Connected TV (CTV) is an ad channel you can’t ignore: 90% of U.S. households now use internet-connected TV devices at least once per month, with over 250 million Americans watching CTV content.

With every major broadcaster launching over-the-top (OTT) offerings and independent players multiplying, the CTV advertising market is getting critical traction.

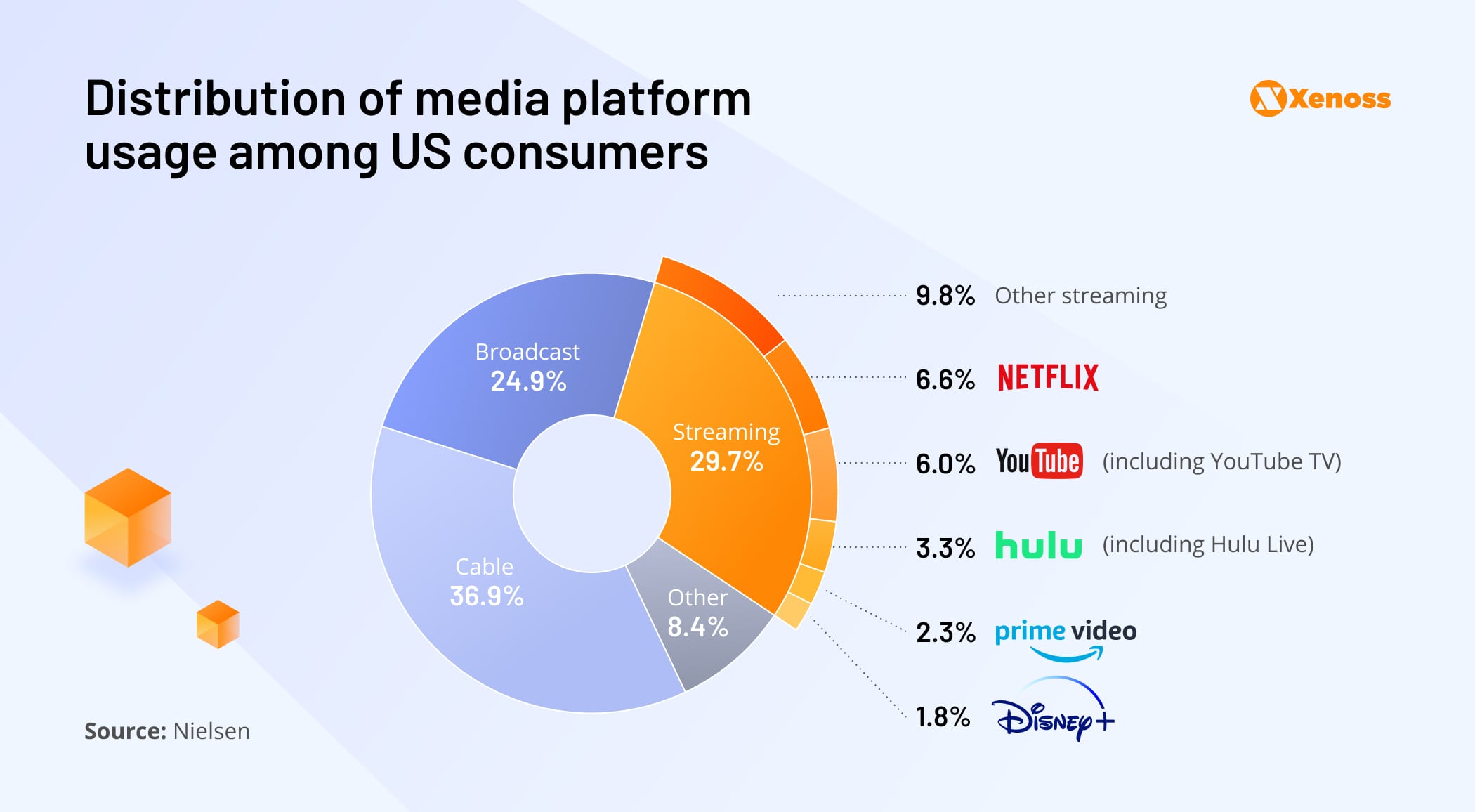

As of mid-2025, streaming accounted for 44.8% of total TV viewership, surpassing the combined share of broadcast (20.1%) and cable (24.1%) for the first time in history.

CTV ad spending is set to grow from $33.35 billion in 2025 to $46.89 billion by 2028, when it will surpass traditional TV ad spending ($45.10 billion) for the first time, according to eMarketer

However, media buyers are right to have mixed feelings about CTV advertising.

The lack of transparency and proper safeguards in CTV costs advertisers an average of $700,000 in wasted spend per billion impressions.

Advertisers point out that it’s difficult to tell whether CTV buys are reaching viewers due to the highly fragmented ecosystem. A DoubleVerify report found that only 50% of all CTV impressions offer full transparency, and even so, CTV advertising is still perceived as difficult to measure.

Fortunately, connected TV ads can provide data points as relevant as those from other digital channels with a proactive approach to partnerships and interoperability.

In this post, you’ll learn about:

- The fragmented CTV market landscape and its implications for AdTech companies

- The main challenges of CTV advertising measurement and attribution

- Best tech practices for gaining CTV measurement data that buyers need

CTV market overview: Platforms & operating systems (OS)

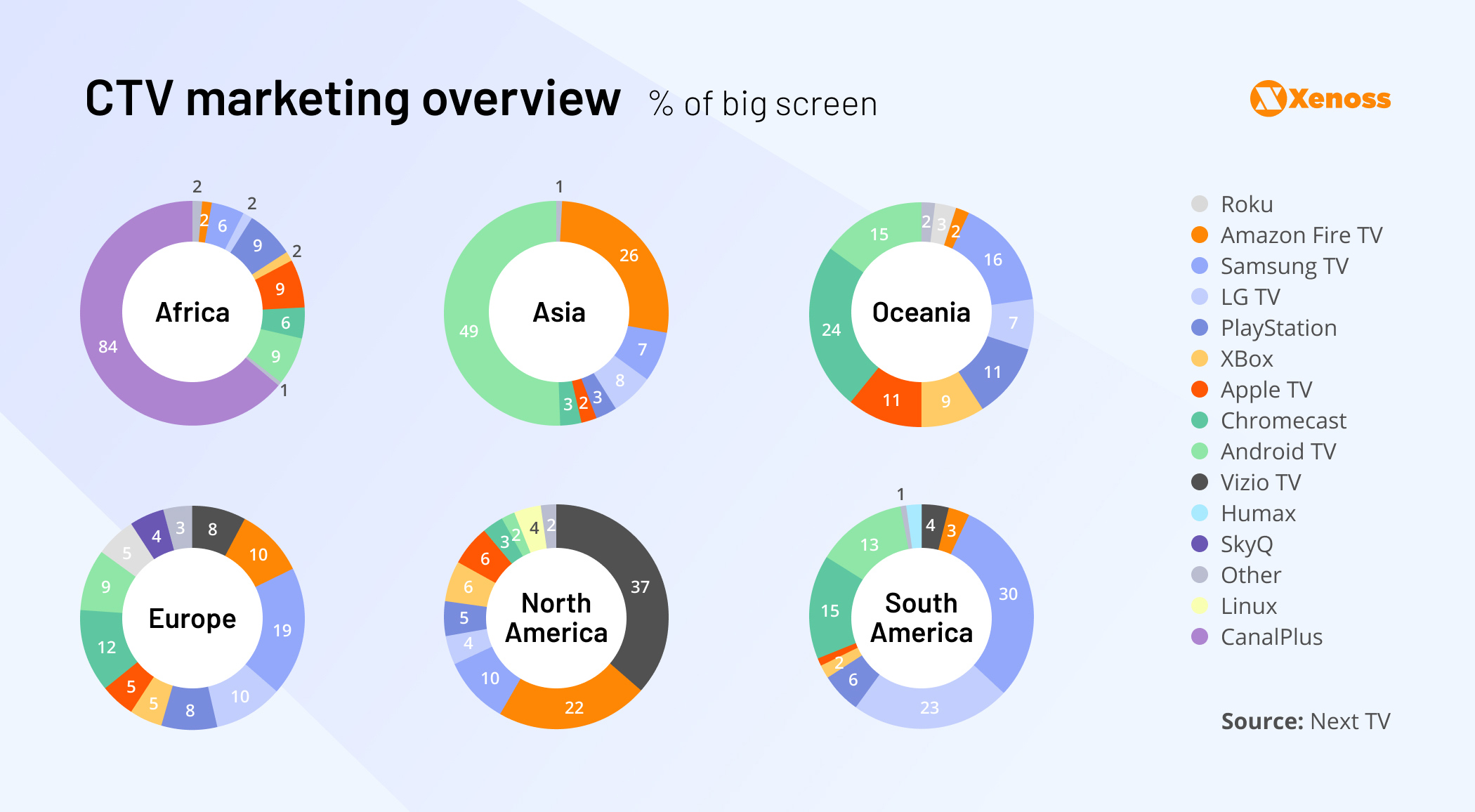

The CTV market is an ecosystem. Participants include smart TV device manufacturers, standalone media players, OTT providers, and content distribution platforms. All of them have a heavy hand in the market because they own (but do not always share) consumer data.

To gain full visibility into CTV ad performance, ad platforms have to integrate data from multiple sources. What makes CTV measurement even harder is that no single player dominates the smart TV OS market or the OTT market.

Main types of CTV players

- Smart TVs with native OS (e.g., Samsung TV, LG TV, Sony, Vizio with embedded Chromecast)

- Stand-alone streaming devices and media players ( e.g., Roku, Amazon Fire, Chromecast, or Apple TV)

- OTT video-streaming services (e.g., AT&T TV, HBO Max, Hulu, Netflix, Paramount+, Rakuten TV, etc.)

- Content distribution platforms (e.g., Amagi, Castify.ai, BitCentral, Viaccess-Orca, etc.)

That said, the global CTV market has its “big four” players, holding most of the audience data (and advertising dollars).

Samsung Connected TV

Samsung was among the first to release competitively priced smart TV sets. Since its market launch in 2015, the installed base of Samsung Tizen has grown to 270 million TV and smart signage devices worldwide.

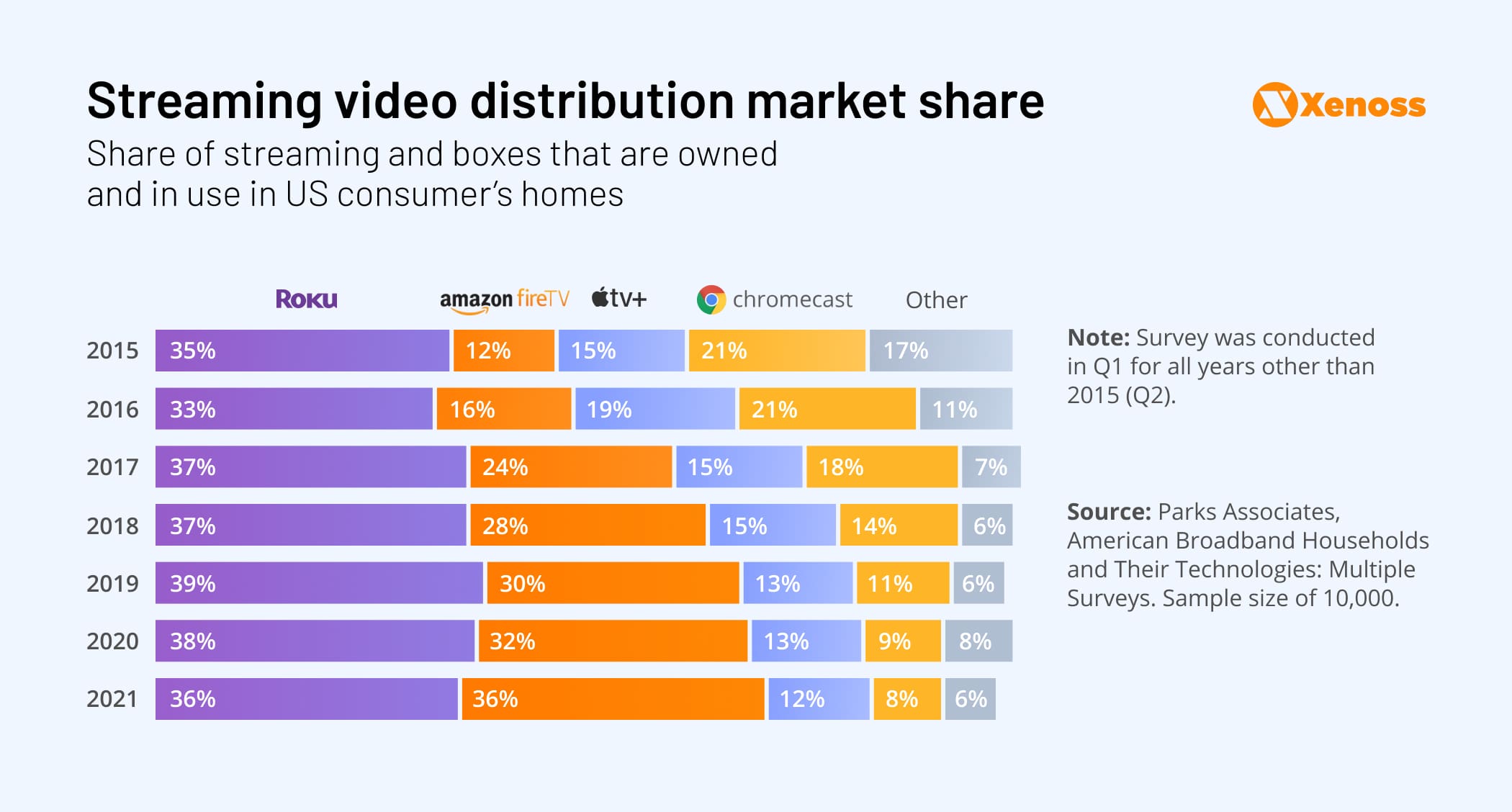

On a global scale, Samsung remains a leader, though the competitive landscape has shifted significantly. Android/Google TV is now the leading Smart TV OS, accounting for over 24% of global shipments, with Tizen at 16.9%, WebOS at 11.8%, and Roku at 9%.

Hisense’s VIDAA OS has emerged as a major competitor at 7.8% global market share, followed by LG WebOS at 7.4%, with Roku and Amazon Fire TV tied at 6.4%. However, Samsung continues to trail in the North American market, where Roku leads the CTV device market share at 37%, followed by Amazon Fire TV at 17%, while Samsung holds just 12%.

Roku

The first Roku streaming device was released with Netflix in 2008. Since then, the company has expanded its hardware product range, developed the Roku OS, and launched a programmatic CTV advertising network.

Roku reached more than 90 million streaming households as of the first week of January 2025, making it an attractive platform for OLV advertising. Roku’s Platform revenue surpassed $1 billion for the first time in Q4 2024, growing 25% year-over-year. In the Q4 2024 earnings call, Roku’s CEO noted that at least one Roku-powered device is in half of US broadband homes.

However, Roku’s devices segment faced challenges with a full-year 2024 gross margin of -14% and a Q4 gross margin of -29% due to increased seasonal discounts.

Amazon Fire TV

Amazon entered the CTV space with affordable Fire sticks, went on to launch Fire TV (an edition of smart television sets), signed Fire OS distribution deals with popular device manufacturers (Insignia, Toshiba, JVC, Grundig, and, more recently, Panasonic).

To date, Amazon has sold more than 250 million Fire TV devices globally since the platform’s launch in 2014, with an increase of 50 million since late 2023

Amazon has also been exploring the emerging in-car video streaming market. At CES 2022, Amazon announced a pact with Ford Motor Co. to embed Fire TV in Ford Expedition and Lincoln Navigator models, and separately announced a deal with Stellantis to integrate Fire TV into Wagoneer, Grand Wagoneer, Jeep Grand Cherokee, and Chrysler Pacifica models.

Google TV (Android TV)

Google entered the connected TV space with Chromecast devices (smart TV sticks), but quickly assembled a larger ecosystem of products. The Android TV platform is the original Google OS for smart TV sets.

In 2020, Google released a major upgrade to Android TV and rebranded its offering as Google TV. At its core, Google TV is a new interface running on top of the original Android TV OS.

It comes pre-installed on the Google TV Streamer (which replaced the Chromecast line in 2024) and is the primary interface for smart TV manufacturers that opted for Android TV OS.

Google is progressively phasing out the older Android TV interface in favor of Google TV across all devices. Google TV now comes pre-installed on smart TVs from brands like TCL, Sony, Hisense, Sharp, Philips, and others. As of September 2024, Google TV is active on over 270 million devices monthly

What CTV market fragmentation means for the AdTech Industry

Device and data fragmentation is the bane of all new channels, like in-game advertising or DOOH. Sourcing data from multiple smart TV sets, OTT providers, and OS is technically complex. In addition to many conflicting requirements and limitations is a lack of standardization. Combined, these factors complicate CTV ad measurement.

On the other hand, as Tal Chalozin, CTO and Co-Founder at Innovid, an independent CTV measurement platform, rightfully noted:

Fragmentation means competition, and competition means lower prices. When platforms have to compete against one another to secure ad dollars, then the number one lever available to them is their price. As long as the connected TV space remains heavily fragmented, marketers will benefit from a buyer’s market.

More advertisers consider CTV advertising. AdTech companies that can develop better CTV ad measurement solutions and provide precise attribution metrics will emerge on top.

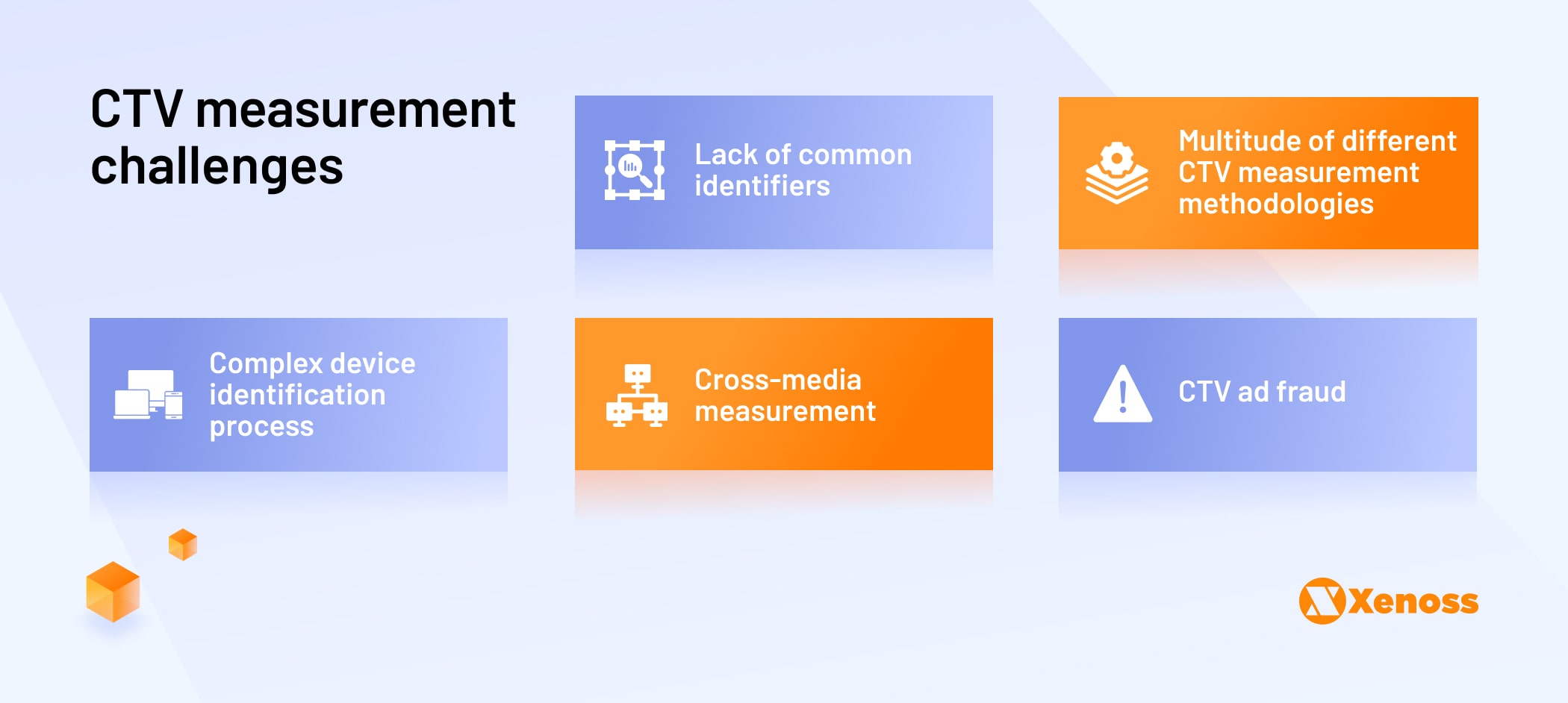

CTV advertising measurement challenges

CTV attribution is hard primarily due to the absence of shared standards for measurability.

Back in the day, Nielsen pioneered measurement for linear TV advertising. Though the company made a tentative move into CTV measurement, both of its frameworks are often criticized for inaccurate audience counts.

Brands (and their agency partners) are on the hunt for a better measurement solution. Which one will it be? The following could resolve the CTV measurement and attribution issues.

Lack of common identifiers

The digital advertising space relied on third-party cookies for years to identify, track, and report user behaviors. Now the industry works towards universally acceptable cookieless tracking and shared user ID solutions.

CTV ad space faces a similar dilemma: It needs cross-platform identifiers. IP addresses have been the most common means of identifying households as they are easy to capture. Most programmatic CTV advertising uses IP addresses for targeting and remarketing.

But is an IP address a reliable ID? No. Many consumers share streaming accounts and use various devices to view the content (i.e., the IP address changes, but the user stays the same or vice versa). Because neither supply-side platforms (SSPs) nor demand-side platforms (DSPs) can precisely ID users, a lot of budgets are wasted. For example, if a brand buys connected TV ads through Roku and via a DSP platform, they risk marketing ad duplication. According to the Innovid x ANA Report:

The average CTV campaign frequency was 7.09 in 2024, with an average CTV household reach of only 19.64%. As campaign sizes grow, so does the risk of oversaturation: high-investment campaigns with over 200M+ impressions saw frequency rise to 10+.

So what are the good options? CTV-specific user identity graphs may help. Digital ID providers like Ramp ID (former IdentityLink) and Tapad offer connected TV capabilities as part of omnichannel identity graphs. However, both solutions primarily rely on IP addresses for initial user identification. Then they augment the created identity with other data points.

No viable alternatives to IP addresses have been found so far, apart from first-party-based ID solutions built by different players in the ecosystem. That said, IP addresses aren’t definitely going away just yet. So the industry has time to come up with new ID types like device graphs or universal user ID graphs.

Multitude of different CTV measurement methodologies

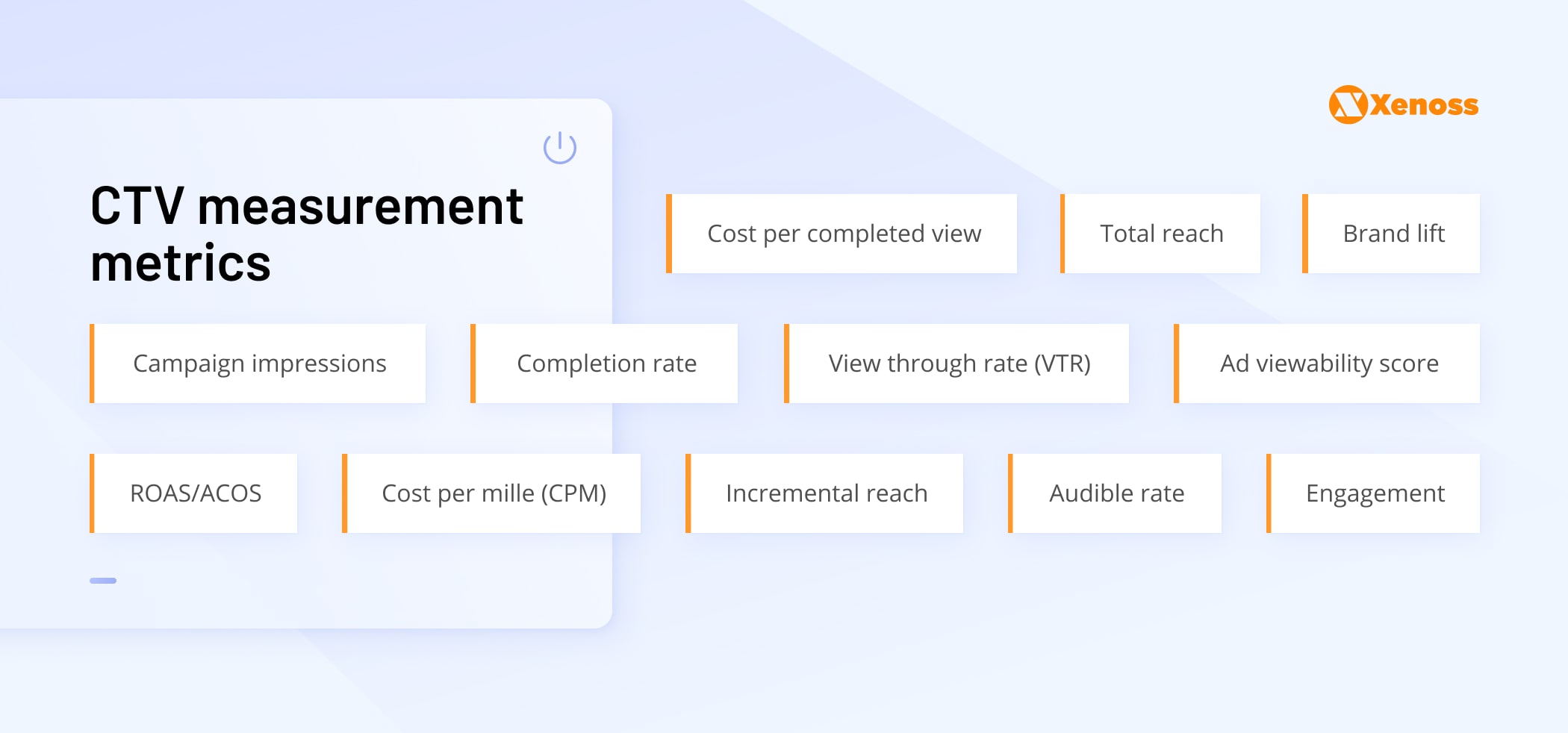

When you ask Ad Ops which CTV measurement metrics they use, you’ll get an entire spreadsheet of answers:

Buyers want both familiar linear TV metrics and programmatic ones. Yet, many DSPs and SSPs struggle to deliver such a large roster of accurate insights. So brands are eager to test multiple CTV attribution options on the table. The Trade Desk and Viant Technology already went with iSpot. Xandr, ABEMA, Smadex, and tvScientific have selected Adjust.

Why do brands want multiple partners? Because the “big four” CTV platforms (Samsung, Roku, Amazon, and Google) employ proprietary approaches to measurement (which they don’t fully disclose).

While Nielsen has expanded into CTV measurement, its cross-platform coverage is still evolving, leaving gaps in independent verification.

Also, fragmentation exists on the AdTech level, where buyers can purchase CTV ads via different ad platforms directly. This further splinters audience data and complicates measurement.

Complex device identification process

Since most platforms rely on IP addresses for user identification, it’s hard to determine who saw the ad: the same person on two different devices, multiple people on one device, or multiple people via the same OTT app.

Also, CTV/OTT ads rely on the server-side ad insertion (SSAI) mechanism. It seamlessly integrates ad videos into the streamed content. SSAI is resistant to ad blockers and allows low-latency ad serving. However, SSAI needs accurate device ID data to deliver accurate impression counts.

IAB Tech Lab’s original 2019 guidelines for CTV/OTT device and app identification recommended using “app store IDs” where available, but significant challenges persist. A lack of standardization around the syntax of Bundle IDs has led to confusion around targeting and measurement, creating a vulnerability that fraudsters could exploit.

To address these persistent identification challenges, IAB Tech Lab created the Ad Creative ID Framework (ACIF) in 2024 to simplify ad creative management and tracking across platforms. It supports the use of registered creative IDs that persist in cross-platform digital video delivery, particularly in CTV environments. The ACIF Validation API entered public comment in December 2024, and ACIF Version 1.0 was released in March 2025.

Using the WURFL device detection database is one workaround. It streamlines user device identification (device model, browser, OS, screen width, etc.). WURFL can be used to improve CTV attribution when paired with machine learning. Still, the setup process is quite complex.

Cross-media measurement

Market fragmentation means that consumers have a lot of choices. Naturally, most switch between watching linear TV, using CTV apps, and OTT services on mobile.

The wrinkle? Few exchange data with one another. Audience data is siloed between:

- Digital multichannel video programming distributors (MVPDs)

- Direct-to-consumer OTT apps

- Smart TV manufacturers

- CTV OS distributors

- SSPs, DSPs, and ad networks

As a result, procuring data points such as device ID, audience demographic, or average viewership is hard, even for original content owners. Distributors typically hold most of the data to attract demand, though some publishers now buy back audience insights. Getting a consolidated view of video content viewership rates is somewhat problematic.

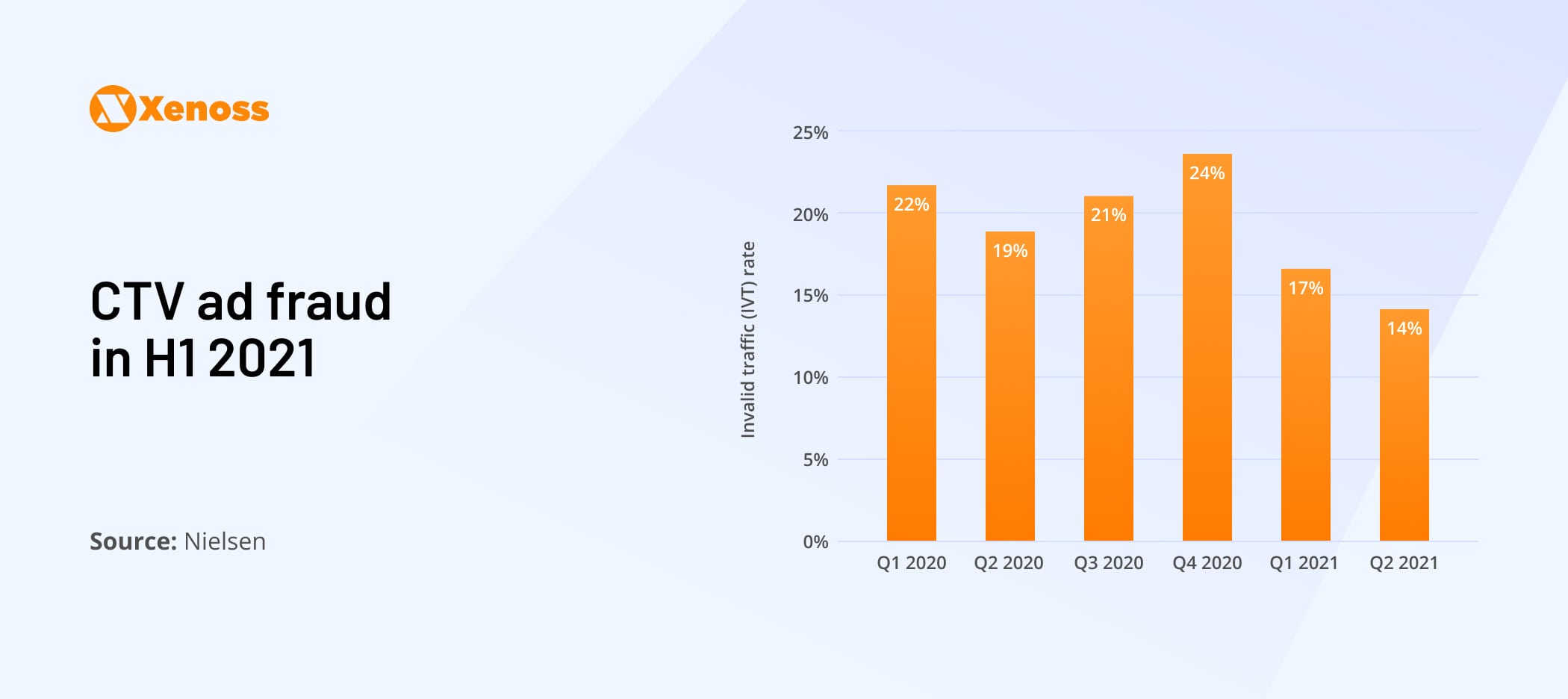

CTV advertising fraud

Programmatic ad fraud is a gruesome industry issue. CTV ads are no exception.

Complex attribution stands behind high IVT rates in CTV advertising. Because verified data is hard to produce, faking ad impressions for CTV is easier than for desktop or mobile devices (although sophisticated ad fraud detection mechanisms might help).

Organizations like IAB Open Measurement, Media Rating Council (MRC), Trustworthy Accountability Group (TAG), and Brand Safety Institute have released comprehensive CTV ad fraud prevention guidelines. The challenge, however, lies in implementing them.

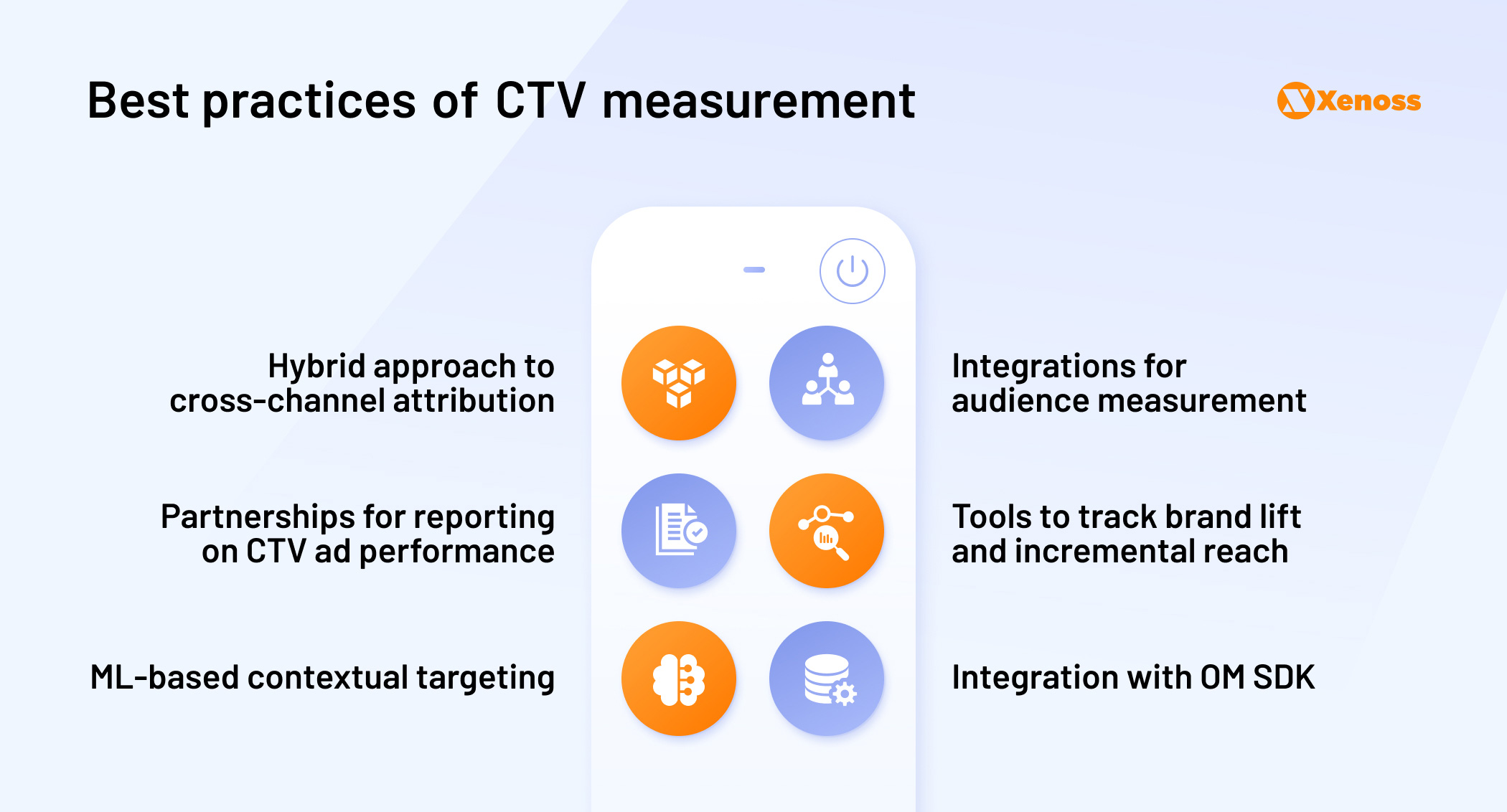

6 best practices of CTV measurement

No single metric can indicate the success of a CTV ad campaign. To reassure the buy-side, AdTech players have to provide a roster of cross-channel metrics, proving ad validity and viewability.

Of course, the best industry minds are working on the CTV measurement problem. In May 2024, IAB Tech Lab expanded its Open Measurement SDK (OM SDK) to include Samsung and LG platforms, now covering 40% of CTV households.

The framework continues to evolve as a common standard for interoperability, with IAB Tech Lab releasing Device Attestation support in late 2025 to combat device spoofing in CTV environments.

OM SDK gives advertisers flexibility and choice in the verification solutions from their preferred providers by making it easier for publishers to integrate one SDK and enable ad verification with all verification vendors.

The IAB Tech Lab announcement

OM SDK is a helpful tool, but not a stand-alone solution. To improve CTV measurement, you need to combine several best practices.

Employ a hybrid approach to cross-channel attribution

Because access to audience data is constrained, no best-of-breed user attribution solution is available. Instead, the industry tests various methods for identifying users and tracking their interactions with content.

IAB suggests that the path pass forward would be using hybrid measurement approaches that combine:

- Automatic content recognition (ACR) methods, such as audio fingerprinting or watermarking

- Passive panel metering technologie,s such as people meters

- Digital metering using linked mobile devices or home router-level meters

- Third- or first-party census feeds

The combination of these signals can enable industry players to minimize ad duplication and better distinguish between linear TV, CTV app feeds at the household and individual levels, and broadcast video on demand (BVOD).

Separately, user ID data such as identifiers for advertising (IFAs), CTV IDs, device IDs, and IP addresses could be cross-matched with audience profiles across platforms. In fact, most market players are making strides in this direction.

Verizon Media ID

Yahoo DSP (formerly Verizon Media) ConnectID includes CTV household data. In 2021, the company partnered with smart TV manufacturer VIZIO to gain viewership data from some 18 million VIZIO Smart TVs.

However, the CTV landscape has shifted significantly since then, and Walmart acquired VIZIO in 2024. Now, one of the largest US retailers’ ecosystems is linked with a major source of TV viewership data, creating new opportunities for retail media targeting on CTV.

Roku Advertising Watermark

In early 2022, Roku released Advertising Watermark, a platform-native way to validate video ads’ authenticity on the Roku platform. The technology has since evolved significantly: in 2023, Roku launched Watermark 2.0, which detects fake impressions at both the device and app level and can be passed through the programmatic bidstream.

Working with partners like DoubleVerify and HUMAN, the watermark has helped combat major fraud schemes, including CycloneBot, which generated up to 250 million fake ad requests daily.

Roku reports a marked reduction in fraudulent ad requests imitating its device traffic since 2023. The watermark is now integrated with Roku Ads Manager, which has replaced OneView as Roku’s primary ad-buying platform.

Determine the optimal approach to audience measurement

Since CTV is a cookieless environment, precise audience measurement is complex but possible. The Media Rating Council (MRC) has an exhaustive list of standards and approaches to cross-media CTV audience measurement.

In short, there are two main options:

- pixel-based technology to capture an impression, video start, and completion data; and to detect and report on Invalid Traffic.

- embedded SDK or client-side measurement code for cross-channel measurement (such as OM SDK by IAB).

Once again, leaders don’t settle for one option. Most establish extensive audience measurement with Automatic Content Recognition (ACR) technologies.

ACR matches individual objects in a video with database records to identify and recognize streaming content. The technology includes either or both video pixel detection (video fingerprinting) and audio capture (acoustic fingerprinting).

ACR-supported devices (smart TVs, smartphones, and tablets) allow ad networks to capture these data points:

- Platform type – linear, CTV, MVPD, or another VOD service

- Geo-location data

- IP address

- Demographics data

- Viewing behaviors – average watch time, ad competition rates, channel surfing parameters, etc.

Tech-wise, ACR algorithms generate library-side fingerprints for the publisher’s media. Fingerprints are designed to compare sample video/audio content against references in the publisher’s database to identify the played content. When a viewer browses content via an ACR device, they generate extra fingerprints, which then get matched to stored records.

Based on matches, AdTech platforms access the above data for targeting, measurement, and attribution. Next, ACR data can be cross-validated with passive or digital metering for even higher accuracy.

iSpot audience measurement with ACR

iSpot has developed a robust cross-channel TV measurement tech suite for detecting ACR-sourced ad impressions across 83 million smart TVs and set-top boxes. Following its 2023 acquisition of 605, the platform combines smart TV data from VIZIO and LG with set-top box data from 16.6 million homes.

The platform relies on intelligent algorithms for matching impression counts against set-top box data and a person-level panel for extra precision, with direct integrations with over 400 streaming publishers. Separately, ad impressions are verified manually by a team of editors.

Such a comprehensive TV ad measurement stack, bolstered by four acquisitions since 2021, has made iSpot a leading challenger to Nielsen. Its publishing partners include NBCUniversal (which certified iSpot as a cross-platform currency vendor), Warner Bros. Discovery, Paramount, and Roku, among others. On the AdTech side, iSpot has secured deals with The Trade Desk, Google, and an exclusive data partnership with TVision.

Figure out how to best report on CTV ad performance

Brands can track connected TV ads using standard performance metrics like ad viewability, quartile rates, and completion rates. However, these don’t always provide an accurate picture.

Ad verification firm DoubleVerify found that one in four CTV platforms continued playing content, including recorded ad impressions, after the TV set was turned off. Ouch, this better get fixed, and it likely will be.

In June 2022, GroupM launched an initiative to co-create a streamlined measurement framework and best practices for verifying that ads only get served when CTV screens are on. A joint study with iSpot found that 8-10% of streaming impressions play when the TV is shut off. Companies including Disney, LG Ads Solutions, NBCUniversal, Paramount, VIZIO, Warner Bros. Discovery, and Fox/Tubi committed to the effort.

The initiative has since evolved, with NBCUniversal and GroupM conducting successful tests in 2024 using IAB Tech Lab’s Ad Creative ID Framework (ACIF) for cross-platform ad tracking.

DoubleVerify has continued to expand its MRC-accredited CTV measurement capabilities. Its Fully On-Screen certification, first accredited in 2021, ensures ads are only displayed when TV screens are on. In April 2024, DV earned additional MRC accreditation for Video Viewable Impressions in CTV, which is significant given that DV’s research shows over one-third of CTV impressions serve into environments where ads fire when the TV is off, contributing to an estimated $1 billion in wasted ad spend annually.

IAB also recommends using the cost-per-completed viewable view (CPCVV) metric since it’s the most efficient and value-driven option.

Provide tools to track brand lift and incremental reach

Most advertisers choose CTV to improve ToFU metrics like brand awareness and consideration. Also, they want to understand how many unique audiences OTT video campaigns engage on top of linear TV campaigns.

Respectively, buyers want to see brand lift and incremental reach stats in their dashboards. In CTV/OTT advertising platform development, you have several ways to deliver these stats.

Brand lift tracking options:

- Partner with CTV/OTT providers and/or third-party measurement companies to access intel.

- Employ statistical modeling methods to estimate CTV ad exposure.

- Augment extrapolated data with passive exposure tracking panels, such as mobile metering and fingerprinting technologies.

- Issue in-device surveys to capture viewers’ sentiment towards promoted brands.

Incremental reach tracking

- Use ACR technology (audio or acoustic fingerprinting) to identify consumed content and viewing patterns.

- Add a passive metering device to capture audio watermarks for higher precision.

- Combine ACR data with device graphs to better distinguish between users who saw linear vs. OTT campaigns (and vice versa). This tech combo can also help retarget exposed users with a sequential campaign across channels, plus re-optimize display frequency.

Consider ML-based contextual targeting as an add-on

ACR is a firmware-based solution. ML-based contextual targeting is a conceptually similar solution, but on a software level. This option might be better suited for AdTech companies that don’t want to source ACR data from multiple CTV platforms.

Apart from monitoring user behaviors similar to ACR, ML-based contextual targeting systems can:

- Forecast advertising inventory volumes across networks

- Model accurate campaign performance predictions

- Facilitate audience segmentation and data-driven audience modeling

- Promote better CTV ad fraud detection and prevention

- Improve user/device identification and ad measurement tracking

Combined, these qualities make ML-based contextual targeting a competitive add-on for your ad network.

Integrate a third-party CTV ad measurement SDK

At the end of the day, brands want guarantees. Many CTV platforms have already voiced their support for OM SDK:

- Apple TV

- Amazon Fire

- Android TV (Google TV)

What about the remaining options like Roku, Samsung Tizen, LG Web OS, and others? If you work with those providers, you’ll have to build a custom SDK for integrating third-party measurement partners. You can turn to professional tech consultants like Xenoss to build a custom SDK for integration and resolve other challenges of the CTV/OTT advertising platform development.

Final thoughts

Connected TV advertising is still a “Wild West” for AdTech providers. Some chose to go “cowboy style” and accelerate their entry into this environment without having CTV ad measurement and attribution tools. This tactic might have worked a couple of years back, but in today’s swiftly maturing CTV landscape, vendors that cannot send a wealth of data down the bid stream will soon turn obsolete.

As CTV platforms continue to compete with one another for ad dollars, smarter AdTech players can focus on developing better CTV measurement solutions to fit into this nascent ecosystem.

Want to be at the vanguard of CTV ad measurement? Xenoss can help you get there with our in-depth AdTech market expertise and technical know-how. Contact us to discuss your project.