PwC estimates 2026 will be the year businesses embark on a “disciplined march to value” in AI adoption. Companies increasingly recognize that effective AI integration requires an organized, consistent effort.

Rather than letting teams crowdsource their own playbooks, executives are stepping up to identify high-yield transformation areas.

Understanding which AI use cases have successfully improved productivity, expanded revenue opportunities, and strengthened the bottom line helps the C-suite make data-backed decisions about their next pilot.

In this post, we examine 10 use cases where AI adoption empowers employees, improves customer experience, and delivers measurable returns on investment.

1. AI-assisted coding

ROI in numbers:

- 68% of engineers reported saving 10+ hours per week using AI

- Enterprises record a 376% ROI lift over three years, with payback in under 6 months after the adoption of coding assistants

- In three years of active coding copilot use, leaders have saved up to $48.3M in developer productivity gains and gained $18.4M in revenue impact from accelerated time-to-market

Enterprises are adopting AI copilots embedded in developer environments, IDEs, terminals, code review, and CI/CD, to support code generation, refactoring, reviewing, and testing.

What began as individual productivity tools used without formal company policy has evolved into a workplace-wide practice after organizations recognized that developers using coding agents are 55% faster than those who don’t.

Proactive adopters are now introducing tools like Claude Code across both technical and non-technical teams, giving employees greater autonomy to build personalized automation.

Real-world example: Accenture pushes for AI coding assistants

Approach: Accenture is pursuing a “developer productivity at scale” strategy focused on upskilling its workforce and productizing delivery capabilities around coding assistants. The company initially supported GitHub Copilot adoption without centralized oversight, then partnered with Anthropic in December 2025 to create a dedicated Business Group.

This task force will train over 30,000 employees on Claude models in what will become the largest enterprise-scale deployment of Claude Code.

Results: Early productivity gains were significant: internal telemetry showed an 8.69% increase in pull requests per developer and a 15% increase in merge rates, demonstrating faster review cycles without compromising acceptance standards.

Engineers also reported higher job satisfaction. 90% of developers who used GitHub Copilot for more than three days felt more fulfilled, and 95% said they enjoyed coding more with AI assistance.

2. Document processing and data extraction

ROI in numbers

- Teams report a 2–3× reduction in end-to-end processing time and faster downstream decision-making in claims, finance, and compliance workflows.

- Operations teams automate up to 68% of document handling, recovering a significant share of manual capacity and redeploying staff from data entry to exception management.

- Companies report that automating data processing helps manual review and correction drop by ~50%, reducing operating costs and increasing throughput in finance, claims, and compliance teams.

Enterprise document processing teams use AI to automate the intake, classification, extraction, and validation of high-volume documents that previously required manual review.

These pipelines ingest documents, extract text using OCR and layout-aware models, classify content, identify key fields, and validate data against business rules or master data, such as PO matching, policy checks, or customer records.

AI systems flag low-confidence fields and route only true exceptions to human reviewers, while clean documents flow straight through to downstream systems.

This enables end-to-end workflow automation with fewer manual touchpoints, shorter cycle times, and predictable processing costs as volumes scale.

Real-world example: Allianz taps into AI-assisted claims processing

Approach: Allianz used to process millions of insurance claims annually, many arriving as unstructured documents (scanned forms, invoices, medical reports, photos, and handwritten attachments) that required manual review and data entry, creating bottlenecks during peak periods.

To address this, the company deployed an AI-driven document processing copilot combining OCR, classification, and data extraction to automatically identify document types, extract key fields, and validate them against policy and customer records.

Outcome: Following the rollout, Allianz reported an 80% reduction in processing and settlement time for eligible, low-complexity claims in its Project Nemo deployment, cutting turnaround from days to hours and enabling the team to handle sudden spikes during natural catastrophes. Executives now plan to expand AI automation to other back-office claims processes.

3. AI-powered content generation

ROI in numbers

- Using generative AI saves content teams an average of 11.4 hours per week and allows marketers to reallocate time from first drafts to review and campaign execution.

- Deploying generative AI tools helps marketing teams cut creative production time by 50% in an enterprise customer deployment without adding extra headcount.

Generative AI helps creative teams streamline content creation from research and outlining to final polish, while maintaining consistent tone across formats.

Embedding generative AI into content workflows cuts time-to-draft from weeks to days and enables expansion to new channels and audiences.

AI writing assistants also support global teams in localizing content, creating nuanced translations, and tailoring blog posts, social media, and ad copy for target demographics.

Real-world example: generative AI helped streamline creative production for Curry’s

Approach: Currys, a UK-based electronics retailer, embedded Adobe Firefly into its internal creative workflow to accelerate ideation, iterate on campaign visuals, and rapidly produce on-brand asset variants for seasonal retail moments.

Outcome: The creative team reduced production time by 50%, translating to significant budget savings, as the marketing team cut third-party agency costs by more than half.

4. Copilots for knowledge management

ROI in numbers

- Enterprise teams save up to 30 minutes per employee per day on drafting internal knowledge bases by adopting Microsoft Copilot

- After adopting a knowledge copilot, 70%+ of enterprise employees report spending less time searching for information

- One enterprise company reported that adopting an internal chatbot resolved over 3,500 employee inquiries in the first three months after adoption.

Combining conversational AI with autonomous agents helps teams support new employees with personalized, on-demand assistance, allowing new hires to direct basic questions to an AI copilot rather than managers, freeing team leaders for higher-priority work.

AI copilots also help experienced employees by automating everyday tasks like reminders, email scheduling, and meeting notes.

Middle managers can use custom copilots to organize internal task management and build multi-agent workflows connecting critical systems like internal data, task managers, and messaging platforms.

Companies can build multi-agent orchestrators to process complex internal databasesReal-world example: Morgan Stanley’s AI copilot supports new hires

Approach: Morgan Stanley implemented an internal knowledge copilot, Morgan Stanley Assistant, to help financial advisors query and synthesize institutional knowledge.

The assistant enables advisors to search, retrieve, and digest content from a large internal database directly within their workflow, eliminating manual searches across research and policy materials.

Outcome: The bank successfully scaled the assistant to support over 16,000 financial advisors, analyzing more than 100,000 internal documents.

5. Invoice matching and reconciliation assistants

ROI in numbers

- AP teams removed 85% of manual effort and reconciliation costs and cut the reconciliation process by 2 days after deploying automation for invoice reconciliation.

- Invoice processing teams reduced manual effort by 80% by using AI that reads invoices and automates invoice entry and coding workflows (AppZen Autonomous AP for SAP Ariba).

In the last decade, RPA was the go-to tool for automating invoice matching and reconciliation.

While these rule-based systems cut time-per-invoice, they lacked contextual understanding and robust exception handling, so human reviewers remained essential for preventing errors and matching ambiguous items or vendors.

AI agents address these limitations by understanding natural language, analyzing context around each reconciliation item, and continuously improving exception handling by learning from human reviewers.

Real-world example: Dole Ireland increased A/P productivity with AI-based invoice processing

Approach: Dole Ireland automated its accounts payable reconciliation to address growing invoice volumes previously handled manually. The company used AI to streamline invoice-to-statement matching, exception detection, and reconciliation tracking, with human reviewers handling only mismatches or disputes.

Outcome: Dole reported an 85% reduction in manual reconciliation effort and costs, cutting cycle time by two days and improving month-end operations. The automated workflow also identified missed credits and duplicate payments earlier, reducing downstream adjustments and strengthening financial control.

6. Report generation

ROI in numbers

- 75% of enterprise workers surveyed reported AI improved the speed or quality of their output.

- ChatGPT Enterprise users are saving 40–60 minutes per active day on average on automating reporting tasks.

- Consulting teams that used generative AI for report generation are achieving 25.1% faster completion and 40% higher quality on day-to-day knowledge work tasks.

For regulated industries like finance and healthcare, reporting consumes significant time and resources. Regulators demand increasingly detailed descriptions of workflows and processes: PwC estimates the average banking institution submits over 67 reports annually, spanning 340,000 data points. Even in less regulated industries, teams lose an average of 180 hours per year to reporting.

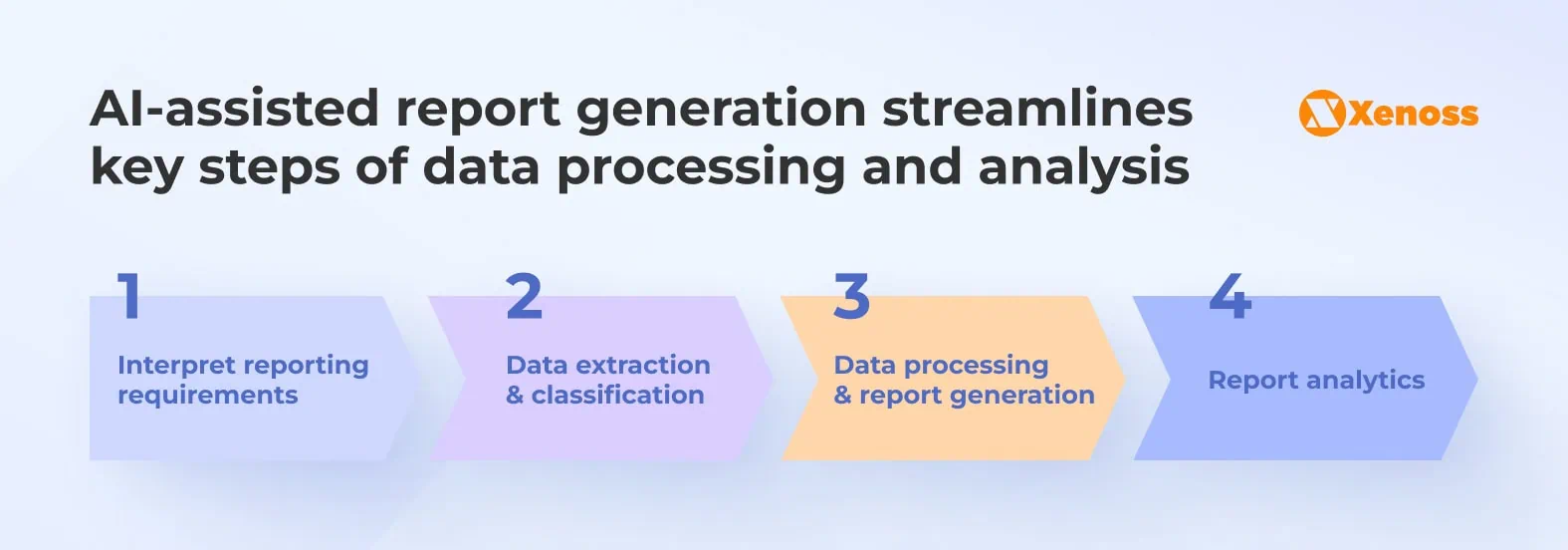

AI eases this burden by analyzing requirements, autonomously mining the necessary data, generating reports, and routing them to human reviewers for approval. This shifts reporting from a resource-intensive bottleneck to a streamlined workflow where human oversight focuses on validation rather than manual compilation.

Real-world example: Walki implemented AI-assisted reports

Approach: Walki, a global packaging materials producer, integrated generative AI into its enterprise reporting and analytics workflows by embedding AI capabilities into its existing Anaplan planning platform.

The company automated traditionally manual aspects of reporting (pulling data, synthesizing trends, and generating narrative commentary), allowing planners and analysts could focus more on interpretation and decision support rather than data assembly and formatting.

Outcome: After deployment, Walki reported that the use of generative AI in reporting and analytics led to faster report generation, provided deeper analytical insight, and helped teams work more efficiently across planning cycles.

7. Predictive analytics and quality control

ROI in numbers:

- Manufacturing teams reached 300–500% ROI lifts by using AI-driven predictive maintenance systems to minimize downtime, improve asset availability, and reduce reactive service costs.

- The ability to predict and prevent equipment deterioration brought about a 5–10% reduction in maintenance costs and a 10–20% increase in equipment uptime.

Historically, predictive maintenance relied on vendor recommendations or prior experience with similar equipment, which helped anticipate potential issues but lacked the precision to accurately predict malfunctions.

AI-powered predictive analytics systems provide far more accurate estimates of equipment lifetime and time to failure.

Using machine learning, these tools create a comprehensive view of each machine based on sensor data, ERP logs, production records, and field reports. Production managers can then catch early failure signals and address issues before they cascade into costly downtime.

Real-world example: Rolls-Royce combines predictive maintenance and digital twins

Approach: Rolls-Royce uses AI-powered predictive analytics alongside digital twin technology to monitor the health and performance of its aircraft engines and critical systems. Embedded sensors feed real-time telemetry into machine-learning models that detect subtle patterns preceding failures, enabling maintenance to be scheduled before faults occur.

Outcome: The integration of AI-driven models with predictive technologies has extended maintenance intervals by up to 48%, allowing engines to run longer between scheduled interventions and reducing unplanned service events.

8. Fraud detection

ROI in numbers

- Intelligent fraud detection helped HSBC reach 60% fewer false positives in financial crime alerts and reduced manual review workload for monitoring over ~900 million transactions per month.

- Another financial institution reached a 2–4× increase in true positive risk detection in anti-money-laundering operations after AI models replaced traditional rule-based systems.

Although fraud detection is a cross-industry challenge, few domains are more impacted than finance and banking. KYC and anti-money-laundering activities are top-of-mind concerns, yet ROI on these investments remains questionable. Interpol reports that banks detect only 2% of financial crimes despite increasing fraud detection spending by 10% annually.

AI is becoming a powerful support system for these organizations.

Generative AI platforms detect fraud patterns in call logs and user activity, improving detection accuracy.

AI agents augment human reviewers by managing fraud detection workflows end-to-end.

Advanced analytics expand the behavioral and demographic signals processed by traditional systems, further strengthening detection capabilities.

Real-world example: HSBC uses AI to detect financial crime

Approach: HSBC has embedded AI and machine-learning systems into its financial crime and fraud detection operations to augment traditional rules-based monitoring.

These systems ingest transactional data at scale to detect anomalous patterns across retail, commercial, and payment channels, enabling real-time risk scoring and alert prioritization rather than relying on static thresholds.

Outcome: HSBC’s AI platforms process over 1 billion transactions monthly, detecting 2–4× more suspicious activity than traditional methods while reducing false positives by approximately 60%. This allows compliance teams to focus on genuine threats rather than false alerts, cutting investigation timelines from weeks to days and significantly reducing operational costs.

9. M&A decision-making and due diligence

ROI in numbers

- Corporate workers report saving the equivalent of 122+ hours per year through AI tools handling routine data synthesis, summarization, and repetitive analytical tasks.

- AI adoption allows relocating 18–24% of research hours to high-impact strategic tasks such as deep analysis and decision support.

- In research-intensive industries like asset management, AI brings up to 40% productivity gains by streamlining manual research and administrative tasks.

AI hallucinations make M&A teams reluctant to heavily rely on machine learning for mission-critical acquisition decisions. Yet the productivity gains are too significant to ignore, so teams are finding ways to integrate AI into due diligence without undue risk.

Advanced analytics can predict cash flows, growth rates, and discount rates for acquisition targets.

AI systems also excel at identifying promising candidates by analyzing alignment with the company’s strategic goals, by processing large data volumes that would overwhelm human teams.

Implementing generative AI across these areas helps teams consider more data points while significantly reducing the time needed to vet M&A candidates.

Real-world example: Kraken used AI to validate the $1.5 billion acquisition of NinjaTrader

Approach: When Kraken pursued its $1.5 billion acquisition of NinjaTrader, the strategy team faced the typical due diligence challenge: manually reviewing vast volumes of financial records, operational metrics, and risk factors would take weeks.

To accelerate the workflow, Kraken integrated an AI-powered analysis platform to rapidly process large datasets and generate detailed insights, allowing analysts to focus on validating findings rather than sifting through raw data.

Outcome: Research and synthesis that would typically take weeks were completed in hours, significantly compressing the due diligence timeline and reducing the resource burden on the internal team.

10. Personalization and improving customer experience

ROI in numbers

- Companies that adopt AI-enabled customer experiences see a 10–15% increase in sales, thanks to higher levels of personalization maturity.

- Using AI-enabled recommendation engines reduces cost to serve by up to 30%.

- AI-powered “next best experience” personalization can reduce customer attrition by up to 20% per year.

As AI becomes more embedded in daily life, customer expectations are shifting to where personalization is no longer a “nice-to-have” but an expected default. These expectations are justified, as building highly tailored recommendation engines is now more accessible than ever.

Engineering teams can leverage out-of-the-box large language models and ready-to-deploy AI agents to capture, contextualize, and respond to customer signals in real time.

The ROI of AI-enabled personalization solutions has been proven by multiple successful adoption case studies.

A McKinsey survey of Fortune 500 companies revealed that teams focused on building AI-assisted personalized customer experiences increase revenue by 5 to 8 percent.

Real-world example: Starbucks uses AI-assisted personalization with Deep Brew

Approach: Starbucks integrated AI into its customer experience through Deep Brew, a machine-learning platform that analyzes transaction and loyalty data to deliver personalized recommendations and offers. The system ingests data from the mobile app, purchase history, and contextual signals like time of day and store inventory to tailor promotions and digital interactions across millions of daily customer touchpoints.

Outcome: Deep Brew analyzes data from 100 million weekly transactions worldwide, delivering a 30% ROI tied to AI-powered offers and personalization through the Starbucks Rewards ecosystem.

The bottom line

Transforming internal processes with generative and agentic AI can feel like reinventing the wheel. Successful transformations often require putting AI at the center of workflows rather than using it for incremental improvements.

Choosing the wrong area can reduce productivity and increase chaos. To minimize this risk, explore use cases that worked for AI trailblazers and apply their practices and lessons learned to your organization.