In 2021, cookie-based advertising took some body blows. While Google is temporarily letting advertisers off the hook by delaying “cookie death” to late 2023, Apple is actively pushing strict privacy updates by limiting access to its users’ IDFAs, and Google is soon to follow with its mobile ID.

Encouraged by ID depreciation and fueled by the growth of AI and machine learning technologies, contextual advertising seems to be back in the race as a preferred way to connect with audiences.

For online advertising, contextual targeting is not news — however, emerging channels like CTV (Connected TV) are yet to learn the ropes of deploying contextual solutions.

In this post, we will take a closer look at the challenges of contextual targeting in CTV, projects that successfully leveraged ML technologies for precise and privacy-savvy targeting, and considerations you should take before implementing machine learning.

Contextual targeting is entering the CTV ecosystem

First things first, let’s see what contextual targeting stands for.

In CTV, the switch to contextual targeting is a privacy-centric alternative to IP identification. In 2021, more CTV publishers acknowledged the importance of contextual targeting capabilities. Here are some clear signs that the market is switching to context, by Digiday:

- Crackle and Tastemade have expanded contextual advertising to both CTV and OTT inventories.

- IRIS.tv, a contextual targeting marketplace for CTV showed 25% growth since January 2021.

- Xandr contextual targeting accounts for 35% of total spending.

- IAB reports that 51% of advertisers plan to rely heavily on contextual advertising.

While CTV growth seems unstoppable, it doesn’t mean that a bump-free road lies ahead. There are both ecosystem-specific and cross-platform challenges that slow down the implementation of contextual both for CTV and other platforms.

Let’s see how these hurdles are stalling the growth of contextual targeting and how we can mitigate their impact.

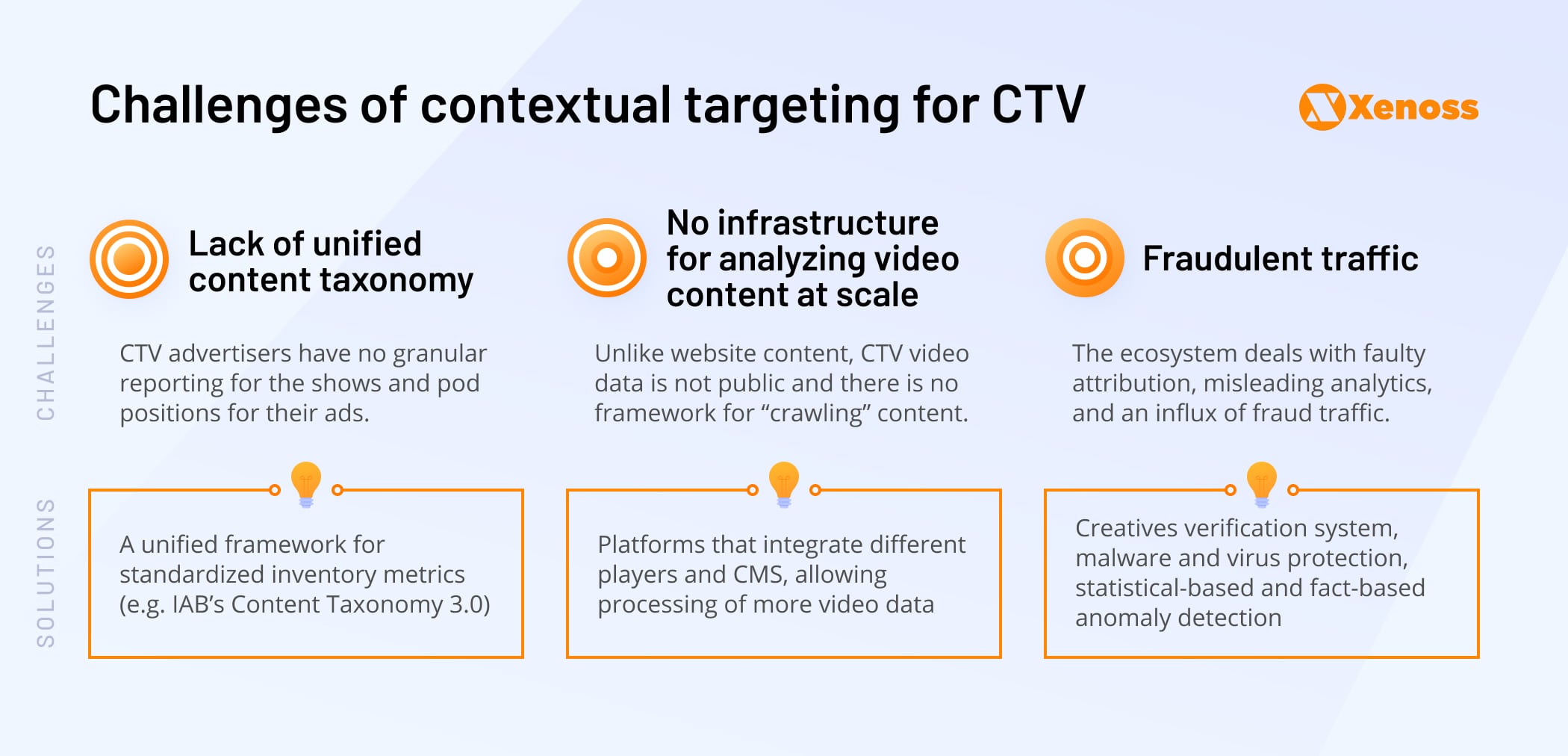

Challenges of contextual targeting for CTV

Before discussing the details of building a context-driven CTV targeting, let’s examine the pitfalls that keep vendors from fully embracing this new way of reaching audiences.

Let’s dive into detail, and examine each challenge and potential workarounds.

Lack of unified content taxonomy

The critical challenge to tackle when dealing with contextual advertising is the lack of inventory standardization.

At the moment CTV advertisers have no comprehensive analytics for the shows and pod positions for their ads. Transparency varies from seller to seller, often leaving advertisers with breadcrumbs of placement data.

Industry leaders encourage CTV publishers to join forces for context standardization. OmniMedia Group has released a paper outlining the practices and protocols for successful content standardization:

- Publishers need to share with advertisers explicit data on shows, genres, and pod placements.

- Independent verification companies must validate inventory.

- Regulators should build a unique framework for standardized inventory metrics (which is already happening with IAB’s Content Taxonomy 3.0).

Data collection challenges and lack of context

Another challenge CTV is facing is the limited access to video data. Most publishers lock access to their video players, making it harder for data providers to analyze video content at scale without direct integration. When developing an advertising platform for CTV, AdTech vendors ought to have additional tech solutions to effectively access context in CTV.

Data analysts used to be largely limited to scanning page-level content and had no access to clips. Lack of context recognition kept advertisers uneasy, with both performance and brand safety at stake.

Lately, global market players helped broaden the field of view – IRIS, for one, designed an infrastructure that gives contextual data providers access to video inventory.

Growth of CTV fraud traffic

Ad fraud is a cross-platform challenge, but it is definitely more pronounced in emerging ecosystems like CTV, with no out-of-the-box tools and protocols to fight off fraudulent traffic.

CTV market players ought to take a hint from the development curves of mobile and web advertising and anticipate fraud-related challenges before they escalate.

At the moment, the ecosystem is already tormented by fraudulent tactics. Device impersonation makes it look as if ad requests are sent from the CTV devices even if they are not. Through data center bots, fraudsters can amplify and scale operations, using thousands of servers and virtual machines to generate fake ad requests.

How do publishers, advertisers, and regulators respond to the threat? Here’s a quick review of anti-fraud projects that are already launched or about to go live:

- IAB is rolling out what’s dubbed ads.cert.2.0 – a new set of standards designed to combat ad fraud. Also, the Interactive Advertising Bureau has designed a CTV extension for OpenMeasurement SDK, that’s supposed to improve attribution and increase ecosystem transparency.

- Publishers are building proprietary solutions for improving server and device authentication

- From the hardware standpoint, embedding chips and other verification hardware into CTV devices helps detect spoofing.

To improve your understanding of ad fraud and ways to tackle it effectively, take a look at our post on ad fraud detection and prevention where we explore fraud techniques and strategies for detecting anomalies.

How to deal with these challenges?

While contextual targeting is making its way into CTV, the challenges listed above are preventing its mainstream adoption. Understandably, the CTV vendors feel pressure to effectively resolve those challenges without resource-intensive development. The good news is – there is already an abundance of CTV projects that pulled it off.

Our team is confident that machine learning holds the biggest potential to be the CTV game changer. Further, we’re going to describe the most promising ML applications.

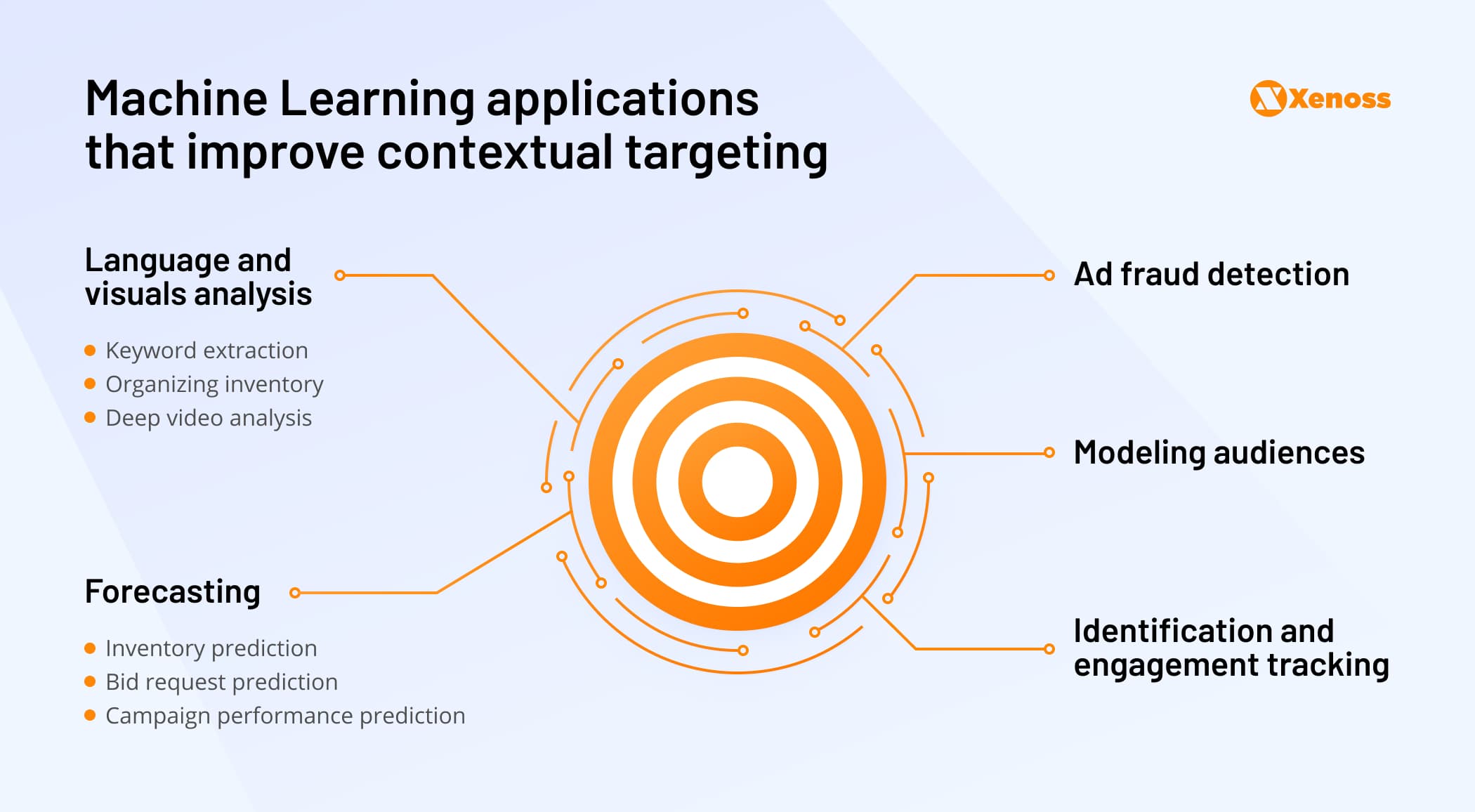

Machine learning and contextual targeting in CTV

Machine learning is critical for advertisers and vendors to make sense of this increasingly fragmented environment. It is impossible to organize millions of heterogeneous ad requests without some degree of automation and predictive modeling.

Here’s our take on how machine learning can remove guesswork, improving the security and effectiveness of contextual targeting in CTV.

Language and video analysis

Machine learning opens an array of opportunities for improving the quality of ad placements. Publishers and AdTech technology providers can leverage ML models to analyze inventory items, understand the emotional impact of the visual, and match ads with relevant clips.

Keyword extraction

Among the ways to better grasp the context surrounding CTV ad spaces, is deploying models that analyze inventory and discover meaningful language patterns. Through such techniques, advertisers can extract keywords and choose the best placement and timing for an ad.

An example of such a technique could be a sequential pattern mining model that helps identify language patterns in broadcasted content. It was developed by a team of researchers from Microsoft Research Asia.

Organizing inventory

Recent studies suggest a more complex approach to analyzing the semantics of video advertising. A team of Chinese scientists built an unsupervised model for detecting linguistic patterns, analyzing them, and classifying over 10,000 content items into a comprehensible catalog.

Deep video analysis

Similarly, machine learning engineers introduced a deep learning framework DeepLink, which detects the clothing of Sitcom stars and matches it with similar garments from online shops. The system uses several convolutional neural networks to analyze actors’ facial expressions, poses, movements, and clothing.

Forecasting

Compared to linear TV, CTV has already raised the bar for data-driven decision-making and, as contextual targeting picks up the pace, advertisers will have even more insight at their fingertips.

AdTech technology providers can deepen the pool of available data by enabling inventory, bid requests, and ad performance forecasting. Let’s take a look at how machine learning makes it work.

Inventory prediction Teams that build predictive models to estimate the available volume and CPMs of video inventory are already seeing noteworthy progress. For one, a team from Yonsei University in South Korea built an algorithm that helped predict TV advertising inventory.

They used a deep learning algorithm – Long Short-Term Memory Networks (LSTM) – to forecast advertising inventory for 36 local channels.

This method is highly promising – mainly due to feasibility and stellar precision. In fact, it has outperformed two alternative approaches by a huge margin in a range of relevant metrics.

Bid request prediction

Predicting the bid landscape is a challenge across all advertising platforms. Thousands of advertisers compete over a winning bid, making the highest price a highly dynamic metric.

As machine learning gives advertisers and AdTech vendors access to more market data and introduces techniques for deeper analysis, it is a promising tool in bid request forecasting.

In a 2016 paper, a team of researchers presented the functional bid forecasting model based on decision-tree modeling. This system led to a 30.7% increase in precision compared to alternatives.

Campaign performance prediction

Machine learning has a rich toolset for campaign prediction. Here is a short review of architectures designed to this end:

- DBNLR – a deep architecture model that combines logical regression (LR) with a deep belief network (DBN) presented by Jiang et al.

- Two-stage ad ranking that ranks ads by performance using a regression model.

- Building deep neural networks via attention mechanisms to estimate CTR (Wang et al.)

- FTRFL (Follow-The-Regularized-Factorized-Leader) – an online learning algorithm designed for CTR prediction.

While these models, in particular, have not yet been tested in the CTV landscape, the ecosystem should follow the lead of online advertising in adopting ML innovations for forecasting inventory and in-depth inventory analysis.

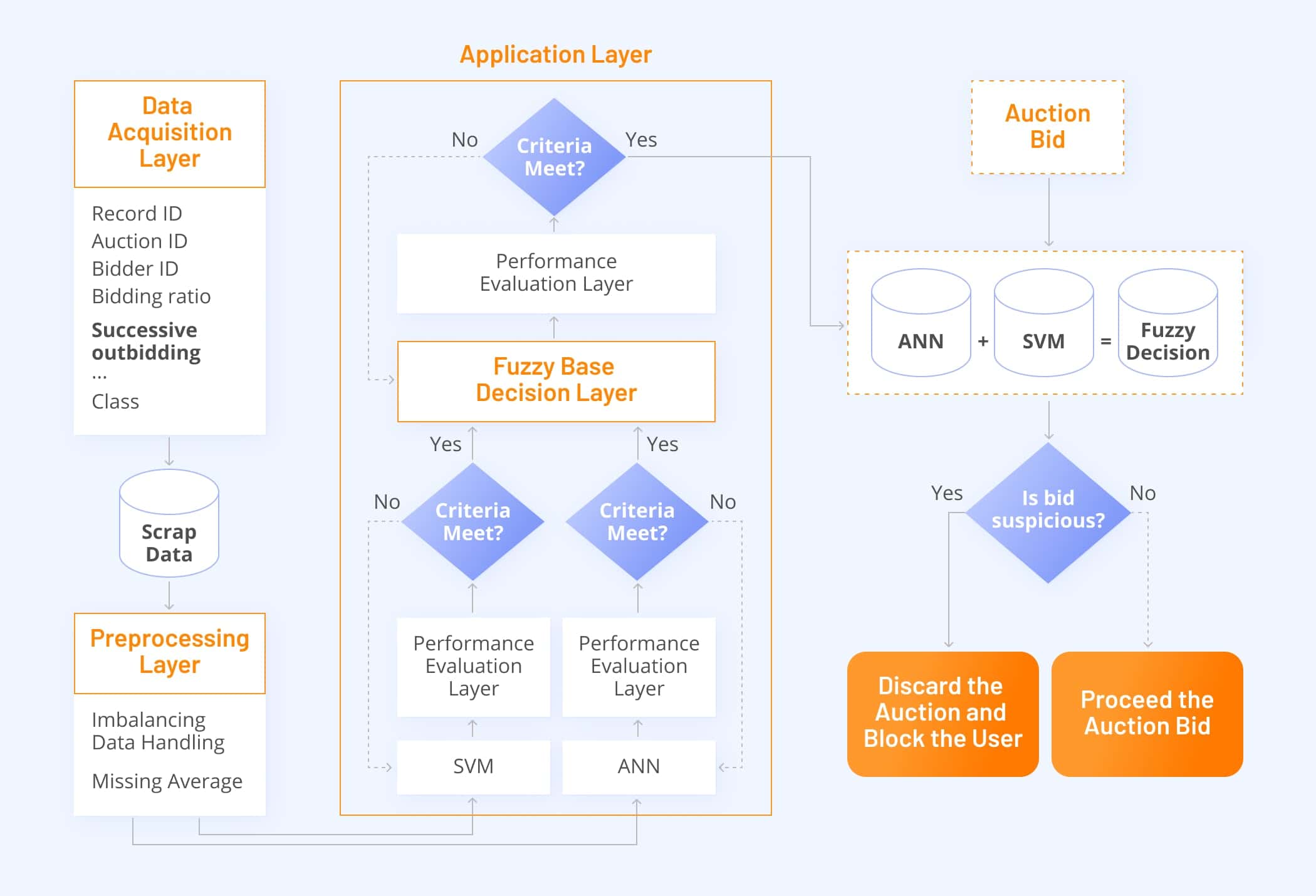

Ad fraud detection

We’ve already covered the disastrous impact of fraud on the CTV ecosystem. Understandably, both advertisers and AdTech providers are not ready to sit back and watch fraudsters raking in millions in ad revenue.

Tech teams work on ways to detect and eliminate tricky CTV fraud techniques like “RapidFire”, which feeds fake CTV bid requests into open auctions of the ad exchange.

Among those approaches is a recently published model that combines diverse machine learning algorithms and reaches laser-point 99.63% accuracy in detecting counterfeit bid detection. Here’s an illustration of how it works.

Modeling audiences

While clustering and segmentation have long been weaponized by CTV players, machine learning can fill in missing user data attributes: gender, age, and Big Five personality attributes.

Researchers look for ways to build data-driven audience modeling with ML techniques like linear regression, SVM, and Naive Bayes.

Identification and engagement tracking

Machine learning and data science give publishers and CTV vendors new ways to increase transparency and track how audiences engage with ads. Here are a few intriguing machine learning applications for engagement tracking:

- Mapping household devices and monitoring online behaviors associated with individuals as they interact with ads. Machine learning models help determine if a user second-screens while watching an ad by counting the number of bid expressions coming from other devices in the household.

- Calculating conversions with higher precision by linking online and offline behaviors.

- Removing consumers from targeted segments as soon as they stop sending in-market signals (this decision can be made and executed in milliseconds).

The power of machine learning in user identification is apparent in all-in-one platforms like Segment. These platforms use proprietary ML models for data tracking and user authentication.

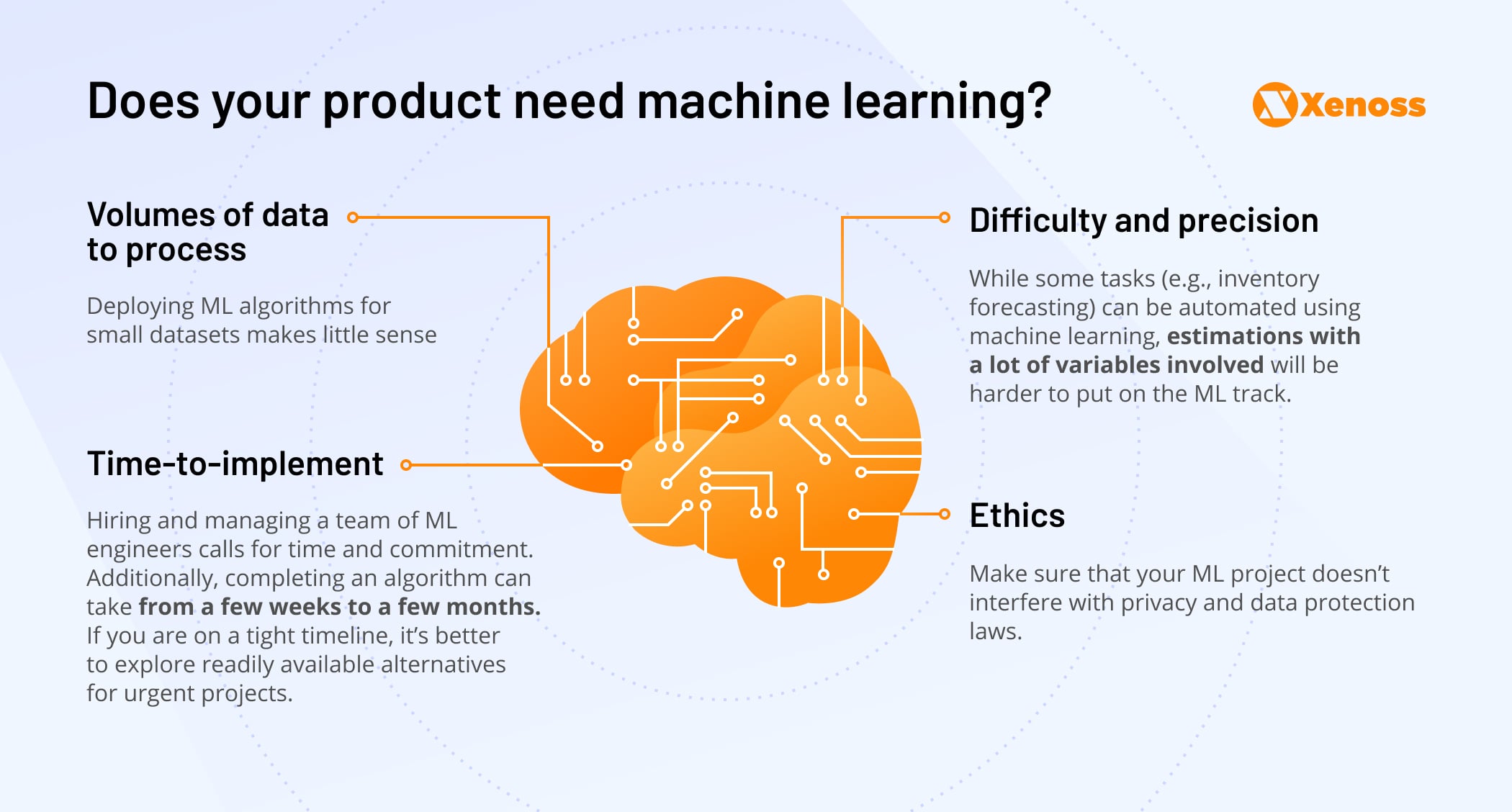

That said, we believe that AdTech and MarTech product teams should assess the ROI from machine learning when developing CTV advertising platforms, as sometimes the pay-off is not worth the effort.

Let’s take a closer look at the considerations leaders should keep in mind when planning ML-based features.

Considerations for ML implementation in CTV contextual targeting

While machine learning has enormous potential in improving contextual targeting several challenges are hindering full-arm embrace of ML algorithms by CTV publishers and AdTech providers.

Here are the main considerations for adding ML-driven features to AdTech products.

Following the need, not the hype

Before jumping on the ML bandwagon, AdTech providers should be confident that their publishers and advertisers would actually benefit from innovative features.

According to Pawel Godula, a Senior Data Scientist at AdColony:

Knowing what really matters for the general success of the solution and adjusting modeling complexity to the task is key to building machine learning models in AdTech.

Here are a few things to crosscheck before you invest in building a machine learning project.

Shortage of qualified tech talent

A recent LinkedIn report states that the pandemic revealed the need for machine learning and AI tools, leading to the growing demand for ML engineers.

However, the supply is not quite there – two in five companies see talent shortage as the key roadblock in AI/ML implementation.

You can solve the ML talent shortage by broadening your field of view. Here are the ways to expand the hiring pool:

- Build an AI team by training engineers from other departments.

- Hire an external team of machine learning engineers to access both skilled and affordable talent.

Implementation costs

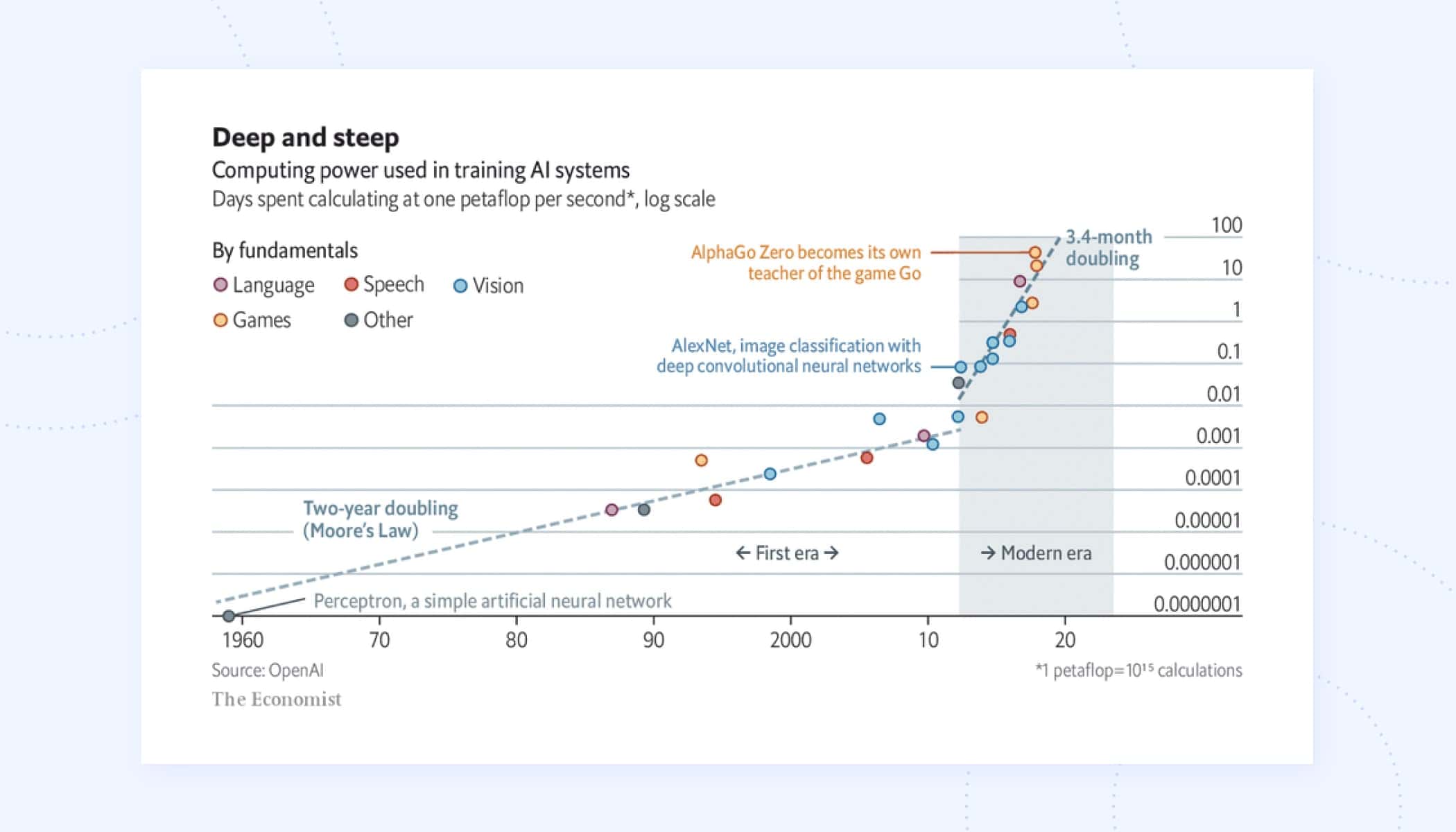

The increasing cost of training machine learning models has been a growing challenge for at least a few years. The Economist elaborates on the topic:

A combination of ballooning complexity and competition means costs at the cutting edge are rising sharply.

Generally, Moore’s law is true for ML algorithms: innovative technologies become gradually cheaper to implement.

However, our ideas of high-performance ML algorithms evolve so quickly that teams have to constantly increase their datasets and computing power to meet market expectations.

As far as CTV is concerned, the growing number of daily viewers, amount of inventory, and the number of ad networks raise the bar for effective ML models.

Engineers have to build tools that can process hundreds of thousands of requests per second and extensive datasets. On top of that, advertisers expect a higher degree of precision of targeting precious and comprehensive conversion CTV measurement, which puts additional pressure on development.

In the realm of these higher-than-ever demands, the concerns about rising costs of ML implementation are extremely valid for CTV.

So, before deciding to commit to machine learning, product teams should clearly understand (or get a consultation on) how much data and computing power is needed to build a self-sufficient model.

Time expenditure

Time is another important consideration for deploying machine learning models. According to the survey by Statista, 37% of companies spent between three months and a year on ML model deployment as of 2021. One-fourth of respondents did so in 8–30 days, while 24% needed from 31 to 90 days.

On the other hand, 11% of teams completed the task in a week or less.

The pace of deployment depends on the size of the team, budget, toolset, tech seniority, and other factors. AdTech providers eager to implement ML in their projects should assess their operational efficiency and make a feasible estimate that considers both the team size and budget allocated for the project. You should also reach out to a team of machine learning experts to confirm the attainability of your estimates.

Infrastructure management

Last but not least, designing an infrastructure that’s tailored to the upkeep of ML models comes with a unique set of challenges. We briefly review them below.

- Lack of relevant datasets for training machine learning models. Statistically, gathering and filtering data calls for more time and budget than actually training the models – in fact, collecting and processing consumer records take up to 80% of a data scientist’s workday. Consequently, if you don’t have a large and trusted source of data for training models, a machine learning project might be a premature investment.

- Organizations struggle to pinpoint the right set of tools that will empower AI projects. To that end, consulting a team of engineers is a reasonable workaround.

- IT departments directly involved in model design struggle to integrate and align processes with business requirements and logic, leading to a disconnect between the technical and strategic cores of the team.

Final thoughts

Contextual targeting is a viable alternative to cookie-based advertising. In the CTV space, there are more factors involved in processing the contents of each video – so it’s harder to choose the right context for ads. Also, niche-specific problems including ad fraud and attribution hold back the shift to contextual targeting.

But innovative technologies like machine learning help pave the way for deeper inventory analysis, attribution transparency, and unified content taxonomy. By harnessing the power of image recognition, natural language processing, and sentiment analysis, AdTech providers can build a bridge that leads to efficient and safe seller-buyer interactions.

If you want to integrate machine learning into your AdTech platform, consult a team of professional engineers to make sure your project is feasible. At Xenoss, we have been helping AdTech providers build innovative AdTech solutions for over 15 years. Get in touch with us to discuss your project.