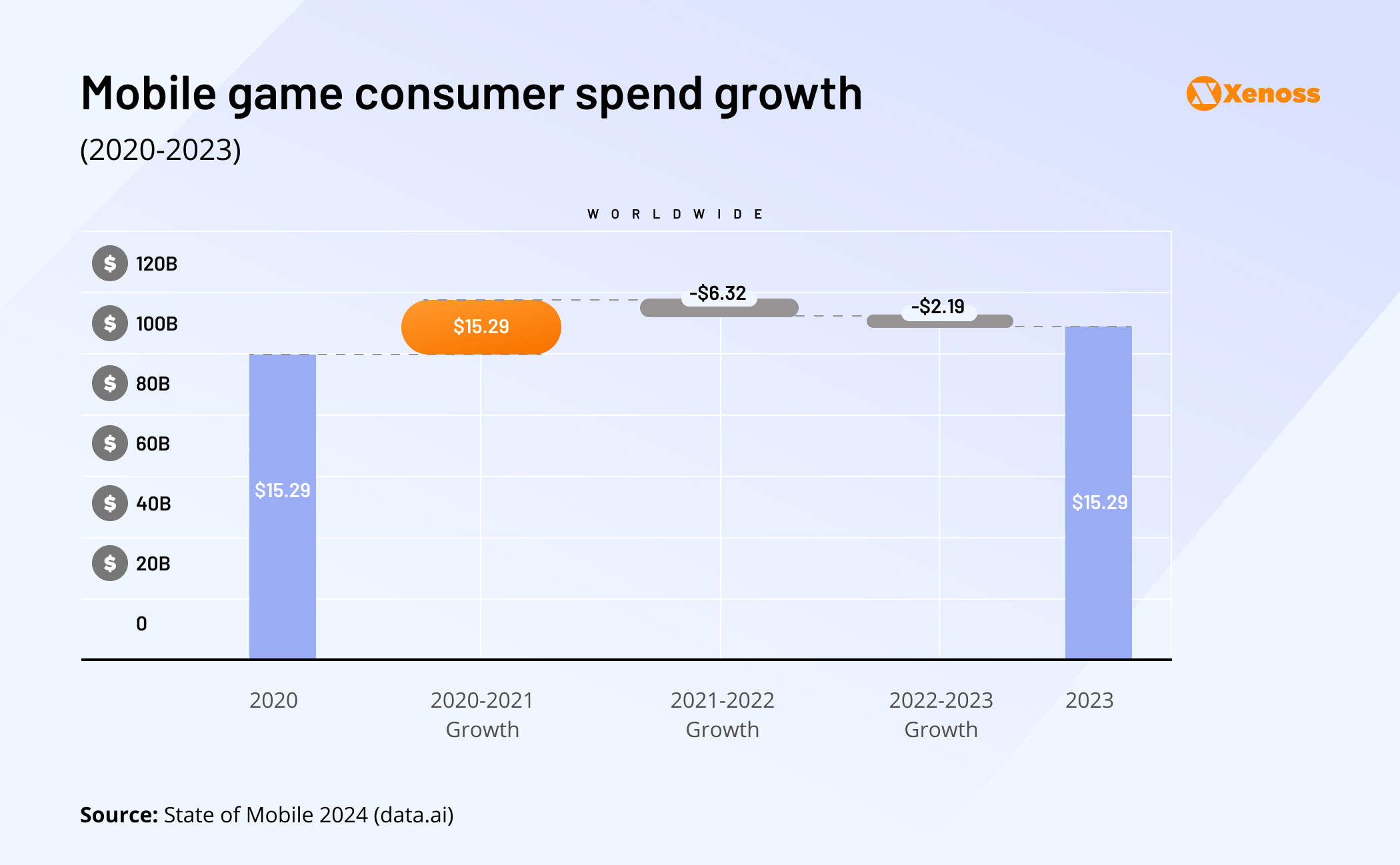

The game monetization market is at a crossroads, showing a rebound from a pandemic-fueled surge to pre-2020 levels.

According to State of Gaming 2024 by Sensor Tower, game downloads decreased by 6% for the App Store and 10% for Google Play.

Revenues have steadily declined even in the world’s leading game categories. Data.ai’s report on the mobile gaming industry found that RPGs—the industry’s most profitable genre—saw a 3.8% revenue decline between 2022 and 2023. Strategy games—the second highest-yielding category—suffered an even more drastic decrease of 11.7%.

The same report discovered that the number of new games entering the top 1000 by revenue in 2023 hit the lowest figure since 2019.

The rebounding market led to widespread downsizing across gaming studios. Reportedly, over 10,000 people lost their jobs in the gaming industry in 2023.

Recent changes in user tracking consent for mobile, namely Apple’s adoption of App Tracking Transparency (ATT), have cut away a sizeable portion of in-app ad revenue.

Following the implementation of ATT, Meta reported losing US$10 billion in revenue. A 2022 survey by Liftoff echoed a similar sentiment, reporting that 64% of game developers felt the negative impact of the changes.

The last two years have been sobering for the industry following the lockdown growth spurt. As the market rebounds, it’s important not to mistake recalibration for decline. The pandemic catalyzed a lifestyle U-turn and prompted the industry’s unprecedented growth.

When the lockdown was lifted, a decrease in content consumption was inevitable and not exclusive to gaming. Across other channels, Netflix and Spotify also reported revenue slumps.

For game publishers, optimizing AdTech supply chains and finding ways to increase advertiser demand is becoming a path to growth in the changing landscape.

Adopting innovative monetization strategies helped Roblox secure an impressive partnership lineup, including Nike, Walmart, the NFL, Adidas, and many other household names.

Gaming continues to attract over 3.4 billion people, many of whom fall into the highly sought-after 18-34-year-old cohort. To leverage that demand and maximize revenue amidst economic turbulence, publishers have to review their monetization playbook and replace suboptimal practices with growth-fueling strategies.

In this post, we will highlight common game monetization pitfalls that prevent game studios from maximizing revenue and offer actionable tactics publishers can implement to unlock the full value of their inventory.

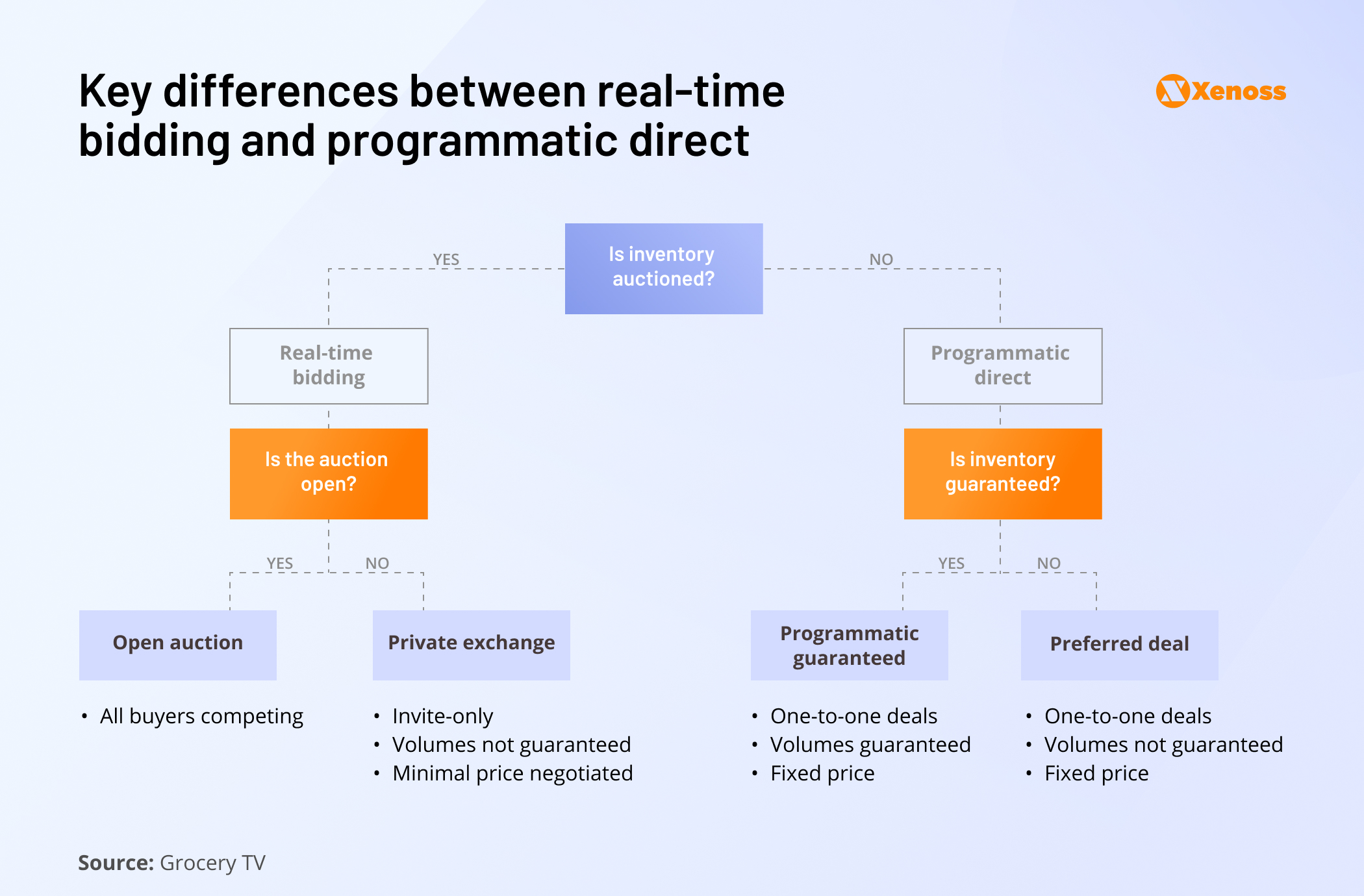

Pitfall #1: Not leveraging direct inventory sales

The open marketplace dominated the 2010s. In 2024, publishers still heavily rely on the OMP, but there are reasons to believe that the pendulum is about to swing back to direct deals.

An Adalytics report released in 2022 shared that the sell-side can lose up to 98% of ad revenue to AdTech tax.

In a landscape where restructuring and cost-cutting are top-of-mind for game publishers (Microsoft, Electronic Arts, and Epic Games adopted such initiatives), eliminating intermediaries from the supply chain is a strategic way to trim expenses and claim full revenue.

Likewise, stringent privacy regulations make it difficult for real-time bidding to continue playing the trump card of control, transparency, and clear attribution. Publishers are growing concerned that the adoption of ATT and a planned cookie opt-out will effectively make up to 70% of audiences invisible to the open marketplace.

In search of alternatives to OMP monetization, gaming studios are exploring the idea of premium inventory.

Google’s research shows that the average CPMs for direct sales are between $10 and $20, compared to the $1-5 average within the RTB ecosystem.

Roblox launched its premium ad offering this year, luring publishers with in-game displays and video billboards.

Nintendo allowed advertisers to create custom experiences within the game, such as adding Mercedes-Benz skins to Mario Kart as part of a brand deal with the car company.

There are several reasons for gaming studios to tap into direct selling.

Higher ad revenue with better CPM

Programmatic used to be the critical ad revenue driver for publishers for years, yet the impact of direct deals has been rising in recent years. According to Digiday and Permutive’s State of Publisher Revenue survey, the sell-side expects direct deals to drive over 40% of total ad revenue in 2024.

Use of first-party data

Direct selling is often heralded as a privacy-preserving approach compared to the reliance on intermediaries since it protects gaming studios from sharing players’ PII with third-party intermediaries. Instead, app publishers can leverage first-party data collected directly from users and offer advertisers targeted and relevant ad slots.

Custom, high-impact ad formats

With direct sales, publishers can focus on creating high-impact ad experiences and formats, from takeovers, native ads, in-app artifact branding, and offerwalls to sponsored content.

Anzu’s survey on intrinsic in-game ads showed that 45% of game players recall ads embedded in the gaming experience, while only 35% remember generic ads displayed via other channels.

The ability to successfully retain gamers and boost ad campaign performance makes direct inventory a win-win ad monetization strategy for game publishers and brands.

Control over ad placements and addressing brand safety concerns

With direct deals, studios have greater control over brands that purchase their inventory, the timing of in-game ads, and how they appear to players.

When Gameloft traded programmatic for direct sales in 2015, the ability to filter brands the company worked tipped the scale in favor of premium inventory. Sylvain Baudry, former senior director of advertising for the US at Gameloft, explained to AdExchanger that monitoring the quality of ads was a must-have for titles the company built for licensors (NFL, Disney, or Marvel).

“In some games, you have brands that the licensor doesn’t want associated with the [intellectual property]. If we don’t manage campaigns ourselves, we don’t have control.”

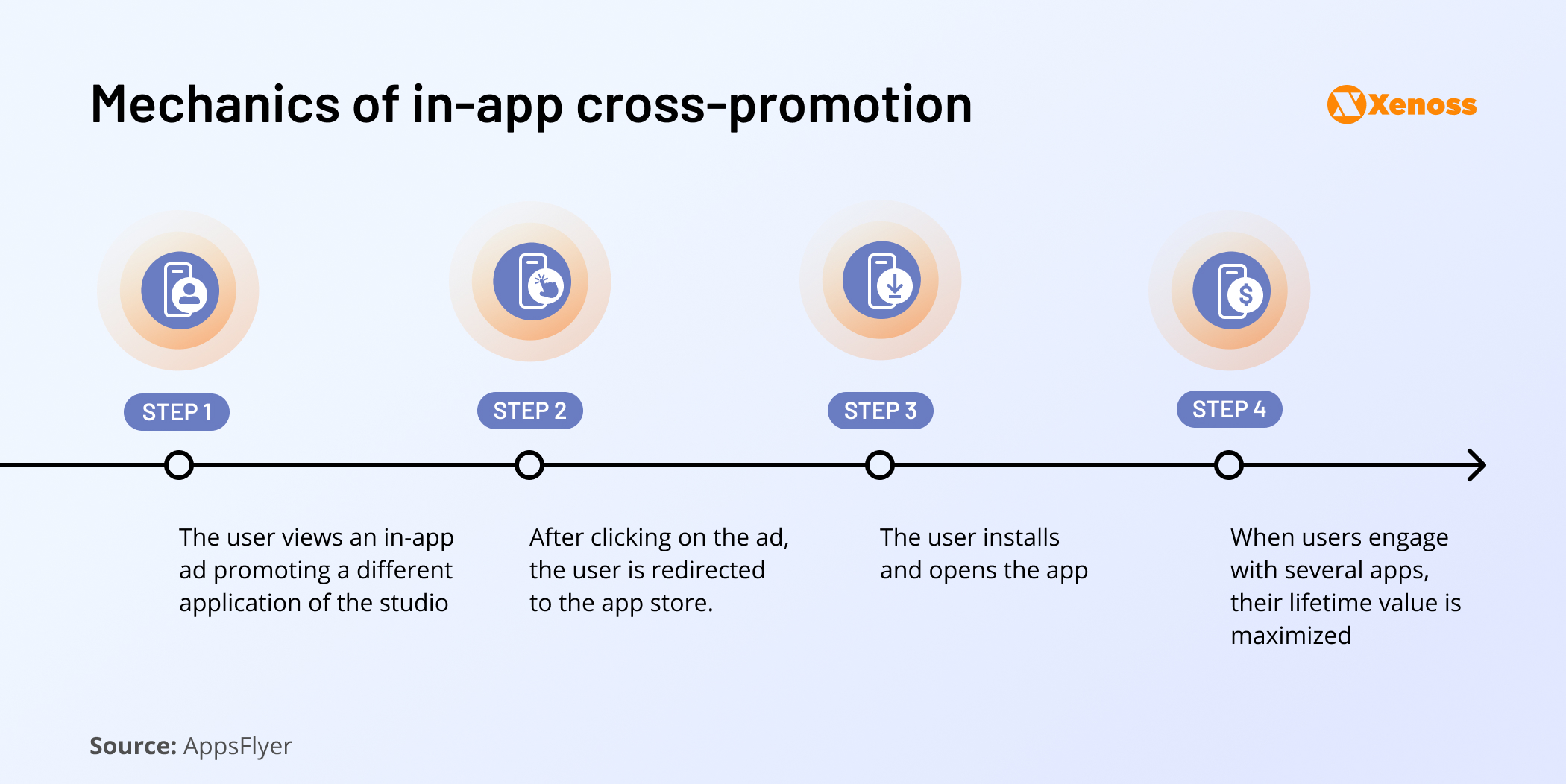

Pitfall #2: Ignoring cross-promotion opportunities

The release of Apple’s ATT framework, stringent rules for app promotion set by the SKAd network, and a limited number of IDFAs (identifiers for advertisers) significantly reduced app developers’ ability to run, track, and measure user acquisition campaigns.

Studios are turning to cross-promotion in mobile games to retain users across their portfolios. It allows publishers to drive engagement for new titles by harnessing the popularity of older releases.

Yet, cross-promotion, while effective, is not immune to privacy challenges.

For example, gaming studios are struggling to figure out how to effectively target users who are likelier to engage with the new title or find the right time for cross-promotion to avoid the risk of cannibalizing inventory monetization.

Good news? The right tech toolset can help address these challenges.

Here’s how game studios can improve the accuracy and effectiveness of mobile game cross-promotion.

- Leverage machine learning to match users with a studio’s portfolio apps based on gaming habits, interests, and other criteria. Machine learning’s predictive capabilities allow it to estimate user churn with 90% accuracy, match users with apps from a developer’s inventory, and choose cross-promotion placements that do not interfere with game monetization.

- Build solutions for MMP management. All-in-one attribution tools like Ad Measurement by Kochava allow game developers to achieve interoperability across marketplaces. In a single cross-promotion platform, marketing teams track promo campaigns for all apps regardless of the MMPs they are integrated with.

- Use attribution identifiers: IDFV, household IP, and custom first-party identifiers.

Publishers with robust application portfolios should consider going beyond the tools currently on the market and building custom cross-promotion technologies. A tailor-made cross-promotion toolset helps design custom segmentation criteria, control attribution settings, and create custom integrations with identifiers.

At Xenoss, we helped gaming studios build machine-learning-based tools that help accurately match audiences with applications in the developer portfolio.

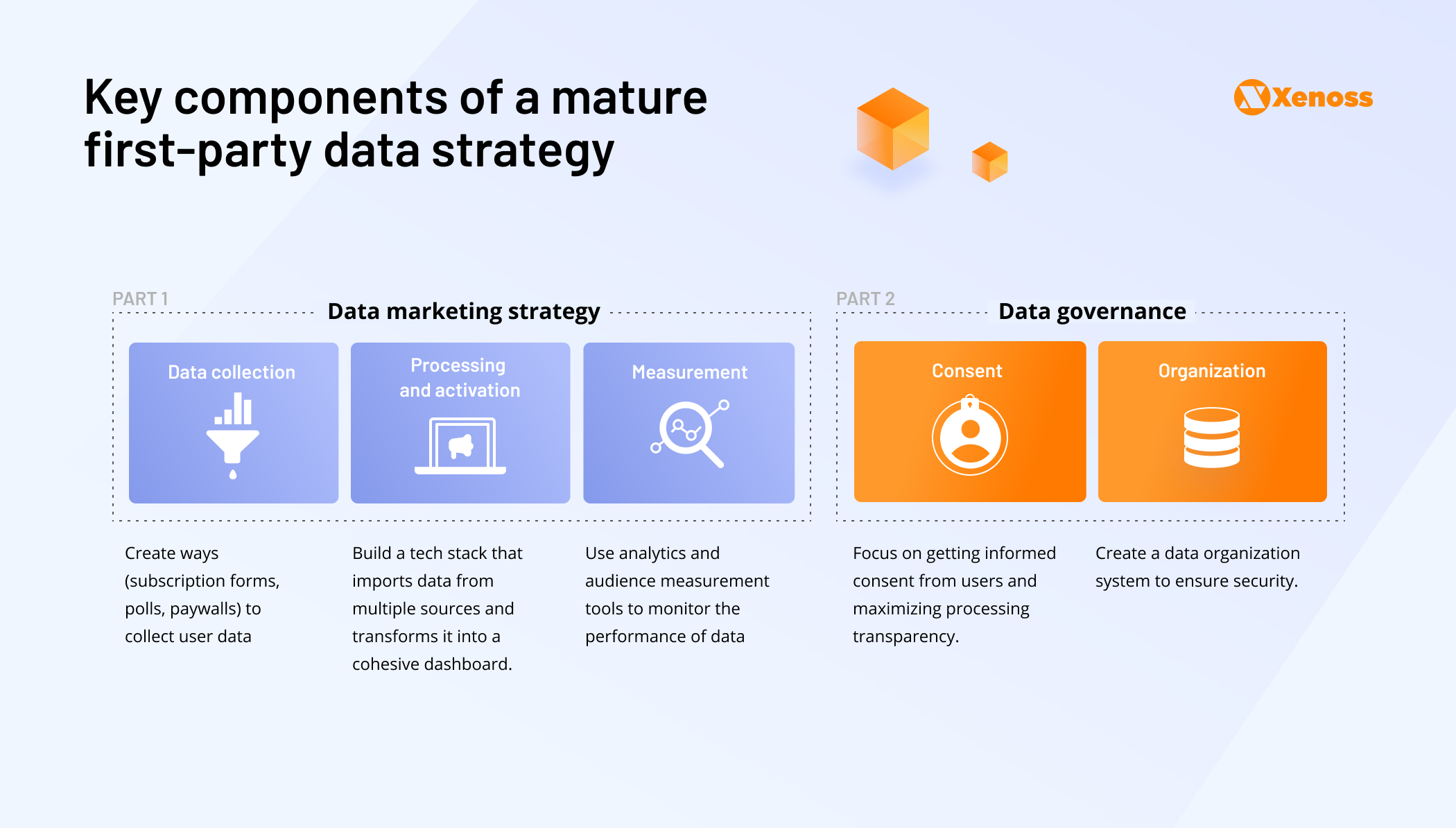

Pitfall #3: Not using audience data

Tapping into first-party data is a way for studios to work around privacy changes like 2022’s iOS scenario.

A robust first-party data processing, analytics, and governance ecosystem helps publishers reach ad dollars, drive internal value, and inform business decisions.

Zynga, the publisher behind Zynga Poker, one of the top-charting iOS games, uses its first-party data network to discover how users interact with games. The company then funnels this insight into improving user acquisition and cross-promotion.

According to Frank Gibeau, the CEO of Zynga, a robust first-party infrastructure positioned the company among the few winners in the post-ATT mobile landscape.

How can game publishers prepare for the first-party-data-dominated market?

Consider expanding your stack for data collection and activation to support all steps of data management and governance.

| Data strategy component | Tools |

| Collection | Custom-built tracking systems process and analyze first-party data app developers collect from users. SDKs (Software Development Kits) help collect first-party data by providing tools to track user interactions, device information, and app performance metrics directly within applications. Alternative IDs assist publishers in cross-referencing hashed first-party data-based reader IDs with those provided by advertisers. In-app surveys help collect direct feedback from players. |

| Storage | Data warehouses help locate, centralize, and maintain large amounts of data from multiple sources in a readily-accessible state. Data lakes are a widely used and secure technology for first-party data storage. Unlike databases, they can store both structured and unstructured data. Data management platforms (DMPs) are traditionally used to store anonymized third-party data securely. Modern DMPs allow combining first-, second-, and third-party data to build customer identities. |

| Mixed (storage and activation) | Customer data platforms (CDP) store first-party data obtained with a user’s consent. CDPs support various data processing operations, such as creating customer profiles, content personalization, and audience modeling. CRM platforms help use collected first-party data for identification, user segmentation, and look-alike audience modeling. |

| Ingestion | Batch data ingestion platforms receive data inputs at set times. Streaming data ingestion platforms ingest data from multiple sources in real-time. |

| Transformation | Analytics software helps organizations transform raw data into meaningful insights through statistical analysis, data visualization, and predictive modeling. BI tools process, analyze, and visualize business data to help publishers make informed decisions. These tools use technologies like data warehousing, mining, ETL (extract, transform, load) processes, OLAP (online analytical processing), and data visualization. |

| Data observability | Data observability platforms provide comprehensive monitoring and analysis of data health, ensuring data quality, reliability, and real-time visibility across AdTech data pipelines. Monitoring platforms track the health and reliability of advertising systems and data pipelines in real-time by providing analytics, alerts, and visualizations. |

Pitfall #4: Slow adoption of mediation platforms and over-reliance on off-the-shelf offerings

In 2024, the adoption of mobile ad mediation platforms is growing and, according to Eric Seufert, the creator of Mobile Dev Memo, is becoming a rising gaming industry trend. Still, it is far from ubiquitous, which leaves many studios missing out on a powerful way to expand advertiser partnerships.

The lack of awareness of the value brought by ad network mediation platforms leads to a disconnect between reachable audiences and ad spending aimed at them.

For example, even though more people identify as gamers than as digital video viewers (3.37 and 3.38 billion, respectively), an IAB survey, “Changing the Game: How games advertising powers performance,” released in 2023, shows that advertisers spent $7.5 billion on game ads and allocated over $24 billion in CTV.

There’s no single reason for the stunted growth of in-game advertising, but a lagging AdTech adoption among publishers is responsible to some degree.

Even mediation-savvy studios mostly rely on third-party vendors instead of building custom mediation technology. Partnering with a mediation provider may ease operational burdens, but it does so at the expense of revenue and control. Relying on third-party mediation platforms forces publishers to contend with specific challenges.

- High partnership fees. Heavy reliance on third-party mediation platforms keeps publishers from fully controlling their revenue. According to data from Adjoe, game monetization networks claim between 30-70% of ad revenue (often without informing the publisher).

- Risk of limiting the range of partners. Some mobile game ad networks still use the waterfall model, which passes a bid from one network to the next, instead of header bidding that allows advertisers to place bids simultaneously. For publishers, the reduces exposure to demand and potential revenue.

Nimrod Zuta discusses the shift of ad mediation from waterfall to header bidding

- Limited control over inventory. If a mediation partner does not filter inventory against brand safety criteria, in-game ads can negatively impact player experience and retention.

The downsides brought about by the overreliance on third-party mediation tools become increasingly impactful as game studios scale their audiences and revenues.

For multi-million-grossing titles, a 30% revenue cut can reach six figures.

Forward-facing publishers opt for custom ad mediation solutions to bypass mediation-related losses.

While building a proprietary mediation toolset will require engineering talent, time, and budget, the benefits of fully controlling advertising partnerships, the quality of the inventory, and revenue outweigh the drawbacks.

Pitfall #5: Not implementing dynamic pricing

What is dynamic pricing?

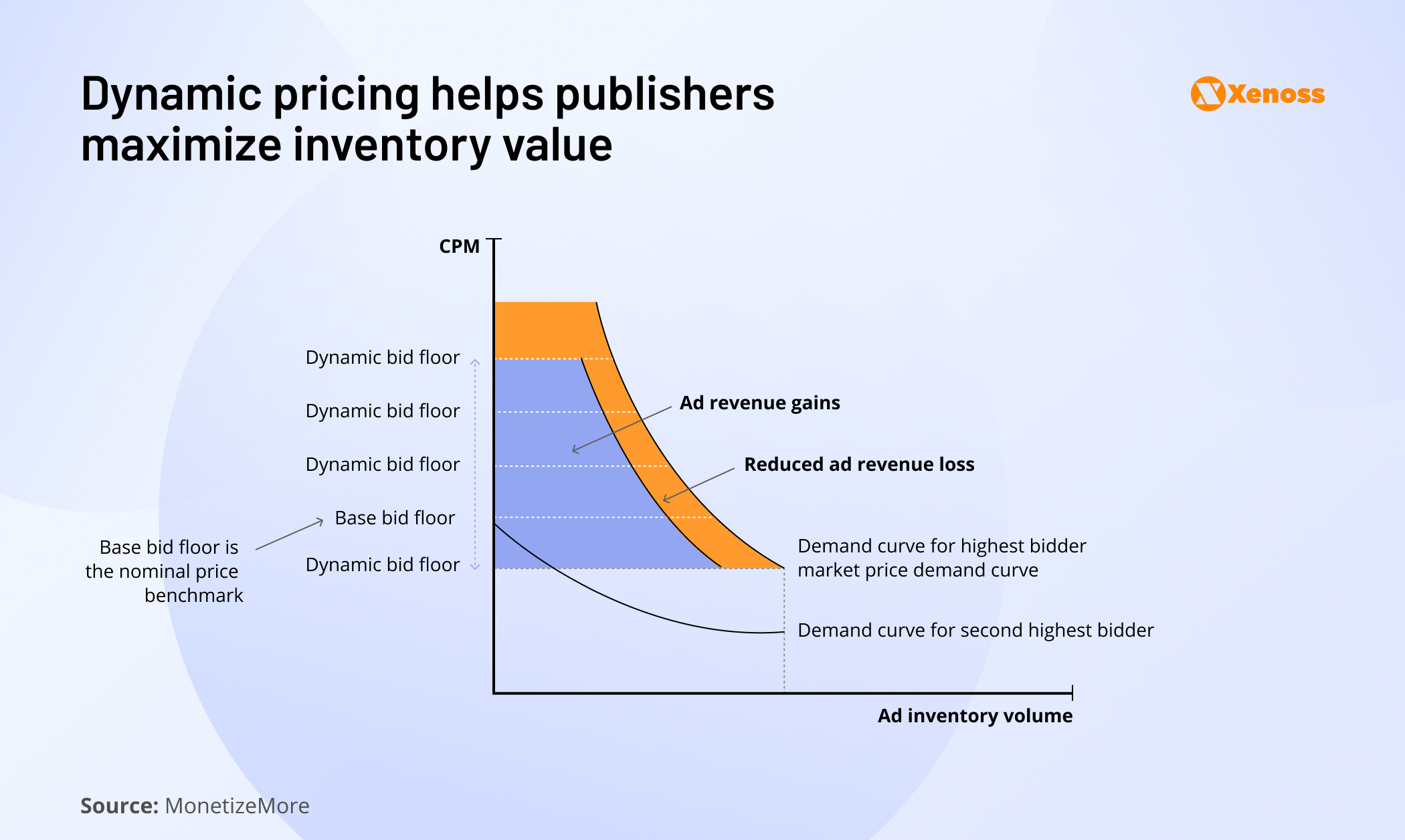

Dynamic pricing refers to modifying the cost of impressions in real time based on user data, market trends, and other criteria.

Conceptually, it is the opposite of fixed pricing, which implies a fixed price per impression.

Dynamic price floors help publishers maximize the value of their inventory and ensure the impression rate reflects the market average. This approach allows publishers to find the highest CPM they can reach before driving advertisers away.

Conversely, suppose a gaming company has set the price wall too high, is no longer attracting advertisers, and cannot keep a high fill rate.

In that case, dynamic pricing will calculate a reasonable CPM, helping publishers sell their entire inventory.

The success of a publisher’s dynamic pricing strategy relies on the precision of underlying algorithms. The increasing adoption of AI is turning using machine learning tools for calculating bid prices into a standard industry practice. For example, Content Ignite’s AI-powered Dynamic Floors solution helps publishers accurately predict bid prices based on historical data.

It’s time to level up your monetization game

With the gaming industry still dealing with the aftereffects of privacy restrictions and facing revenue fluctuations, gaming studios need to be armed with game monetization strategies that drive revenue, ensure control over inventory, and promote long-term user retention.

With knowledge of these common pitfalls—and the best ways to avoid them—you can ensure that your studio gains the best ROI, avoids the need for layoffs, and can more confidently face economic downturns.

Ready to learn more about protecting your gaming studios with innovative game monetization solutions? Get in touch today.