The AdTech market just had another interesting running year. Many of the AdTech trends we saw in 2023 have further matured: First-party data infrastructure is becoming a critical priority, contextual advertising has been reinforced by new custom content taxonomies, and retail media has entered a new growth stage.

At the same time, Generative AI, 5G connectivity, and big data analytics are making a strong debut this year, as indicated by the early findings from our research on the State of Advertising Technology in 2023, which will be released at a later date.

The imminent depreciation of third-party cookies will also shake up the current AdTech landscape. However, the largest AdTech companies don’t seem really phased out by the transition, thanks to earlier investments in identity resolution, data clean room, and unified IDs.

Here are the key trends shaping the future of AdTech in the coming year.

1. Third-party cookies are out for good, signifying the new era of AdTech

The countdown to planned third-party cookies deprecation has begun. Chrome plans to switch third-party cookies for 1% of randomly selected Chrome users in Q1 2024 to test the system. Complete phase-out is planned by the second half of 2024.

Moreover, Google announced tests of an “IP Protection” feature, an opt-in, phased feature to mask users’ IP addresses, starting in 2024. Although an IP address isn’t a reliable standalone identifier, it helps construct more complex user identities. With the IP masking on, AdTech companies will face further challenges with attribution.

The real-world performance of the new Chrome APIs is still unclear. With users now having the option to opt out of targeted advertising, advertisers may have even less reliable data.

Criteo already tested the beta version of Topic APIs and wasn’t impressed by the results. The company started testing Google Topics API in June 2023, first on desktop and later on mobile Android, and observed over 1 million daily Topic-tagged users. In comparison to Topic API audiences, Criteo’s interest-based audiences proved to be five times more relevant.

In other words, AdTech should start looking for alternative cookieless solutions in 2024.

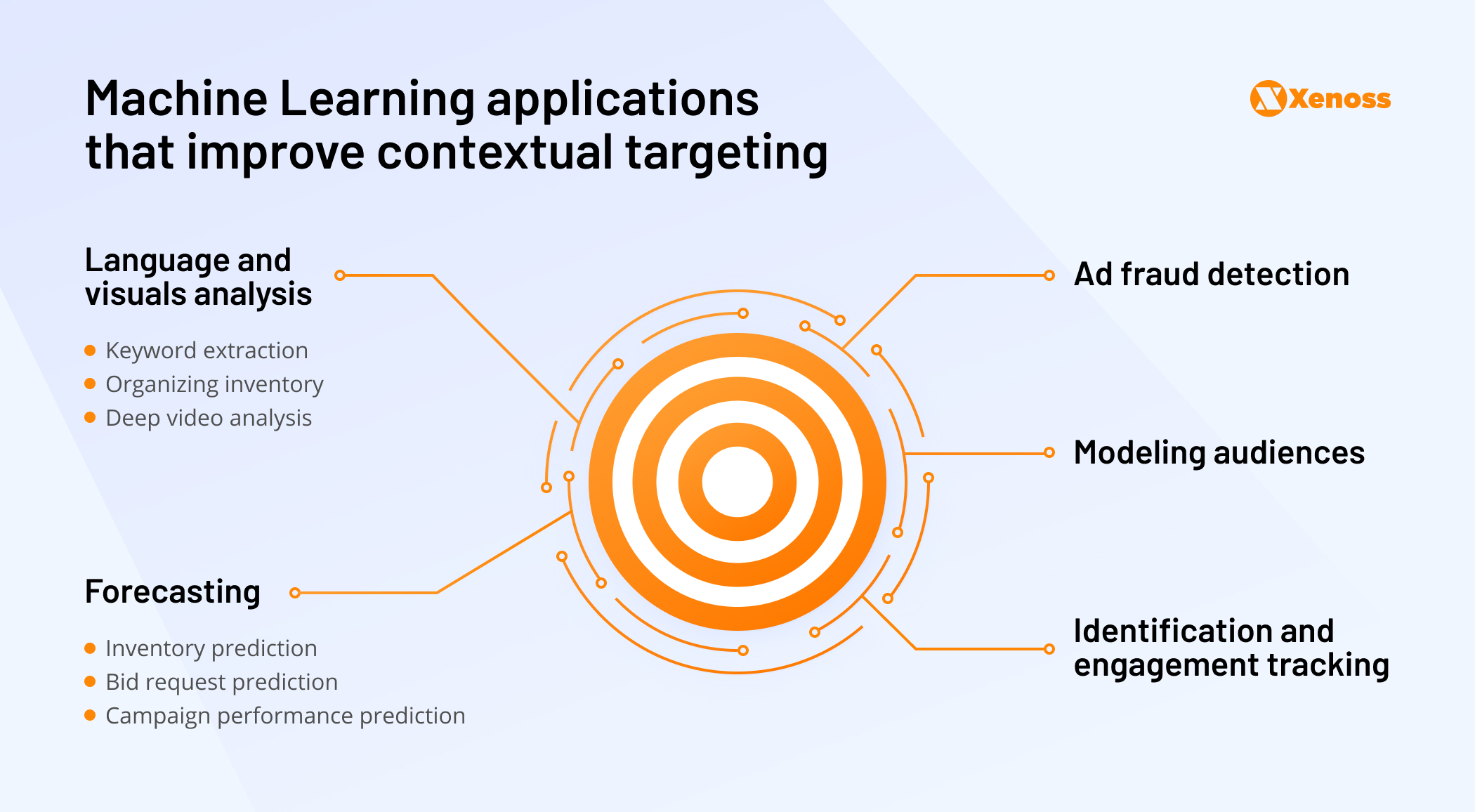

User identity graphs and universal IDs are being actively promoted by The Trade Desk, LiveRamp, and Pubmatic as new shared identifiers. Contextual advertising is making a stronger comeback with machine learning. Data clean rooms will also remain “safe harbors” for private data exchanges and identity cross-matching.

Individually and combined, first-party-based solutions can offer equally (if not more) effective attribution, targeting, and measurement capabilities. The earlier you start running the performance tests and measurement benchmarks for a new cookieless solution, the sooner you’ll land the optimal choice. If you need some advice on reconfiguring your infrastructure, reach out to Xenoss.

But the technical side is just one of the challenges. AdTech companies will also need to “sell” the new capabilities to end users. A recent YouGov study found that 53% of marketers globally aren’t prepared for the end of third-party cookies. Also, 57% aren’t aware of alternative cookieless solutions, meaning the industry still needs to be educated about the benefits of new solutions.

2. Data clean room craze will continue but will be challenged by other alternatives

2023 has been a big year for data clean room technology.

Amazon launched Clean Rooms on AWS early in 2023. Google followed by releasing a clean room on BigQuery by mid-2023. Established players like Infosum, Habu, and Neustar (TransUnion) substantially upgraded their products.

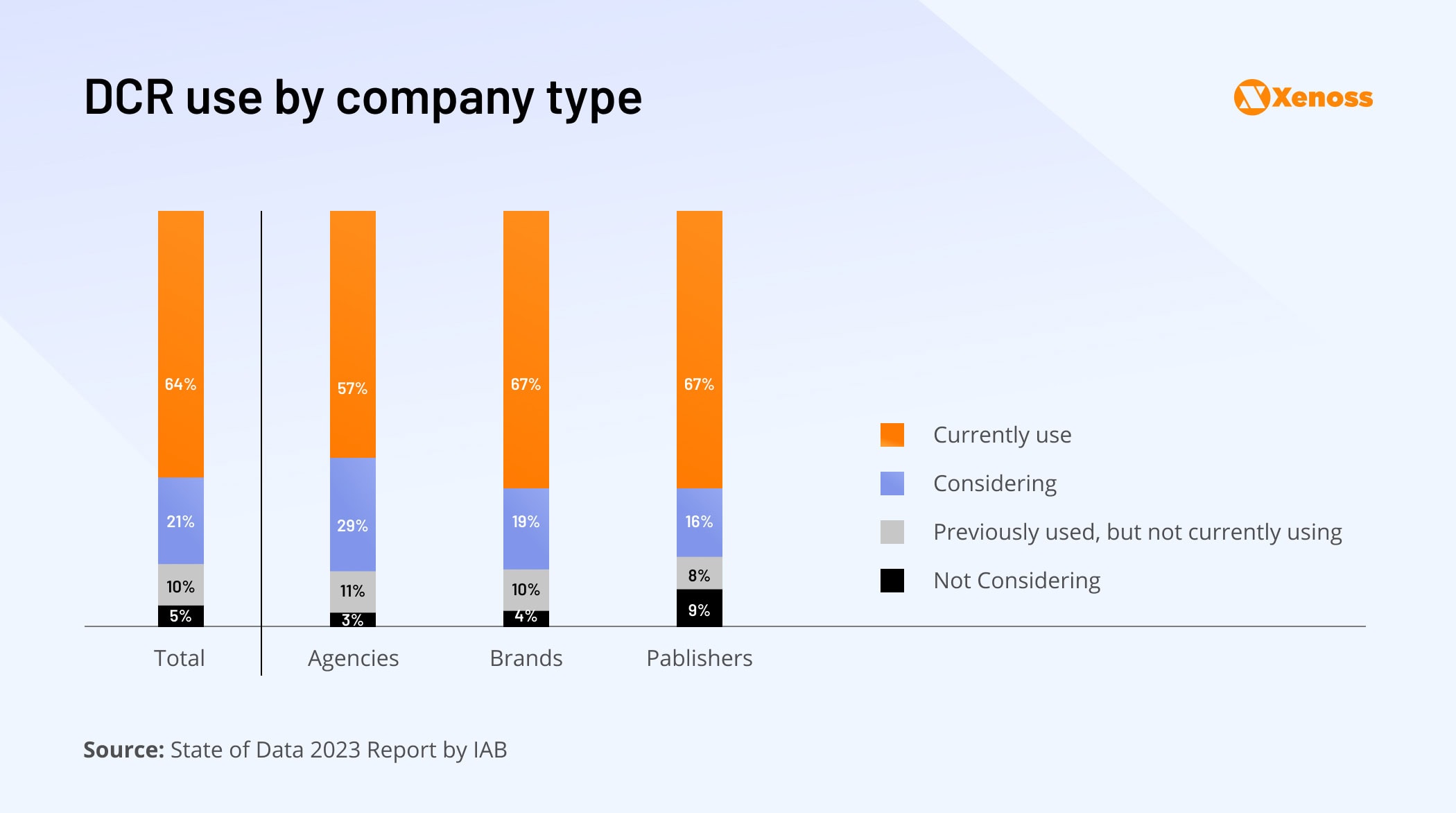

Brands like Disney, Kroger, Walmart, and Paramount, among others, are among mature adopters of data clean room advertising practices — and more adopters are coming. Almost 9 in 10 companies plan to increase usage of clean rooms in the next 12 months, encouraged by the measured improvements in advertising and marketing ROI.

In 2024, data clean rooms will enter a new phase.

The IAB Tech Lab finally finalized its first set of data clean room specifications. Effectively, greenlighting more streamlined data clean room development. New players will likely enter the market, including data warehouse providers, larger publishers, and Big Tech companies.

Cloud data warehouse providers Databricks and Snowflake have strong stakes in the DCR market, and more providers may be enticed to join, given the demand. Google introduced data clean rooms for BigQuerry in March 2023, effectively extending the capabilities of first-party-based targeting on the Google Marketing Platform.

The growing demand for privacy-friendly first-party data, supplied by data clean rooms, will also tinder growth in adjacent channels, namely retail media and connected TV.

Retail media networks also require secure sharing of first-party data. DCRs enable them to share their data with advertisers while still maintaining control over who can access it and how it is used. CTV advertising space will also benefit as clean room technology helps make viewing data available to third parties, promoting better attribution and measurement.

Maria Novikova, CMO at Xenoss

Effectively, data clean rooms serve as a springboard for more advanced targeting for channels like CTV where ad measurement has been problematic.

Roku already uses its data clean room technology to enable better targeting on its streaming platform. Amazon is rolling out Amazon Publisher Cloud, a clean room service that allows publishers to combine owned first-party data with Amazon sources for ad targeting. With DirecTV, Dotdash Meredith, Fandom, NBCUniversal, and TelevisaUnivision already on board, the new solution can bring new levels of effectiveness to CTV advertising.

That said, data clean room technology is expensive. Over 60% of adopters spent a minimum of $200K on the technology, and a quarter (23%) — over $500K. Moreover, users continue to struggle with a plethora of adoption challenges, including interoperability issues, lack of customization, privacy concerns, and the general inability to demonstrate the ROI of the technology.

In 2024, we expect companies to also scale up more affordable (yet equally effective) alternative privacy-preserving technologies including contextual advertising, adoption of universal IDs, and the already mentioned Google Topics API (if it proves its efficacy).

3. Optimizing infrastructure will be the #1 strategy for sustainable and cost-effective AdTech platforms

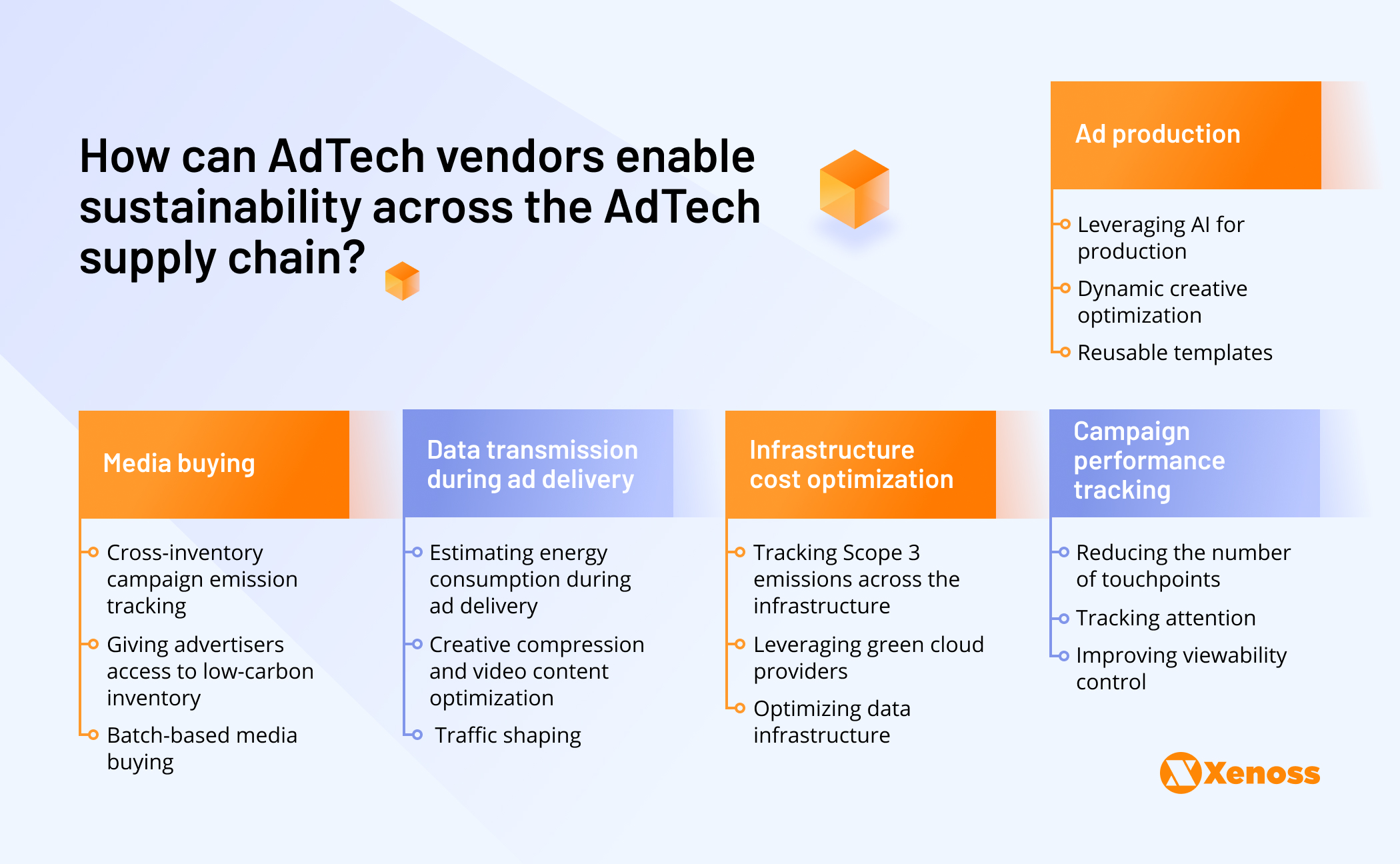

Sustainability has been a key theme in the AdTech market for a couple of years. Digital advertising produces over 13,860 metric tons of carbon each year — an equivalent to burning over 15 million pounds of coal. Collectively, we can (and should!) strive to do better in this decade.

Pressed by new ESG mandates, brands are sizing up sustainable advertising solutions. At times, when AdTech supply outweighs the demand, lower carbon emissions can be a strong differentiator for DSPs and SSPs to attract larger clients.

Apart from doing good for the planet, sustainable advertising technology also helps bring down IT infrastructure costs. More effective application design, coupled with cloud infrastructure optimization, leads to lower energy resource consumption and operational cost reductions.

PowerLinks, for example, managed to reduce infrastructure costs by 20X (from $200K /mo to $10K/mo) without any losses in performance with Xenoss’ solution redevelopment.. Optimized cloud infrastructure and cloud database costs effectively translate to a reduced carbon footprint.

Progressive modernization of legacy applications is another strategy for becoming more sustainable. Statistically, cloud is 93% more energy efficient and 98% more carbon efficient than on-premises infrastructure.

Newer application design approaches such as microservices and containerization also reduce the volume of consumed virtual resources. For example, container-optimized AWS Graviton instances cost 20% less to operate than equivalent x86-based Amazon EC2 instances.

Ogury, an AdTech platform for personified advertising, migrated to Kubernetes from an in-house and in-house container orchestration system to optimize its container deployments and better understand cloud spending. Despite handling over 10 million API calls daily, Ogury can maintain full visibility into cost allocation across all clusters, down to the namespace, deployment service, or any other type of construct. This immensely helps with cost management and budget planning.

This year, we expect more AdTech companies to focus on infrastructure cost optimization to curb the carbon footprint and contain operating costs.

4. Retail media’s experimental phase is over; it is entering a period of consolidation

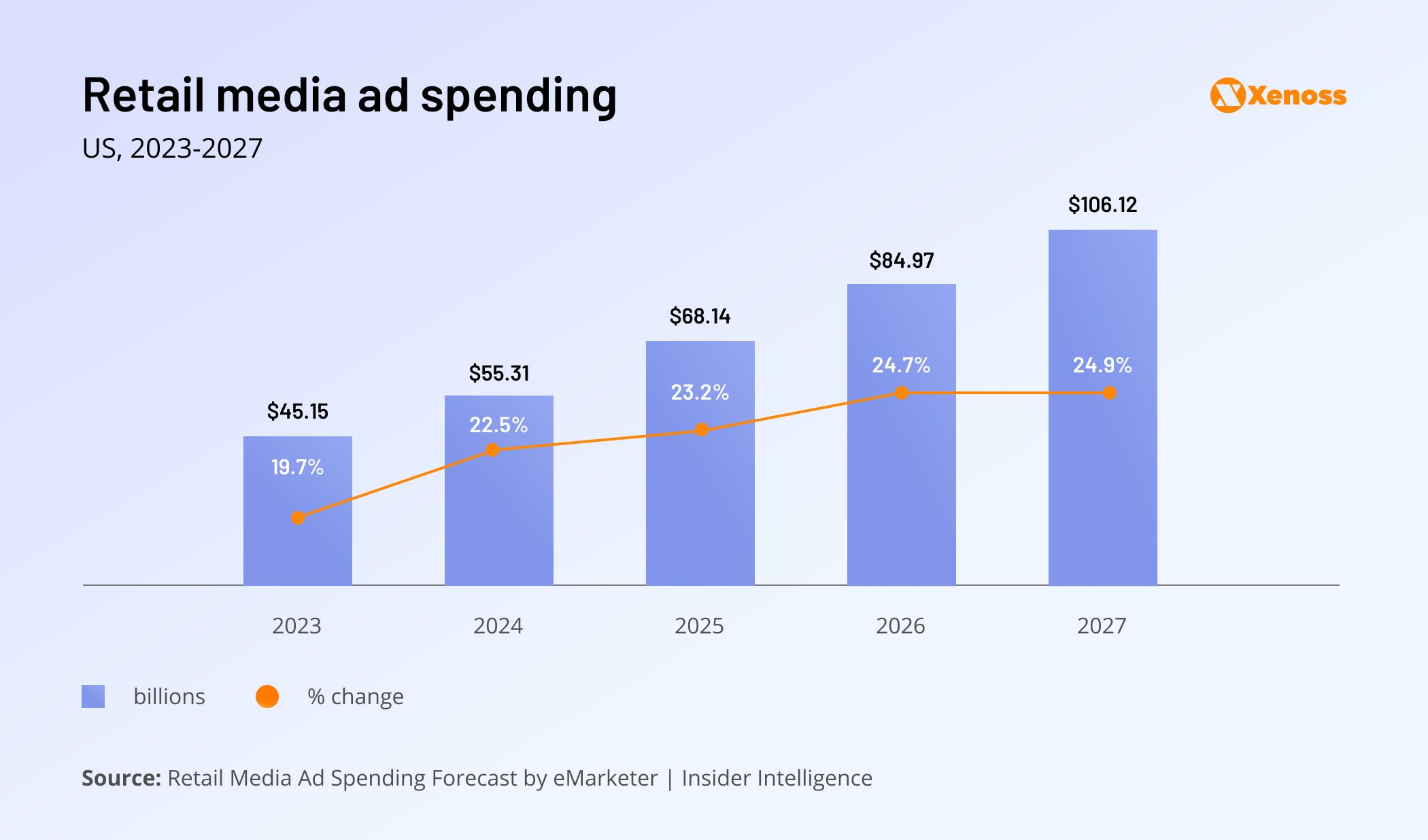

Retail media advertising was one of the fastest-growing ad channels in 2023, securing around $122 billion in global ad spending, according to WARC’s global ad spend outlook.

The growth forecast is bright, with US spending on ads in retail to surpass $68 billion by 2025.

In 2023, we also saw retailers teaming up with “big guns” like Meta, Criteo, and The Trade Desk, among others, to launch new retail media platforms. The retail media landscape also welcomed a host of new entrants from the groceries sector (Hy-Vee, Foodland, and Giant Eagle, among others, now run RMNs), as well as several fashion and beauty companies like British Superdrug and ASOS (which is overhauling its existing network to support off-site channels like premium publishers and connected TV).

Yet, up till recently, most of the retail media networks have been largely experimental. Fueled by the growing demand for retail advertising, brands and their technology partners were “testing waters” and assessing feasibility. Likewise, CPG brands have been eager to test multiple partners to evaluate the ROI.

In 2024, we expect the retail media space to become more mature and consolidate.

IAB finally released Retail Media Measurement Guidelines, which should bring greater transparency to the channel through standardization. That’s timely because, in 2023, 58% of media buyers rated the ROI of retail media networks as “poor relative to other ad channels.”

On the pro side, AdTech companies are polishing up their products. Criteo formally launched its Commerce Max DSP, which consolidates access to its inventory of 210 retailers, 2,400 brands, 1,500 agencies, and 1200 publishers. The Trade Desk also continues to expand its roster of retail media partners, with Schwarz Media, the retail media unit of Schwarz Group, Tokopedia, Indonesia’s largest C2C marketplace, joining this year.

What we’ll likely see in 2024 is a further merger of the retail advertising market, with fewer retailers operating owned RMNs and others consolidating supply to larger demand-side platforms.

5. AI becomes the new copilot for programmatic managers

In 2022, AI-enabled advertising spending worldwide stood at a modest $370 billion, but it’s expected to reach 1.3 trillion dollars a decade later.Behind the scenes, the best AdTech and MarTech companies already use machine learning to detect fraud, dynamically recommend ad creative, optimize inventory management, and improve ad targeting.

This year, we expect to see more AI at the front, a.k.a serving the users directly.

Traditionally, the AdTech products had a steep learning curve, with new users often being overwhelmed (or unbeknownst to all the available configurations). AI algorithms can offer users real-time guidance on campaign setup, ad targeting optimization, and bidding strategy adjustments.

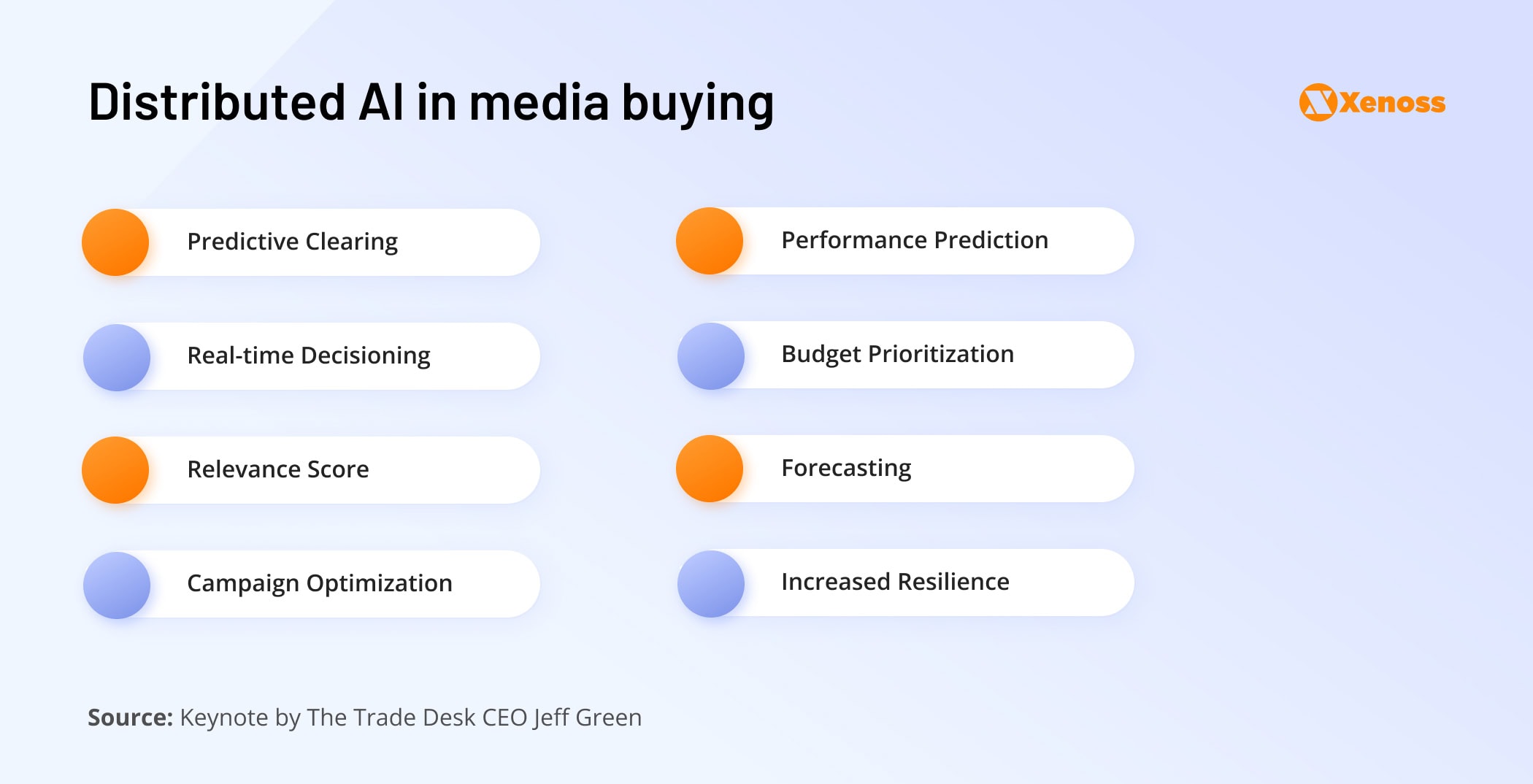

The Trade Desk released Kokai in 2023—an AI assistant for programmatic marketers. Powered by deep learning algorithms, Koa can scan over 13 million advertising impressions per second and dynamically adjust bids based on over 10 dimensions, plus optimize towards up to 3 different KPIs. Koa can also surface new audience insights and provide other contextual tips for campaign optimization.

DeepIntent is another AdTech startup that recently launched an AI copilot for the HealthTech industry. The smart assistant delivers recommendations based on real-time media data tied to clinical outcomes, helping marketers target the right audiences with the right message.

Microsoft is also working on new “copilots” for its advertising products, and Amazon will likely have a similar offering.

Adding AI to your front-end experience may be the quickest path to attracting more users to your AdTech product in 2024.

6. Gen AI is the driving force of creative management

This year’s list of AdTech trends would have been incomplete without Gen AI.

The new breed of dynamic creative optimization (DCO) platforms like Ad-Lib.io (developed in partnership with Xenoss), Adzymic, and Smartly.io have emerged on the market, offering brands highly personalized, fully automated creative optimization.

Gen AI can further accelerate creative ad management, bringing a new scale of efficiency to content generation, management, and optimization workflows across channels. Over 90% of agencies already rate the impact of DCO on successful campaigns as “very” or “somewhat significant.” In particular, agencies praise DCO for real-time adaptability, personalization at scale, improved relevance in ad serving, and faster A/B testing.

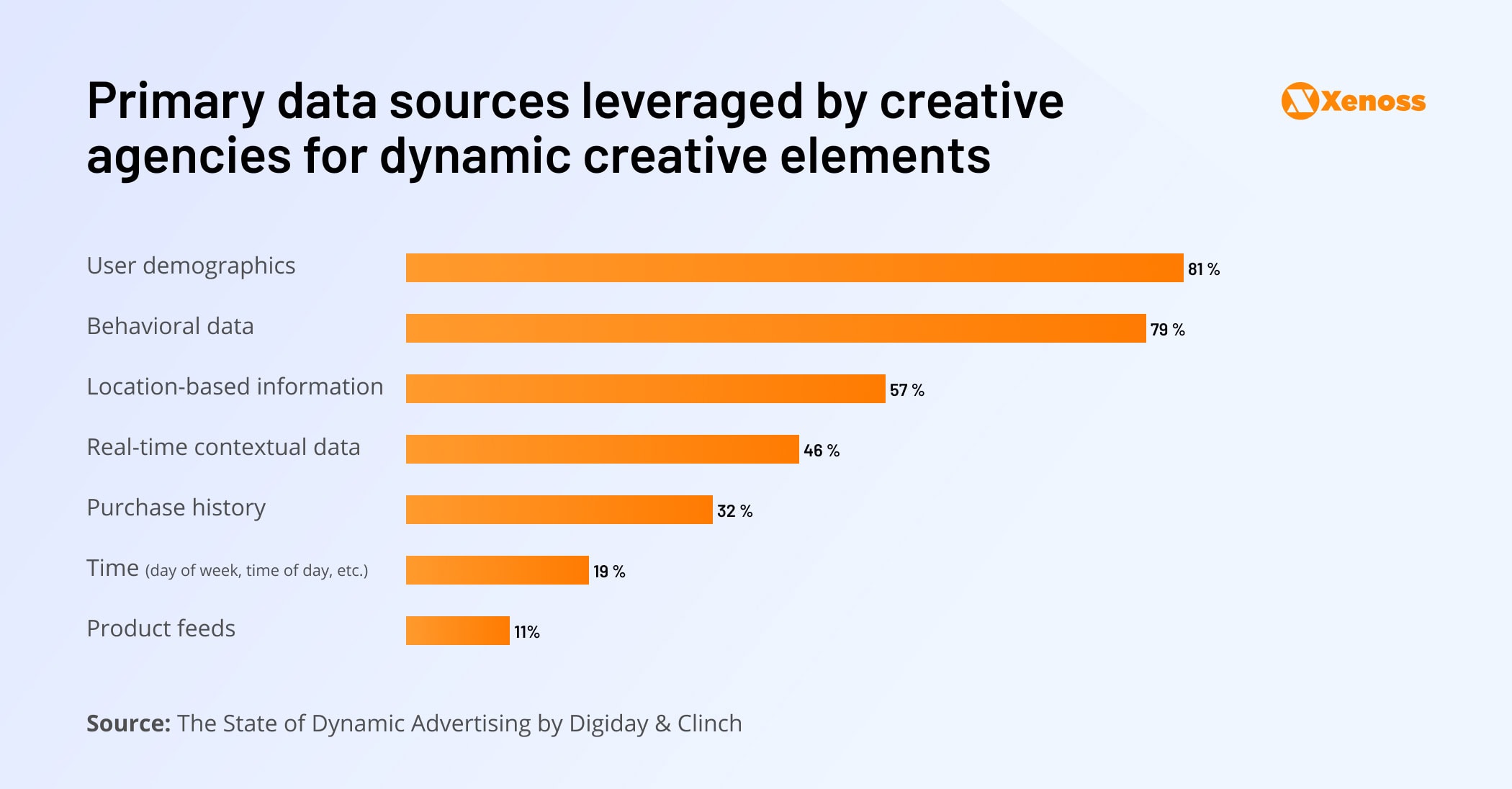

DCO can also help discover new creative directions. By increasing the volume of interaction, advertising teams can test multiple creative variations with different targets to further optimize creative messaging. Especially when optimization decisions are driven by data, which is now often the case.

In 2024, we expect Gen AI to tackle a wider range of creative cases: Dynamic optimization of CTV, hyperlocal audio ads, and even smarter data layering for personalization.

Walmart added DCO capabilities to its demand-side platform in 2023, which enables advertisers to optimize creatives across all supported channels, including in-store TV walls, self-checkout screens, and other Walmart digital properties.

A new AI AdTech startup, Instreamatic, allows advertisers to dynamically produce multiple audio variations for the same creative for connected TV ads. With the help of AI, Instreamatic can replace specific details in the voiceover, such as stating the specific streaming service, TV show, or promo code a viewer is watching.

Generative AI has been transformative for text. There are already some tools that help us create specific ad units for the CTV canvas, particularly these endemic native units that live within the UI. Being able to build them at scale with AI, that’s going to be the game changer in 2024

Tony Marlow, CMO of LG Ad Solutions

7. The rise of contextual targeting in CTV

Connected TV (CTV) advertising had a good year, growing at 13.2% globally in 2023.

Limited CTV measurement, however, has slightly undermined the channel growth. Device and data fragmentation across the market, paired with the lack of common industry identifiers and complex device identification processes, has alienated some advertisers.

But why bid on unreliable user data when you can also optimize by context?

The new generation of machine learning-based contextual targeting solutions for CTV can run a semantic-based analysis of video streams and pair ads with the displayed content. When you have multiple people watching the same show, you can leverage their interests (e.g., cooking) instead of demographic data.

Contextual CTV ads are also more effective. A recent study found that viewers may pay 4X more attention to hyper-relevant contextual ads created with AI tools. Because CTV contextual targeting is driven by the content, it’s also more privacy-friendly and encounters less pushback from consumers.

Dentsu, together with GumGum, launched a cookieless contextual intelligence platform for CTV last year. It relies on video-level keyword targeting and allows filtering impressions in real-time by contextual category, keyword, and brand safety. GroupM Premium Marketplace (GPM), in turn, used Iris.TV video level data to start offering contextual ads on its Magnite Streaming and DV Plus platforms.

The new OpenRTB 2.6 standard also introduced the concept of ad-podding, which allows buyers to bid on specific pods of CTV content.

Overall, AI-driven contextual ads will gain even stronger grounds in CTV, bringing better targeting, optimization, and addressability to the space.

8. Shoppable ads and interactivity are the next frontiers

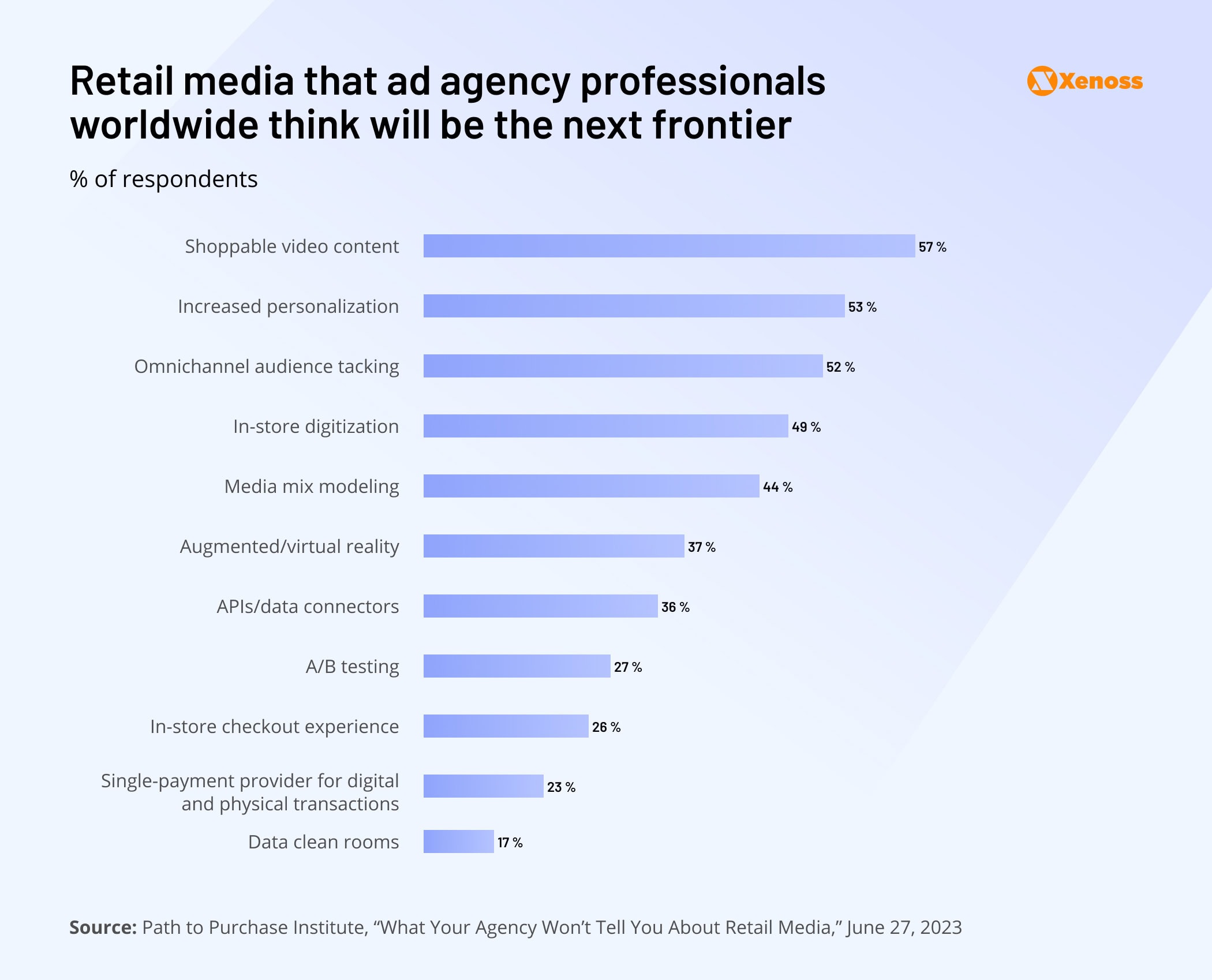

Shoppable video ads (57%) and increased personalization (53%) are considered the next frontiers by retail media ad agency leaders.

Consumers can now add advertised items straight to their virtual shopping carts using a remote control. An Aluma study found that 70% of adults remember a shoppable TV ad, and of those 39% engaged with it, and 70% made a purchase.

NBCUniversal also saw great results from testing shoppable TV campaigns, where users could buy a product with a QR code. The conversion rate was 73% higher than the average across other CTV formats.

Now, Peacock, an OTT arm of NBCUniversal, runs three shoppable video ad formats. Powered by the Frame and In-Scene technology, the new formats also allow geotargeting and ad customization based on the viewer’s location. Peacock also allows advertisers to use its first-party for targeting consumers.

The Fresh Market, in turn, added shoppable video-live commerce (SVLC) to its retail media network in 2023. The first shoppable livestream attracted over 2 million viewers, with featured products generating 300% higher conversions compared to traditional channels. With a successful proof of concept, The Fresh Market plans to expand the offer to its partners in 2024.

OTT and CTV platforms present a brand new playing field for immersive, personalized advertising. With computer vision algorithms, platforms can mark predefined objects like “juice boxes” or “billboards” as digital advertising spaces that brands can purchase programmatically.

Subtle overlays, AR-powered product showcases, and voice-activated product purchases from shoppable ads are other areas of innovation.

9. 5G will boost p-DOOH

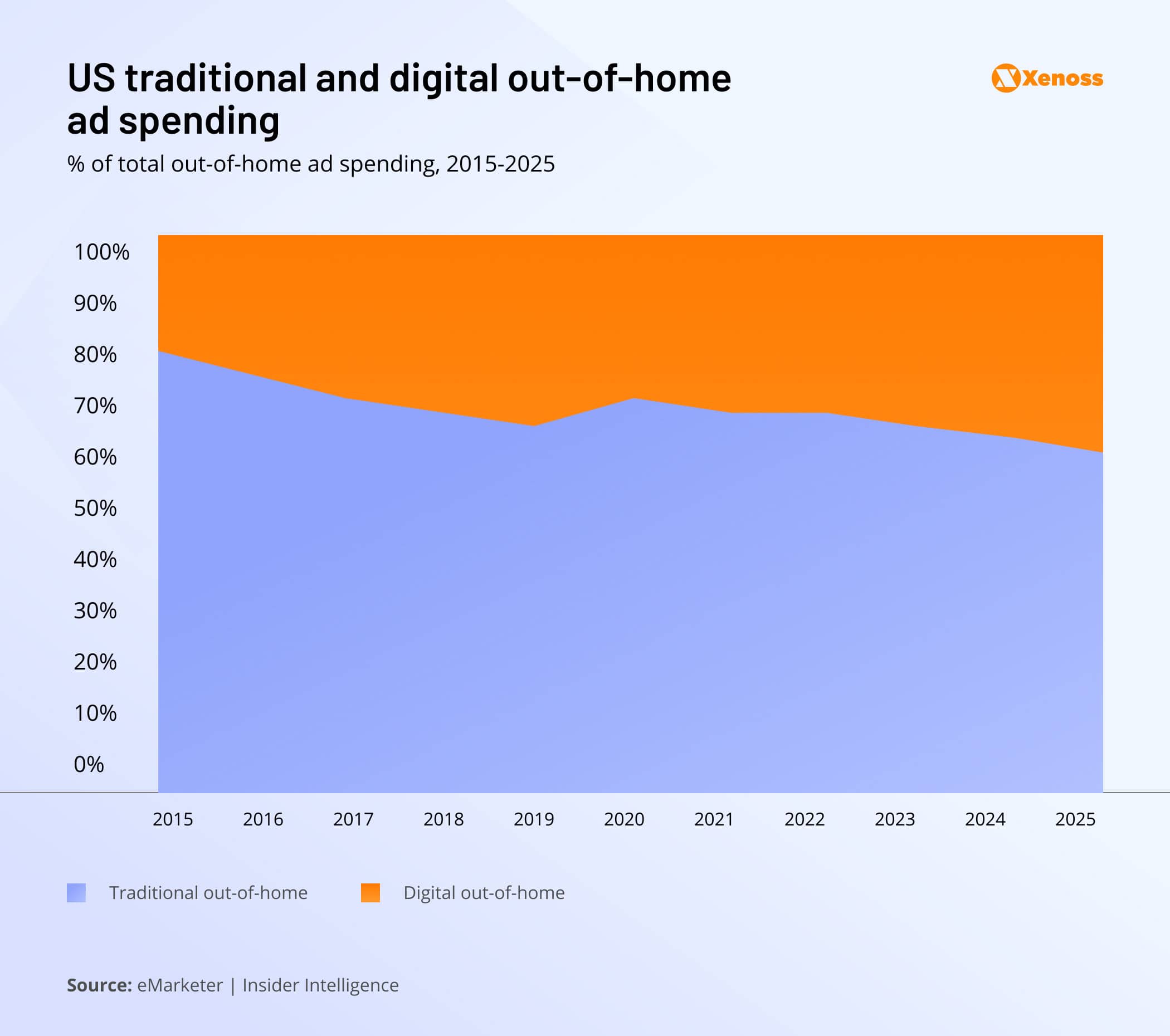

Programmatic DOOH (p-DOOH) advertising may have had a slow start, but it’s getting traction.

While DOOH spending is still down from pre-pandemic levels, it accounted for 31.4% of total OOH advertising dollars in 2023. The tepid interest was mostly because of limited dynamic digital capabilities.

Digital media’s inherent richness and real-time capabilities have so far been lacking in most DOOH executions. Yet, the roll-out of 5G connectivity may change the stakes in 2024.

With 5G, DOOH campaigns can get a new layer of interactivity. Thanks to dynamic connectivity, consumers will be able to engage with personalized content or promotions based on their location, time of day, product popularity, or known interest, using trigger-based creative optimization.

Guinness, for example, ran a dynamic DOOH campaign in 2023, which displayed the times of fixtures and current, or final, results in this year’s Six Nations Championship. The majority of viewers (70%) rated this campaign as more effective, unique, and eye-catching compared to other ad types.

Going further, advertisers can pull real-time data feeds into their pDOOH campaigns to incorporate elements like countdowns, the nearest store location, weather conditions at a highlighted destination, and more into the actual creative design of the ad itself. This capability enables brands to drive home relevance, create a sense of urgency, and encourage immediate audience response with every single ad play – all without having to build multiple versions of their creative.

Franck Vidal, director of Southeast Asia sales & partnerships, Vistar Media

Many retail locations and hotels, for example, have ample first-party data reserves, which can be combined with third-party data from DOOH companies to deliver more engaging ad experiences through context, not third-party cookies.

To promote its Good Move Activewear M&S, for example, worked with Hivestack, Mindshare, Kinetic (Sightline), VIOOH, Global, and DOOH.com to identify a new audience segment of “Women interested in exercise and fitness” and target them with a dynamic DOOH campaign.

The messaging changed based on the time of day and lightbox location, promoting available stock in the close proximity stores. M&S’s first-party stocks and sales data drove the dynamic creative highlighting Goodmove’s latest styles.

Footwear brand Timberland, in turn, used anonymized location data to create a custom audience segment of “outdoor lifestyler” for its recent programmatic DOOH campaign. The audience included people who frequent outdoor recreation areas, trendy restaurants, and similar retailers in major cities. By targeting this cohort, Timberland achieved a 2.8X lift in store visits against the control group.

Going forward, 5G can also enable novel programmatic DOOH advertising formats powered by AR and VR, leading to even higher engagement rates.

10. Further convergence of AdTech and MarTech, driven by first-party data

The majority of US marketers equally use data management platforms (DMPs), advertising platforms, and customer data platforms (CDPs), among other tools.

Because first-party data has taken center stage, the lines between MarTech and AdTech will grow thinner.

In 2024, we expect further consolidation of MarTech/AdTech stacks as old-gen DMPs get replaced by more versatile composable solutions.

Customer data platforms (CDPs) now allow combining advertising data (traditionally held by DSPs/SSPs) with anonymized audience, behavioral, and transactional data (owned by the companies). Such first-party data sets are growing in value, allowing brands to maintain data ownership while collaborating with AdTech partners.

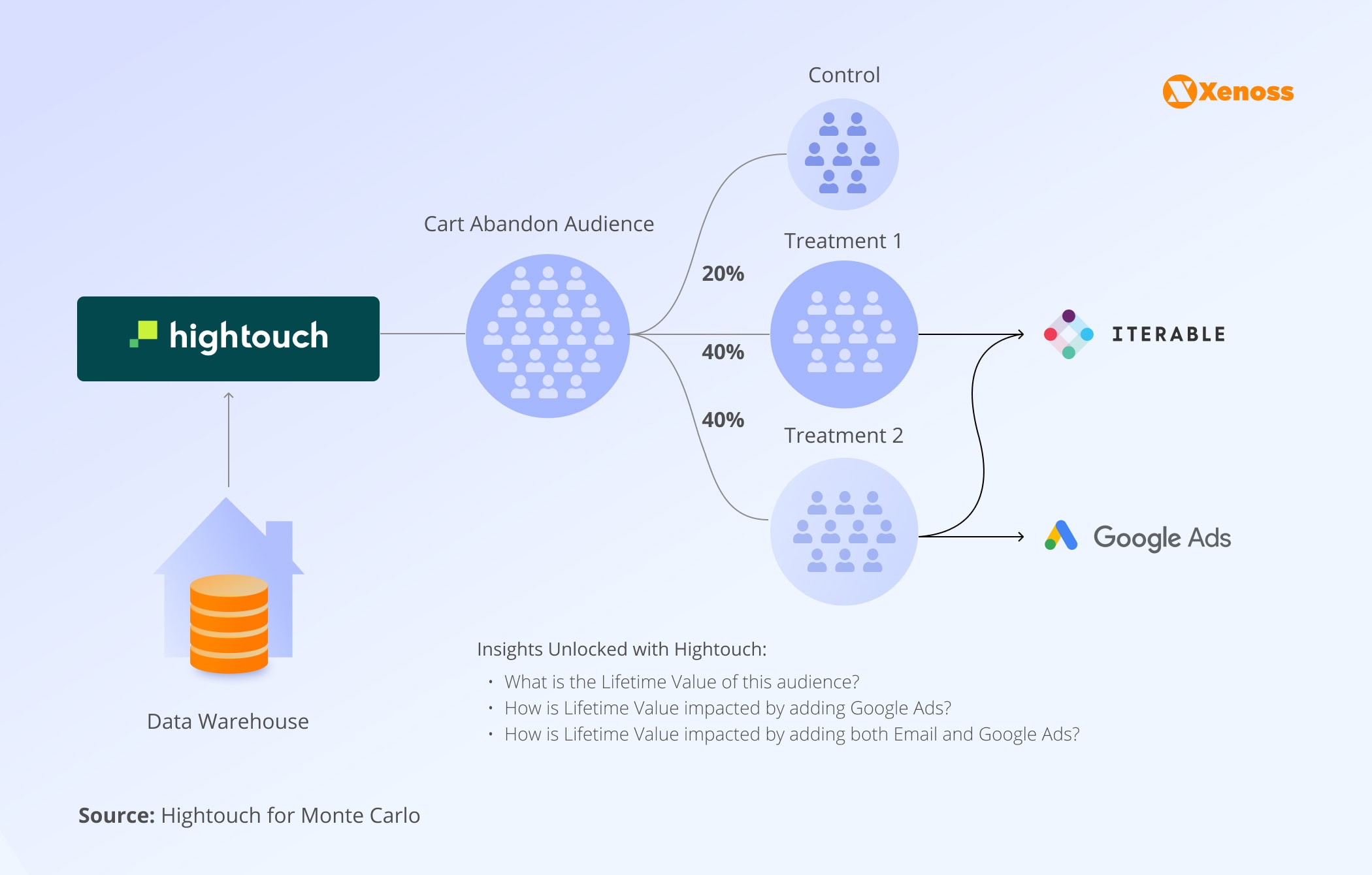

The new generation of CDPs allowed brands to stitch together complete customer identities from previously siloed datasets. For example, Hightouch CDP, a composable CDP, allows brands to activate customer data directly from the data warehouse and sync it across all AdTech/MarTech tools. Unlike traditional CDPs operating as a separate storage location, a composable CDP like Hightouch acts as an activation layer, rerouting audience data to downstream advertising and marketing applications. With the add-on product Match Booster, brands can enrich their first-party audiences with identifiers from third parties to better match them with profiles in advertising platforms.

Thanks to advances in database management technologies and data streaming technologies, the new generation of CDPs can process large data volumes in near real-time, delivering advanced analytics to end-users. If you’re still storing most of your customer data in rigid SQL databases (and struggle with interoperability/data silos), consider upgrading your DBMS. Redshift, Snowflake, and Databricks, among others, offer superior analytics capabilities for MarTech/AdTech use cases.

Popular cloud service providers are also the driving force behind the conversion trend. Google Cloud Platform (GCP) has added several digital advertising and data analytics capabilities to GCP, with native integrations to Google Marketing Platform (GMP).

Effectively, Google encourages advertisers to use its cloud data storage infrastructure and analytics to manage sensitive first-party data. Plus, it provides capabilities to integrate these insights into GMP campaigns.

Google Cloud Security features help address data privacy issues that are emerging from laws like GDPR and CCPA. At the same time, new data processing capabilities address existing constraints of the GMP stack regarding user browser, app, and device privacy features.

What we’re increasingly seeing is that first-party data sets no longer just sit in the brand-owned clouds, but rather, they’re being securely and strategically shared with AdTech partners in a privacy-friendly way.

As mentioned, data clean rooms are one technology that enables such private data exchanges, replacing data management platforms (DMPs) to some degree. But media companies now need better data collaboration platforms (not just clean rooms) to enable more streamlined data enrichment, targeting, and measurement.

The new generation of data collaboration technologies assumes that there is fragmentation. Data collaboration tech must be frictionless by definition. Now, these technologies are completely integrated with the standard ad tech that publishers already use, so activation becomes possible straight from the cleanroom environment.

Vlad Stesin, co-founder and Chief Product Officer at Optable

Snowflake and Beeswax jointly launched a data warehousing product back in 2020. With Antenna, Beeswax customers can easily export logs, bid logs, auction logs, and other bidstream data from the platform to Snowflake to run their own analytics.

AWS, in turn, presented a new identity resolution service in 2023, with Amazon Ads, Merkle, TransUnion, LiveRamp, and customer data platform ActionIQ as initial partners. Of course, the Entity Resolution service is fully compatible with AWS Clean Rooms, which facilitates collaboration.

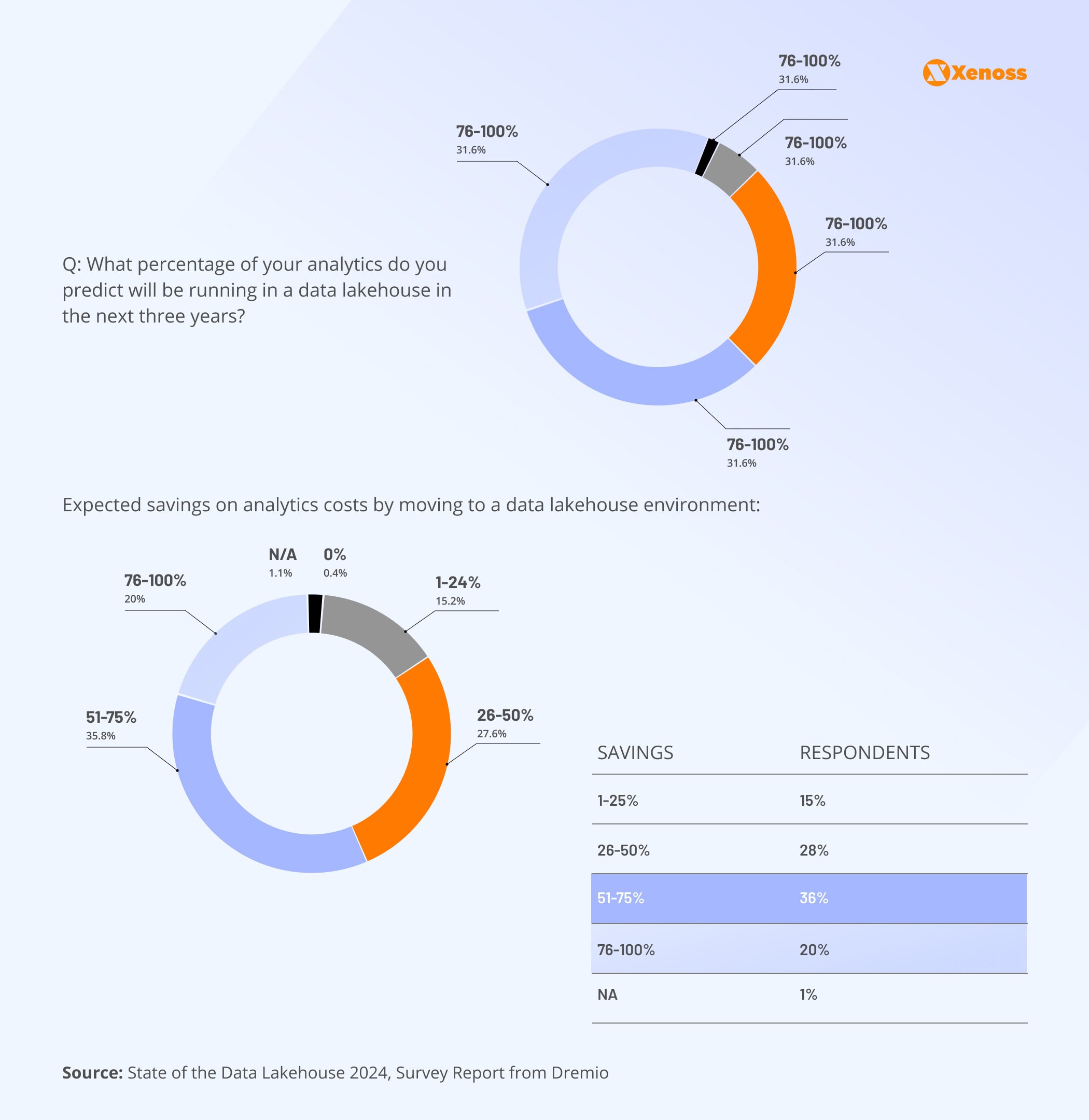

In 2024, we expect global cloud companies to continue their advances into the “marketing data lakehouse” space, holding most of the brands’ first-party data. AdTech companies, in turn, will remain trusted third-party data providers, offering extra data enrichment, identity resolution, and measurement capabilities.

The future of AdTech will be shaped by (first-party) data infrastructure

Most of the key AdTech market trends in 2024 hinge on the companies’ ability to incorporate first-party data. With the cookieless era starting now, AdTech companies must re-assess their current infrastructure, focusing on data management to better understand how they can better accommodate new first-party data sources and achieve deeper integration with the client’s datasets.

Deeper integrations with existing CDPs, DMPs, and the new breed of CSP-powered marketing data lakehouses will also help AdTech companies capture a bigger market share in 2024 as data collaborations enter the new era. Data clean room technologies will also play a critical role in this new environment, allowing brands to overlay owned data against DSP/SSP-supplied insights to activate new audience segments and improve targeting and measurement.

With new data entering the ecosystem, AdTech companies will likely see infrastructure costs going up. To minimize waste (and do good for the planet), look into optimizing your cloud computing costs and application design patterns (an area where Xenoss can help).

Generative AI, natural language processing, and computer vision will also be the key technologies for the market, accelerating the growth of DOOH, CTV, and retail media advertising channels. Buckle up: 2024 is going to be another wind-swirling year for the AdTech sector, and we’re excited about all the innovation!