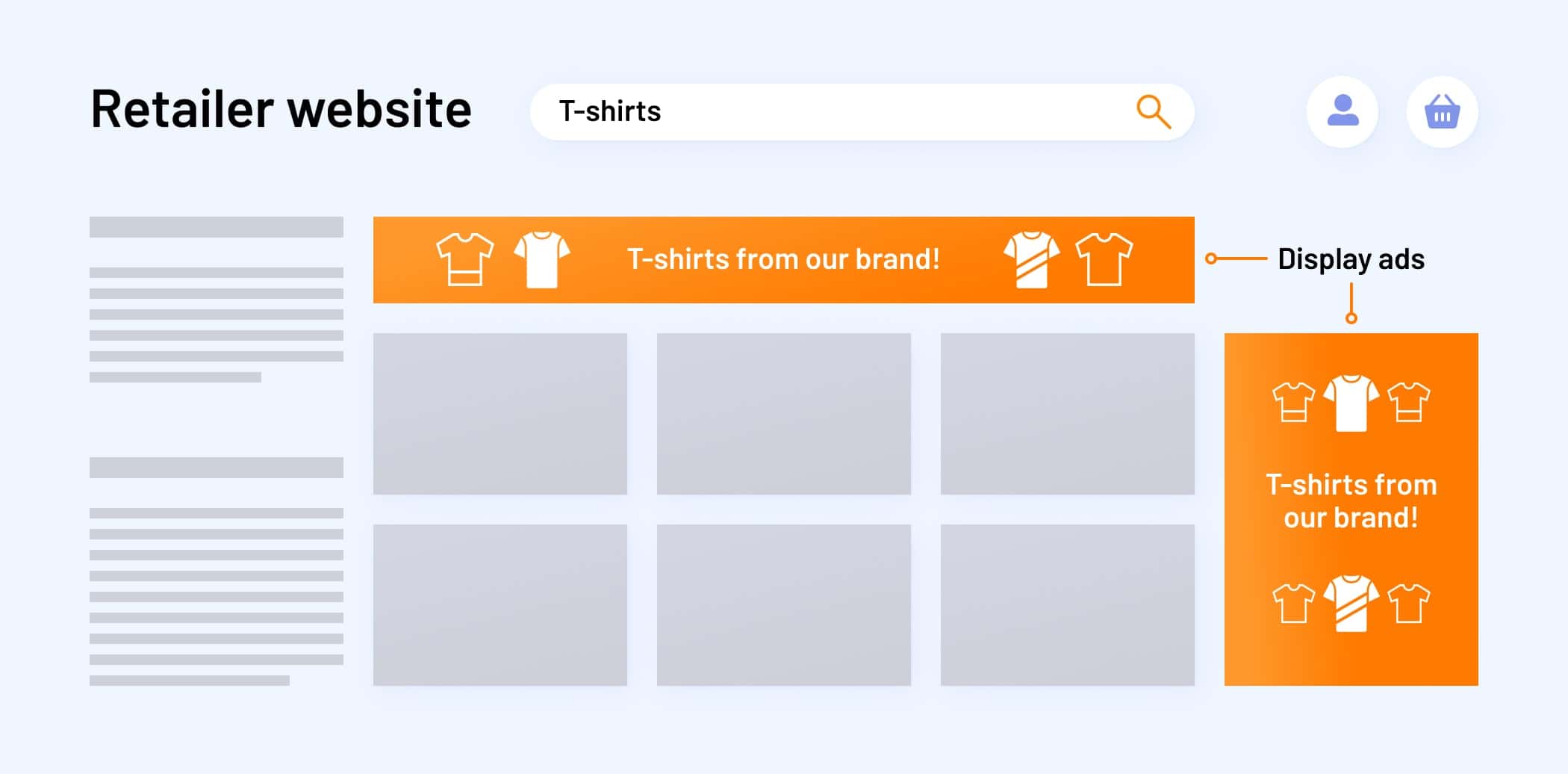

Onsite display

The onsite display is another form of retail media advertising. This ad type resembles traditional display advertising formats but is placed on the retailer’s site, instead of a third-party publisher’s.

Those ads are usually placed in highly visible areas, at the top of the search query, or even on the retailer’s home page, or products detail page.

The onsite display is the mid-funnel marketing technique aimed at raising awareness about the product and gaining shopper consideration during browsing.

Offsite display

A retail media network can also run ads outside of the retailer’s website or “offsite.” While browsing a publisher site or the open web, customers can see an ad for the product they recently browsed on the retailer platform. It is an upper-funnel tactic used to steer shoppers who have left the retailer platform back to the website to make a purchase.

This technology, also known as Offsite Audience Extension, was previously based on cookie syncing, but the retail media industry is developing solutions without cookies, for instance, CORE ID by Epsilon that identifies users based on deterministic first-party data elements. These technologies open immense opportunities for retailers allowing them to monetize shopper audiences by enabling brands to target them offsite. With their wealth of first-party data, retail media networks will become the leading power brokers in the post-cookie world.

What is a retail media network?

A retail media network is a unified ecosystem the retailer set up to let brands advertise on their website, app, email distribution, and other digital properties. In a nutshell, it is the digital version of in-store advertising and can have a variety of formats that allow advertisers to hit the shopper with the right message at every point of the buyer’s journey from product consideration to the point of sale.

This type of promotion is not entirely new for wholesale advertisers, who learned a long time ago that shelf placement affects purchasing decisions. They always accommodated merchandising fees and shopper marketing in their ad budgets, and now they are smoothly transitioning to spending on retail media networks. And this ad spending is turning up to be even more beneficial since, with first-party purchase-based data, retail media networks provide better opportunities to analyze attribution and ROI.

How the changes in the privacy landscape benefit retail media networks

With the tightening of data privacy regulations, the advertising data landscape is going through a paradigm shift. New privacy policies are undermining the two pillars of third-party data targeting – Google and Facebook.

The sheer size and scale of Facebook and Google granted them the perks of the hub-and-spoke model. They operated as data warehouses of behavioral signals, which they converted into targetable audience segments with a clear feedback loop built on the engagement data.

However, the hub-and-spoke model is swiftly turning obsolete, opening a window of opportunity for any owner of a sufficient amount of first-party data to create advertising solutions with targeting in the native environment.

Facebook’s ability to observe those types of purchases is being diminished. Many of the companies that previously transmitted their purchase data to Facebook and other ad platforms very enthusiastically are determining that their data can now be used to power a proprietary ad network.

Eric Benjamin Seufert, Media Strategist at Mobile Dev Demo

Retail websites and apps are in a unique position here. They can take advantage of their user profiles and provide incredibly relevant and actionable targeting for brands in various product categories. With the abundant supply of first-party consumer data, they can build advertising networks that can stand competition with the walled gardens that are swiftly losing their efficiency.

How a retail media network operates

A lot of retail media networks work as closed-loop ecosystems; e-commerce sites provide their advertising partners or agencies they contracted with a self-serve interface to place ads only on their inventory.

However, retail media networks increasingly employ a programmatic approach, where retail media inventory is connected to off-site properties and third-party media for the omnichannel reach in retail campaigns.

For instance, Walmart recently partnered with the Trade Desk to launch its own DSP, allowing its advertisers to serve ads on the programmatic inventory in addition to its retail media placements.

Instead of creating a proprietary network, other retailers partner with existing retail media solutions that group the inventory of different retailers to provide an extensive reach for brands and advertisers.

Similar to programmatic, retail media advertisers use a DSP where they choose the retailer they want to run media on, the products they want to promote, and their budget. Since all activity occurs on a retailer’s site or using a retailer’s data, advertisers can now directly tie spending on their DSP to revenue from a retailer.

Often retail media networks will create a platform dedicated to their retailer partners (a lot like SSP). It reports back the results of the served campaigns, from sales achieved through retail media to the number of ads shown to shoppers over a specific period. This platform consolidates the data and conveys it back to retailers to control yield and ad experience.

Retail media networks overview

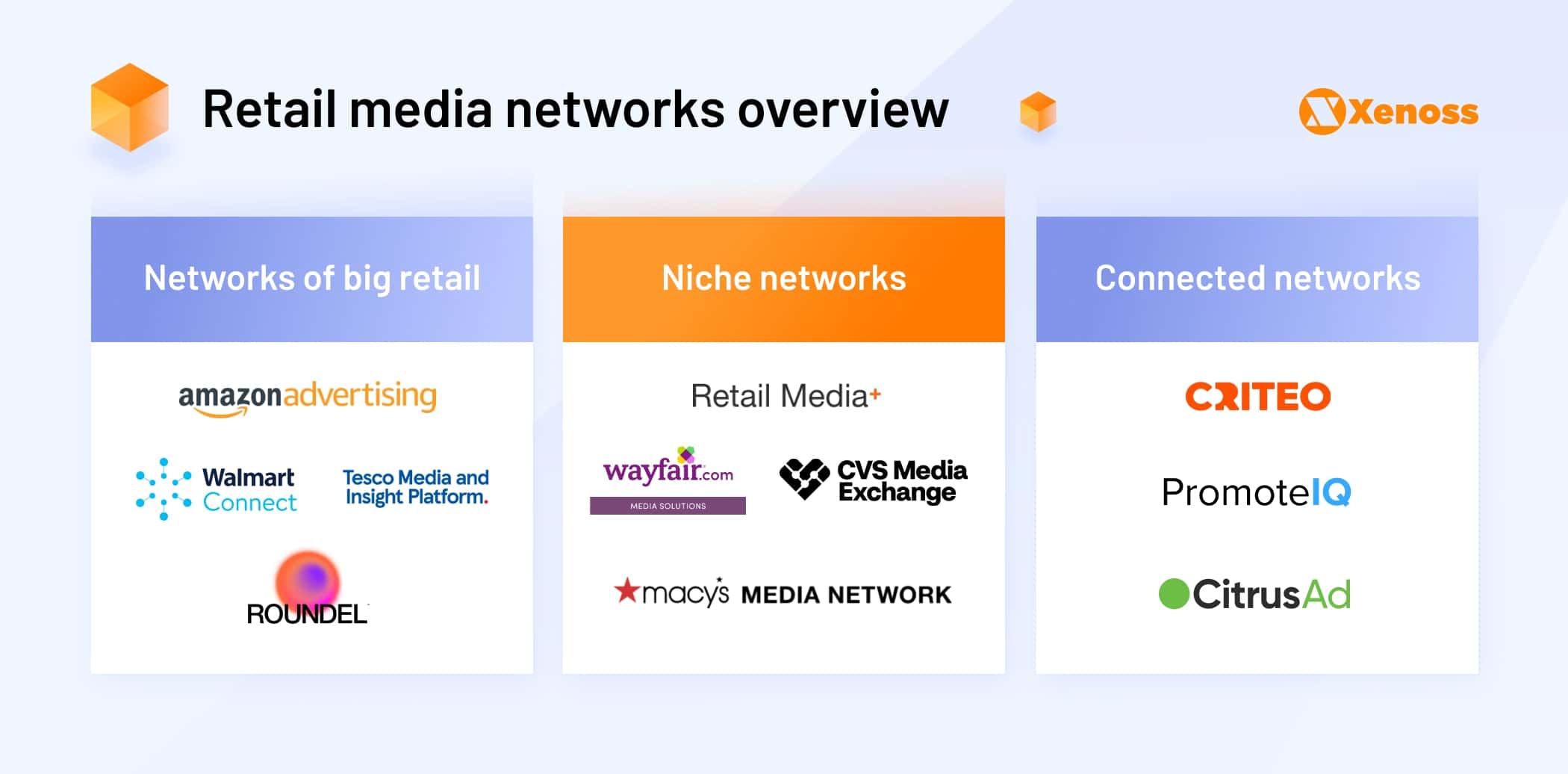

There is a significant proliferation of retail media networks, all the major retailers in the Tier 1 countries have already launched some forms of the retail media business. There are retail media networks of major retailers, specialized niche retail media networks that cater to advertisers of specific product categories, and connected retail media networks – AdTech platforms that consolidate inventory from several retailers and provide advertisers with a unified dashboard for targeting. We’re going to have a closer look at all three.

Proprietary media networks of big retail

Retail media networks of the major retail companies provide advertising capabilities for the vast pool of advertisers from wholesale to electroniсs.

Retail and ecommerce giant Amazon is one of the first companies to acknowledge the power of retail media networks and added an ad business called Amazon Ads to its portfolio. A lot of retail media businesses followed the Amazon Ads business model. Amazon advertising provides access to one of the most extensive sets of consumer data and a massive audience of over 200 million users just in the US.

Despite its relatively recent foray into the retail media industry, Walmart is already rivaling Amazon in advertising revenue. With 100 million unique visitors to its site, Walmart offers a range of ads on its own properties, which you can pair with the onsite ads in its physical store, and with the launch of its DSP with the ads on a variety of third-party inventory.

The third-largest retail company with a stronghold in the European market rolled out its retail media offering, called “Tesco Media and Insight” at the end of last year. Brands on the platform can utilize data from Tesco’s loyalty scheme Clubcard to target customers. Twenty million households in the UK have Club cards, providing a wealth of data for advertisers.

Formerly known as Target Media Network, Roundel is Target’s rebranded retail media platform. Over a thousand advertising partners use Roundel to reach out to the Target consumer base, which can boast 30 million unique site visitors a week. It is used by big-name brands like Unilever, Coca-Cola, Disney, and Microsoft.

Niche retail media networks

Another pocket of growth in the retail media industry is known as niche networks, ad business retailers dedicated to a specific product offering, like home appliances, apparel, or cosmetics. They can provide more in-depth customer profiles to the advertiser in their product category and narrower audience segments.

Two years ago, Home Depot, a renowned DIY/home improvement chain, launched its advertising network Retail Media+. To capitalize on its wealth of first-party data, Home Depot offers brands that sell in its offline store to purchase ad placements on its website and social media channels.

Wayfair is an eCommerce company focusing on furniture and home goods. They launched a retail media network a couple of years back called Wayfair Media Solutions. Through a self-service interface, advertisers can bid to promote SKUs in a particular category on this platform. The primary pricing model is pay-per-click.

CVS retail media network, originally known as the Consumer Value Store, after a serious revamp and rebranding as CVS Media Exchange (CMX), became a major staple in pharmaceutical advertising. CVS is the biggest pharmacy chain in the US, with more than 10,000 locations nationwide and a robust loyalty program that allows it to accumulate a massive data bank of first-party consumer data.

Macy’s is one of the oldest and largest department stores in the US, specializing primarily in apparel, furniture, cookware, dishes, and small appliances. It recently became one of the most successful omnichannel retailers.

Macy’s Media Network was released in August 2020 and was able to quickly put together robust retail media capabilities and gain momentum with advertisers. In 2021, the platform generated $105 million in net revenue.

Connected retail media networks

Some retail and ecommerce providers lack the scale or in-house technical expertise to create their own retail media network. In this case, they frequently turn to connected retail media networks. Those retail media networks don’t leverage their own inventory. Instead, they aggregate inventory of several retailers, unify targeting and measurement across different platforms, and provide advertisers with a handy interface for running campaigns.

Criteo leads the push toward converting a fragmented supply of retail media into a coherent marketing channel. The Criteo Retail Media Platform is a technology solution that facilitates retail media partnerships between retailers and brands.

With its self-service DSP and solid API service that allows integration of various marketing tools, it grants advertisers ease, transparency, and full control over their retail media campaigns.

PromoteIQ is a retail media platform founded in 2012 and acquired by Microsoft in late 2019. The platform helps brands connect to the ecommerce sites of global retailers in grocery, apparel, home improvement, consumer electronics, and other industries and offer awareness and performance marketing opportunities.

PromoteIQ can boast robust data and analytics platforms and a strong automation component that allows optimizing campaigns on the go.

CitrusAd streamlines media sales and ad-serving for the top 20 retailers in the world. The platform powers more than $2 trillion in annual online sales. The platform partners include ShopRite, Lowe’s, Petco, and other retailers across 22 countries.

Programmatic adoption in the retail media networks

The retail media networks are currently balancing between the open AdTech and walled garden approaches in terms of providing access and data to third-party bidders.

Amazon

Amazon is notorious for its closed tech approach, directed at creating its own content fortress. To leverage Amazon audience segments and attribute ads to sales, advertisers can only use Amazon’s DSP. In turn, Amazon DSP can be used for targeting Target’s Roundel inventory. Amazon advertisers can tag their Roundel creative and create a retargetable segment of Target shoppers.

Walmart

Despite its partnership with the Trade Desk, Walmart’s strategy can hardly be called open programmatic. It is using the white label version of TTD without access to its wider infrastructure. As for the supply-side solutions tech, Walmart acquired the SSP Polymorph Labs and the ad server Thunder. With in-housing the entire ad tech stack, Walmart is effectively functioning as a walled garden.

Roundel and Kroger

Target’s Roundel took a different approach. While having an exclusive SSP partner, Index Exchange, it is open to outside DSPs. Target makes its data available through Index Exchange, which orchestrates private marketplaces that outside DSPs can connect to. It currently works with CitrusAd, the Trade Desk, Criteo, Skai, and Pacvue as its demand partners.

Kroger, the fourth-largest retailer in the US, also chooses an open AdTech approach and leverages an open PMP program providing access to third-party DSPs. Pacvue, Skai, and Flywheel Digital were the first to connect.

Pacvue, Skai and Criteo

Skai and Pacvue have a special place in this emerging marketplace, acting as agnostic DSPs for the retail media space. They allow advertisers to run campaigns on the major open retail marketplaces and supply this media buying with omnichannel analytics and recommendation on better placements. Criteo also has similar capabilities, but focuses on direct deals with retailers, nourishing its own ecosystem.

Media agencies

There is an increased interest in the proprietary retail media capabilities from the demand side as well. The major media agencies are betting on retail, which sprung a major wave of acquisition. Publicis Groupe acquired Citrus Ad, together with eCommerce intelligence platform Profitero, while WPP launched its own retail media offering Everymile.

Benefits of retail media networks

Retail media networks are flourishing advertising mediums that provides immense benefits for advertisers, retailers that decide to supplement their business with ad revenues, and AdTech vendors that aim to resolve identity and media buying issues for this new advertising environment. Let’s look closer at those.

Benefits for the advertisers

In light of the fading addressability in other advertising channels, retail media ads are a powerful asset for brands to reach their target audiences, which are susceptible to their messaging.

According to McKinsey data, 90% of ecommerce revenue comes from the first page, while the top 10 products account for roughly 23-27% of all ecommerce revenue.

Better visibility

Retail media ad placements are especially needed by newer products or smaller brands. Organic searches are often returned based on relevance to the search terms and previous traffic the product has received.

The main advantage is that retail media is the closest to ZMOT of the user, the moment where they do the research. Retail media is more relevant for ZMOT than even search advertising. If you have a competitive product and the price, the sale will be yours; it is just a matter of being above your competitors.

Fernando Siles Martin, Head of Online Marketing, Worten España

New products often have no previous traffic, making them less likely to appear organically. Retail media gives brands a fair opportunity to ensure their products get seen by shoppers and obtain an additional revenue stream.

Ad spend tied to digital sales

In the coming years, tracking the ROI of the walled gardens ads will be increasingly challenging. In contrast, advertising with retail media ads enables advertising at the point of sale, directly tying the ad spend to digital sales. With the available first-party data and extensive user profiles built on buying preferences, retail media provides a powerful analytics and attribution mechanism.

Benefits for retailers and ecommerce

Ad placements on the first page and promoted products are a highly sought-after inventory for brands and lucrative advertising inventory for ecommerce retailers. Retail media allows retailers to monetize their websites through advertising and provides several nonobvious benefits.

Additional sales

Retail media is not limited to showing ads to customers. It is a comprehensive tool with potential beyond an additional revenue stream. Due to the built-in data management capabilities, the retail media network engine can analyze the shoppers’ behaviors and suggest relevant products that are good complements to what is already in the cart. This way, retail media networks increase the size of the final check and drive ecommerce sales for the retailer.

Enhanced shopper journey

By gathering data through the scattered retail media property, the retail media network can enhance relevancy measurement and reinforce its suggestion algorithms. With it, retailers can create a more personalized and engaging experience, helping the customers throughout their journey.

Benefits for AdTech vendors

The retail media space is in its infancy and provides immense opportunities for AdTech vendors and startups that decide to venture into this industry. Given all the challenges with the availability of data, third-party cookies, MAIDS, and GDPR, the retail media data can become the new life-blood of advertising. The influx of retail data will drive more precise targeting and consumer engagement patterns with new ad formats and define new paths to purchase that will drive better measurement and optimization.

Future-proof advertising

Retail media ads are fundamentally different from previously dominant display ad targeting based on third-party data. Retail media does not track behavior across retailers. Each retailer is an independent entity, and the profile developed for each shopper is unique to that retailer. Retail media provide powerful targeting based on the first-party data, immune from the tightening of privacy legislation.

Breaching the gap between sales and marketing data.

Retail media networks have the potential to deliver a holy grail of marketing – tracking the ROI on media spend. Additional retail media networks can enrich the advertiser’s customer personas with invaluable purchase intent data. It can be done in a privacy-compliant way via the use of emerging data clean room solutions. The usage of data clean room will only increase, allowing marketers and retailers to extract value from their data in a privacy-compliant way, fostering transparency and better cross-channel measurement.

Challenges of building retail media networks

Despite the booming demand for retail media networks, the industry is still at the beginning of its technological journey. It has yet to resolve the many challenges of the fragmented marketplace, appropriate targeting tools for the buy-side, and integrations with the third-party data and attribution vendors. Let’s dive into the most typical roadblocks the up-and-coming retail media network needs to address to get a competitive advantage in the new AdTech race.

Differentiation

Ecommerce must find its niche and craft a unique market proposition in light of the current proliferation of retail media networks. Instead of releasing another ad network where advertisers can run campaigns, they should develop a genuine solution to address the pain points of a certain segment of media buyers.

To do this, retailers need to upgrade their data management and determine the seasonalities in the platform, the biggest buyers, and the most popular product categories. When the most potent and in-demand audience segments are identified, retail media networks should build ad relevancy algorithms that can effectively monetize this traffic while also cultivating customer loyalty and increasing the size of the final check.

Retail media networks operate in silos

Retail media is currently undergoing the same phase that display advertising was going through during the rise of ad networks. With it comes the lack of standardization and integrations between the vendors. The data landscape in this marketplace is fragmented. The inventory of most retail media networks is limited to the owned website and apps, and they operate similar to walled gardens.

The advertisers that are used to wholesome attribution and omnichannel customer journeys will struggle to consolidate buying through one platform and automate their processes. They would have to utilize more resources to deal with each retail media network individually.

The challenge of the siloed platforms is not immediate. Retailers still possess the quality of purchase and intent data that many advertisers desperately require. This setup obstructs the evolution of the ecosystem, and once market saturation occurs, the industry will have to quickly mature in terms of integrations.

Retailers must strategize to fully integrate into the marketplace, align themselves with standards that enable brands to use automation technology or a unified platform to purchase retail media, and have more holistic measurement and attribution.

Customer data privacy

Even though the retail media networks are built on first-party data, the further evolution of the industry is predicated on the ability of retail media networks to exchange data with third-party vendors and advertisers to deliver more targeted and personalized ads. And that is where data privacy comes into play.

The retail media network is not the sole owner of the purchase data; it still belongs to the user. It won’t be long before customers and regulators start to question the legitimacy of data governance on the retail media networks. To comply with the data privacy laws, retail media networks have to work in two separate directions. First, devise a data governance strategy that will establish how users give explicit consent to the use of personal data, how the data is stored securely on-premise, and how it can be shared with advertisers.

Second, retail media networks need to find or devise a solution, such as a data clean room, to share the data with advertisers in a privacy-centric way, without personal identifiable information.

Best practices for building a retail media network

If despite the mounting challenges for this new advertising medium you still decided to develop a retail media offering, there are several challenges and industry best practices to consider.

First and foremost, retail has to maintain a healthy balance between catering to advertisers and maintaining the loyalty and engagement of their customer base. To serve ads that are relevant to the customer and high-yielding for the platform, retail media networks need to employ in-demand features, deepen their relationships with advertisers, and develop an identity strategy.

The investment in the retail media networks will only increase, and with it, the competition for customers and the ad spend. To develop a viable solution in light of the current proliferation of retail media networks, new entries should accommodate the most in-demand features, deepen their relationships with advertisers, develop a comprehensive identity management strategy, and implement an ML model on their platform.

Accommodating new features

When it comes to developing a retail media network, having a wealth of purchase data and high-traffic media placements is not enough to stand out from the competition. To implement ads on the platform while driving customer loyalty and higher rates of overall spending, retail media networks need to leverage technology tools that provide more control over the customer experience and better visibility into their actions and trends.

At the same time, they must ensure appropriate data infrastructure, targeting, and attribution capabilities for advertisers. According to the INMAR Intelligence study, new retail media network features like data targeting, self-serve capabilities, attribution, and sales analytics are in high demand. Additionally, the new ad formats are taking hold in retail media and soon will become a necessary prerequisite for entering this ad space.

Deepening advertiser relationships

The purchase and intent data is not a silver bullet for keeping advertisers interested in the retail media offering. Savvy media buyers will demand more data for a holistic persona profile and campaign optimization when the market matures. That is when the data partnership with advertisers will matter the most.

Collaboration with the biggest platform advertisers can do wonders in increasing sales by enriching audience segments with additional data. For instance, transactional data can reinforce customer profiles, allow you to analyze users beyond their actions on the platform, find the underutilized potentials, and enhance targeting capabilities.

Major players such as Amazon, Walmart, Kroger, Target, and Best Buy are building their advertising businesses based on first-party consumer data including SKU-level data on transactions.

However, the retail media networks should exercise caution when proceeding in this direction. Using these data has to abide by the data privacy laws and ideally should be done in a closed-loop system that can match data points and improve attribution without sharing personally identifiable information.

Developing an identity strategy

To get accurate customer insights, effectively collaborate with advertisers, and offer actionable targeting, retail media networks need to take control over their customer identity – distitle multiple touchpoints to a singular view of the customer.

However, it requires solving the challenges of securely matching the data from the fragmented data sources, and creating a strong customer identity from the actions on various media properties.

To create the basis for robust customer identity, retail media networks require a data infrastructure that will enable an identity strategy with the following attributes:

- An interoperable solution that completes existing technology and allows the creation of retailer-owned customer segments.

- Privacy-conscious technology to configure the identity graph and enhance it with second and third-party insights.

- Consistent integrations across an organization, a technology stack, multiple data sources, and any number of marketing activation and measurement partners. The translation should be fast, secure, and interoperable across all channels where the customer is engaged.

Utilizing AI/ML for data management

Making sense of the vast data sets of the retail media network is impossible without a savvy use of ML and AI technologies. Automation in the data processes is critical to support the next generation of insights, real-time analytics, and customer intelligence.

Big players like eBay, Amazon, or Alibaba have successfully integrated AI across the entire sales cycle. Machine learning helps retailers apply data about which items are a rare or one-time purchase (a new TV or an entire dining room set, for instance) as opposed to one that will be refilled (like laundry detergent or bread).

Machine learning algorithms of retail media networks should be able to process data that includes input from three platforms: transactional, operational, and analytical systems.

Data movement from transactional systems to operational systems and finally to analytical systems slow down processing, integration, and timely insights. For this reason, the monitoring and automation tools are critical for saving resources on the operation and maintenance of the data pipelines.

Takeaways

Retail media networks are a thriving new sector of AdTech that has yet to resolve the technological challenges posed by its explosive growth. Due to the shift in the data privacy laws, ecommerce sites with a wealth of first-party data are ideally positioned to start their own ad businesses. There is an enormous space for growth for retailers with their ad inventory and AdTech vendors that can provide media buying capabilities in this environment.

To build a retail media monetization solution, retailers or AdTech vendors have to account for data security, platform scalability, and whether the platforms can easily integrate third-party partners and accommodate the future shift to standardization in this industry.