We see a pattern across industries recently: the accounts payable (AP) process resembles a relay race, where each handoff creates an opportunity for error.

Your team receives invoices in dozens of formats: PDFs buried in email attachments, EDI transactions, paper documents that somehow still find their way to your desk in 2025. Each invoice triggers a complex dance: data extraction, vendor validation, purchase order matching, goods receipt verification, exception handling, and finally, if you’re lucky, approval and payment.

Here’s the uncomfortable truth about most “automated” invoice processing: systems fail not because the software lacks intelligence, but because they don’t recognize their own limitations. You’ve probably seen it too. A pixelated vendor logo, a missing dash in the PO number, a unit-of-measure quirk, and suddenly your “touchless” pipeline is all hands on deck.

The trillion-dollar AP challenge

In the context of invoice reconciliation, companies must match invoices against purchase orders (POs), contracts, and payment records across multiple ERP systems, banks, and vendor systems. The key challenges are:

Format complexity

- PDFs, Excel files, EDI transactions, scanned images

- Inconsistent vendor references and missing fields

Business logic exceptions

- Partial deliveries and quantity variances

- Multi-currency transactions and tax differences

- Discount calculations and payment term variations

Risk management

- Duplicate invoice detection across systems

- Fraud prevention and vendor validation

- Compliance audit trail requirements

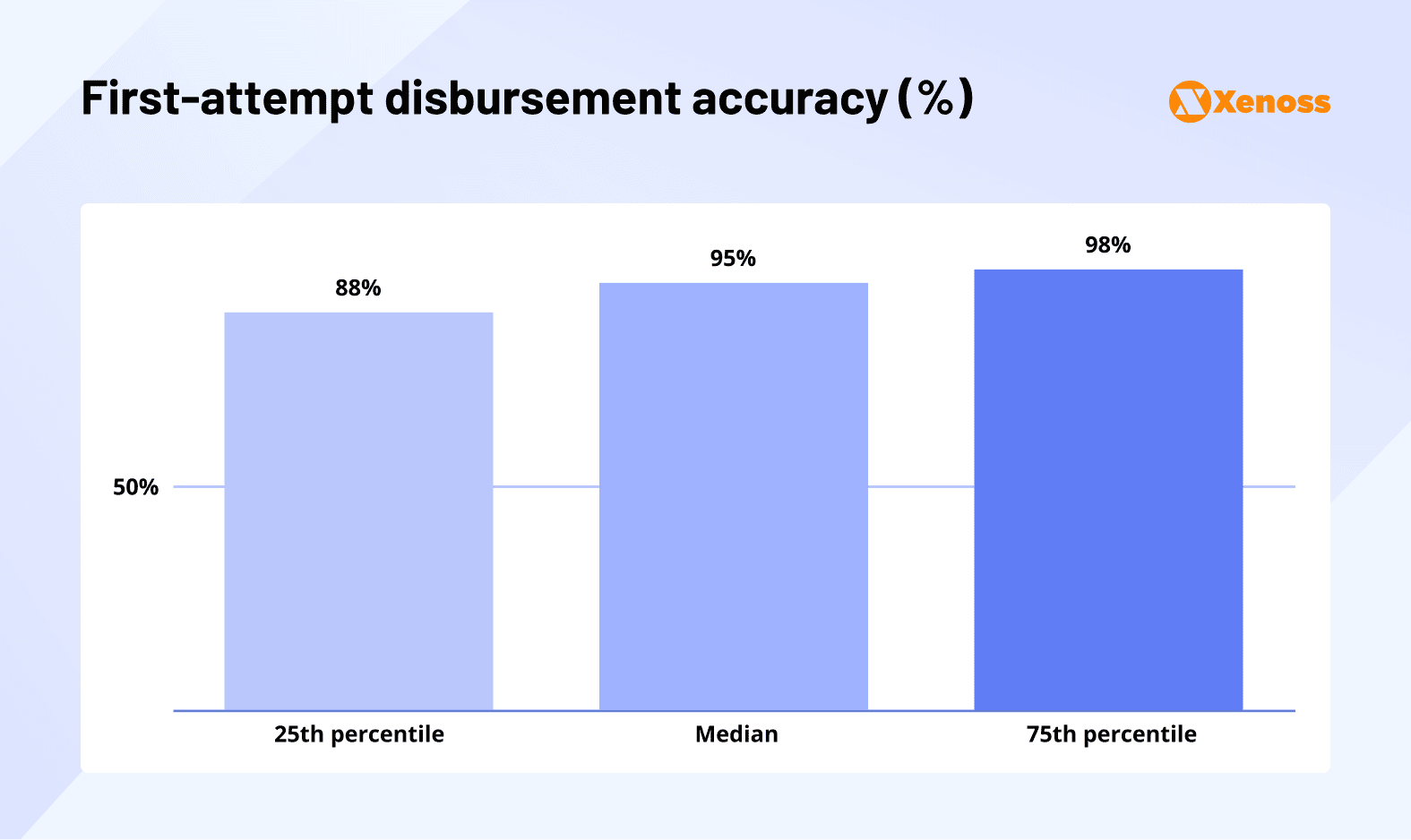

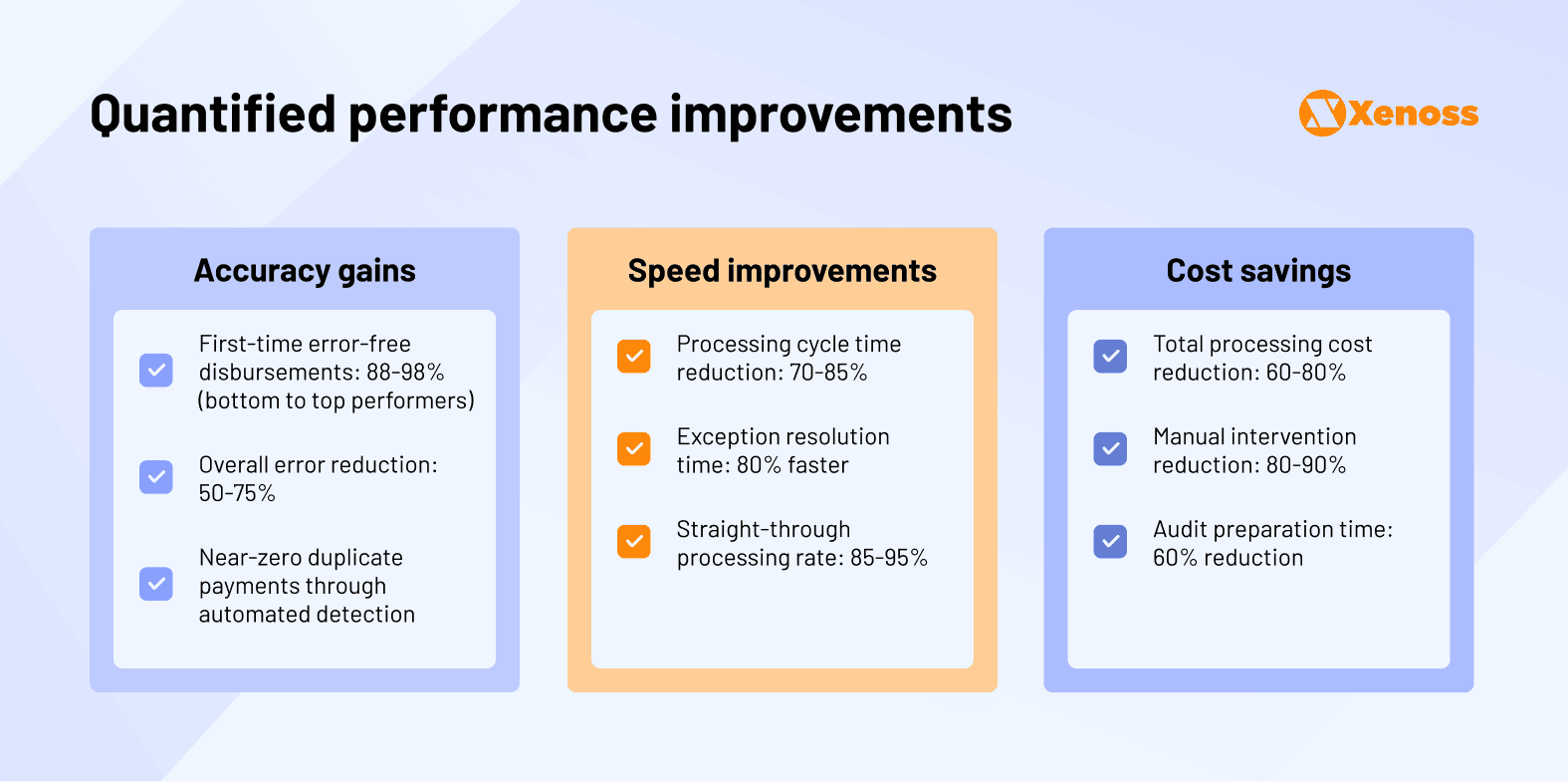

Even top performers still leak value through errors, rework, and duplicate or erroneous disbursements. Recent APQC benchmarks indicate that top performers achieve 98% of first-time, error-free disbursements, compared with 88% for bottom performers. This means that up to 12 out of every 100 payments are late or inaccurate in lagging organizations. That is not a rounding error at scale.

The deeper issue lies in years of digitizing broken processes. If the upstream PO lacks line-level detail or receiving is slow to post goods receipts, even perfect OCR won’t deliver a clean three-way match. So we codify more exceptions, add another approval step, and call it “governance.”

What you really need is a system that knows when to proceed, when to pause, and when to escalate – with proof.

Multi-agent hyperautomation addresses these challenges through coordinated AI agents that clear the routine complexity while leaving exceptions and high-risk calls to human oversight.

How multi-agent AI transforms invoice processing

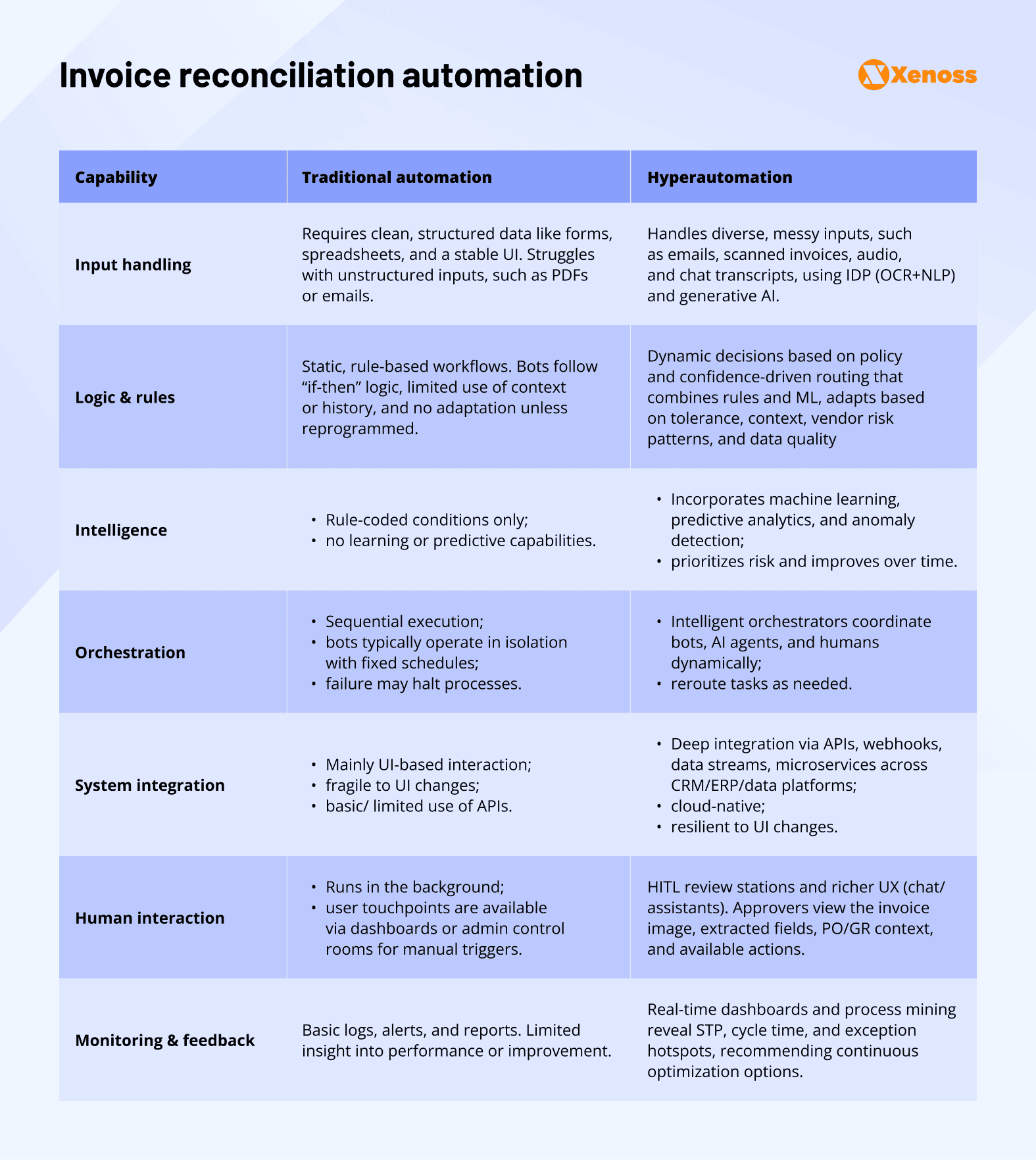

Traditional automation reaches its limits with complex, unstructured processes like invoice reconciliation.

Multi-agent hyperautomation adds the next step, orchestrating focused AI agents that collaborate intelligently instead of relying on rigid, sequential workflows. This approach addresses the variability and complexity that single-bot solutions cannot handle, from messy, unreadable attachments to dynamic policy decisions and exception handling.

Think of it as the best kind of intern who handles 80–90% of the work, asks for help when it should, and leaves an audit trail your controller will actually like.

Here is a visualized comparison between the traditional automation and hyperautomation approaches.

Organizations implementing multi-agent hyperautomation typically experience a 55-70% reduction in processing costs, achieve straight-through processing rates of 90% or higher for standard invoices, and resolve exceptions 80% faster, with complete audit trails.

The agentic architecture makes this possible through intelligent specialization and coordinated execution.

Architecture that works: The core agent lineup for invoice processing

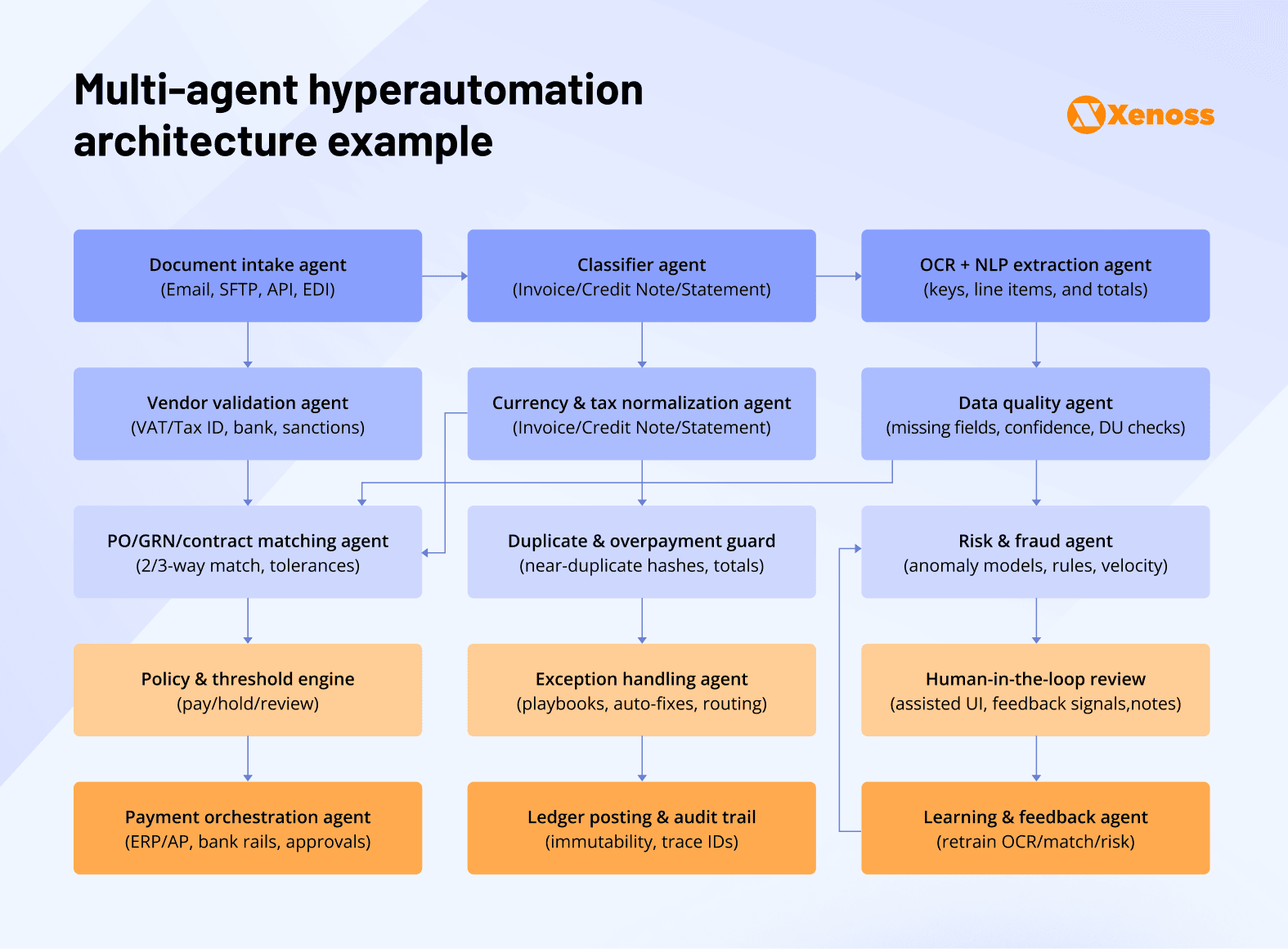

Enterprise multi-agent hyperautomation for invoice reconciliation operates as a team of high-profile specialists coupled with the precision of AI and the coordination of sophisticated orchestration platforms. Each agent operates under clearly defined contracts that specify inputs, outputs, and performance metrics.

The agentic architecture can differ based on the specific needs, size, budget, technology capabilities, and goals of each organization, allowing them to tailor the setup and how components interact in a way that best supports smooth, reliable, and flexible financial processes.

Due to a modular approach that adapts to every operational reality, some companies start with a few core agents and scale up, while others deploy numerous agents using the best-fitting solution.

Capture agent: Document intelligence

When an invoice arrives, whether it’s a PDF from your largest supplier or an EDI transaction from a new vendor, the system doesn’t just extract data and hope for the best.

A specialized Capture agent (with intelligent document processing capabilities), trained on millions of invoice formats, extracts every line item with confidence scores. If confidence is high, the process continues autonomously. If not, it immediately routes to human review with specific guidance on what needs attention.

Business value: Minimizes manual data entry while maintaining accuracy controls.

Normalization agent: Data consistency

Next, a Normalization agent takes over, handling data consistency that breaks traditional systems, including real-time multi-currency conversions, jurisdictional tax calculations, unit-of-measure standardization, and vendor identity resolution.

This goes beyond simple field mapping to context-aware interpretation that follows your business rules. For example, it recognizes that “IBM Corporation,” “International Business Machines,” and “IBM Corp” refer to the same entity, preventing duplicate vendors and payment errors.

Business value: Standardizes invoice data, reducing exceptions and accelerating straight-through processing.

Matching agent: Intelligent reconciliation

The Matching agent performs the time-intensive reconciliation work. It retrieves POs, goods receipts, and service entries from your ERP (SAP, Oracle, NetSuite, Dynamics 365).

It applies your established policies, including two-way or three-/four-way matching with tolerances, handling real-world cases such as partial deliveries, over-shipments, freight allocations, and service charges.

Business value: Automates the bulk of standard matching while honoring existing tolerance policies.

Variance Resolution agent: Exception intelligence

When discrepancies occur, the Variance Resolution agent identifies the root causes and proposes corrective actions. It combines deterministic rules with patterns learned from your team’s past decisions (e.g., how you handle freight differences, tax rounding, partial deliveries), so exceptions are resolved the way your experienced AP team would—consistently and quickly.

Business value: Resolves invoice discrepancies, reducing exceptions and accelerating payment cycles.

Posting agent: Settlement precision

The Posting agent executes settlements with precision, interfacing with your ERP to post or park transactions, apply payment blocks as required, and schedule payments to optimize cash flow and maximize discounts.

It generates append-only, time-stamped audit logs and prepares payment files or runs for bank submission under your approval controls.

Business value: Improves cash flow and payment accuracy while strengthening audit readiness.

Learning agent: Continuous optimization

The Learning agent closes the loop. It observes outcomes at scale, captures reviewer decisions, and turns those signals into controlled changes, retuning extraction for tricky suppliers, adjusting confidence thresholds and routing, and tightening or relaxing match tolerances by vendor cohort.

Business value: Raises straight-through rates and reduces exceptions over time without adding rule sprawl.

Beyond those cores, as the program scales, teams can add specialized agents for duplicate detection, vendor-master change control (with out-of-band bank-detail verification), fraud/anomaly scoring, supplier communications (querying missing POs/receipts), cash optimization (discount capture and payment scheduling), and others.

Orchestration that keeps you in control

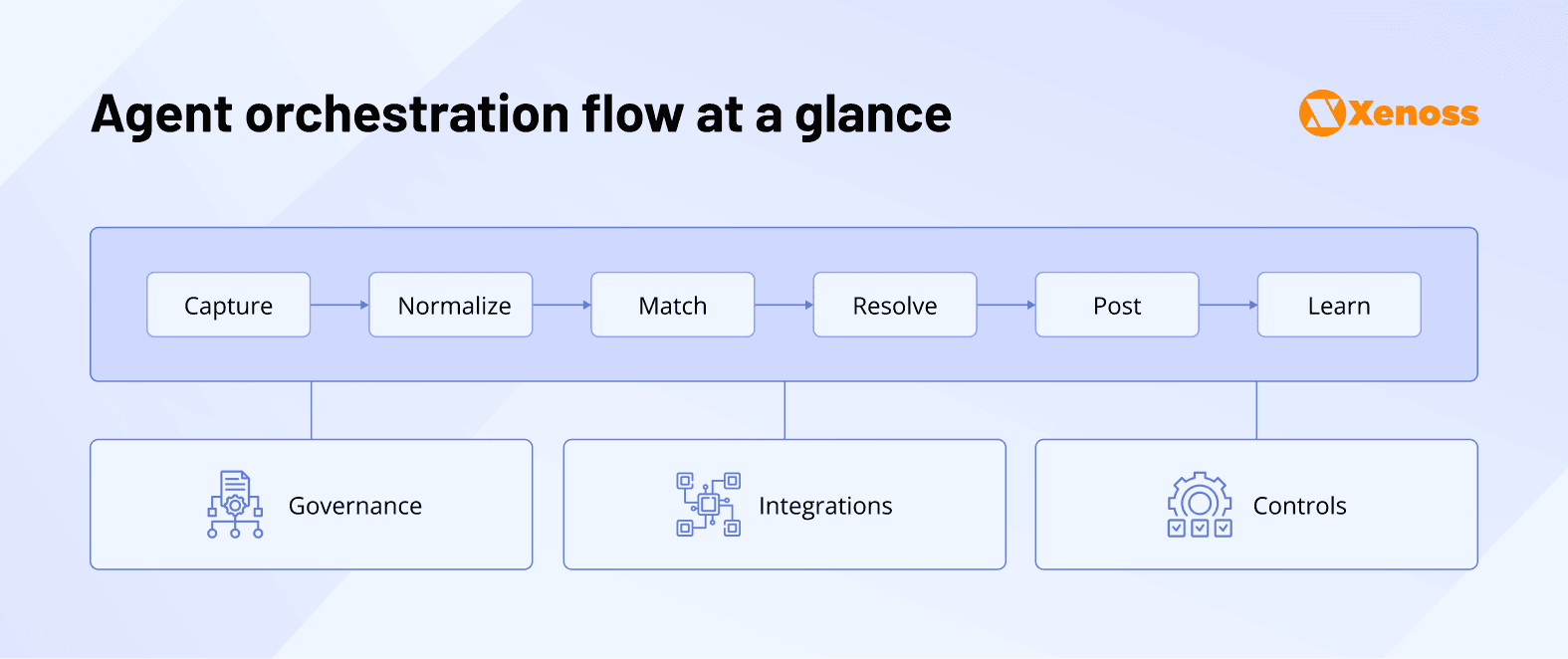

The orchestration layer is a stateful workflow graph that coordinates agents. It acts as a conductor, routing each invoice based on model confidence, business policies, and real-time context, and can branch, reassign, or pause for human review when human judgment is needed.

Frameworks and platforms like LangChain, LlamaIndex, LangGraph, CrewAI, Microsoft AutoGen, Microsoft Copilot Studio, or Agents for Amazon Bedrock provide branching, retries, and observability, so the flow adapts cleanly to your rules and controls.

The payoff is modularity: you can adjust or change a single agent without reworking the entire process when a supplier changes templates.

The orchestration layer embeds governance, integrations, and controls upfront.

It records immutable, time-stamped, and attributed events for every transition, decision, and human action, allowing finance to produce SOX-aligned audit trails and evidence on demand. Integrations default to APIs and webhooks for speed and resilience, with RPA bridging legacy systems that lack modern interfaces.

Security and compliance are also built in.

Role-based access control and segregation of duties govern who can edit vendor masters, approve over-tolerance exceptions, or change bank details, with agent-level checks so no single actor can move a payment end-to-end.

As a result, an orchestration layer runs efficiently under normal conditions, slows down intelligently when risk appears, and leaves a clear, defensible record for finance and audit.

While agents deal with routine tasks, making automation more secure, faster, and auditable, they will not replace your finance teams.

Why human-in-the-loop automation changes everything

Touchless processing is shifting to a baseline expectation: IFOL data reported by NetSuite show that two-thirds of respondents expect their AP processes to be fully automated by 2025, and 76% of AP departments will leverage AI within the next few months as the engine behind touchless workflows.

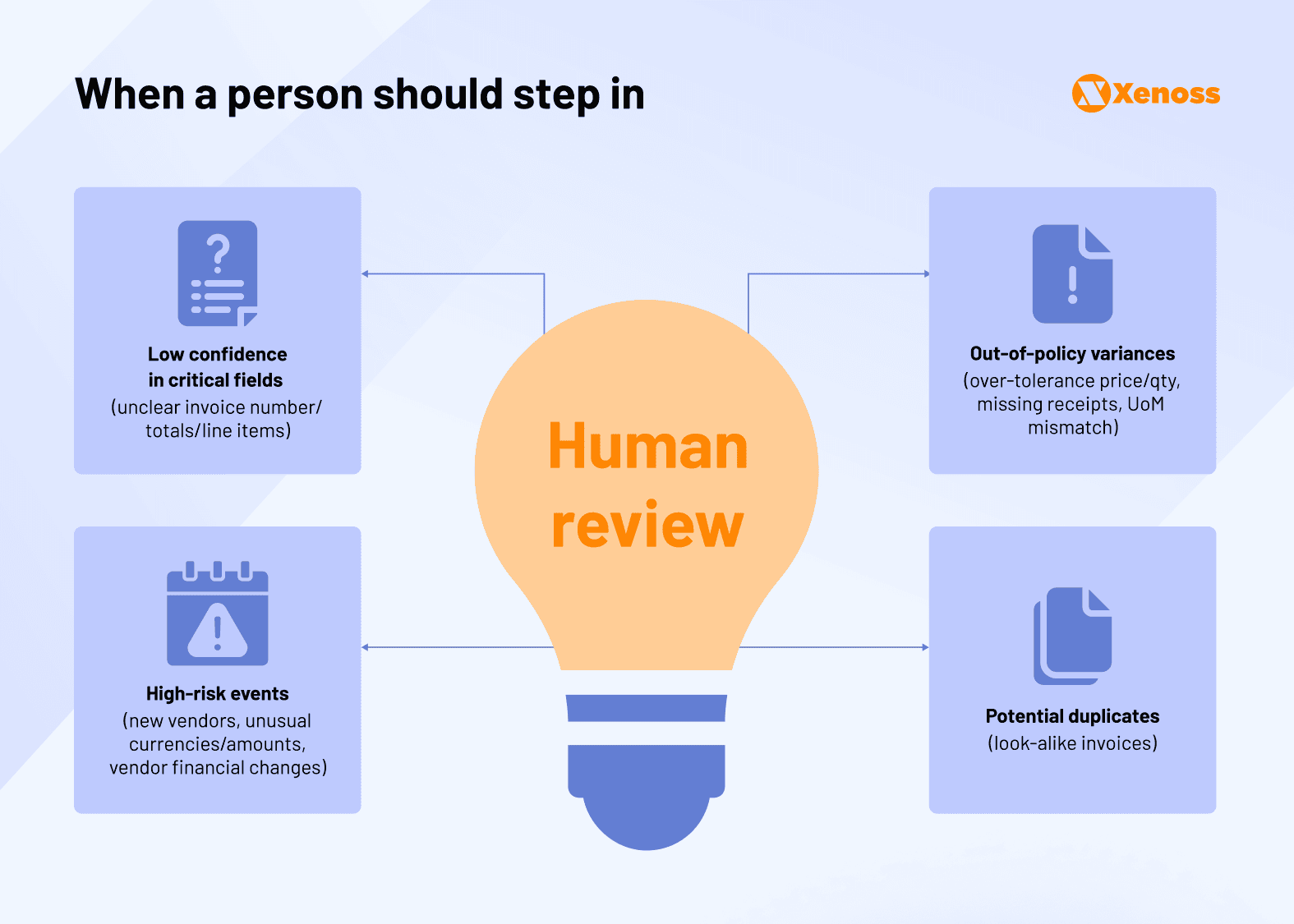

In payables, however, exceptions are where the risk lives, so human judgment serves as the circuit breaker. A human-in-the-loop (HITL) layer makes automation more defensible by routing the right decisions to the right people with the proper evidence, then folding those decisions back into the system, so it gets sharper every month.

Agents do the heavy lifting with capture and matching, but they never guess with money.

Review process

When confidence about critical fields (invoice number, totals, tax, line items) drops or an item falls outside tolerance, the orchestrator pauses and opens a review task.

Approvers see the source image, extracted fields, PO/receipt context, and only compliant actions (approve, short-pay, request credit, fix receipt). Decisions take minutes, not days, and every step is time-stamped and attributed to create an audit trail.

That immutable trail is the difference between “trust us” and “here’s the evidence,” which is exactly what finance and audit expect.

Security by design

Segregation of duties is enforced in-flow: the person who requests a vendor-master or bank-detail change cannot approve or execute it; high-risk actions require dual approvals and out-of-band verification. Suspected duplicates are blocked before payment and routed to AP with full context. Clean cases go straight through, shifting human effort from re-keying to risk control.

Compliance readiness

As AI regulations tighten across jurisdictions, having human oversight built into your financial processes is a regulatory requirement. External auditors don’t get a black box; they get clear decision trails showing where people validated AI recommendations, especially on high-value or high-risk items. The append-only log provides the evidence that finance and audit expect.

Learning loop

When an AP manager overrides a recommendation (e.g., short-paying after a partial delivery, adjusting a tolerance, rejecting a bank detail change), the system records the rationale and applies it to similar scenarios. Your team’s expertise becomes part of the decision logic, improving automation without compromising accountability.

Measured business impact

Organizations with mature HITL implementations report:

- Higher accuracy: more first-time, error-free disbursements, as only ambiguous cases reach people

- Faster cycles: approvers resolve exceptions with full context in centralized interfaces

- Reduced leakage: duplicates and misposts are stopped before cash moves

- Stronger audit confidence: every exception and approval carries time-stamped evidence

The goal of human-in-the-loop practice is to let automation run at full speed where it’s safe, pull a human in precisely where it isn’t, and make every decision train the machine.

As a result, payables are faster, cleaner, and audit-ready without risking your cash or credibility.

Business outcomes of the multi-agent hyperautomation your CFO will measure

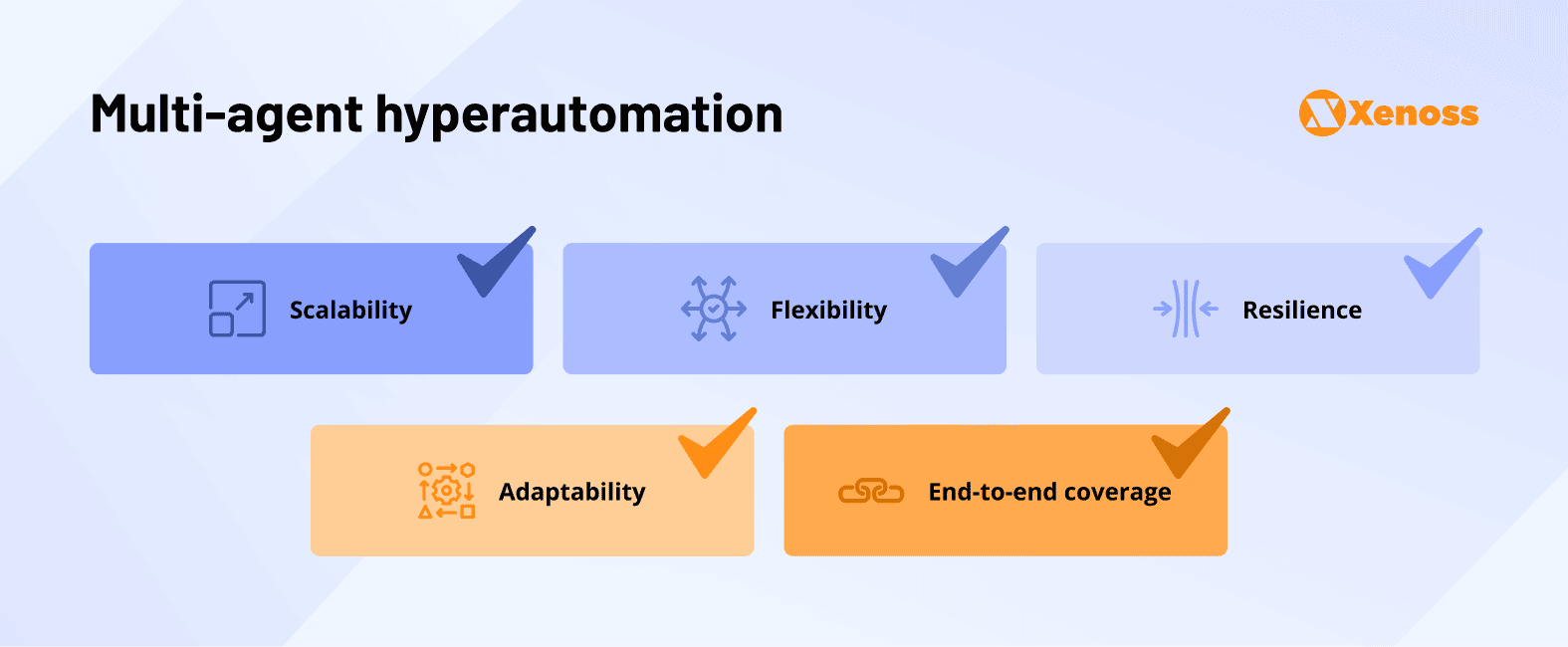

Multi-agent hyperautomation offers scalability (various agents can process different invoices simultaneously); flexibility (each agent has its specialization, so updates are modular); resilience (if one agent fails, others still function); adaptability (the system learns from exceptions and evolves); end-to-end coverage (from ingestion to fraud detection, to final payment).

Some measurable benefits that show up in your P&L and balance sheet include:

Immediate financial impact

AP automation delivers tangible operational expense relief. Goldman Sachs demonstrated years ago that automation achieves cost reductions of 60-70% per invoice.

The recent APQC studies confirm this trend continues: automated top performers process invoices at $2.07 each, while manual operations spend nearly $10.

These cost savings per invoice accumulate across every expense category: labor costs drop by 70-80%, while the hidden drains of physical goods (such as paper checks and stationery) and transaction/credit card processing fees are systematically eliminated, as automated costs become only 33% of the manual processing costs.

Working capital optimization

Multi-agent systems identify and capture early payment discounts that manual processes miss. A 2% discount on invoices paid 10 days early delivers a 36% annualized return (better than most investment portfolios).

Organizations report a 15-25% improvement in discount capture rates, translating to millions of dollars in additional cash flow for large enterprises.

The system also optimizes Days Payable Outstanding (DPO) within your policy constraints. Instead of paying everything at the last minute or leaving money on the table with early payments, intelligent agents schedule payments to maximize cash on hand while capturing available discounts.

Minimum risks and losses, even those you don’t know about

Duplicate payments are the silent profit killer in AP operations. Reports claim that organizations typically lose 0.8-2% of disbursements to duplicate payments and overpayments.

Multi-agent systems cut this to near zero through detection algorithms that cross-reference supplier information, invoice amounts, dates, and line-item patterns.

Fraud prevention evolves from a reactive to a predictive approach. The system flags suspicious patterns, like new vendors with banking details matching those of existing suppliers, manipulated invoice sequences, or amounts strategically positioned just below approval thresholds, delivering risk-scored alerts with specific recommended actions.

Suppliers’ relationship enhancement

Your suppliers value predictability over speed, and automated systems deliver both. Real-time invoice status visibility, clear exception communication, and consistent payment timing translate directly to better contract terms, priority allocation during shortages, and partnership relationships that drive advantages when you need them most.

Audit and compliance efficiency

External auditors demand comprehensive, immutable audit trails. Multi-agent systems create complete evidence packets for every transaction, from the original invoice, matching documents, approval chains, to payment confirmation. SOX compliance becomes a natural byproduct of regular operations, instead of a separate audit preparation exercise.

Multi-agent automation scenarios across industries

Custom multi-agent hyperautomation systems appear to be a perfect solution, but it’s not a universal playbook. Every industry sector needs to approach the implementation with a focus on business operating nuances, unique requirements, and regulatory constraints.

Manufacturing

In Manufacturing and Production, complexity is the norm, and control without drag is the goal.

Challenge: Multi-site receiving, partial shipments, and multi-currency POs strain manual matching and handoffs.

Solution: Multi-agent orchestration enforces two-, three-, or four-way communication across POs, receipts, and invoices, with policy-based routing for variances.

Outcome: Fewer handoffs, consistent cross-location controls, faster, cleaner period closes, and reduced manual coordination overhead.

Retail, eCommerce & CPG

In volume businesses, like Retail, eCommerce & CPG, scale and seasonality test throughput and control.

Challenge: High-volume, low-value transactions with seasonal spikes, promotions, deductions, and short-pays.

Solution: Agents buffer peaks, push clean POs straight through, and route only ambiguous invoices and trade claims to the right owners with full context.

Outcome: On-time supplier payments, shorter cycle times, fewer deduction disputes, and audit-ready trails.

Healthcare

For Healthcare providers, discipline and explainability come first.

Challenge: Varied reimbursement models and strict audit requirements around medical services and sensitive supply purchasing.

Solution: Agents perform nuanced matching with role-based approvals and documented evidence aligned to healthcare privacy and audit needs.

Outcome: Fewer escalations, defensible audit evidence, and a timely close without loosening controls.

Pharma

In Pharmaceuticals, pricing programs and chargebacks raise the stakes on accuracy.

Challenge: Complex pricing and chargeback programs, distributor relationships, and risk of duplicate discounts.

Solution: Agents validate eligibility, detect potential duplicate discounts, and link delivery/EDI records to invoices before posting.

Outcome: Reduced revenue leakage, cleaner settlements with wholesalers, and stronger compliance posture.

Financial Services & Banking

In regulated Finance and Banking, policy enforcement is non-negotiable.

Challenge: Fraud control, regulatory reporting, and risk management require strict approvals and reconciliations before money moves.

Solution: Agents encode maker-checker, dual controls, and pre-funds reconciliation as an executable policy, auto-documenting who did what, when, and why; ambiguous signals are escalated with context.

Outcome: Lower operational risk, faster clean throughput, examiner-ready documentation.

Energy & Oil & Gas

For the Oil & Gas industry, allocation accuracy and layered approvals are critical.

Challenge: Joint-venture accounting (JIB/JVA), field tickets, and non-operated interests across entities and jurisdictions.

Solution: Agentic systems automate multi-entity allocations, tie field tickets to invoices, and enforce role- and project-based approvals.

Outcome: Faster acceptance, accurate cost splits, tighter governance across assets.

iGaming & Digital-native payouts

In iGaming businesses, speed must coexist with AML/KYC control.

Challenge: Affiliates, creators, and player withdrawals across multiple payment partners and jurisdictions.

Solution: Daily agent-led reconciliation of platform balances, settlement reports, and bank movements; clean payouts auto-clear, anomalies (identity mismatches, unusual velocity) route with evidence.

Outcome: On-time payouts, fewer write-offs and disputes, and regulator-ready logs.

Sales & Marketing

In Sales & Marketing, the ad/media spend ties up budget when billing doesn’t reconcile quickly with orders and deliveries.

Challenge: Reconciling insertion orders, delivery, and invoices across platforms and agencies.

Solution: Multi-agent automation standardizes billing data, confirms delivery against contracted terms, and routes only exceptions to media, finance, or vendors.

Outcome: Faster billing close, fewer make-goods and credit notes, stronger working-capital discipline.

Based on the Xenoss case study, showing a 55% reduction in accounting staff costs through multi-agent reconciliation automation, we can see that successful hyperautomation isn’t about deploying generic solutions, but about architecting systems that understand and adapt to each industry’s operational DNA. The most effective implementations work within existing enterprise infrastructure while building intelligence that scales with business complexity.

How to make the right choice between Build vs Buy

This is the decision that keeps CIOs and CFOs in heated budget discussions.

The framework for making this choice is based on four key dimensions: capability requirements, total cost of ownership, implementation timeline, and organizational readiness.

1. Start with capability evaluation. For invoice reconciliation, you need three things working together, whether custom-made or off-the-shelf: dependable document ingestion (target for 95%+ field-level accuracy), an orchestration layer that adheres to ERP controls (e.g., two/three/four-way match), and explainable exceptions that your auditors can follow.

Most organizations need solutions that integrate with their existing financial systems without expensive middleware or custom development.

The good news is that major cloud service providers offer pre-built agents for common scenarios and allow customization for your specific business rules.

Look for solutions that offer explainable AI, as you need to understand why the system made particular decisions.

2. Then consider the total cost of ownership. Licenses are just the tip of the iceberg; implementation, integration, training, and ongoing operational expenses make up the bulk.

Justify the spend with CFO-grade outcomes: higher first-time error-free disbursements, fewer duplicate or erroneous payments, and shorter cycle times.

For TCO optimization, buying is often the sensible default. Procure commodity components (extraction, workflow, human-in-the-loop) and build the policy and risk “brain” that enforces your controls.

This hybrid approach delivers value sooner and reduces the costs of staffing a full AI/automation stack.

Reserve full custom builds only for unique reconciliation logic that helps you operate more cost-effectively at scale.

Tie your choice to key metrics and select the option that moves them within a reasonable timeframe without inflating your operational spend.

3. As for the implementation timeline, “build” approaches typically require 12-18 months for full deployment, assuming you have the right technical talent and project management capabilities.

“Buy” solutions can be operational in 3-6 months, but they call for a careful vendor selection and a straightforward implementation methodology.

The fundamental question shifts from speed to risk management. Building gives you complete control when policy is the product, but only if you can develop AI expertise internally.

Buying transfers technical risk to vendors but creates dependency on their roadmap and development priorities.

Here, the human-in-the-loop approach lets finance teams approve exceptions with complete evidence packets, allowing you to govern outcomes, not watch bots.

4. Evaluate organizational readiness honestly. This means considerable changes to supplier communication, internal workflows, role definitions, approval processes, exception SLAs, and vendor-master data hygiene on top of new software and systems.

Many organizations underestimate the investment needed for change management. Budget for training and communication programs, as the process changes affect supplier relationships and internal operations beyond just installing technology.

Regardless of your choice, ensure that vendor bank detail changes are locked down with segregation of duties and out-of-band verification. This is a well-documented fraud vector, and stopping it prevents expensive mistakes.

Practical recommendation

For most organizations, the pragmatic answer is a hybrid approach.

Buy a proven foundation for extraction and workflow, and tailor the policy/risk logic that makes your business unique.

Whichever path you choose, define the non-negotiables in business terms:

- Reliable invoice and line-item capture

- ERP controls enforced

- Explainable exceptions

- Clear approval accountability

- Results measured by straight-through rates, cycle time, and payment accuracy

If a vendor or your internal build can’t show measurable progress on these within a couple of quarters, keep looking.

Getting started with multi-agent hyperautomation: 90-day roadmap

Here’s a tried-and-tested plan for launching multi-agent hyperautomation for invoice reconciliation, structured to minimize risk, demonstrate value quickly, and set you up for scalability.

Ownership and alignment (pre-work)

We recommend appointing a single executive sponsor as the initial step, typically the CFO, to own outcomes, funding, and change management operations.

Stand up a core team: IT (architecture and integration), AP (process and controls), and Procurement (supplier communication). Use this group to lock scope, KPIs, decision rights, and the pilot plan.

Days 1-30: Foundation and discovery

This is the staging step, where you need to run a current-state review (invoice volumes by type and source, exception rates and root causes, cycle times and bottlenecks, compliance gaps, and audit findings).

Then, map system touchpoints and data-quality issues.

The next point is to set baseline KPIs against which you will report. In parallel, evaluate vendors using proof-of-concept tests on your real invoices, especially the messy edge cases.

A platform that handles exceptions reliably will handle routine transactions at scale. With facts, baselines, and an honest vendor read, you can design a pilot that matters.

Days 31-60: Pilot planning and preparation

During this phase, translate the findings into a focused pilot, typically one vendor segment or business unit that reflects broader patterns without excess complexity.

Define success criteria, measurement methods, and rollback steps. Additionally, prepare the infrastructure by connecting data sources, finalizing security and access controls, and specifying audit logging.

Begin change management with affected teams, focusing on how roles evolve (fewer manual touches, clearer exception ownership). With scope locked and people briefed, you’re ready for a controlled rollout.

Days 61-90: Pilot execution and optimization

Launch the pilot with daily monitoring and weekly review cycles. Multi-agent systems learn from experience, so ensure your team tunes rules, thresholds, and assignments as signals arrive.

Capture lessons learned, refine agent configurations, and document standard operating procedures.

Most importantly, measure processing accuracy, cycle time improvements, exception reduction, user satisfaction, and financial impact. These metrics become the business case for broader rollout.

Finally, at every stage, instead of perfection, we advise aiming for clear proof of value, control comfort for audits, and a credible way to support organizational learning that enables confident scaling.

The future of touchless AP

Ten years ago, we shipped AP “projects,” nursed them along, and rebuilt from scratch when requirements shifted. Today’s approach treats AP automation as a product: stable, secure, and evolving nonstop. Regular refactoring, tech upgrades, and component retirement aren’t glamorous; they keep you out of the “legacy, do not touch” death spiral.

Adaptive multi-agentic intelligence is designed to optimize outcomes, such as adjusting payment timing to maximize discounts while meeting DPO targets, or systems that automatically renegotiate payment terms with suppliers based on historical performance and market conditions.

The future of touchless AP centers on the key technological shifts:

- Policy as code replaces tribal knowledge: match/variance/approval rules live in versioned engines that agents read and execute.

- Adaptive tolerances adjust by supplier risk, historical accuracy, spend, and criticality.

- Confidence-native UX lets reviewers confirm or correct AI suggestions with a single click, feeding corrections back into the training pipelines.

- Real-time payments with real-time controls integrate RTP capabilities while maintaining pre-release checks for duplicates, vendor changes, and sanctions.

- Process mining evolves into closed-loop optimization, where systems diagnose, propose, and safely apply graph changes, such as tightening tolerances.

The combination of multi-agent AI with other technologies promises even more powerful possibilities. We are already witnessing the experiments with blockchain integration for immutable audit trails, IoT sensors for automatic goods receipt confirmation, and predictive modeling for cash flow optimization.

Most of all, these systems will grow more autonomous, with complete transparency and control built in, automating routine complexity and routing atypical cases to human judgment.

Meanwhile, the most operationally disciplined companies are revisiting financial process automation. They figured out the secret of multi-agent systems that are smart enough to say, “Hey, I’m not sure about this one,” and hand it to someone who is. That’s what multi-agent hyperautomation for invoice reconciliation actually does.

No claims to fix everything, it commits to solving the critical issues and being upfront about what it can’t.