In-app advertising, one of the most dynamically growing segments in AdTech, is facing a significant hurdle: the retirement of mobile ad IDs. The mobile advertising industry will soon lose sight of identifiers critical to tracking ad engagement and conversions. ATT on iOS and the introduction of the Privacy Sandbox on Android present challenges for a supply-side platform’s role in the mobile advertising market.

Similar to the 3rd-party cookie phase-out on the web, the in-app environment is facing mounting challenges to the traditional business models built on identifiable device IDs. Effective app monetization requires a new technology vision and innovative solutions to continue providing growth for SSPs and new revenue opportunities for their publishers.

If you are considering developing a mobile SSP or revamping your existing programmatic capabilities, take into account the recent development in the data landscape and IdTech. In this guide, we’re going to

- review the privacy-related in-app advertising challenges;

- outline the key tech bottlenecks for in-app advertising;

- explore ways for mobile SSPs to be more competitive.

What’s driving the in-app advertising transformation?

The 2021 update to the iOS featured a new privacy feature called App Tracking Transparency that restricts the use of IDFA, a mobile ID that allows tracking of mobile phone user activities across apps. Also, it had a more gradual implementation schedule, Google announced similar measures of deprecating its ad ID and introducing Privacy Sandbox for Android.

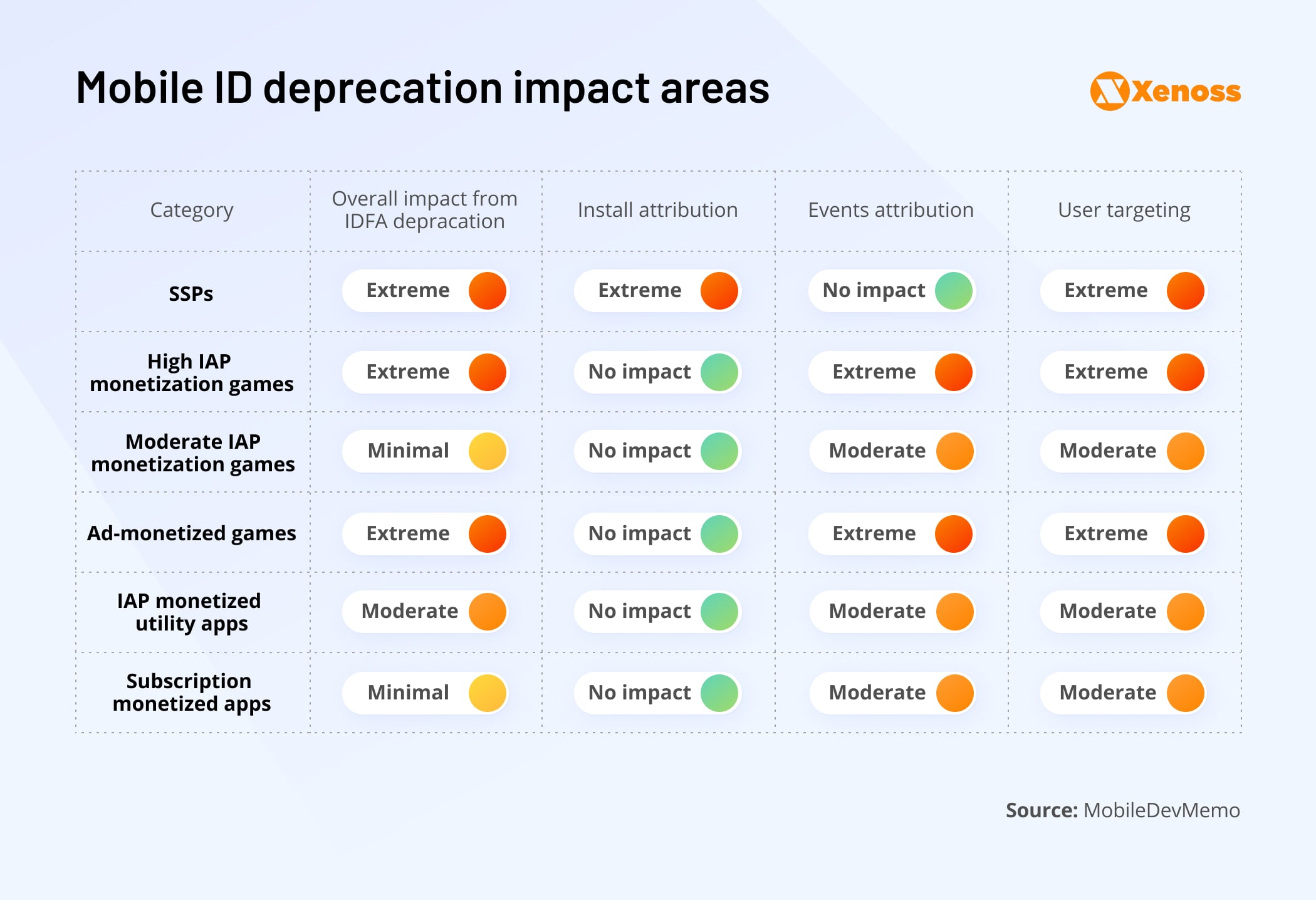

Ad ID deprecation will reduce the targeting options to an anonymized cohort level with attribution based on the limited post-back events. The reduced addressability not only substantially deprecates CPMs of the ad-supported apps but also undermines the time-honored user-acquisition and user-engagement strategies of IAB-based and subscription-based apps.

The ID deprecation incurs losses for both the buy- and sell-side in the in-app trading. For the supply-side platforms, adapting to the shift towards privacy by default is critical for the survival of their business model.

In this landscape of data scarcity, mobile DSPs and SSPs are forced to adjust to new technologies, integrations, and perhaps even expansion to previously untapped business models. SSPs have data signals we can’t necessarily get from a DSP and can use this potential to offer a competitive solution to media agencies and big advertisers.

Bottlenecks and solutions for mobile supply-side platforms

To adapt to the swiftly consolidating market, SSPs need to distinguish themselves from the competition with robust programmatic capabilities, strategic data partnerships, and an up-to-date tech stack. Further, we will review the main technological gaps SSPs need to fill.

SSPs that do not innovate in their data integrations and additional value-added services for the publishers and media buyers may be unprepared for the road ahead.

Bottlenecks for in-app SSPs

The deprecation of ad IDs and the new consolidation phase in the marketplace affect SSPs across two dimensions: loss of demand partners that may prefer a more data-rich inventory and dissatisfied publishers looking for direct connection with DSPs. Supply-side platforms must try to solve this challenge by rolling out a competitive offering for both media buyers and publishers.

The new quality of SPO

With the deprecation of mobile IDs, SSPs without a sustainable addressability strategy in place are risking depressed CPMs. If they fail to provide an appropriate match rate, their market share will quickly succumb to programmatic players that secured access to the first-party data for targeting.

Supply-path optimization has a renewed resonance in the media trading field. As ad ID and traditional methods of audience segmentation deteriorate, media buyers start to discriminate against supply partners that cannot provide an additional layer of data for targeting their inventory.

Supply path optimization has grown more sophisticated compared to the early days of merely eliminating unreliable partners.

We’re focused on a new level of SPO, where it’s moving beyond the quality of media supply and more into an addressability play.

John Speyer, Senior Director, Advertisers Solutions, PubMatic

In light of the new optimization priorities, big media agencies are reducing their number of programmatic partners, prioritizing platforms that can provide targetable data-rich audience segments.

For instance, Havas Media Group’s recently trimmed the number of SSP partners from five to seven. Back in 2018, it used up to 42 SSPs. The main criteria for choosing supply partners for Havas is the possibility of “data activation,” a.k.a the ability for Havas’ clients to target audiences on inventory without third-party cookies and mobile IDs.

All major media agencies are reducing the number of their supply partners, leaving a little wiggle room for players without a substantial offering of data or premium inventory. The recent Unity and ironSource merger marked the beginning of the consolidation phase among the in-app SSPs.

Blurred lines between SSP and DSP

The lines between buy- and sell-side AdTech companies have become increasingly blurred. Earlier this year, The Trade Desk, the industry’s largest independent DSP, proposed direct integration with premium publishers via its OpenPath initiative, a move many interpreted as an immediate threat to the traditional role of SSPs.

On the other hand, SSPs are increasingly forming partnerships with media agencies — relationships that DSPs traditionally facilitated. For instance, PubMatic, previously an old-school SSP, reported that it made more than a quarter (27%) of its Q4 2021 revenue from helping advertisers buy better impressions.

More advertisers are moving the activation of their programmatic advertising to the supply side of the ecosystem where the sustainable data is. Another notorious example is Integral Ad Science — an ad verification firm at its core, but its latest move has it operating more like a large SSP.

Revenue model changes

Many mobile SSPs out there are on life support due to interest rates rocketing up in an already depressed market. Fluctuation in marketing budgets for 2022/2023 will only push for more consolidations to enable survival.

The attribution model based on identifiers is being replaced by alternative measurements due to the difficulty of understanding the multi-touch attribution model. In a landscape where only scale can guarantee the appropriate audience match rate, mobile SSPs focus more on the new emerging attention metric, which not only gives advertisers the knowledge of who has seen their ad but can also estimate how performant the creative has been in generating the desired outcome.

The ability to leverage those metrics is predicated on the ability to foster strategic partnerships with data owners/exchanges and work out new revenue-share models with data-rich publishers. Since the amount of data on the open exchanges is drying up, ramping up capabilities for programmatic guaranteed deals and private marketplaces is crucial for in-app SSPs.

Ad fraud

While a problem for the entire industry, the vast majority of ad fraud usually originates on the supply side. With this challenge at hand, it is critical for supply-side platforms to focus on mobile ad fraud prevention and monitor inventory provided by suspicious actors.

The inability to audit mobile ad inventory and trace it to specific users, as well as untested ways to bundle inventory, will, unfortunately, increase the likelihood of mobile ad fraud with bots, malware, and device farms with human operators. Because of this, SSPs and ad exchanges need to follow IAB Tech Lab standards and consider building custom ad fraud detection software.

Increasing technological complexity

Having a highly functional mobile SSP demands an architecture capable of integrating a variety of ad network SDKs, keeping them updated and optimally synchronized with new functionality, creative formats, and so on. Because so much depends on a highly complex system, most enterprises fully rely on an in-house software development team.

However, in times of rapid change, having a tech partner proficient in the industry becomes critical. Even the optimal configuration of the Ad Tech stack does not make your product immune from problems down the road. New platform policies and integrations with the new partners can clog your data pipelines or undermine your attribution picture.

In mobile ad mediation, even if you performed the integration by the book, following every letter in the guidelines, there is still no guarantee that everything will function properly. This is because everybody counts their impression differently and may send back the signal about the viewed impression at various times, significantly skewing the measurement on your side.

No AdTech configuration is optimal for long, so having a proactive stance towards emerging platform policies and integrations with the new partners is paramount.

Solutions for in-app SSPs

As you can see, the deprecation of mobile IDs created several bottlenecks in the in-app ecosystem. Now, let’s consider strategies and tools that savvy industry players use to counter those challenges.

Mobile SSPs are establishing ways to reach app consumers in a world without mobile advertising IDs with a rapidly shifting technological landscape. They have already developed several vital strategies not just to survive but to thrive within an ever-changing ecosystem. Here we review examples of some of the most promising solutions.

Mobile ad ID and data partnerships

Audience measurement challenges when users don’t opt-in to app tracking are a given, but already available walkarounds can help solve the problem. While no single solution exists, several approaches are currently available, each reinforcing the other for a powerful combined effect:

- Alternative IDs

- Data partnerships with Telco

- ML-powered predictive audiences

For a small portion of opt-in users, alternative IDs are already being incorporated into new identity structures and will play an important role. These will not apply to the same number of audiences as before, but this addressable, measurable, and identifiable audience is a valuable part of the overall inventory.

AppLovin, for example, is experimenting with UID 2.0, while Smaato chose to integrate with the Liveramp. PubMatic rolled out its proprietary platform Connect, which worked as a data exchange of addressable signals to help data owners drive monetization and help media buyers drive performance. At least ten alternative universal IDs are also being offered and tested.

Finding and integrating the right data partners to implement alternative measurement approaches will be vital in offering premium audience segments. Mobile network infrastructure players like Eriksson are experimenting by offering network data via their subsidiary Emodo. They are trying new ways to obtain user insights and promise to enrich non-identifiable user data with mobile carrier data points.

Predictive audiences are another method being tested to replicate premium ID-based inventory. To do so requires analyzing a much greater volume of real-time data points and proficiency in training and fine-tuning machine learning models.

The vendor ecosystem is only emerging here. One of the industry pioneers here is IBM’s Watson Advertising Predictive Audiences. The AI-powered offering for data teams is based on enriching existing data with over 13,000 data signals available from Watson. IBM claims a 44.6% per customer cost decrease among the predictive audience–built segments and a 45.7% conversion rate improvement among users.

Capabilities for the buy- and sell-side

With the traditional roles of ad traders cast aside, SSPs need to adjust and focus on where they can create value for different stakeholders. With the rising trend of disintermediation, SSPs need to go outside of just bringing incremental demand to publishers to stay relevant.

In light of DSP encroachment on the traditional SSP turf, the supply-side platforms need to provide their publishers with superior inventory and data management features, additional data points to enrich their impressions, and the shortest possible path to quality demand.

At the same time, SSPs need to capitalize on the disintermediation trend and become the preferred pipelines to inventory for marketers because they are no longer exclusive to publishers. In the new privacy-first landscape, SSPs are ideally positioned to become a primary access point for agencies since they have data signals that they can’t necessarily get from a DSP.

To make this relationship work, SSPs need capabilities for media buyers. Developing a proprietary DSP with functionality to support preferred deals and private marketplaces can be a good start. Take PubMatic; it recently released a Media Buyer Console solution to help curate media buying for agencies and in-house brand teams.

At the end of the day, SSPs need to diversify their business model and create a holistic ecosystem that connects buyers, sellers, publishers, data platforms, and everything else in between in a way that’s efficient, transparent, data-rich, and fraud-free.

New ad revenue options

Establishing new revenue streams for supply-side platforms will require wins on many fronts: optimizing mediation, expanding real-time bidding, and supporting advertiser direct deals.

Improving revenue potential via mediation is achievable by getting more direct access to the programmatic marketplaces. For instance, AppLovin recently connected RTB demand from Google, in addition to the waterfall demand it already had from AdMob. The next logical step can be adding direct demand functionality on platforms or adopting private marketplaces and programmatic guaranteed deals on the programmatic exchanges.

Supporting advertiser direct deals isn’t a trivial challenge, as format standardization is ongoing. Ad networks like Anzu already announced that their platform supports programmatic and direct deals with brands by being admitted to the Unity partner program. New partnerships, new ad formats, and new integration offer exciting opportunities for the supply-side platforms to grow and thrive.

Ad fraud detection and prevention solutions

Effective ad fraud detection and prevention rely on two pillars: automated solutions for anomaly detection and establishing due diligence processes that follow IAB standards.

Within the automation realm, various solutions like Adjust and Pixalate based on fact-based and statistic-based anomaly detection already exist. They help detect malware and viruses and prevent phishing and cloaking attempts. Learn more about programmatic ad fraud detection in our comprehensive overview or see the available ad fraud prevention services that may be relevant.

Equally important are internal processes that are updated to follow emerging industry practices. IAB Tech Lab standards (seller.json and app-ads.txt) aren’t just a way to list approved partners, but follow a business process for vetting new supply chain partners makes the approach effective.

As standards rapidly change, are replaced, and added, one way to stay up to date is to get listed in the IAB Tech Lab compliance directory to monitor the industry and to showcase current standard proficiency publicly.

Contracting AdTech vendor with integration expertise

Because so much depends on a highly complex system, most enterprises fully rely on an in-house software development team.

However, most mobile mediation SDKs are essentially black-box solutions that do not provide the workings of their inner algorithms. That is why it is essential to have a tech partner who can reverse-engineer the logic of the connected ad networks based on the outputs of their attribution dashboards and tailor the integrations accordingly. Only an experienced tech partner with years of integration experience can effectively fix the discrepancies in impression measurement for the newly added integrations.

To avoid the company’s business needs being sidelined by the limited capabilities of the in-house team, AdTech businesses should not neglect hiring outside experts for consulting and team training.

Takeaways

The deprecation of mobile advertising ID has broken the user data-centered measurement and advertising-based monetization business model, presenting significant challenges for the AdTech industry and supply-side platforms in particular. To adjust and thrive in this landscape of data scarcity, SSPs need to act on two separate fronts.

On the one hand, they must stand their ground in relationships with publishers, eliminate any possibilities of fraud, and provide transparent analytics and an additional data layer to increase yield for their publishers. On the other hand, they need to attract the ad spend from the media agencies and in-house teams of the big brands by rolling out media buying capabilities and enhancing their data offering with audiences signals no DSP can provide.

Taking advantage of the new opportunities will require technical agility and increased engagement with business and technology partners, but progress is achievable, and the market is ripe for more innovation.