We’ve seen shoppable ads on social media and apps. We’ve seen CTV (Connected TV).

Now, we’re heralding a new fusion of advertising innovation with shoppable TV.

So far, it’s performing astonishingly well.

Research by consumer tech giant LG, who trialed shoppable TV for their US audiences, found 70% of CTV users like TV ads with QR codes, and 62% would scan a QR code on their screens if exposed.

For a platform that has always struggled to bridge the gap between impression and action, those are some promising figures that help fuel the adoption of shoppable video.

Still, not everybody is on board. A fair share of the industry has concerns that should not be swept under the rug.

The questions are: Would asking viewers to shop while watching their favorite show be considered intrusive? What technologies do publishers need to turn their inventory into shoppable media? How can executives know the hype of shoppable video is not short-lived and worth betting on?

We took a deeper dive into the promises and realities of shoppable TV and decided to address the industry’s commonly asked questions.

Here’s what the article covers:

- What is shoppable TV, and how is it different from other types of video content?

- What benefits do shoppable videos bring to brands, publishers, and retailers?

- How far and wide does the adoption of shoppable video reach?

- What tools would publishers need to get started?

Let’s take a deeper look at shoppable TV by examining how it’s different from other video formats and what opportunities it brings advertisers, publishers, and retailers.

Understanding concepts and differences

What is shoppable media?

A shoppable video is an advertising format that allows viewers to buy products featured in a video. Jamie Irwin, founder and director of Straight Up Search, explains that shoppable videos offer “an immersive experience for shoppers as they get to watch product demonstrations while being able to make purchases without leaving the page.”

The format has been around for many years but only shoppable video platforms gained traction during the pandemic. Now, video shopping ads are becoming one of the key advertising trends in 2024.

How is shoppable TV different from live shopping?

Live video shopping is another trend taking video commerce by storm (mainly in Asia and, to a lesser extent, in the West). Shoppable livestreams help increase viewer engagement with the product, as audiences can ask product-related questions in real-time.

While successful in its own right, live video commerce is different from shoppable video content. Here’s a quick review of the differences between the two.

Live shopping offers more direct engagement with the product since viewers actively discuss it in the chat. At the same time, shoppable TV has the benefit of seamlessness, making a viewer’s shopping experience part of entertainment.

How is shoppable video different from T-commerce?

The difference between shoppable video and T-commerce is subtle, but understanding it helps to avoid confusing these formats.

Shoppable TV implies that a viewer can complete a purchase directly through the screen using a TV remote.

T-commerce, a format that comprises QVC (Quality Value Convenience) and infomercials, allows viewers to engage with ads in limited ways (e.g., entering their phone numbers). Still, they would need a different device (e.g., a smartphone) to complete the purchase.

Shoppable commerce is gaining an upper hand over T-commerce because of attribution. Shoppable formats make it easier for publishers to link an action to a purchase.

Is shoppable video a promising trend?

Yes, according to market data and a surge of interest among publishers and retailers. Here are a few data points that put the rise of shoppable video into context:

- 53% of shoppable video viewers engage with featured brands

- Shoppable videos help increase purchasing intent by nine times.

- According to a report by LG Ads, 50% of respondents wished they had a seamless way to buy products featured in CTV content (shoppable video addresses this very issue)

- According to BrightLine, during the 2023 holiday season, advertisers’ shoppable TV budgets doubled compared to the previous year.

Market data shows that high viewer engagement and interest among advertisers make shoppable TV a lucrative investment for publishers.

Shoppable video opportunities for brands

What are the benefits of shoppable video for marketers?

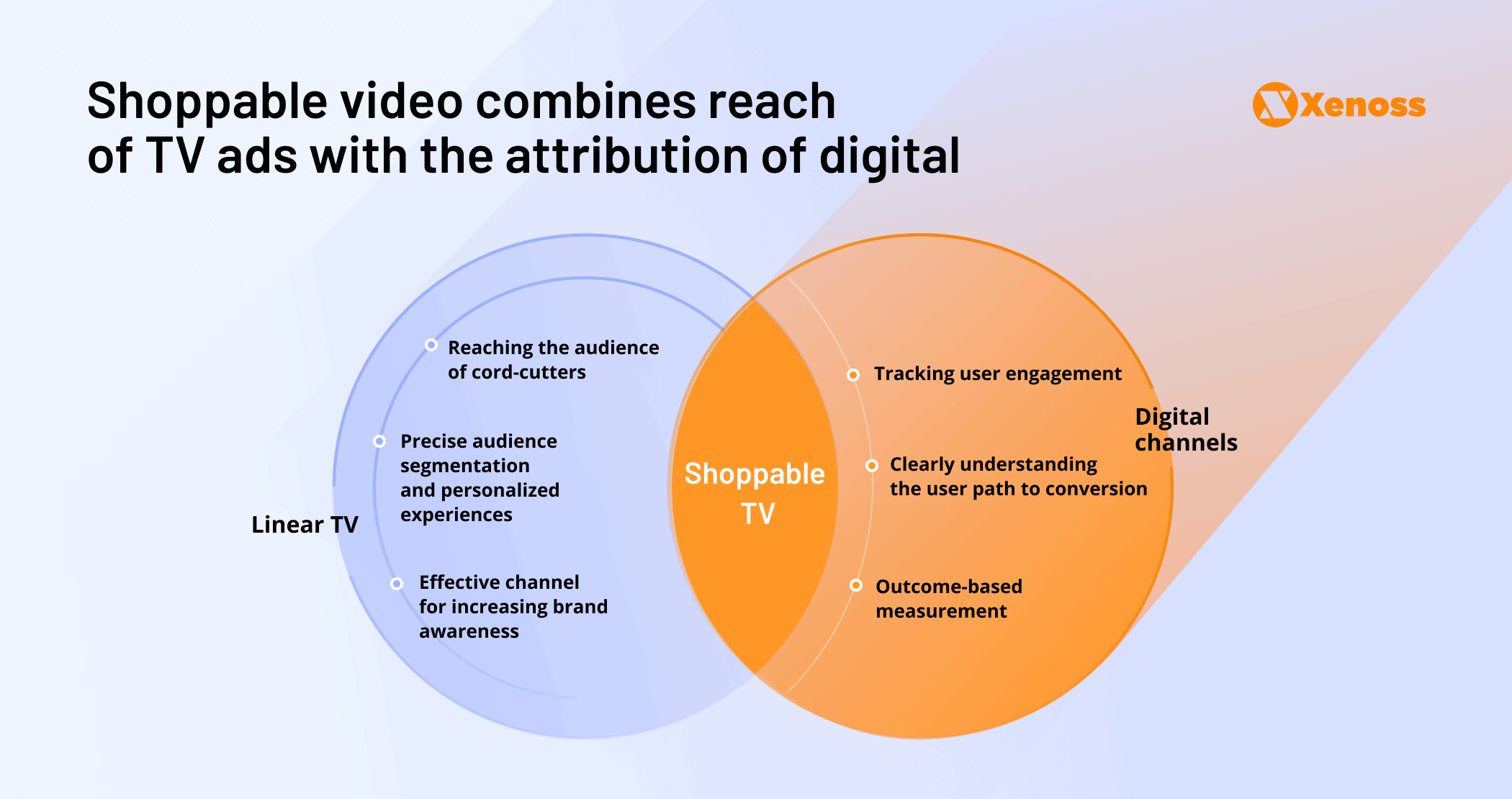

While TV remains relevant for advertisers as a brand awareness booster, attribution challenges have made marketers reconsider directing their budgets to TV ads. Shoppable TV is a way for TV to improve attribution and become more competitive when pitted against other channels.

Here’s why marketers have been flocking to shoppable TV:

- Shoppable TV allows brands to combine reach and attribution.

- Shoppable TV ads are becoming increasingly targeted and personalized, allowing marketers to deliver viewers personalized ads based on their interests or consumer habits. AI is now playing an essential role in providing these tailor-made shopping experiences.

- High influence of shoppable ads on buyer habits: according to LG Ads, 81% of viewers report being influenced by TV ads when making purchase decisions.

- Excellent conversions: a Samsung survey highlights that 52% of CTV viewers have purchased products they saw in shoppable ads.

What are some shoppable video examples brands can use for reference?

Fashion and beauty brands lead shoppable video adoption on CTV and social media.

To capture purchase-ready audiences, Swarovski launched a shoppable video campaign on Instagram, allowing viewers to buy the jewelry featured in the video without switching tabs.

Unilever, on the other hand, turned to shoppable CTV. The company was among the first to sign up for Disney’s new shoppable TV channel, Gateway Shop, available to its 225 million subscribers.

Ted Baker, All Saints, ASOS, and other fashion brands also ran successful shoppable video campaigns.

Benefits of shoppable TV for publishers

How are publishers leveraging shoppable TV?

For CTV publishers, 2024 is the year of shoppable ads. Here’s a recap of key market moves:

- Disney announced shoppable TV offerings at CES 2024. New formats allow viewers to get more info about featured products sent to their emails. Disney also teased that, in the future of shoppable video, viewers can instantly buy the products they see in films and TV shows.

- In 2023, Samsung expanded its inventory of CTV ad types, adding trivia, product carousels, polls, dynamic (addressable) creatives, and other formats to its list of ad units.

- In March this year, NBCU unveiled the expansion of shoppable TV capabilities. The company extended its Must Shop TV offering to six unscripted Bravo series airing on Peacock and unveiled a “Virtual Concession” feature. The new format enables last-mile delivery of food and drinks to viewers who plan a movie marathon or a TV binge.

- Paramount partnered with Shopsense to integrate shoppable TV into its inventory. The goal behind the partnership is to generate more data for advertisers and enable granular targeting.

- Channel 4 launched a shoppable series, “Ready or Not,” sponsored by E.l.f, a cosmetics brand.

What opportunities does shoppable video offer to publishers?

Publishers are aggressively betting on shoppable TV because they realize that customers are ready to buy the products we’ve seen on TV.

Looking up iconic outfits from TV shows and movies is decades old, except these days, shoppable TV spares audiences the trouble of research.

Having shoppable TV inventory allows publishers to capture a significant share of ad budgets, considering that the CTV market value is expected to exceed $40 billion by 2027.

What challenges will publishers face when introducing shoppable video?

Publishers’ key improvement area is designing a frictionless viewing experience that keeps audiences from losing interest in the content.

When considering adopting shoppable ads, publishers should realize that the new format challenges the “sit back and enjoy” nature of TV content consumption. As Steven Golus, a digital advertising consultant and founder of Steven Golus Consulting, said to AdExchanger, “If I’m watching the Super Bowl, I’m not going to stop and buy a pair of shorts.”

Changing consumer habits is not impossible, but it sets a high bar for seamlessness. Right now, publishers are solving this problem by implementing solutions that help users save information about the products they are interested in instead of buying them on the spot. We believe that solutions may emerge as the market reaches maturity.

Shoppable capabilities for retailers and social media

How are retailers tapping into shoppable video?

Like CTV publishers, retailers are bullish on the promise of shoppable video. Amazon is an undisputed leader in the segment, with its shoppable-video-only platform Amazon Live, a recent partnership with Omnicom to connect media and sales insights, and a steadily maturing ad-supported offering for Amazon Prime.

Aside from Amazon’s shoppable video expansion, retailers are jumping on the shoppable bandwagon.

- Walmart partnered with Eko, an interactive video startup, and released 22 episodes on the Walmart Cookshop, the company’s shoppable content hub for cooking enthusiasts. According to the company, internal tests have shown an 8.7% CTR, four times the industry average.

- Klarna introduced shoppable ads in 2022, allowing buyers to add products they see in videos to their shopping carts with one click.

- In Cannes this year, Instacart announced that the company is bringing its first-party data activation to YouTube and leveraging Google Shopping Ads to create more shoppable targeted video content for advertisers.

Are there shoppable video capabilities on social media?

Many social media offer shoppable video tools for advertisers. In fact, Tiktok’s launch of shoppable videos in 2022 pretty much fueled the format’s growth. YouTube has been offering shoppable videos to its viewers for around ten years.

Perhaps the most exciting player in the social media segment is Pinterest.

The company showed a strong interest in shoppable experiences by unveiling new formats (interactive quiz ads, among others) and facilitating the path to conversion with Direct Links.

The feature directly takes a viewer from Pinterest to the retailer’s website, facilitating check-out. Since the launch of Direct Links, advertisers have seen a 235% increase in conversions.

AdTech enabling shoppable video

Which AdTech companies are catering to the shoppable video segment?

The surge in demand for shoppable video solutions led to several new tools that provide publishers and retailers with ready-to-deploy toolkits.

At the moment, the most prominent market players are:

- Shopsense AI, an AI-based platform that allows publishers to transform content into shoppable journeys, enabling second-screen shopping experiences.

- KERV Interactive, a platform leveraging AI-driven image recognition technology to improve contextual targeting and turn videos into explorable and shoppable assets with high precision.

- BrightLine, a platform supporting interactive, dynamic, and shoppable CTV ads. It offers a reliable in-stream format (viewers can interact with branded content without interrupting the viewing experience).

- Vudoo, a shoppable TV vendor enabling in-stream checkout, granular targeting, and personalized ads.

Need a custom solution for shoppable TV adoption? Contact Xenoss developers to learn how we can help build one.

How is AI impacting the growth of shoppable video?

Going forward, machine learning and AI will be instrumental in driving the growth of shoppable video. AdTech companies are leveraging these technologies to create a more personalized and streamlined experience for CTV shoppers.

Shopnsense, for example, uses AI to identify products characters or celebrities are wearing on screen and allow viewers to buy them. The startup successfully piloted the feature for a large audience in a partnership with Paramount. During the CMT Music Awards red carpet pre-show coverage, viewers can experience AI-enabled shoppable TV.

ITV piloted its AI recognition tool in shoppable TV during its Love Island series on ITV2. The Take, a contextual product discovery company in partnership with ITV, designed the ML integration.

What tools do publishers need to build a video ecommerce platform?

The introduction of shoppable TV pushes publishers to expand their CTV stack and enrich it with tools that provide advertisers with an immersive, measurable, and compliant workflow.

To successfully release shoppable TV offerings, publishers would need tech that covers:

- Converting video content into shoppable assets viewers can engage with.

- Improved personalization that allows advertisers to create one-to-one shopping experiences.

- In-stream checkout: Viewers should be able to complete the purchase within the content they are watching without being redirected to a browser.

- First-party data activation tools that allow advertisers to create precisely targeted shoppable campaigns.

What lies ahead for shoppable video

Shoppable video will probably continue to ride the wave for the rest of the year. Here’s what we expect to see.

- New collaborations between publishers and retail media. We have already seen partnerships between Roku and NBCU or Paramount and Walmart. Similar publisher-RMN alliances likely are to come.

- Brands will spend more on shoppable ads, hoping to get purchase-ready eyeballs and first-party data.

- The buyer experience will evolve beyond the QR code. Survey data by Roku shows viewers are likelier to click “OK” on their remote than scan QR codes. Therefore, we think that more publishers will explore clickable formats.

- All inventory will be shoppable. Disney has already teased such an offering, and viewers are ready. In the future, we will move from “shoppable TV formats” to TV shoppable by default.

Bottom line

In some form, shoppable videos have been around for a long time. Yet, it took the growth of CTV, a pandemic-fueled shift of consumer behavior, and a massive growth spurt of technology to bring them into the spotlight. Now, the idea of no longer needing to look up products we see on TV is becoming a reality.

With shoppable TV, we are looking at a fierce market, with retailers and CTV publishers competing over budgets. They need to sort out a lot, from data collection to building a frictionless experience. We will likely need months before a shoppable TV experience enters every living room. Yet, by now, it has proven to be AdTech’s next frontier and is here to stay.