Lockdown accelerated the transition to digital media and gave a gigantic boost to AdTech. The valuation of the major AdTech titans is surging, attracting the eyes of institutional and big equity investors. Digital media and technology companies took stock exchanges by storm, while recently, public companies like Apploving, Magnite, and Digital Turbine have become active consolidators.

The AdTech bubble of 2013, when a bunch of ad networks posed as SaaS solutions, dismayed many investors. However, the rising tide of ad spend in new digital media, a new wave of M&As and loud exits indicate that big capital is ready to come back.

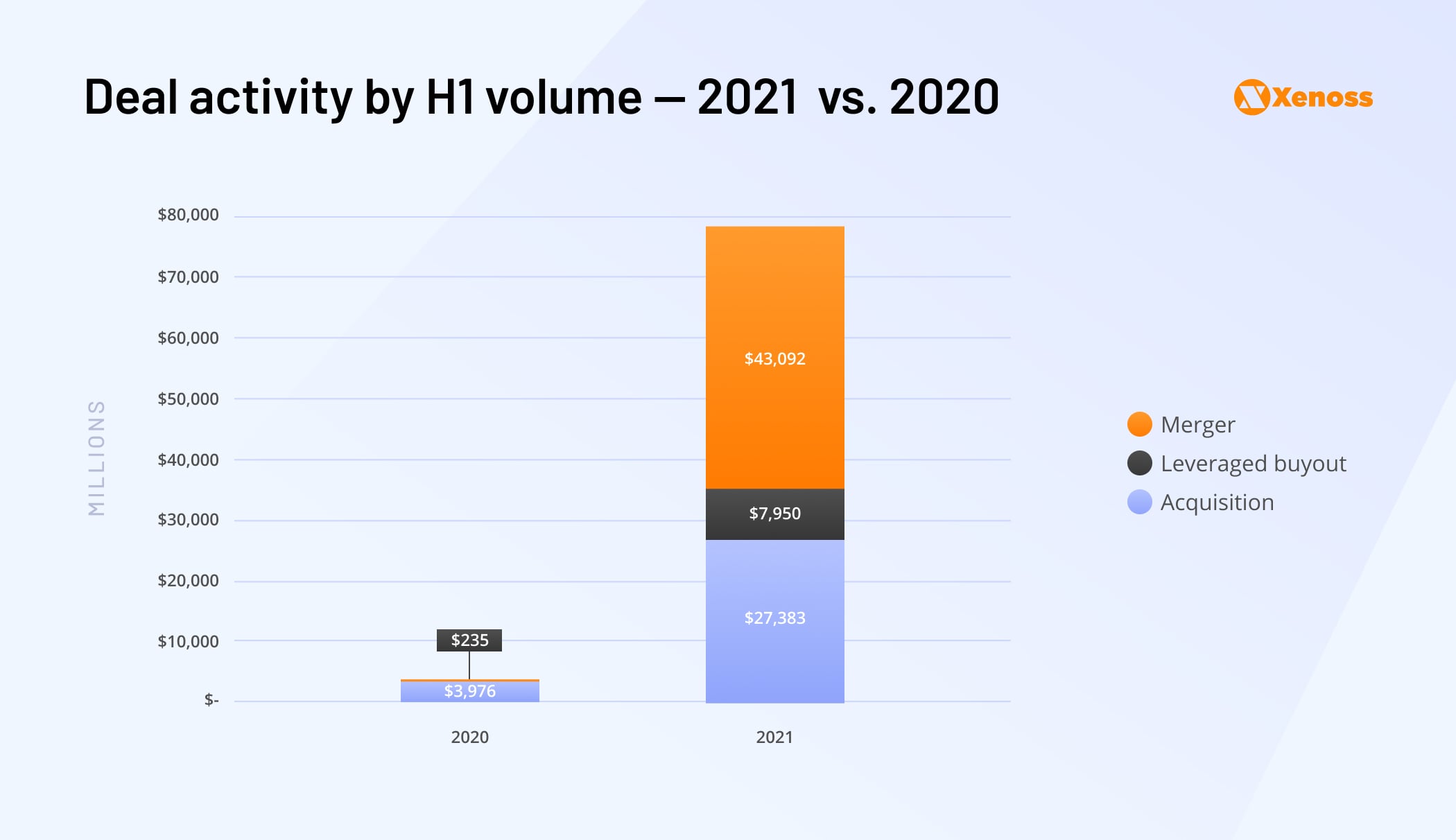

2021 witnessed not just a rebound to prepandemic deal activity but a new phase of bullish growth. The need to address user privacy concerns stimulated over $7 billion in investments in identity solutions and $4 billion in measurement startups. The creative optimization niche also cultivated strong investor interest, with Ad-Lib going to the highest bidder for over $100M.

In 2022, the market will see a streak of purchases and further market consolidation. The newly-minted walled gardens and conglomerates will buy technologies and tools to prop up their ecosystems. This is the year for AdTech startups to finally come of age and gain market recognition.

Let’s review the key growth areas and startups that are ready for big investment rounds.

Frontiers of AdTech startups

The life-cycle of the AdTech startup is more stretched out than in most industries. It takes a company longer to acquire necessary integrations, data partnerships, or a large enough client pool to test its stack correctly. As a result, the startup phase can take years before the technology fully comes to market.

Frequently, founders bet on the niche that is yet to be developed. Such AdTech startups are known but never get the spotlight because the time for their technology hasn’t come yet. However, when tides turn, those companies get well-deserved attention and funding. This year, the time has come for AdTech startup companies that focus on:

- Identification and cookie-less advertising

- Media buying

- CTV advertising

- Dynamic creative optimization

Further, we will talk about startups that capitalize on those trends and how their technologies disrupt related industries.

ID solutions for cookie-less advertising

The combination of Google’s plans to retire third-party cookies from the Chrome browser together with the iOS 14.5 update that implemented the ATT framework put the entire ad business in flux. Web and iOS audiences swiftly lose addressability, depriving advertisers of granular reporting and deterministic 1-to-1 targeting.

Remarketing mechanisms and optimization models momentarily turn obsolete without the operational advertising ID, leaving advertisers with a very broad categorization for targeting. With the depreciation of third-party identifiers in 2022, the market desperately needs an identity solution based on first-party data to re-establish addressability. Several promising startups can help with that.

ID5

Product category: ID solution for big publishers

Funding: $7M

When the phase-out of third parties was only looming on the horizon, British AdTech communities decided to act. ID5 provides a cookieless alternative to tie together IDs of buyers and sellers. It is a privacy-centric solution for publishers to retain the addressability and CPMs of their inventory.

When the company went live in 2017, it was a long shot, bidding at the eventual 3rd party cookie retirement. Yet, thanks to chief strategy officer Joanna Burton and her relentless advocacy for the first-party ID solution, ID5 was able to secure a foothold in the UK market and gear up for the expansion.

In 2021, ID5 became the most installed ID module in Prebid, powering 60,000 domains and reaching 3.4 billion users per month globally. ID5 presents a viable alternative that can already improve match rates and substitute for fading cookies and MAIDs. ID5 monetizes its solution by licensing its ID to ad tech companies and with its recently launched suite for advertisers IdentityCloud.

Novatiq

Product category: ID solution built on telcos data

Funding: $4M

Novatiq is another undertaking to build a cookie alternative. This startup tries to preserve third-party identification and give advertisers a consistent ID. Novatiq creates its solutions around the user graph based on telcos data.

Novatiq ID depreciates after the audience segment is served with the ad to stay in line with current privacy policies. Tanya Field, Novatiq’s chief product officer, comments on the significance of this solution:

With telco-verified IDs, brands can continue to receive the accuracy and scale they need for effective engagement with their most important audiences at scale.

In 2020, they tested their technology in the Middle Eastern markets, they launched it in the UK in 2021, and now venture into other markets. With in Europe, alternative ID solutions for the anonymous web got a second wind. Solutions like Novatiq will get extra attention from investors and emerging ad ecosystems looking for a privacy-centric tool to target users.

InfoSum

Product category: First-party data solution

Funding: $15.1M

While some startups are fighting to preserve third-party identification, others see it as a lost cause and are looking to develop a first-party data infrastructure. Infosum does precisely that; it was built on a promise of connecting the world’s data without ever sharing it. Its solution manages, organizes, and transfers first-party data.

The technology is for enterprise-level clients with owned media and big media holdings. It creates an extra security layer to monetize audiences without their data ever leaving the ecosystem.

It allows the creation of tailored audience segments that can be activated across the company’s media properties without compromising consumer privacy. Company founder and CTO Nicholas Halstead, elaborates on how data collaboration is possible without data sharing:

InfoSum simplifies the creation of custom data clean rooms built to the exact requirements of each party in minutes. The result is an end-to-end data collaboration platform that removes the need for any data sharing between companies.

In 2021, Omnicom group and Alex Springer became InfoSum clients, adding to dozens of media ecosystems they already manage, like CNN and Telegraph.

Permutive

Product category: First-party audience platform

Funding: $105M

New privacy measures were perceived by many as the dusk of the programmatic. Real-time bidding and global trading are almost entirely based on third-party identifiers. Well, it has to be, said Permutive. This company is set to resolve data leakage inherent in programmatic and revamp the infrastructure based on the first-party data. CEO and co-founder Joe Root insists on the new paradigm for data sharing:

Using data isn’t a problem — it’s when you attach data to an identity. So, instead of saying, ‘Here is an ad for Anthony, look up everything you know from Anthony,’ we say, ‘Here is an ad for a user interested in tech media.’ One model leaks data and the other doesn’t.

Initially, a data management for publishers, Permutive was mainly used to store and organize users’ behavior to transform them into cohort-based targeting segments later. With BuzzFeed, Insider, News Corp, The Guardian, and BBC among its clients, Permutive aggregated the supply of first-party data for the next logical step in its development.

In 2021, Permutive almost doubled its funding and released the buy-side technology to safely execute campaigns against a publisher’s first-party data. With cookies and MAIDs swiftly losing their grip on users, advertisers desperately need a solution to preserve targeting efficiency in these environments. In 2022, it will be exciting to watch how Permutive and AdTech solutions alike will create a new framework for targeting the anonymous open web.

Media buying tools

Advertisers are gradually waking up to the fact that with the phase-out of IDs, their well-tested approaches to user re-engagement will go down the drain, not to mention AI-based optimization models for ROAS and LTV.

In 2022, many methods will lose their relevance, and most of the client base of big brands that have not been preparing for transition could become unusable for remarketing mechanics.

As a result, the market is desperately looking to develop new programmatic tools, from AI-based predictive marketing platforms to various contextual solutions.

Many players that were originally in the behavioral targeting business, like Captify, Criteo, and Silverbullet, switched gears and are now heavily invested in alternatives. Get ready to see a raft of newcomers as well as headline-worthy funding rounds in this space this year.

Tomi

Product category: Predictive marketing platform

Funding: $1M

In this highly uncertain media landscape, the company that can offer effective buying optimization for advertisers will be a kingmaker. A new startup, Tomi, is among the most promising candidates for this role.

Industries with the offline sale cycle, like automotive, real estate, and banking, have difficulty matching their online activity to their acquisition cost. With branding and BTC advertising involved, it is hard to attribute the digital budgets to an actual sale of the real world asset. Konstantin Bayandin, Tomi’s founder, recount their ambitious missions:

People like to browse but rarely convert and most of these transactions happen offline. So real-estate clients don’t know how to optimize for their real buyers. Tomi uses machine learning to analyze the way real buyers browse the website and optimize ad campaigns toward conversions.

Using ML and AI analytics, Tomi segments and analyzes the interaction from CRM, corporate website, and ad APIs, for the most comprehensive conversion picture. Tomi integrates with Facebook, Instagram, and Google and aspires to provide offline brands with conversion precision of the eCommerce ads.

Semasio

Product category: Contextual solution with semantic targeting

Funding: $3M

With the post-cookie world knocking at the door, the timing is just right for Semasio. This German startup has been refining its contextual technology for over ten years, and now it’s finally time for it to shine. Kasper Skou, CEO and co-founder of Semasio, asserts that context has never been more relevant:

Even with the two-year delay in the deprecation of 3rd-party cookies in Chrome, the elephant in the room, which no one wants to talk about, is that basically half of your audience is no longer targetable via cookies today.

Semasio’s Unified Targeting combines the strength of both audience and contextual targeting. The semantic approach allows advertisers to build audiences and contextual targeting strategies without worrying about the taxonomy. The technology enables switching between the two seamlessly with a single click.

The solution also allows advertisers to run a data-driven contextual campaign based on the behavior of the existing audience, scale it, and create look-alike segments. In 2021, Semasio struck a partnership with PubMatic, providing its audience and context segments for activation, and already can boast about the results.

Qwarry

Product category: Semantic analysis and targeting technology

Funding: $2M

With behavioral targeting leaving center stage, contextual targeting is back in fashion. However, advertisers are not ready for a broad categorization of CPM networks. They need the new context quality – with comprehensive reporting, predictive analytics, and ultra-narrow targeting.

Qwarry is ready to deliver. Founded in 2019, it is a self-branded “Semantic Marketing Platform” for brands and publishers who want to drive the future of digital advertising without personal data. Qwarry is building a proprietary DSP for effective contextual campaigns with its contextual capabilities.

Currently, the company is scaling, crawling sites, and crafting prebuilt segments. 2022 will make it or break it for Qwarry, as it has to prove that its offering is ready to contest renowned DSPs with integrated contextual solutions.

CreatorIQ

Product category: Influencer marketing measurement and predictive analytics

Funding: $80.8M

Influencer marketing already takes up a significant chunk of media budgets, especially for DTF brands. Yet, the impact of influencer marketing is tough to track, measure, and quantify.

CreatorIQ software connects brands with influencers that cater to their target audience and deliver detailed reporting. CreatorIQ founder and CEO Igor Vaks testifies to the importance of this channel:

From high-growth brands to Fortune 500 companies, our customers rely on creator partnerships to grow their businesses — from building brand loyalty to co-launching new e-commerce solutions together.

Trusted by big brands such as Disney, H&M, and Sephora, this year CreatorIQ signed a partnership with TikTok, giving platform advertisers access to influencers and content metrics from the TikTok Creator Marketplace.

Dataseat

Product category: Mobile-first DSP

Funding: 2.4M

The adoption of real-time auctions has been lagging behind in the app industry. Unlike mobile and desktop, apps don’t have a header, while mediation platforms and ad networks historically didn’t support RTB. However, programmatic is finally starting to take hold here, opening a window of opportunities to companies like Dataseat.

Dataseat offers a self-serve demand-side platform with apps to buy inventory directly using their own bidder. Dataseat tools grant complete control over app marketing – campaign setup, optimization and analytics.

It is a fully-featured platform for mobile programmatic advertising, which with the help of Xenoss was made highly scalable and able to manage the high load. Dataseat has already attracted large-scale publishers, such Jam City and Socialpoint, which work with Zipcar, Zappos, and Amazon’s Audible.

CTV advertising companies

TV’s switch to programmatic was inevitable, but the pandemic truly accelerated this transformation. Both linear and directed TV were destined to change and provided a hot jumping-off point for the new AdTech startups.

Since the beginning of lockdowns, consumers got a taste for digital video in two tiers. Connected TV space grew exponentially in viewership, engagement, and ad spending, especially in LATAM and APAC. In the US, more than 86% of households are now reachable via CTV devices, unprecedented reach for web and in-app environments, which are swiftly losing addressability.

Yet, CTV is a fragmented marketplace that needs an additional tech layer to stitch together buyer and seller identifiers to provide advertisers with targeting, addressability, and measurement. When developing an advertising platform for CTV, AdTech vendors ought to have additional tech tools to effectively integrate with the programmatic marketplace.

TV Scientific

Product category: CTV ad measurement

Funding: $1.5 M

CTV has an inherent measurement problem. Targeting on CTV is primarily based on user IDs generated by external SSP platforms or synthetic IDs of apps. Further, that identifier is tied to a household and can hardly be attributed to individual online activity. This made the CTV space unfit for the performance campaigns since the ad cannot be attributed to the actual sale.

But everything is about to change with TVScientific. This AdTech startup provides performance advertisers with granular reporting on their CTV ad spend and determines whether it generated successful deals. Jason Fairchild, CEO of tvScientific, is confident in the performance future of this environment:

CTV represents a unique new era in which advertisers can reach consumers with large, full-screen ads with no surrounding clutter. They deliver superior consumer recall and drive measurable performance for advertisers.

TVScientific match served ads with the online activity of the specific individual in households, allowing for tracking and measuring conversions and sales. Before serving the ad, the startup collects IP addresses and creates a household device graph to understand other devices and individuals in proximity to the screen. It also allows building retargeting audiences that extend reach from web to TV.

EDO

Product category: Streaming ads measurement

Funding: 24M

EDO is a seasoned player in the TV measurement market, yet it is still on our list due to the headway it made last year. Historically EDO focused on linear TV, cross-referencing aired TV ads with increased search activity and other signals that indicate purchase intent.

However, in 2021, EDO ventured into the much more lucrative digital video space, adding capabilities to track and measure streamings and CTV broadcasts. In March, EDO launched Ad EnGage CI Streaming. This solution is a competitive intelligence platform that provides marketers with competitive intelligence in the share of voice, ad occurrence, and creative and targeting data. Kevin Krim, CEO & President of EDO, said:

With the expansion of our Ad EnGage platform into AVOD streaming, advertising sellers and brand marketers will now have access to EDO’s precise, reliable data on the non-linear platforms where they want to spend more.

EDO introduced handy audience metrics like the probability that an individual will engage with a brand because it saw an ad and how frequently a person is exposed to an ad on average in a seven-day period. EDO’s optimization algorithms are reinforced by more than 200 million ad airings and 1.5 million creatives from its native database.

Publica

Product category: Ad server for streaming and CTV

Funding: acquired for $220M

Publica is a comprehensive monetization platform for CTV publishers and OTT apps that ensure both ad serving and effective ad trading. The company’s technology manages and serves targeted ads as well as generating campaign analytics.

Publica was one of the first AdTech vendors to implement OTT header bidding. It allows the sell-side to connect both programmatic and direct demand, and analyze and optimize yield for each ad break. Publica, supports media companies, including ViacomCBS Inc., Fox Corporation, and streaming-TV company Philo Inc.

Recently, Publica was acquired by the ad-verification firm Integral Ad Science Inc. for $220 million, in an effort to expand its relationships with video publishers. Lisa Utzschneider, IAS CEO elaborates:

Publica reports that publishers using its platform have seen on average a 30% lift in yield for their CTV inventory. I welcome Benjamin Antier and the Publica team as we innovate together to increase CTV advertising quality and impact.

[cta-with-description title=”Looking for AdTech engineers to build CTV solution?” description=”Get in touch to see how Xenoss can help strengthen your in-house expertise.” url=”” buttontext=”Contact us”]

Dynamic creative optimization platforms

It is more and more evident that 1-to-1 marketing, targeting specific users with a tailored message, will get increasingly harder. The number of targeting options will dwindle, so getting a narrow audience segment with a formulated product need will become nearly impossible.

Previously, the success of the performance campaign was determined not by good creativity but by reaching consumers at the right time. Without these narrow targetings, marketers need to step up their creative optimization game. Creatives need to get smarter, more adaptable, and employ machine learning. Several startups can help with that.

Ad-Lib

Product category: Creative optimization platform

Funding: acquired for $100M

Ad-Lib offers a new quality to the creative management platform. It swiftly got traction and last year was acquired by Smarltly.io for over $100M. It leverages AI technologies to automate creative ad production workflows and optimize performance across multiple channels.

Ad-Lib employs AI models that automatically identify attention catchers in video and images, and then crop them for cross-channel distribution. Ad-Lib’s video analysis module automatically identifies objects, people, text, and scenes. The platform can determine which digital asset will be more effective and show better performance results.

With the help of Xenoss, Ad-Lib was able to swiftly roll out a creative optimization platform that adapts any video for multichannel advertising campaigns. Ad-Lib clients are the world’s biggest brands, such as Nestlé, Johnson & Johnson, Virgin Group, Warner Bros., and others.

Transmit

Product category: Ad placements in streamings

Funding: $7.8M

The connected TV space is one of the major areas of growth for AdTech startups. Despite the exploding viewership, the creative formats are still exported from in-app and TV ad space – a lot like the dawn of mobile advertising when display ads were shoved onto mobile devices regardless of the screen size and navigation features.

This lagging adoption undermines user experience and the conversion potential of the CTV ads. Seth Hittman, co-founder, and chief executive of Transmit, criticize the current state of CTV advertising:

Streaming is fragmenting where consumers go for content, but the ad experiences have not caught up and answered the bell.

Transmit comes to the rescue of the CTV ad experience, with native in-content ad formats for streaming platforms and OTT.

With its end-to-end platform for monetization, Transmit allows video publishers to integrate organic ad formats into the content, customize ad breaks, manage yield, and streamline ad injection.

Marpipe

Product category: Creative optimization platform

Funding: $8.2M

With precise one-on-one targeting quickly turning obsolete, creative optimization projects are getting more praise and recognition. Without the ability to show ads at the right time, it is critical to make them adaptable and apt for any occasion.

Marpipe is working on such smart creatives. The startup helps advertisers create thousands of variations of different ads and then test and analyze how different fonts, colors, or copies influence performance. Marpipe’s CEO, who was recently nominated to in Marketing and Advertising, Dan Pantelo claims the company maps out the future for ad campaigns:

Here’s an observation that informs everything we do: the creatives of tomorrow will look a lot more like engineers and scientists than like traditional artists. With this new reality, brands have to adapt or die. We’re offering an easy way to adapt.

At Marpipe, everything is optimized automatically with ML algorithms that pick variants that drive the most consumer action. Marpipe is integrated with Google Display Network, Adobe, and is the preferred testing platform for Facebook and Instagram.

Takeaways

In AdTech, it is essential to bet on the right technologies. The tectonic shifts around identity, CTV, and nonstandard creatives have happened over the past couple of years, but the startups we have discussed were betting for years that this would happen.

The public privacy concerns were inevitably leading to the retirement of third-party identifiers. And many companies from the buy and sell sides rolled out, replacing solutions from depreciating ID to contextual targeting in an attempt to salvage retargeting. 2022 will determine if those alternatives are viable and whether they can scale beyond their home markets.

CTV is surging in viewership, engagement, and ad spend, yet remains a technologically lagging environment. The absence of a common ID and measurement framework in this environment is a fertile ground for new AdTech startups ready to fill in the gaps.

The curbed enthusiasm regarding one-to-one marketing renewed the interest in creative optimization. Several startups are exploring ML technologies to arrange creatives and determine the best placement on the go. 2022 will be a year of acquisitions for this segment, as media buying platforms and emerging walled gardens will be eager to secure a grip on creative optimization capabilities.