In a twist that might not be all that surprising, Google has decided to hold off on the planned deprecation of third-party cookies. Instead of phasing them out, Chrome users will have more control over their cookie preferences.

For publishers with a large pool of first-party data and own in-house AdTech, this development is unlikely to be a game-changer. Many have already been shifting away from cookies and are well-prepared for a cookie-less future. They’ve been investing in first-party data, retail data, and alternative IDs, and are optimistic about the possibilities beyond cookies. By harnessing first-party audience data—gathered through subscriptions, paywalls, and newsletters—they’ve already started gaining a competitive edge. Moreover, their strategy has made them less vulnerable to Google’s U-turns.

At Xenoss, we believe the industry should persist in advancing cookie-free research and development despite Google’s announcement. The strides made in recent years have permanently transformed the digital ecosystem, paving the way for a more privacy-centric and data-driven future.

To build on these advancements, media owners need a new infrastructure for data activation and secure, privacy-focused data sharing to capture more revenue. High audience addressability and match rates are crucial, requiring a comprehensive first-party data strategy and investments in new technology stacks.

In this guide, you’ll learn about:

- The main components of first-party data strategy

- Recommended tech stack for data collection and activation

- Best customer data capture methods

- Strategies for ensuring customer data privacy

- First-party data monetization techniques

- Data-driven content strategy development and execution

Building a future-proof strategy with first-party data

Traditionally, advertisers used third-party data (like cookies) to identify users, track their behavior, and collect interest-related data. AdTech players, operating as walled gardens, aggregated, consolidated, and enriched this data across multiple properties to offer advertisers the best audience data.

Publishers have a unique chance to reclaim their audience knowledge and build a direct bridge with advertisers.

Media owners still have access to rich behavioral and interest data, but they lack the mechanism to amplify data collection, audience modeling, and secure data sharing with advertisers in real time for cookie-free targeting.

With the right stack, publishers benefit from targeted audience segments, brand-safe environments, and contextualized advertising against hyper-relevant content.

Moreover, publishers can cross-match first-party data with advertisers using third-party cookie alternatives like data clean rooms to resolve identity conflicts, identify new addressable audiences, and deliver high-fidelity measurements.

This transition requires organizational changes and tech investments in the right areas.

1. Strategy development and implementation

Publishers have the most valuable asset in the AdTech industry—a direct relationship with their audience. A first-party data strategy amplifies the ability to collect and activate customer data. To provide more context on this, we asked Luke Taplin-McCallum, Head of Advertiser Partnerships at Anonymised, what advice he would give to publishers who are choosing identity solutions for their first-party data stack. He highlighted the importance of a strategic approach.

The transition will need buy-in from every level—product, editorial, subscription management, and the technical office. At a high level, you’ll need to decide:

- What type of 1st party data is already accessible?

- Which extra data points you could collect?

- Which methods would work best?

- Where will you store the acquired data?

- How can you ensure data privacy and security?

- How will you perform identity resolution and first-party data activation?

- Who will be involved in the project?

A good publisher strategy focuses on addressability—the ability to target large groups of users sharing similar characteristics with personalized messages and offers. The depreciation of third-party cookies, however, forced publishers to start building new user identities based on first-party data. Google’s initial decision to deprecate third-party cookies was actually a good thing because it allowed publishers to reclaim extra valuable data, traditionally held by ‘walled gardens,’ including more insights on campaign exposure, known devices, or past engagement with different ad formats. In other words, publishers can collect more deterministic data—user identity insights we know to be true—which help create richer, addressable audience profiles.

Forbes built an internal data center dubbed “ForbesOne” for collecting and analyzing first-party user data using machine learning (ML) and AI techniques. According to Vadim Supitskiy, Forbes’ chief technology officer, the platform allows them to better categorize available content and understand the sentiment and topics. “Using ML models and AI, we can understand what our audience wants and we can scale our audience segments. We can create lookalike audiences at scale.” ForbesOne showcases impressive metrics, with over 600 data points shaping audience segments, access to nine key communities, and a reach exceeding 140 million monthly.

Pop culture publisher Ranker, for example, started collecting first-party data using on-site voting systems, surveys, and behavior analytics tools to build first-party-based user identities. Then, using Permutive CDP, Ranker created high-intent audiences to offer across various direct, private, and programmatic guarantee campaigns. The new first-party data-based programmatic advertising brought Ranker a 4X revenue increase YoY and a 25% RFP win rate. By using Permutive instead of developing a custom CDP, Ranker could start monetizing their data faster.

You’ll need the following elements in your first-party data tech stack to obtain similar capabilities.

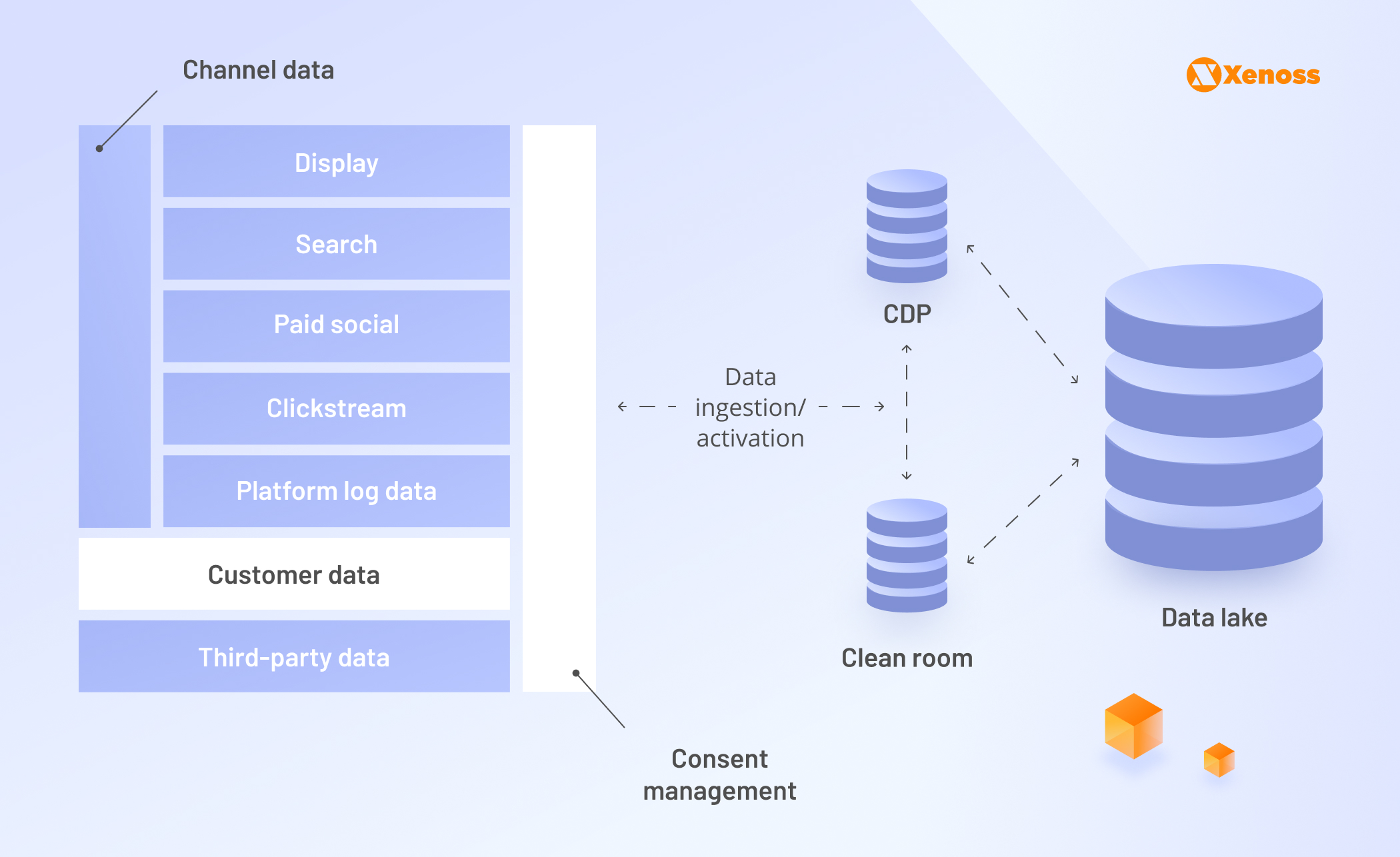

Data lake infrastructure

Publishers need a new storage layer to securely host accumulated first-party data. The most common choice is to implement a data lake. Unlike databases, data lakes can host both structured and unstructured data, making aggregation easier. Using data lakes, publishers can store all customer data securely and generate custom datasets for ad-hoc analysis.

As opposed to data management platforms (DMPs) and customer data platforms (CDPs), data lake technology doesn’t require physically moving the data. It allows data to be queried directly, leading to faster querying and reduced data leakage and compliance risks.

Modern data lake vendors also provide extra tools for publishers. Snowflake offers data clean room technology for media publishers to connect their first-party impression data across channels and devices to purchase and intent data (acquired from partners) for cross-channel conversion analysis. Google launched BigQuery data clean rooms in 2023 to support cross-organizational and cross-industry collaborations.

Recommended data lake tools and technologies:

Data management platforms (DMP)

Traditional data management platforms help consolidate (pseudo)anonymous third-party audience data and store it for short periods. With a DMP, marketers can analyze user behaviors using identifiers like cookies (for now), IP addresses, and devices.

The newer audience management platforms go a step further and allow you to securely combine first-, second-, and third-party data to build 360-degree customer identities, perform advanced audience modeling, securely match audiences with advertisers, and ensure more accurate attribution.

Permutive, used by the BBC, the Financial Times, Business Insider, and Immediate Media, among others, performs edge processing computations on a user’s device. This allows publishers to safely collect audience and behavioral data without third-party cookies and use it to match impressions and build new audiences.

Marketing data management platform Lotame provides identity resolution and data enrichment services for publishers looking for secure ways to combine internal and external data for actionable customer intelligence.

Best data management platforms favored by some publishers:

Customer data platform (CDP)

A CDP platform is another data storage technology, primarily for first-party data. Unlike DMPs, CDPs typically store personally identifiable information (PII) and unique identifiers tied to individual users, obtained with their consent. Common CDP use cases include customer profile creation (e.g., new vs. long-term subscribers), content personalization (e.g., recommended newsletters and headlines), and lead generation (e.g., creating more conversion opportunities).

CDP software helps create and analyze customer journeys to optimize their experience and prevent churn. You can learn what content resonates the most with different audiences to improve engagement and retention rates. Publishers can also use CDP data to broker better advertising deals by sharing anonymized interest, behavioral, and location data.

Modern CDP platforms also include features for audience data collection and modeling. Raycom Sports used the BlueConic platform to create personalized online surveys to capture more insights about its visors. The publisher collected over 27,000 data points, including preferences on travel, content types, and other behaviors. Based on this data, Raycom created new highly targeted and segmented viewer profiles to pitch to advertisers.

Top customer data platforms

For example, Piano doesn’t market itself as either CDP or DMP. Still, it combines features from both sides: The ability to combine first-, second-, and third-party data with volunteered zero-party data to develop user profiles and audience segments; instant sync with popular ad servers and MarTech tools, integrated identity management service, and adaptive audience measurement tools for personalizing experiences across channels.

Composable CDPs like Hightouch and mParticle, in turn, let you effortlessly channel segmented data into any ad platform, CRM, email tool, or marketing tool to run ad hoc analysis.

Effectively, publishers no longer need to choose between a CDP and a DMP and can opt for a hybrid solution.

CRM Software

Customer relationship management (CRM) systems contain personally identifiable user information (PII), like full contact details, address, and payment information. These insights are off-limits for direct targeting but can help with user identification, customer segmentation, and look-alike audience modeling. CRM software also contains valuable transactional data publishers can use to model users’ interests and preferred spending categories.

The best CRMs also help publishers increase audience engagement at every step of their journey through targeted promotions, personalized premium content, optimizing pricing, and retargeting checkout bounce.

Some of the best CRM software publishers use:

Smart paywall technology

Paywall software helps publishers gate premium content for subscribers. Apart from bringing direct subscription revenues, paywalled content also helps capture extra audience data. Publishers start by asking users to create a free account to access more content, which allows them to better identify users through an assigned ID, work to increase their engagement over time, and progressively capture more data through interactions.

User identification is critical, as many people will try to bypass a subscription paywall using simple methods like switching devices, browsers, or IP addresses. Publishers, in turn, need to balance using paywall content to acquire subscribers and ensuring that their properties generate good engagement.

Mittmedia, one of Sweden’s largest media groups, used analytics to determine that article pageviews peak approximately an hour after publishing. So, the team launched a time-based paywall that automatically kicks in after that and subsequently increased subscriber conversions by 20%.

Recommended digital paywall solutions:

Identity platforms

The last component of the first-party data tech stack is identity platforms, which help publishers identify more users via hashed email addresses to create more precise targeting profiles for advertisers.

Cookie alternatives, such as The Trade Desk’s Unified ID 2.0 solution and independent identity graphs operated by ID5 and LiveRamp, among others, help publishers cross-match hashed first-party data-based reader IDs with those brought in by advertisers to ensure proper attribution and measurement in programmatic advertising campaigns.

Sovrn Signal and ID5 demonstrated how efficient such an approach can be. By combining first-party data from Sovrn Data Collective and ID5 identity resolution service, publishers can share a bid request in real-time to any SSP with the following details:

- Viewability, attention, and CTR prediction scores

- Interest, intent, and demographic user segments

- Extra attributes like HEM, mobile ad IDs (MAIDs), offline data, 3PC

In a benchmark study, publishers using this approach saw a nearly two times greater lift in eCPMs than those who didn’t.

Disney, in turn, created an integration between its first-party-based Audience Graph and the operated ad marketplaces through the Unified ID 2.0 from The Trade Desk. The direct integration allows Disney to provide superior measurement and addressability across its linear, CTV, and digital properties, as part of the Disney Select offering.

Recommended ID providers:

2. Data collection and management

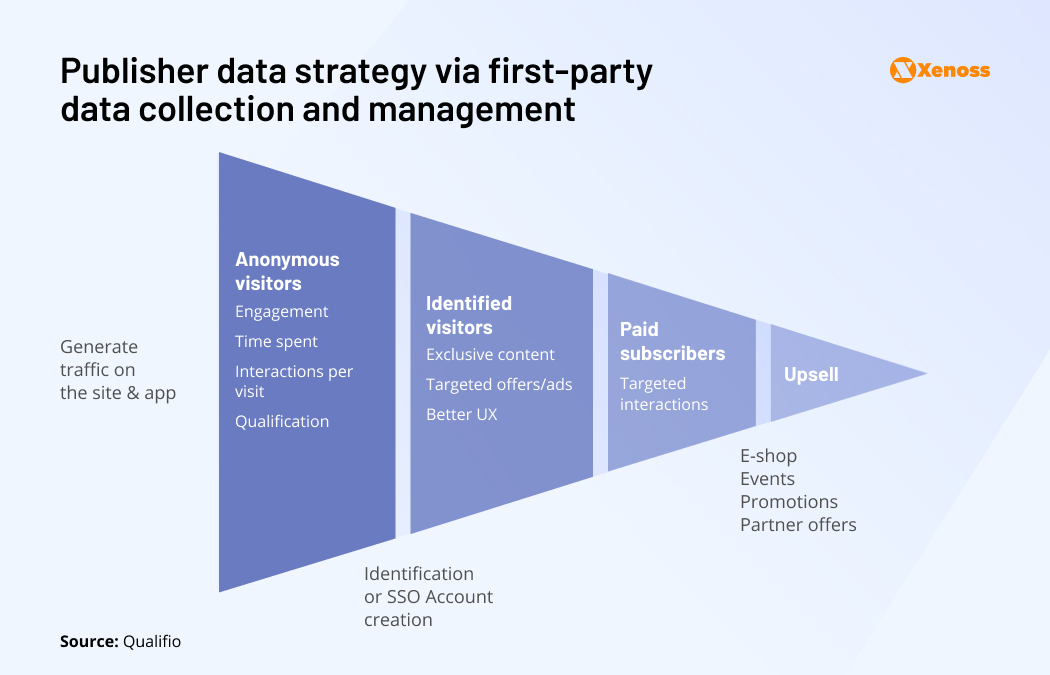

With third-party data, publishers could immediately acquire a wide range of customer identity data points. First-party data collection (and subsequent operationalization) requires a different, funnel-style approach.

Most publisher data will come from anonymous visitors—people who didn’t register an account and can’t be assigned a unique user ID. You aim to progressively convert anonymous visitors into identified ones and then paid subscribers by targeting them with the right offers in exchange for more personal information. Although not too keen, 76% of consumers agree that sharing personal data with companies is part of the modern economy.

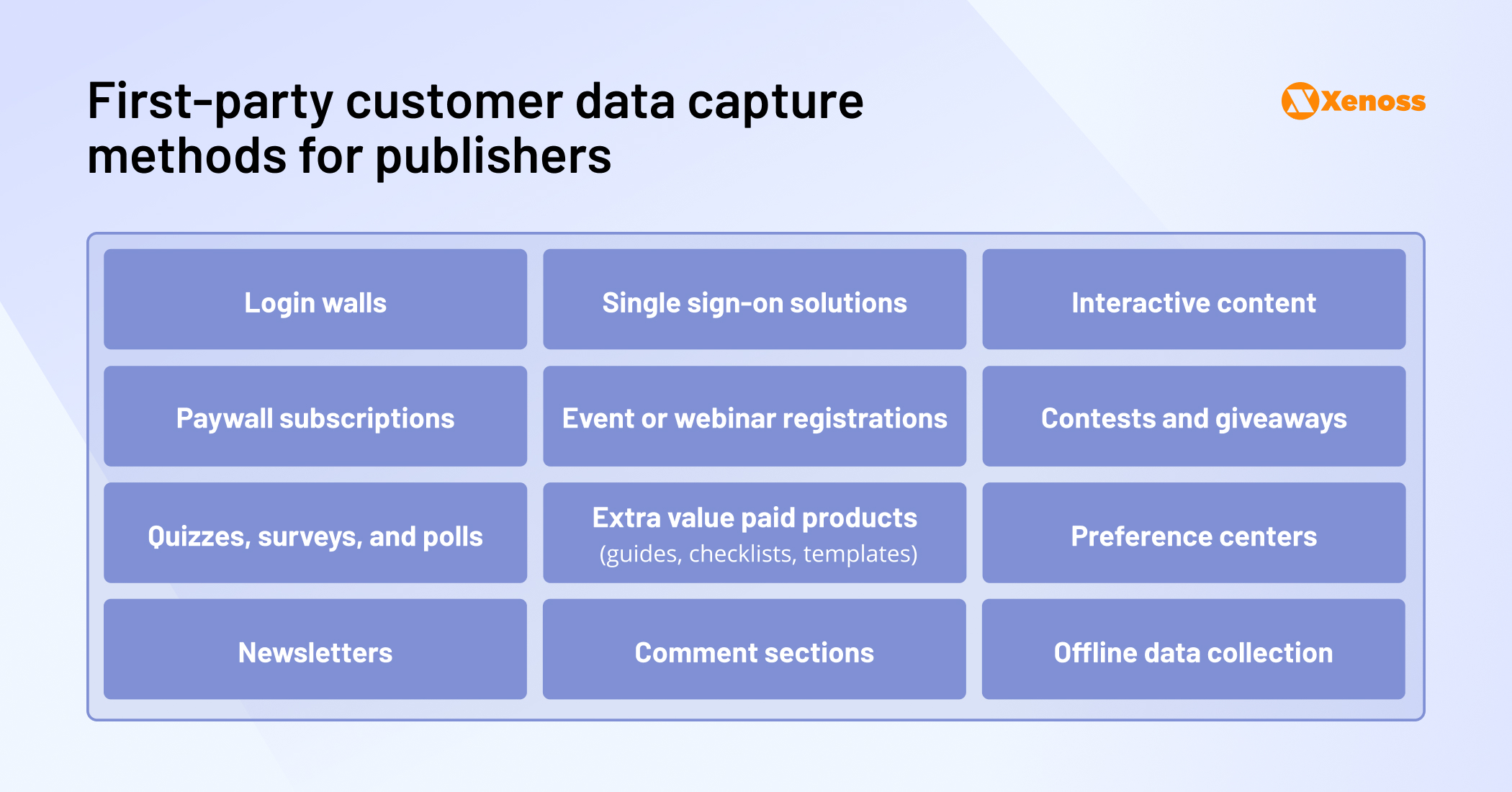

First-party customer data capture methods are diverse and tailored to fit the unique needs of publishers. Implementing these methods can significantly enhance data collection efforts:

- Login walls: Encourage users to sign in to access premium content, creating a direct line for data collection.

- Single sign-on solutions: Simplify the login process for users, increasing the likelihood of capturing first-party data.

- Interactive content: Use engaging formats to collect user data through their interactions.

- Paywall subscriptions: Monetize content while simultaneously collecting data on user preferences and behaviors.

- Event or webinar registrations: Gather detailed data through user sign-ups for online events.

- Contests and giveaways: Incentivize data sharing through opportunities to win prizes.

- Quizzes, surveys, and polls: Directly solicit user input to collect valuable first-party data.

- Extra value paid products (guides, checklists, templates): Offer premium content in exchange for user information.

- Preference centers: Allow users to customize their content preferences, providing insight into their interests.

- Newsletters: Collect data through subscription sign-ups and engagement tracking.

- Comment sections: Foster community interactions while capturing data from active users.

- Offline data collection: Utilize in-person events or other offline methods to gather data.

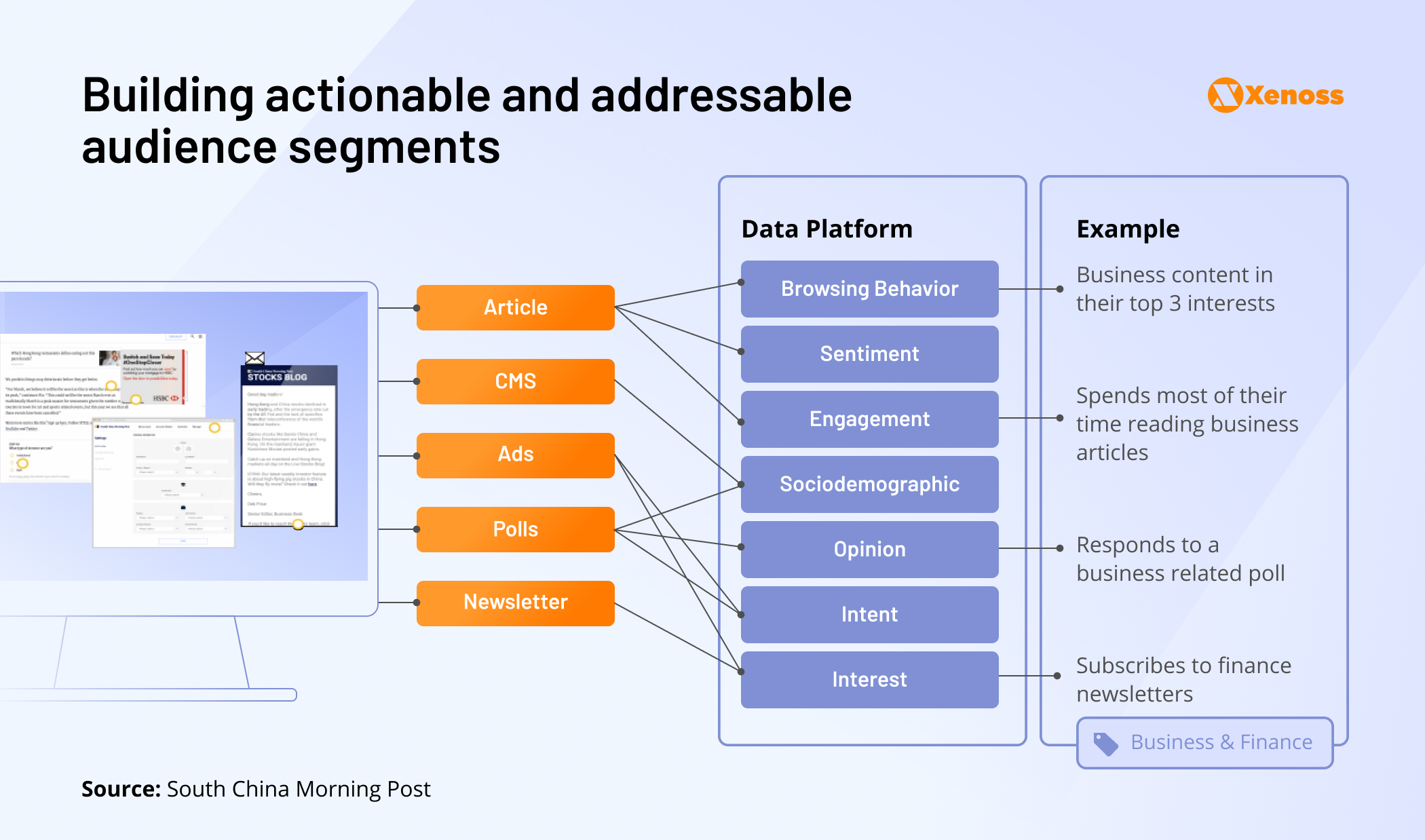

Top publishers combine the above data collection methods to increase engagement and convert casual browsers into paid subscribers. Take it from the South China Morning Post (SCMP). The publisher started working on a 1st party data collection in 2020 and created a proprietary customer insight and activation platform powered by data from 50 million global monthly users.

Collected data includes email, phone number, interests, content preferences, behaviors, sentiment, and intent. To expand customer profiles, SCMP regularly runs surveys, quizzes, and polls and offers interest-based newsletters.

SCMP then develops different content personas and uses the “K-means” clustering technique to organize these into cohorts. Thanks to streamlined data collection, SCMP developed 24 addressable segments advertisers can target.

When evaluating tech partnerships, publishers need to prioritize criteria that enhance their data capabilities and address the challenges of a privacy-first future. To gain insights into this critical aspect, we asked Emily Palmer, a Digital Media & AdTech Consultant, for her expert opinion:

Emily Palmer, Digital Media & AdTech Consultant, discusses how programmatic advertising propels the growth of addressable TV and its advantages for both traditional TV advertisers and new market entrants

Palmer’s approach underscores the importance of a thorough evaluation process. By focusing on both foundational and advanced criteria, publishers can ensure they choose partners who not only meet current needs but also provide room for growth and adaptation in a rapidly evolving digital landscape. This comprehensive vetting process is essential for building a robust first-party data strategy that can thrive in a privacy-first future.

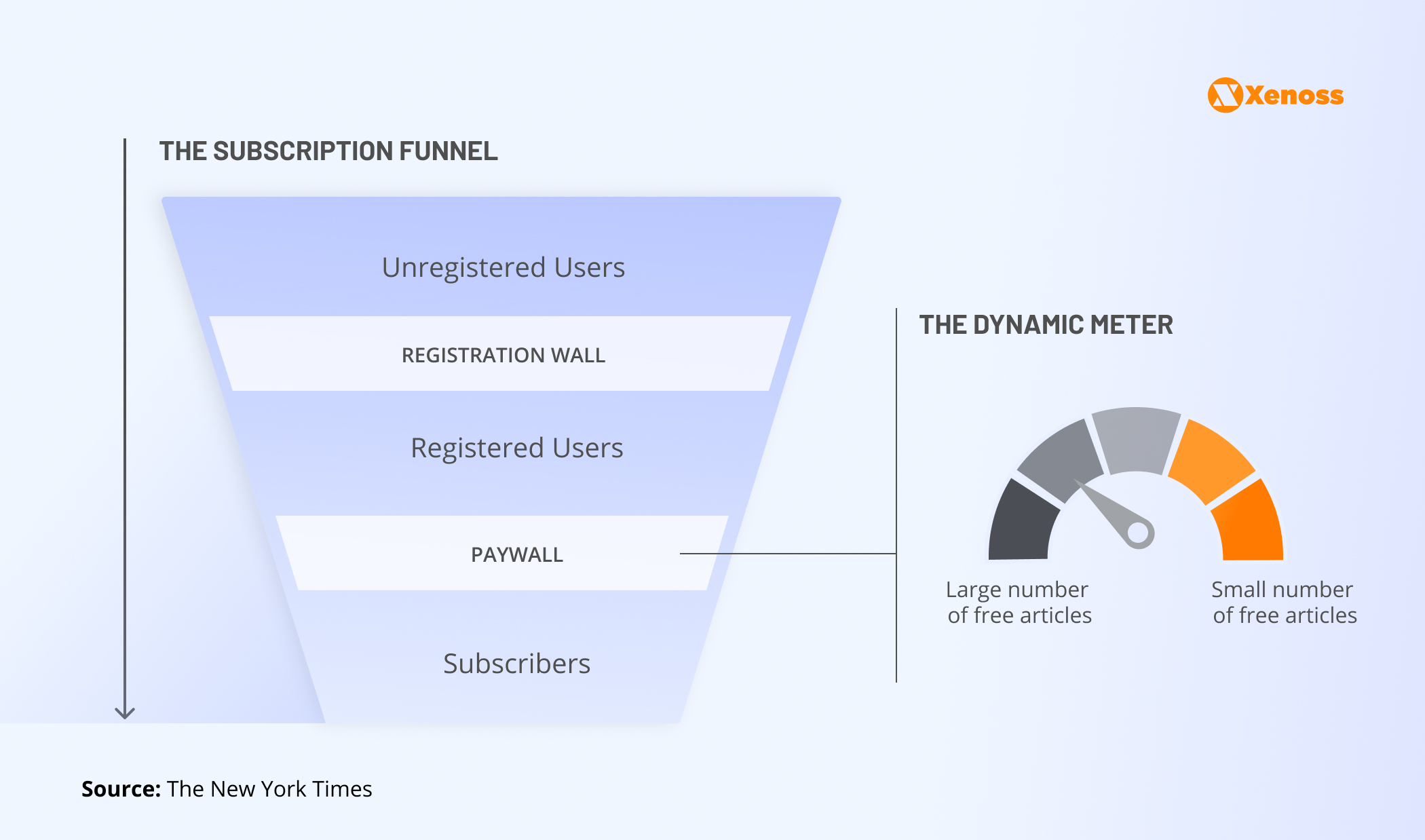

Some larger publishers, as they transform into data-driven digital companies, can afford to develop certain technologies in-house. Their ML-specialists can employ various techniques, such as decision trees or random forests, to predict audience behaviors. For example, they can identify the propensity for subscribing to a paid account or responding to a particular upsell offer. The New York Times developed an AI paywall solution for this goal. The prescriptive machine learning model assigns individualized paywall meter limits for each user (unknown, registered, and paid) to balance engagement with Times content and subscription conversion rates.

Talk to data science experts about which data types they’ll need to create rich customer personas and addressable advertising segments. Then figure out the best customer data collection by testing different options. Assign each registered user a unique identifier based on their email or phone number. Then, progressively collect extra insights while ensuring quality data management, focused on customer privacy, security, and personalized engagement.

3. Privacy and trust

Advertising and privacy have a complex relationship. Walled gardens have enabled an unparalleled degree of ad personalization, to the point where two-thirds of global consumers admit that ads across devices feel “creepy.”

Global privacy laws like GDPR and CCPA, among others, curbed the AdTech companies’ ability to collect, store, and use personally identifiable information (PII) for targeting or reselling to other parties.

Yet a 2022 study found that 88% of European publishers still pass data before receiving unser consent due to a misconfigured consent management platform (CMP). No wonder 85% of consumers wish there were more companies they could trust with their data.

Poor publishers’ privacy compliance is already a matter of regulatory scrutiny. The UK Information Commissioner’s Office imposed a fine of £1.48 million on the e-commerce company Easylife for profiling over 145,000 customers without their consent. The company inferred health conditions based on customers’ purchase histories. Criteo received a $44 million GDPR fine last year from a French regulator for failing to obtain user consent and inform them about how their data would be used.

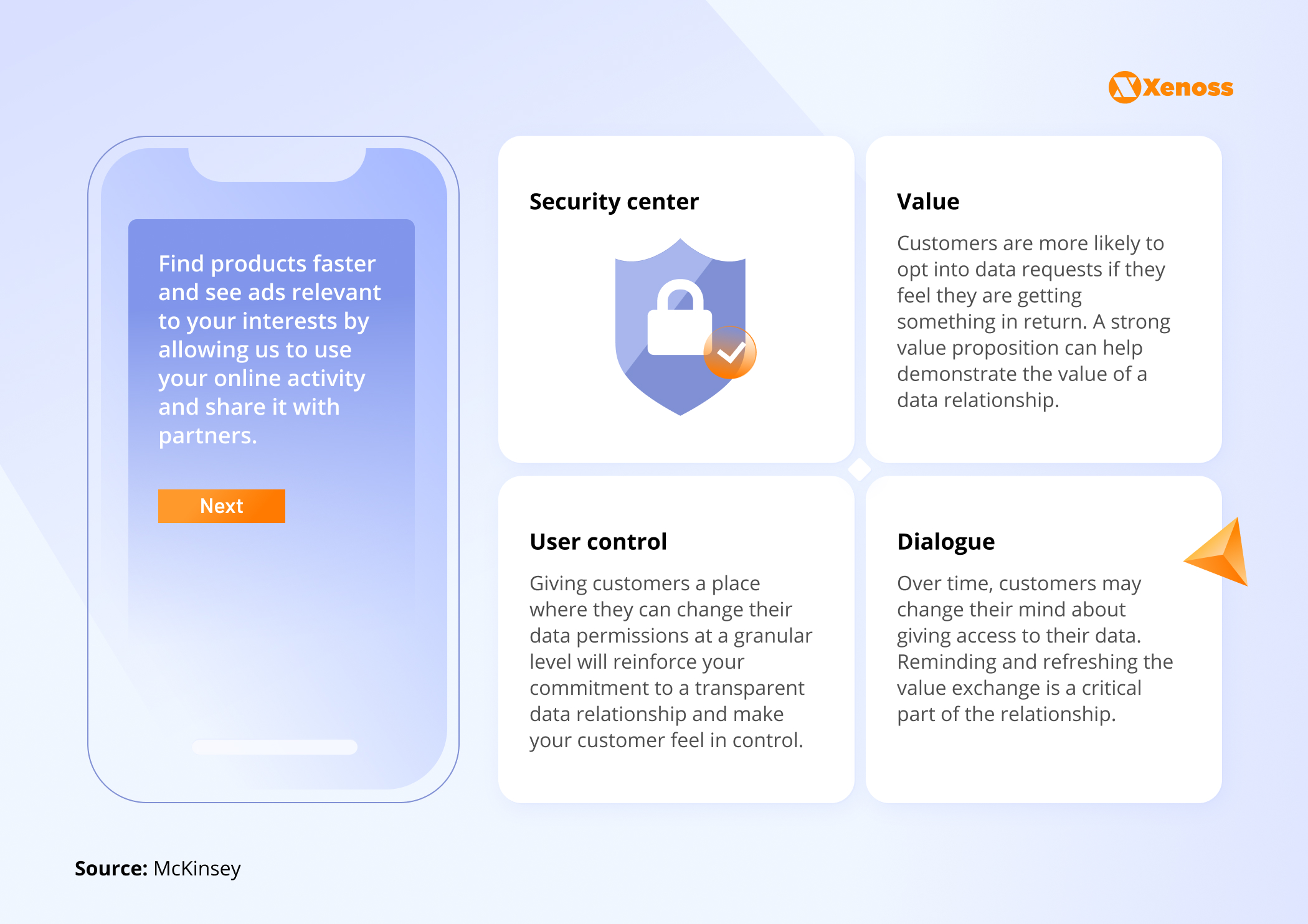

When collecting your first-party sets, implement appropriate consent mechanisms to avoid getting into hot waters.

A consent management platform (CMP) has three main features:

- Consent capture. The feature involves displaying notices or prompts that enable users to authorize data collection and processing of their personal data.

- Privacy settings. These user interfaces and controls allow users to indicate their consent preferences regarding different types of data collection practices.

- Consent sharing. This integration helps maintain privacy standards and compliance across different platforms and services. CPMs often generate and manage audit logs to provide evidence of compliance with regulatory requirements, such as the GDPR.

Given the critical role of CMPs in ensuring compliance and user trust, it is not surprising that leading customer data platforms (CDPs) are also emphasizing consent management. Gartner’s 2024 Magic Quadrant for CDPs highlights the growing emphasis on consent management, noting that leading platforms like Adobe Experience Platform and BlueConic are adding advanced consent management features to support compliance with regional privacy laws.

To ensure GDPR compliance, mobile game publisher Homa Games implemented Usercentrics enterprise CMP to manage consent and respect user privacy across its portfolio of 80 games. By organically embedding consent management into the game flow, Homa ensured high consent capture and user engagement rates. By implementing CMP, the publisher could also access new inventory in Europe and California, bringing a 10% increase in Ad LTV.

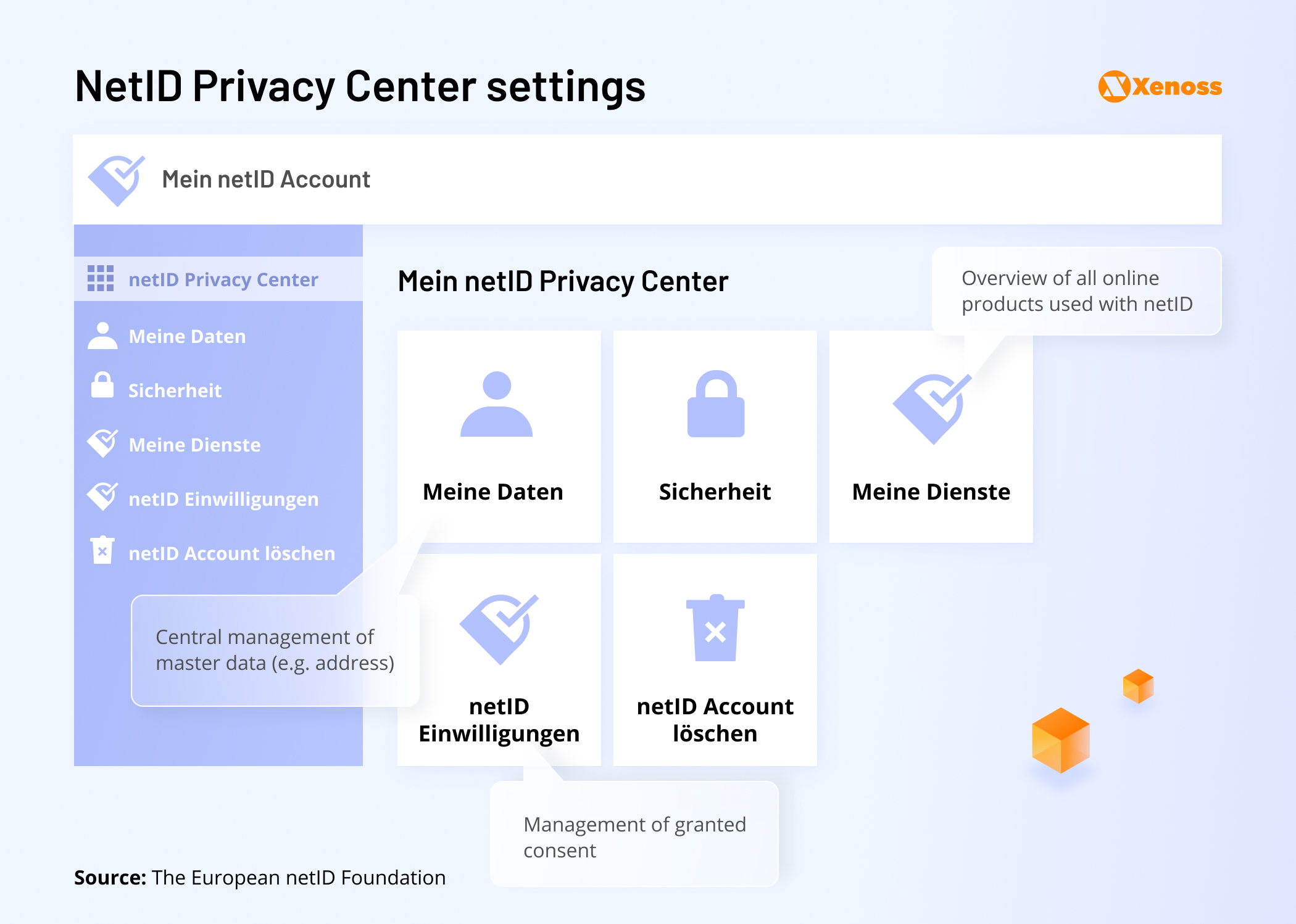

Similarly, the European Foundation has launched the netID product to address the need for streamlined and compliant data management. This single-sign-on system allows users to log in to different services with a unified credential and manage their data-sharing preferences from a Privacy Center. Effectively, netID transfers data-sharing controls to users, forcing businesses to work harder to earn users’ trust.

To ensure higher consent rates, optimize and personalize opt-in screens and prompts. Allow users to select what data they wish to share based on their current status in your system (e.g., free account, paid subscriber, etc.).

Remember: You can always collect extra first-party data by sharing more value with their user, e.g., by giving them access to new exclusive content or asking them to participate in a paid customer survey.

On the backend, you should also prevent sensitive customer data from leaking to ad networks or other unauthorized parties. Privacy-first publishers are doubling down on using cookie alternatives like unified ID solutions or data clean room technology to safely exchange user data with advertising partners.

TVNZ, the first media company in New Zealand, recently adopted AWS Clean Room to securely exchange anonymized audience viewership datasets with its biggest advertising partner, McDonald’s. With the help of the data clean room, the two sides can identify what types of programs McDonald’s customers watch, allowing TVNZ to share its advertising and media strategy without breaching user privacy.

4. Data utilization and monetization

With a proper strategy, first-party data can skyrocket media revenues. Penske Media Corporation (PMC) heavily invested in a first-party data strategy and can now apply precision audience targeting across 100% of their audience, including transient audiences. Reaching audiences without consent status and from a first-page view means they have reached ultra-high visibility and engagement.

After identifying all the data types it collects, PMC began building its data studio, ATLAS, outlining the most popular/requested segments in collaboration with Permutive. ATLAS contains contextual, behavioral, proprietary, and enriched first-party data. Based on this, PMC can suggest custom audience segments to advertisers based on their objectives and campaign types (awareness, consideration, and conversion).

With this setup, PMC can offer ad inventory to advertisers, even in cookieless environments, unlocking 40% of the web that’s usually invisible to advertisers. In 2022, PMC served 70% of ad impressions based on first-party data while also capturing a 5X increase in CTR across first-party-based advertising campaigns.

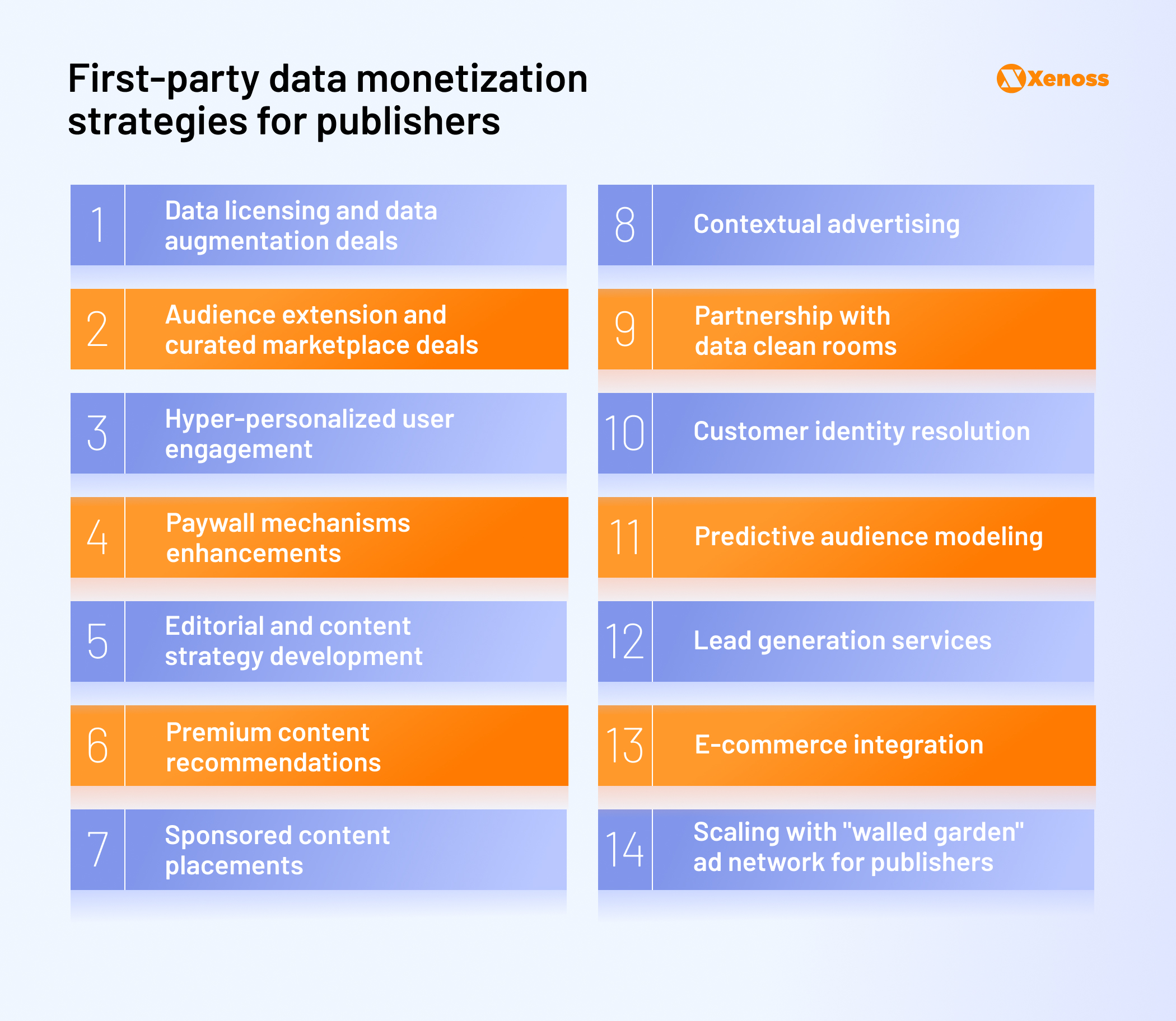

Programmatic advertising for publishers is just one first-party data monetization strategy. Other options include audience extension via data licensing, data pooling for cross-audience monetization jointly with other media companies, personalized premium content, and value-adds to grow paid subscription bases, and identity resolution.

As part of its publisher monetization strategy, the Wall Street Journal created Project Habit—a data analytics initiative to maximize the number of paid subscribers. The WSJ team evaluated how 100 user behavior patterns impact subscription and retention rates. To ensure high-paid user retention, the team optimizes the maximum number of active days within the last month. The company’s digital paywall is also based on the premise that generating high audience engagement is critical within the first 100 days to ensure low subscriber churn.

WSJ and other publishers often rely on premium content recommendations to maximize subscriber engagement and increase customer lifetime value (CLV).

One US daily newspaper was initially struggling to turn a profit from subscriptions. The publisher partnered with Mather—a provider of audience monetization technology. Matether’s Premium Content Engine gives publishers a predictive score for each published article to determine if it fits premium content well. The score is based on the publishers’ first-party audience data and Mather’s proprietary scoring techniques. After adopting the engine, the US newspaper increased premium conversion rates by 30% and obtained a 3-year LTV incremental lift from subscriber revenue of $2.7 million.

To achieve similar results, create data-backed audience personas to use as a reference in editorial planning. Identify the most loyal personas and model lookalike profiles to better understand what content and offers resonate most with them.

Hearst Taiwan, owner of several large media properties, including the Mandarin editions of ELLE International and Cosmopolitan, recently partnered with Apprier, an AI-powered full-funnel marketing platform, to unlock deeper customer insights and improve its premium content strategy. Using Appiers’ audience modeling technology, based on probabilistic matching, Hearst created 360-degree intelligent user profiles, now used to personalize on-property advertising and user remarketing. With the new system, Hearst saw a 5.5X increase in CTR for promo offers and better returns from remarketing campaigns for existing high-value subscribers.

Detailed audience personas are also essential for increasing advertising revenues in the privacy-first world.

News aggregator app SmartNews built out a custom AdTech stack for first-party data activation to create contextual audience segments for open programmatic and direct sales and inform its content recommendation strategy. Once the user installs the app, SmartNews generates a consent screen, prompting them to indicate their interests from the available list. The app also tracks user location unless they opt out.

The app tracks which articles users have read and adjusts recommendations accordingly. SmartNews trained its recommendation algorithm on first-party data and can now create over 3,000 interest-based feeds for users, resulting in high engagement. The algorithm also determines which ads to serve to different users. SmartNews packages content into contextual buckets using the IAB’s Seller Defined Audiences content taxonomy and its proprietary tools. Then, these are offered to advertisers via open and direct deals.

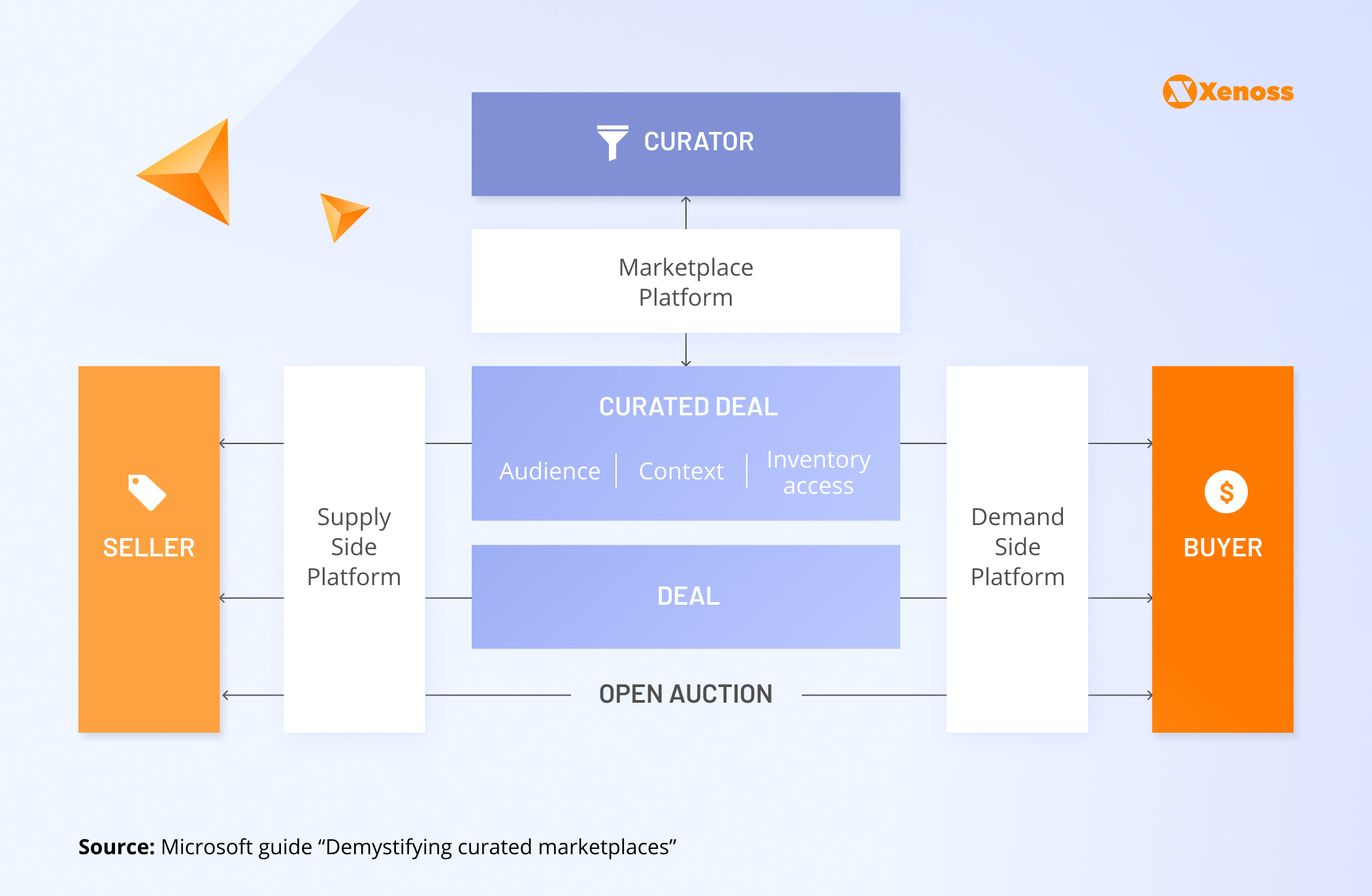

Curated marketplaces are another emerging avenue for monetizing first-party data. Effectively, a curated marketplace is a private supply-side platform (SSP) embedded into a traditional ad exchange. Rather than allowing all bidders to access curated deals, the curator only displays part of its marketplace offers to selected brands. For example, a beverage brand may be offered a CTV ad placement on a cooking program watched by British middle-aged women.

From advertisers’ POV, a curated deal looks like any other one in their demand-side platform (DSP). However, they purchase the inventory directly from the publisher without fee-hungry intermediaries.

For publishers, curated marketplaces offer a better way to sell premium inventory and access to curated audience segments, resulting in higher revenues. Apart from merely offering the inventory, publishers can also securely share audience and context data without risking data spills to ad exchanges. Media owners can bundle different data points and inventory to provide advertisers with bespoke offers.

A recent Microsoft survey found that over 60% of publishers plan to use first-party data for curated marketplaces. Among them, 76% intend to leverage context in curated deals, and 41% also want to use industry IDs to offer cross-audience monetization to advertisers.

There’s value in curation across publishers not just in a one to one fashion but also a one to many way, which we would call an auction package. This is what we’ve been doing for several years now: we’re taking a single supplier’s total system traffic and shaping that down to quality sellers.

Ryan Eusanio, managing director of digital activation at Omnicom Media Group

Publishers can also monetize first-party data via data clean rooms (as many already do). Or pitch data augmentation deals to advertisers, agencies, or other publishers.

To determine which monetization strategy works best for you, consider your audience size, technological capabilities, and relationship with advertisers.

5. Content strategy and organizational transformation

Effective data monetization is level-set with the right content strategy. Publishers must provide users with relevant, high-quality, personalized content to nurture relationships and obtain extra first-party data.

Audience data also informs better premium content strategies to maximize registrations and subscriptions and ensure optimal brand content marketing placements, contextual advertising inserts, and wider advertising efforts.

The richer your relationship [with audiences], the better your insights and your branded content business becomes. The more you engage your readers so that they renew their subscriptions, the more inventory they’re creating, the richer that inventory is, and the better your pricing leverage in an advertising market, which is otherwise trending downwards in terms of price. It’s a symbiotic relationship, not an ‘either-or.

John Slade, chief commercial officer of the Financial Times

The Financial Times (FT) acquired over 1 million subscribers, with 48% of its total revenue coming from digital subscriptions. To shape its strategy, FT began analyzing first-party data and creating models for optimizing customer acquisition and retention. Thanks to analytics, they found that website usage directly correlated with customer value and is a great predictor of subscription renewal.

FT prioritizes customer engagement through RFV (Recency, Frequency, Volume) scores, correlating with key metrics like subscriber renewal and satisfaction. They transitioned from optimizing for page views to Quality Reads to better assess article consumption, leading to informed editorial strategy decisions and higher conversion rates.

Rely on subscription and registration data KPIs to shape a better content strategy. Use analytics tools for publishers like Comscore and Quantcast Measure to better understand what content formats, themes, and subjects drive the best results. Already, 45% of publishers use first-party and third-party data collection methods to build applications for data-driven personalization.

Democratize access to audience and engagement data by equipping employees at all levels—from advertising to editorial staff and customer support—with analytics tools. This will enable them to better shape customer experiences and refine both editorial and branded content strategies.

Experiment with advanced personalization techniques to further grow your user base. Newsletters have proven effective in driving first-party data acquisition, content engagement, and subscriptions.

Funke Mediengruppe, one of the largest German media companies, grew its subscriber list from 56,000 to 250,000 in one year and now enjoys a 5% growth of paid subscribers. The team achieved such great results by experimenting with different newsletter formats. Interactive elements like tests, surveys, ratings, and image rollovers helped ensure engagement while also serving as extra measurement tools for audience engagement (and first-party data collection).

The Telegraph went further and used AI to personalize content in its Headlines newsletter based on the users’ interests and past interactions. The newsletter converts registered users to subscribers at twice the rate of its other newsletters.

Top newsrooms are moving to integrated operations to maximize the results of publisher marketing programs.

Traditionally, editorial, subscription, and advertising units operated in silos, often not aware of each other’s objectives and capabilities. Consolidating these work streams into an integrated one helps ensure better business outcomes. Jointly, these teams can create better data sets and new customer offerings aligned with the wider KPIs of higher user engagement, retention, and accelerated first-party data connection.

The Philadelphia Inquirer launched new digital ad-content hubs built around first-party audience data thanks to strategic collaboration across editorial and revenue teams. For the Fall 2021 Education Guide campaign, advertisers received an article with guaranteed page views and traffic drivers, a paid social post, an open house calendar, and an interactive map from The Inquirer’s owned and operated site. Thanks to deep audience knowledge and effective editorial planning, the publisher could guarantee page views and engagement and exceed all KPIs for the local sponsors.

Conclusion

To thrive in a post-cookie era, publishers must establish a new technology-value chain that supplies advertisers with deterministic, reliable audience data and abilities to precisely measure campaigns’ impacts.

That’s no small task, given the degree of technical transformations required. However, it’s also the only certain path to long-term, sustainable revenue growth.

If you’re a media owner looking to maximize the value of your audience data, Xenoss will be delighted to help. Contact our team to get personalized advice for your first-party data strategy.