Connected TV growth is beating expectations. It’s the fastest-growing ad channel in the US, set to command $30 billion in spending by the end of 2024. The connected TV advertising market in Europe is also going strong at €2.77bn in 2024 with a projected CAGR of 5.26%.

CTV networks and digital video are practically everywhere in US households. Streaming services and publishers are stepping up their game, offering more ad-supported options and better ad experiences for viewers. Brands are all in, and AdTech infrastructure must keep up.

What’s driving CTV growth?

Four factors fuel CTV advertising growth:

- Ad budgets shift with CTV viewership growth. As viewers cut cords and spend more time binge-watching content on AVOD, advertisers ditch linear TV. US CTV ad spending will increase by 13.3% next year, while linear TV ad spend will decrease by 13.3%. For almost 70% of US marketers, CTV is now a “must-buy” as these offer better audience segmentation and higher return on ad spend.

- Data-driven CTV targeting. CTV offers advertisers better addressability. Thanks to emerging identity resolution services, cross-industry identifiers, and improving MarTech software, advertisers gain sharper targeting, better personalization, and precise measurement of their OTT/CTV advertising campaigns.

- CTV marketing is becoming more accessible to SMEs. The big screen isn’t just for big box retailers. Hulu CTV advertising cost just $10-$30 per CPM. YouTube ads: $0.010-$0.030 per view. Roku lowered its minimum CTV campaign spend to $500 to attract a wider pool of brands. Lower CTV advertising price = more buyers, open to experimenting with the channel.

- CTV is ripe for tech experimentation. Contextual targeting with machine learning and dynamic creative optimization for advanced personalizations, data clean room technology for precise measurement, and tightening integration with retail media networks—AdTech companies keep enticing users with innovative solutions.

AdTech CTV trends to watch

From more ad-supported viewing plans to shoppable TV ads, the CTV landscape is evolving faster than you can hit “skip ad.” We’ve trawled the latest connected TV news and digital TV trends to give you the best scoops.

1. Growth of AVOD

Streaming platforms are switching from SVOD to AVOD, especially as consumers curb spending on subscriptions amidst the rising cost of living.

Ad-supported streaming services like Crackle, Pluto TV, and Tubi were the pioneers in the space. New players are following suit. Half of new Disney+ subscribers in March-September 2023 chose ad-supported streaming, and engagement rates rose by 35%. Netflix’s ad tier, launched in 2023, now has more than 23 million monthly active users.

Ad-supported TV audience growth naturally attracts more advertisers, but there are reservations, too. Brands want greater spending flexibility, more programmatic TV deals, and better CTV measurement.

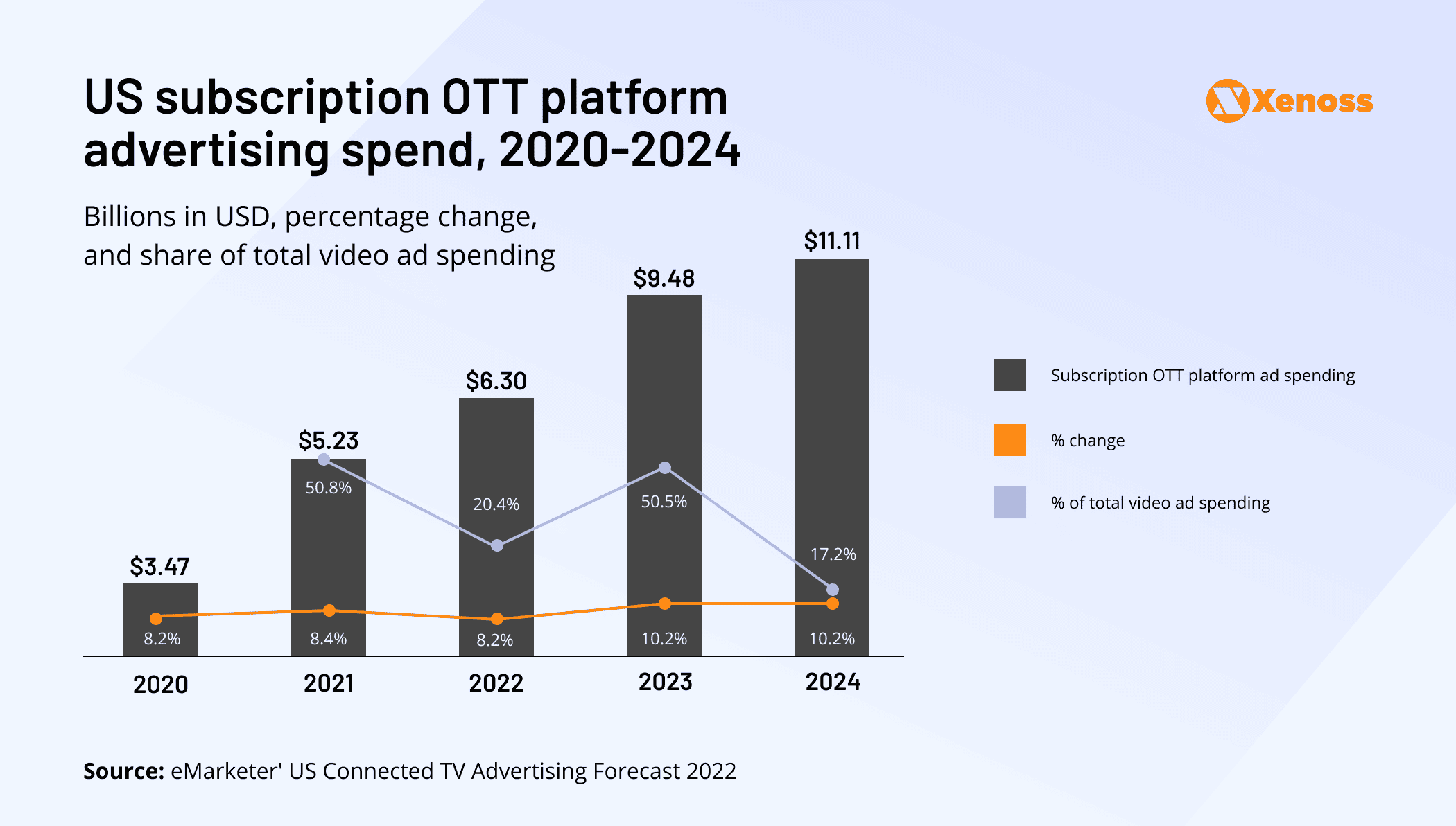

AdTech companies to deliver on that will ride on the wave of growing spending on streaming ads, already hovering at $10 billion in the US.

2. The rise of FAST streaming platforms

FAST(Free Ad-Supported Streaming Television) platforms are a growing competition to SVOD (Subscription Video On Demand), AVOD (Advertising Video On Demand), and MVPD (Multichannel Video Programming Distributors) platforms. They’re claiming more and more viewing time.

In January 2023, FAST streaming made 43 of the top 100 apps by impression volume on Amazon Fire TV and 24 of the top 100 apps on Roku.

And it’s not just casual peeking. FAST TV viewers are paying 35-40% more attention than linear TV viewers and 20-25% more attention than CTV app viewers in Adelaide’s attention benchmarks. The attention levels are on par with the biggest AVOD and vMVPD apps by volume, such as YouTube, Netflix, and Spectrum TV.

Roughly 47% of new FAST TV channels have emerged since May 2022, with advertisers now having access to 5,000 different channels for reaching new audiences.

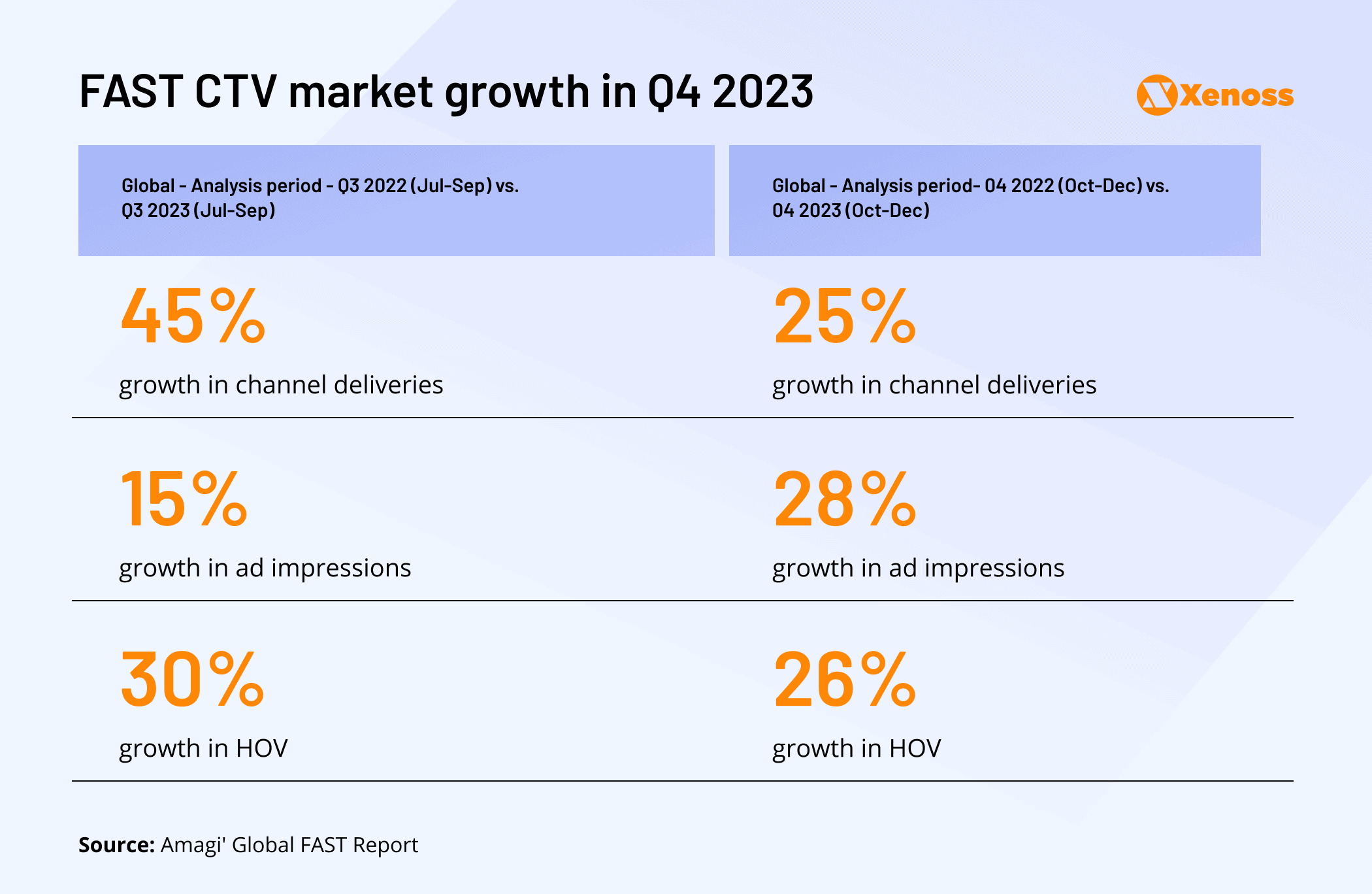

FAST CTV market growth in Q4 2023

Although FAST ad spending has grown fast, some advertisers are holding back their dollars.

IAB says only 30% of advertisers and publishers have full transparency into ad placements, and 27% can determine the brand suitability of the shows they’re advertising on. One-third of impressions are also served when the TVs are turned off. So if FAST channels (and DSPs selling these) want to be taken more seriously, they’ll need to address measurability problems.

As the FAST streaming platforms continue to capture more viewing time and attract advertisers, it is crucial for those new to the CTV landscape to approach their investments strategically. To shed light on this, we asked DJ Agahi, Managing Director at Sabio, for his advice to advertisers venturing into CTV for the first time.

DJ Agahi, Managing Director at Sabio, shares advice for advertisers venturing into CTV investments for the first time.

3. PMP deals are on track to surpass programmatic guaranteed deals

Advertisers have grown comfortable with CTV programmatic advertising. To understand how this shift is fueling the growth of addressable TV and what advantages it brings, we reached out to Paul Gubbins, Advisor at Streamr.ai, for his insights.

Paul Gubbins, Advisor at Streamr.ai, discusses how programmatic advertising propels the growth of addressable TV and its advantages for both traditional TV advertisers and new market entrants

Media buyers who previously did manual programmatic direct deals have first adopted programmatic guaranteed transactions and are now exploring non-guaranteed deals. In 2023, non-guaranteed transactions account for 76% of CTV ad views across the US vs 24% of guaranteed.

For non-guaranteed transactions on connected TV advertising platforms, PMP deals now account for 23% of ad views, with impressions growth of 119% in 2023.

Pre-packaged premium CTV ad inventory is more attractive to advertisers as they can negotiate a better price for a roster of highly relevant placements, ensuring better brand safety and higher engagement. PMP advertising platforms also entice brands with first-party-based targeting and CTV data enrichment services to build lookalike audiences and optimize ad delivery (e.g., cap ad frequency and sequencing across CTV channels).

NBCUniversal and Instacart signed a deal, allowing advertisers to target and measure CTV campaign performance using Instacart’s first-party data. Disney, in turn, extended its already substantial first-party audience graph with over 1,800 interest- and behavior-based audience segments with Walmart Connect. Through 2024, we expect PMP deals to keep gaining traction over programmatic direct.

4. Cautious optimism about open exchanges

Programmatic CTV largely remains a “private club,” with publishers keeping their premium CTV inventory off the open ad exchanges. Due to the slow adoption of open auctions by top CTV platforms, media agencies still consider programmatic as a nice-to-have option. But the stakes may be changing.

With more potential OTT inventory entering the market, especially from FAST platforms, buyers are growing a bigger appetite. If they’re not getting enough volume from direct, programmatic guaranteed, or PMP deals, they’ll be moving to open exchange programmatic deals, as long as these offer access to the desired audience for a fair price.

Especially, when new developers of CTV and OTT advertising platforms are proving that open exchange deals can be transparent and brand-safe. OpenX launched a biddable programmatic connected TV marketplace in late 2023. By eliminating all resellers from its connected TV inventory, OpenX reduced invalid traffic volumes and ensured media companies got a fair cut from ad spending. IAB Tech Lab published an exhaustive guide for programmatic connected TV ad delivery, which should also help bring extra transparency to the industry.

5. Rise of shoppable TV

Shoppable CTV ads are coming to more OTT platforms. And CTV users are all about them—70% dig TV ads with QR codes, and a solid 62% would actually scan if they saw it. Engagement with shoppable media is also potentially high. 65% of viewers are already on their secondary devices, looking up info and visiting advertiser sites while streaming and eager to engage with shoppable content in more ways.

Amazon Prime launched shoppable ads this year to seamlessly link its e-commerce prowess to Prime Video’s new ad tier. Disney has shoppable ads in beta mode. Paramount+ wants to run AI-enabled shoppable TV ads. NBCUniversal, Dish Media, and Channel 4 are also experimenting with the t-commerce.

Shoppable ads can give OTT advertising an even bigger push this year, as, unlike other formats, they’re offering direct conversions For 57% of retail marketers, shoppable video ads are the “next frontier,” ranking atop of other advancements like in-store digitization or AR/VR.

To further understand the potential and innovation behind shoppable ads, we asked Gavin Stirrat, CEO at Adimo, about the most promising new ad formats in CTV.

Gavin Stirrat, CEO at Adimo, on the rise of shoppable ads in CTV and their impact on advertising.

Takeaways

CTV 2024 forecast is looking good: Viewership is surging as more consumers cut cords and purchase CTV devices instead. What’s more, new viewers don’t mind ads. AVOD and FAST app user bases are growing the fastest this year, and we expect the trend to sustain.

New digital experiences like shoppable ads and dynamic personalized ads also yield high recalls, engagement, and conversion rates for connected TV partners.

Data clean rooms and composable CDPs also make it easier for brands to safely use first-party data for audience segmentation and targeting. Advances in computer vision help better screen available inventory for brand safety.

The CTV market is just on the brink of getting really big — and we’re thrilled to watch what’s coming next!