The traditional drug R&D pipeline is riddled with challenges.

On average, bringing a new drug to market costs $2.5 billion, and many candidates never make it through pre-clinical and clinical testing.

Out of hundreds of thousands of molecules screened, only 35% show any therapeutic potential. Of those, just 9–14% survive Phase I clinical trials.

The multi-step process of demonstrating the efficacy of a newly discovered drug, its ability to compete with other formulations on the market, and the lack of side effects that undo the therapeutic benefit explains why the R&D process takes anywhere from twelve to fifteen years.

In such a challenging market, pharmaceutical companies are always looking for ways to cut costs and time from drug discovery to commercialization. Can AI models, now maturing at mind-boggling speeds, be the solution to the problem?

Seeing AlphaFold successfully predict protein structures and win the 2024 Nobel Prize in Chemistry sparked interest and enthusiasm in finding other ways to leverage machine learning in biotechnologies.

In the last three years, there’s been a proliferation of AI startups that help streamline every step of drug development, from discovery and pre-clinical research to clinical trials and final regulatory checks.

Our series of posts on AI use cases in drug development will examine the current state of AI adoption in drug R&D across three levels:

- Drug discovery

- Pre-clinical studies

- Clinical research

This is Part 1 of the series, focusing on machine learning applications in drug discovery.

A significant portion of reflections shared in the article was inspired by the “AI in Pharma: The New Playbook for Drug Research & Development” webinar hosted by Ellen Knapp, Senior Intelligence Analyst in Healthcare & Life Sciences at CB Insights.

The rising momentum of AI in drug development

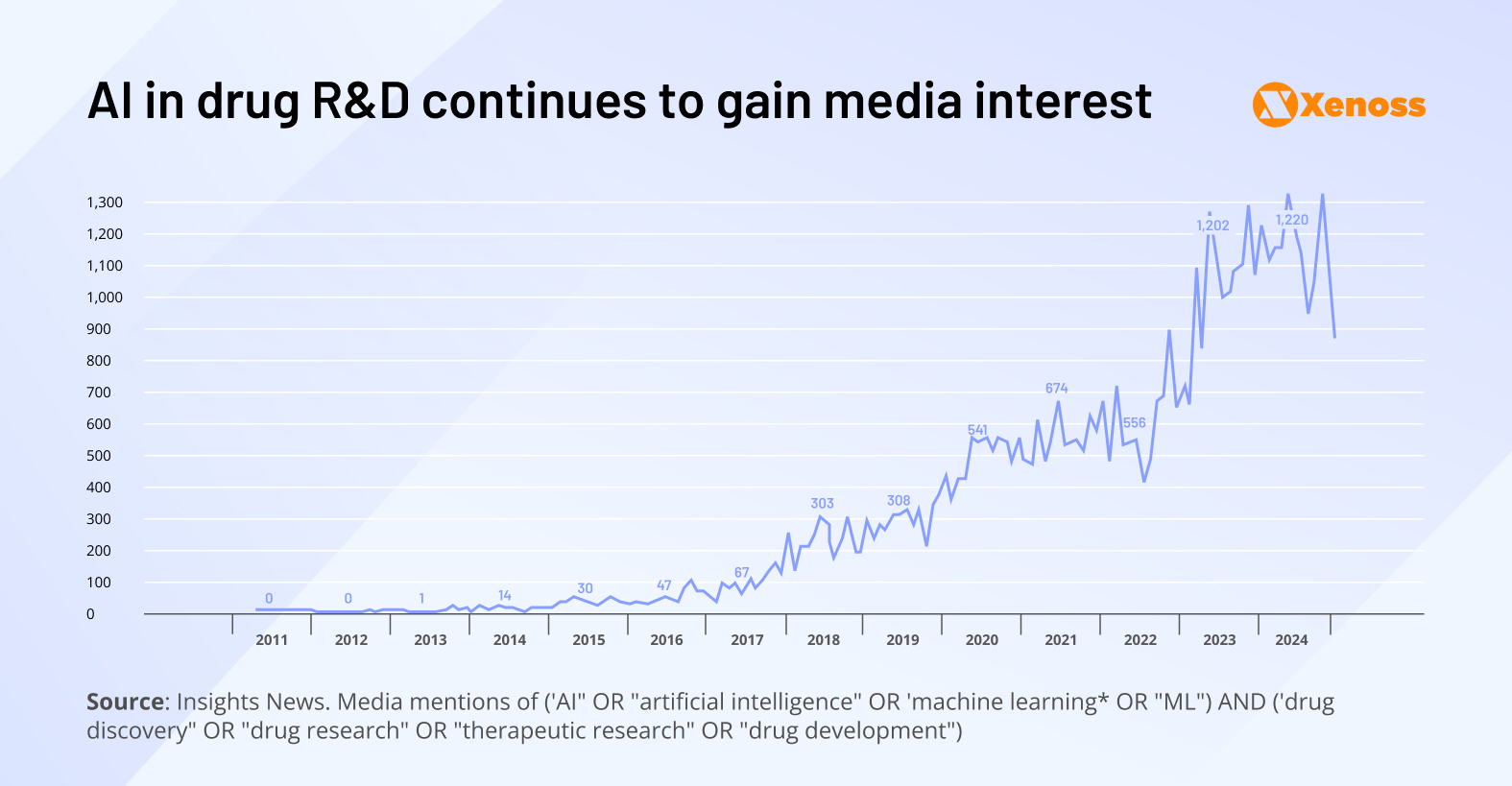

The interest in AI-powered drug development has exploded in recent years.

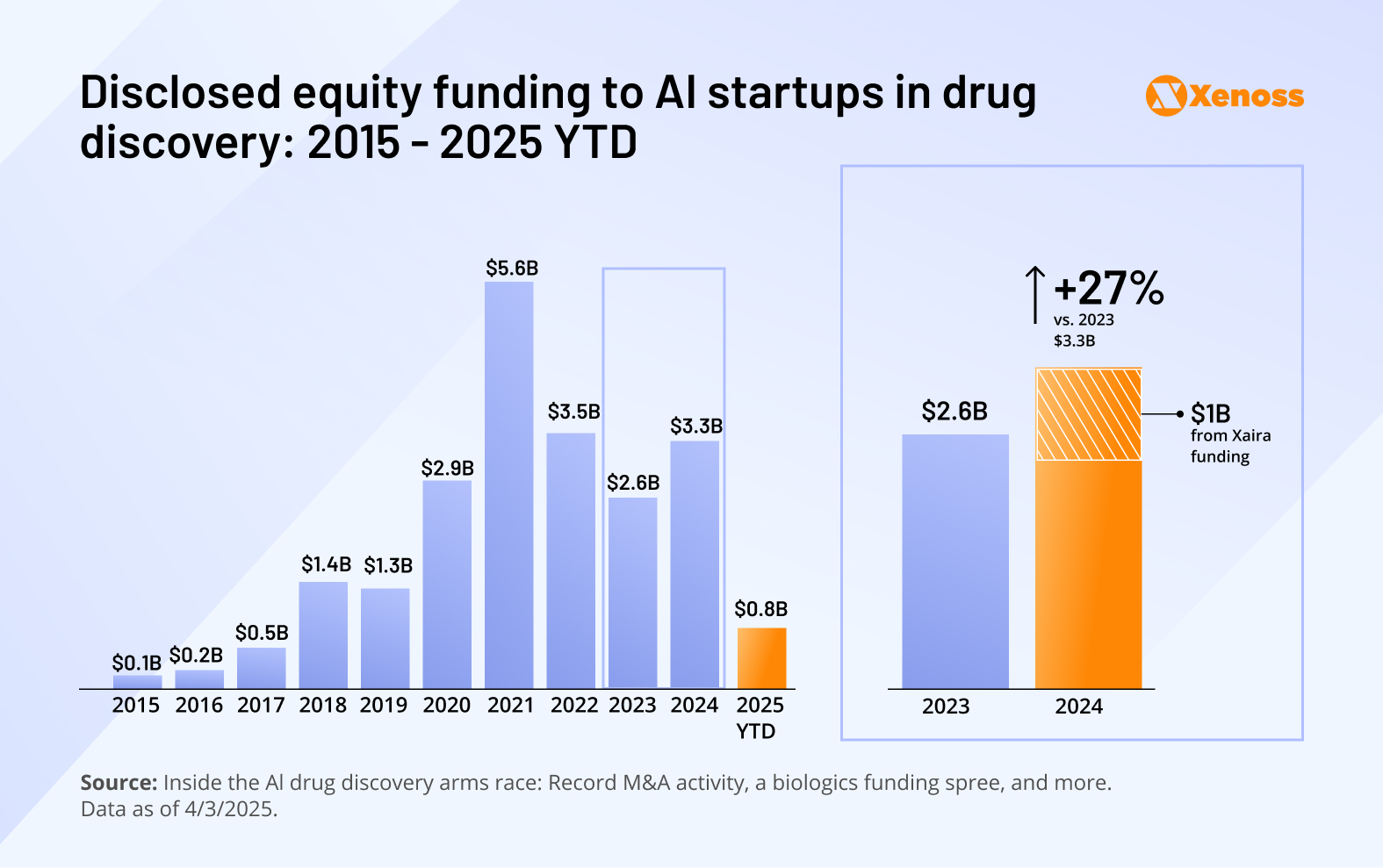

The graph highlights that as recently as 2015, there was barely any enthusiasm about AI-enabled drug R&D.

In 2022, after ChatGPT showed the far-reaching potential of machine learning models, interest took off.

In 2024, AI and R&D were mentioned side-by-side 1200 times per month. Clinicians are becoming more receptive to AI-assisted therapeutics, and investors are increasingly channeling capital into biotech startups that embed machine learning into their development pipelines.

Stages of drug development where AI comes in

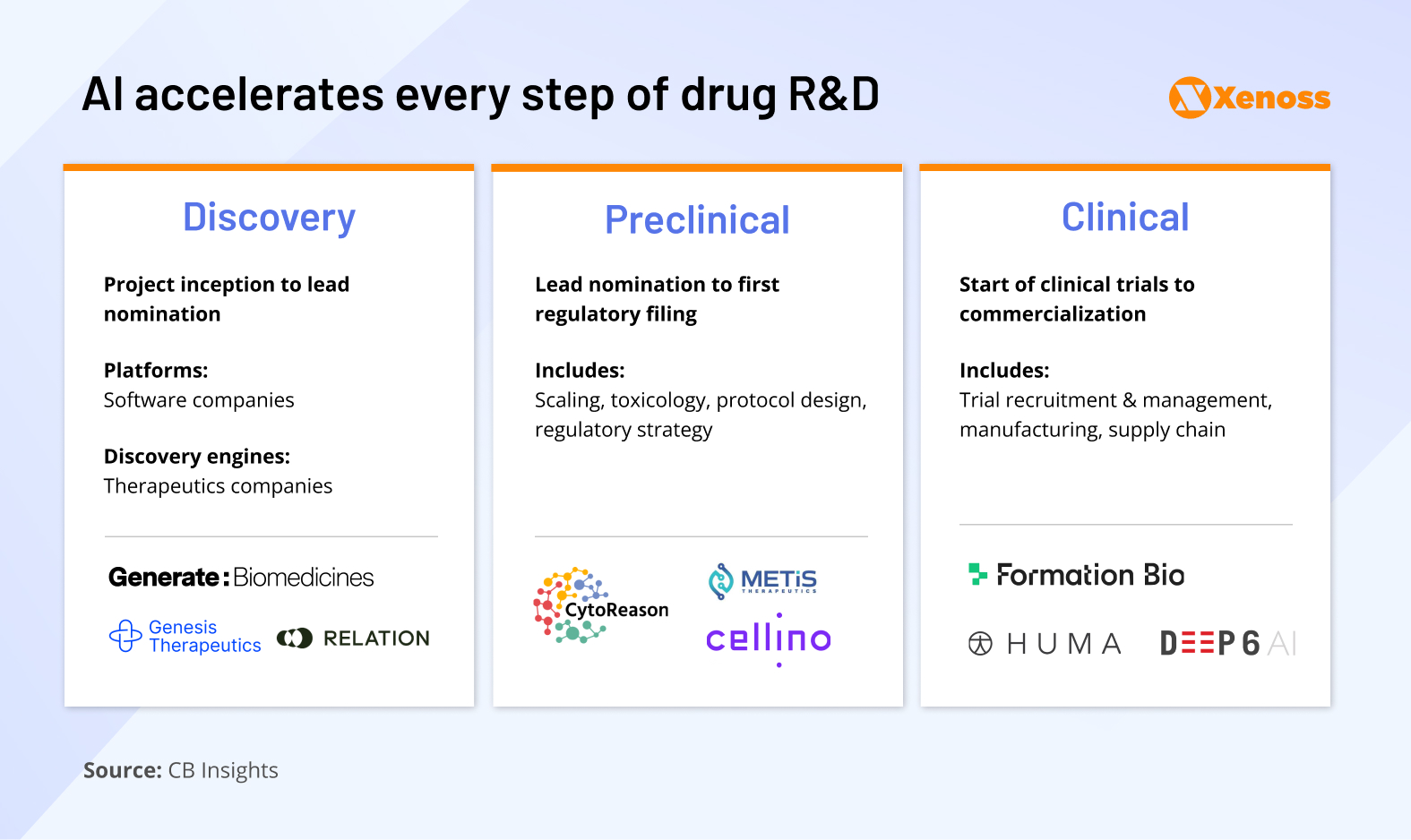

Drug development typically unfolds across three key stages, each with its complexity and opportunities for AI intervention.

1. Discovery. Identification of targets (proteins, metabolites, RNA/DNA sequences, or microorganisms) and compounds that interact with these molecules. AI has the potential to improve drug discovery through faster candidate improved understanding of underresearched conditions.

AI assists drug discovery teams by:

- Mining large datasets to uncover underexplored conditions or pathways.

- Generating new candidate molecules using de novo molecular design.

- Prioritizing hits and leads with favorable properties (binding, toxicity, manufacturability).

AI startups in the drug discovery space: Generate: Biomedicines, Relation, Genesis Therapeutics

2. Pre-clinical research. Animal (in vivo) and test tube (in vitro) testing of candidate models, determining their pharmacokinetic and pharmacodynamic profiles: bioavailability, solubility, toxicity, therapeutic index, etc.

AI can ramp up the speed of pre-clinical assessment by

- Predicting pharmacokinetic (PK) and pharmacodynamic (PD) profiles.

- Assessing bioavailability, solubility, and toxicity through in silico models.

- Streamlining protocol design and regulatory strategy.

Companies introducing AI to pre-clinical research: Metis Therapeutics, Cellino, CytoReason

3. Clinical research. The drug is tested on humans in a four-phased research pipeline. Each stage of clinical development can be a target for AI enablement, from designing better drug combinations to predicting the outcome of an RCT by combining patient records and real-world data.

Machine learning is driving progress in clinical research by:

- Optimizing patient recruitment and site selection.

- Designing better drug combinations or personalized trial arms.

- Predicting outcomes by integrating clinical trial data with real-world evidence.

Biotech innovators in clinical research: FormationBio, HUMA, Deep6 AI

After a candidate drug passes all clinical trials, it is reviewed by the FDA and approved for commercial distribution.

While the process may appear linear, real-world drug development is often iterative, with setbacks, revisits to earlier stages, and parallel workflows. AI tools are especially valuable in navigating this complexity, helping companies make faster, data-informed decisions throughout the pipeline.

Where traditional drug discovery falls short

Although molecular biology advances helped pharma companies better identify drug targets and design molecules that bind to them, there hasn’t been much progress in scaling the beneficial effects of these drug-like molecules across larger populations.

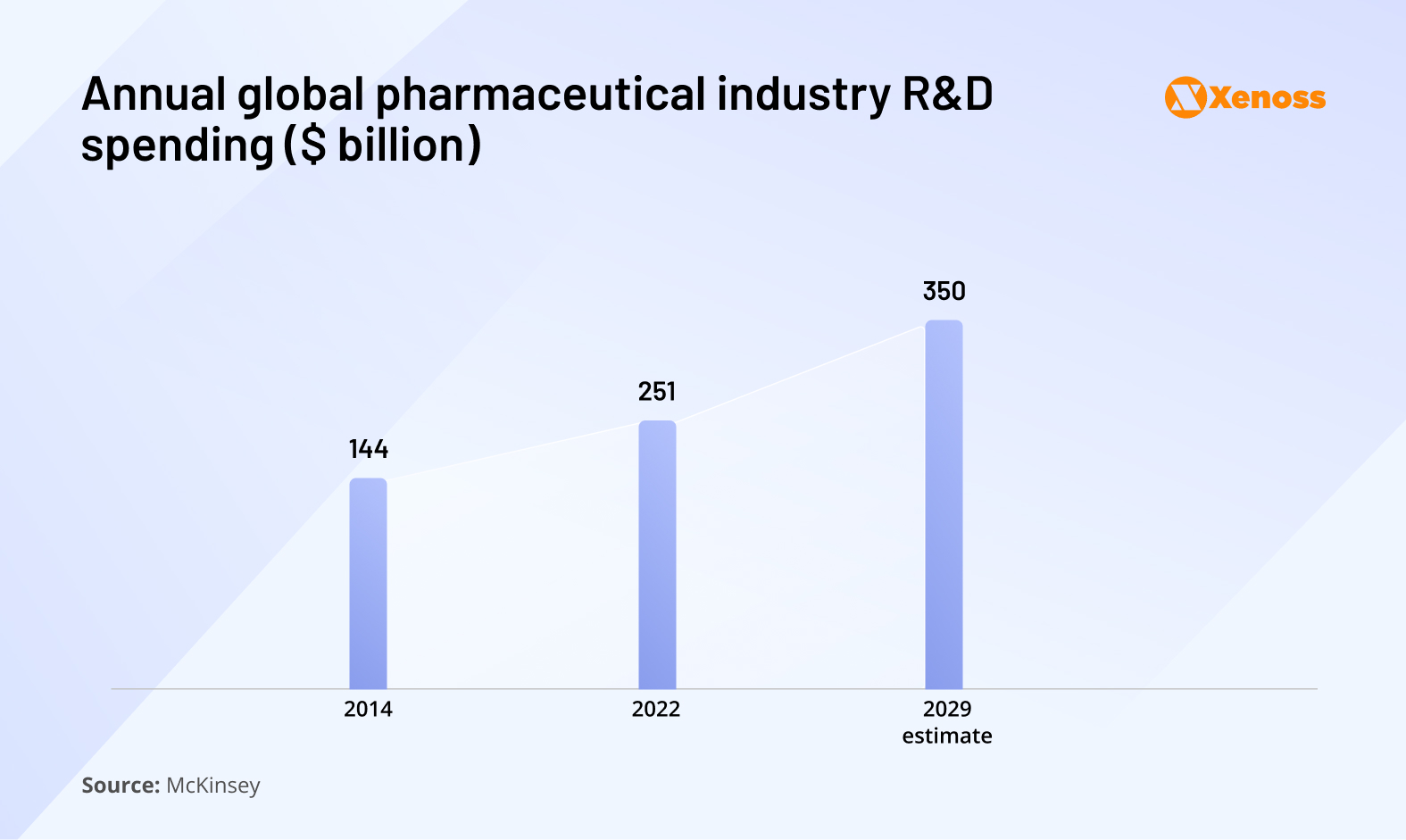

In the last five years, drug discovery costs have been rising steadily

McKinsey reports that, in 2014, the pharma industry invested $144 billion in drug development. By 2022, R&D expenses shot up to $251 billion. By 2029, pharma companies are expected to funnel up to $350 billion in developing new therapeutics.

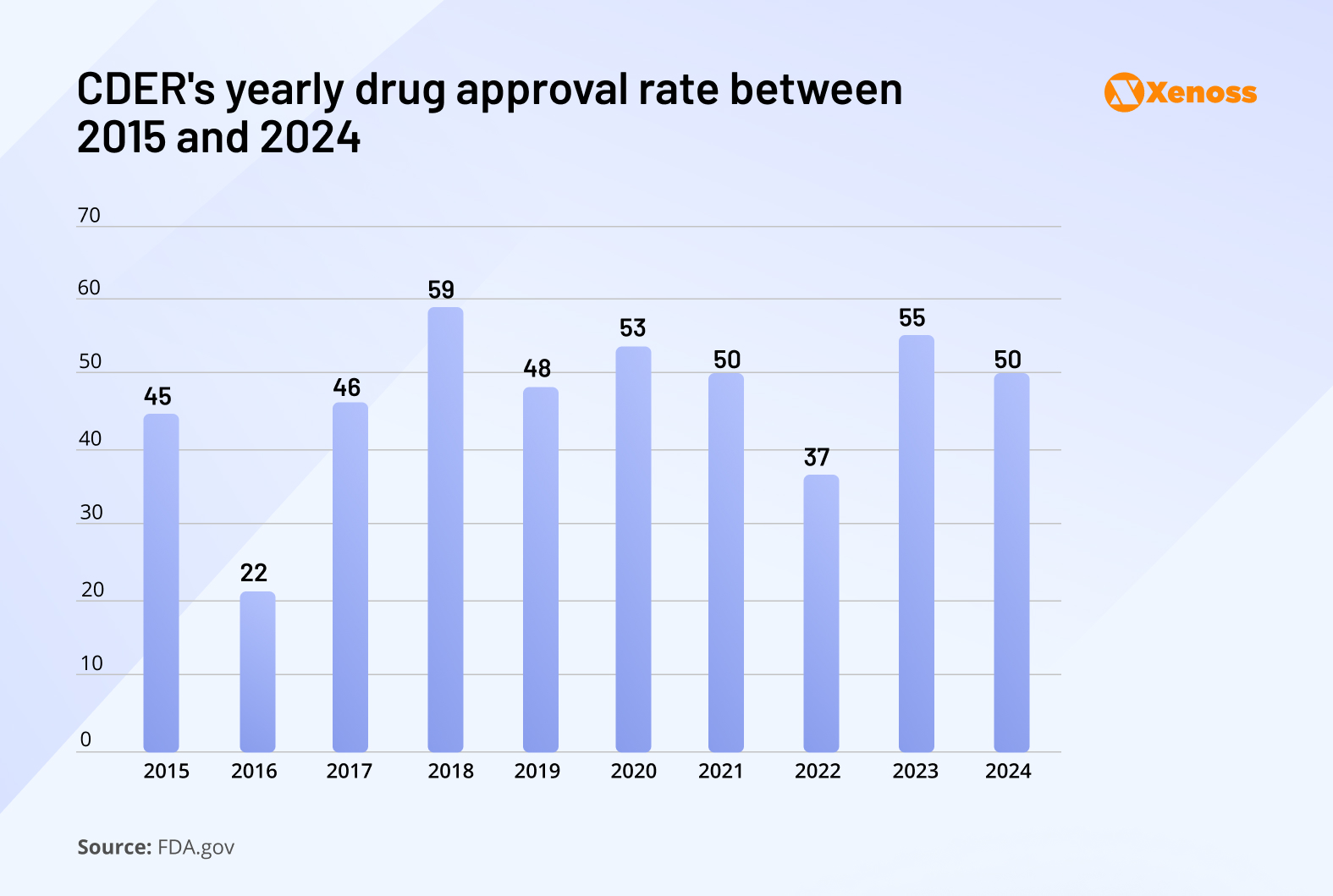

The rising R&D expenditure has not yielded higher regulatory success.

FDA reports tracking the rate of drug approvals by the Center for Drug Evaluation and Research show that, after peaking in 2018 at fifty-nine new therapeutics, the rate of drug approvals have been fluctuating.

Multiple research groups studied the decline of R&D productivity but failed to trace it back to a single root cause.

The limitations of material chemistry are a considerable barrier for R&D progress. As most structurally unsophisticated drugs have been discovered in the last 70 years, chemists are called upon to design more complex candidates.

The synthesis and purification of increasingly robust molecules are expensive and time-consuming, hence, drug design teams only yield a limited amount of new compounds per year.

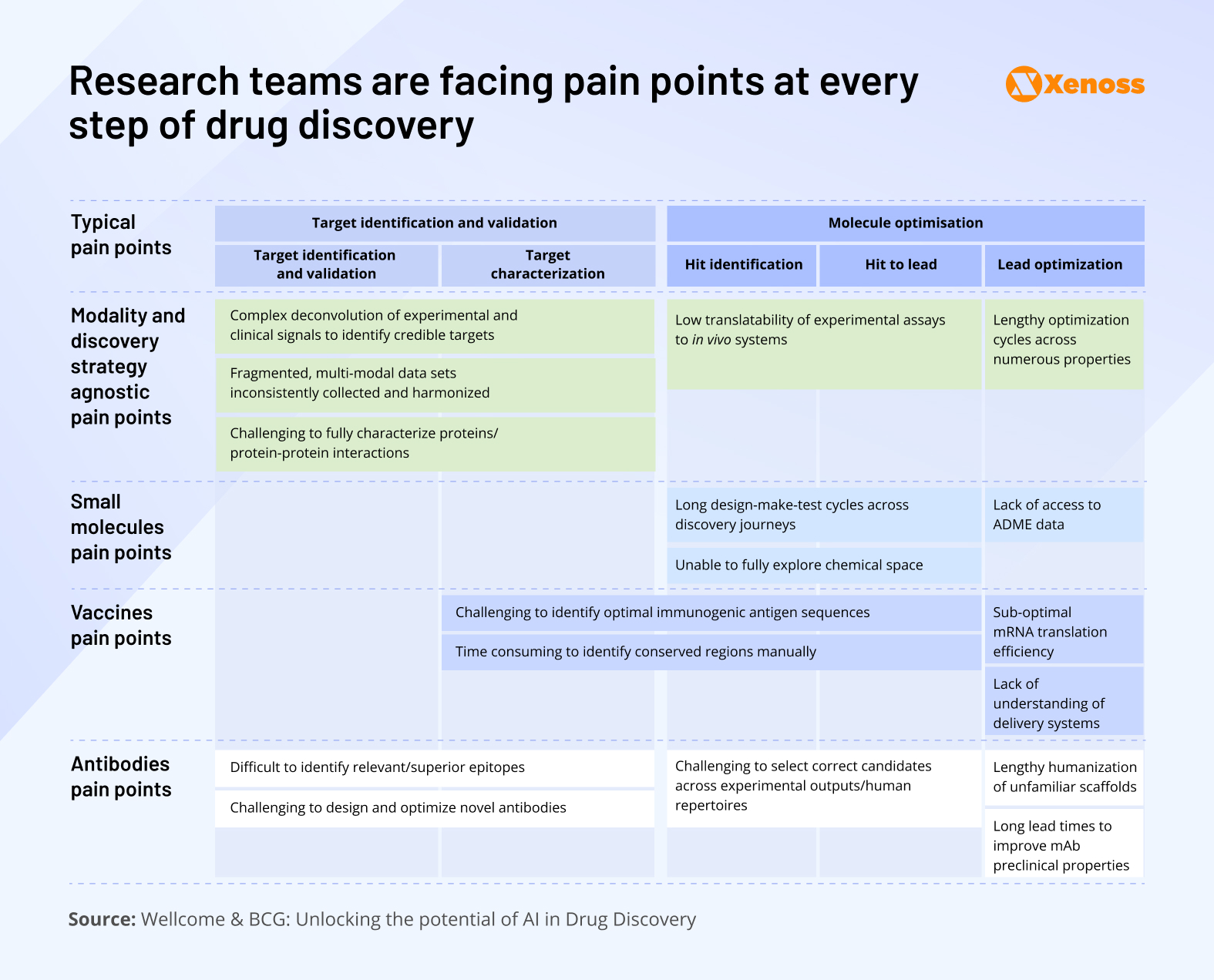

Depending on the drug in the works, research teams may face specific challenges. For instance, the complexity of experiments that would help identify optimal antigenic sequences and ensure high binding affinities slows down progress in vaccine design.

As the visual shows, challenges span across the pipeline, from long design-make-test cycles in small molecules to suboptimal mRNA translation in vaccines and difficulties in antibody optimization.

Additionally, pharma companies have to find a balance between capitalizing on approved portfolios and identifying novel hits.

Both institutional and venture investors appear to be skeptical about diversified research portfolios, instead backing companies with a handful of battle-tested therapeutics.

In this landscape, R&D is on the verge of becoming an afterthought, and productivity plummets.

How machine learning transforms drug discovery

AI offers a new source of hope for solving the industry’s persistent challenges. At the moment, tech companies go about doing that through two major solution categories: Discovery engines and software platforms.

AI-enabled discovery engines

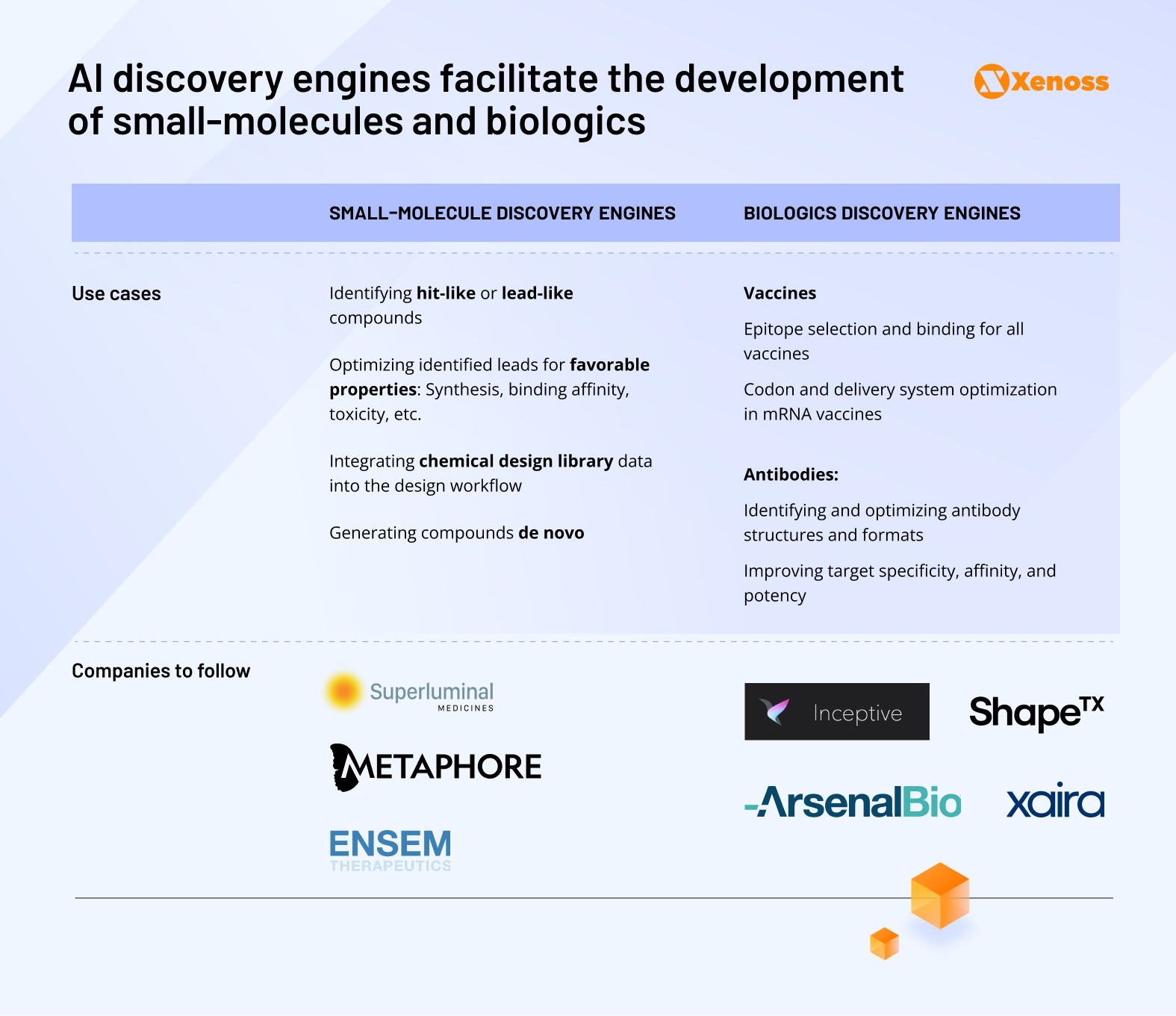

AI-enabled drug discovery engines are platforms that integrate lab data, traditional automated testing, and machine learning into a single workflow. Their primary focus is on discovering new candidate molecules.

AI-enabled discovery engines are a new frontier in identifying both candidate small molecules (molecules that act on the target following consistent chemical reactions, such as aspirin) and biological drugs (substances of formerly animal origin now derived through recombinant genetics, such as antibodies and vaccines).

AI software platforms accelerating discovery

Unlike full-stack discovery engines, point-based platforms enhance specific tasks within the discovery process. For instance, advances in computer vision have led to the surge of platforms that aid in image analysis, which can better analyze cell-and-tissue responses for in vitro assay screenings.

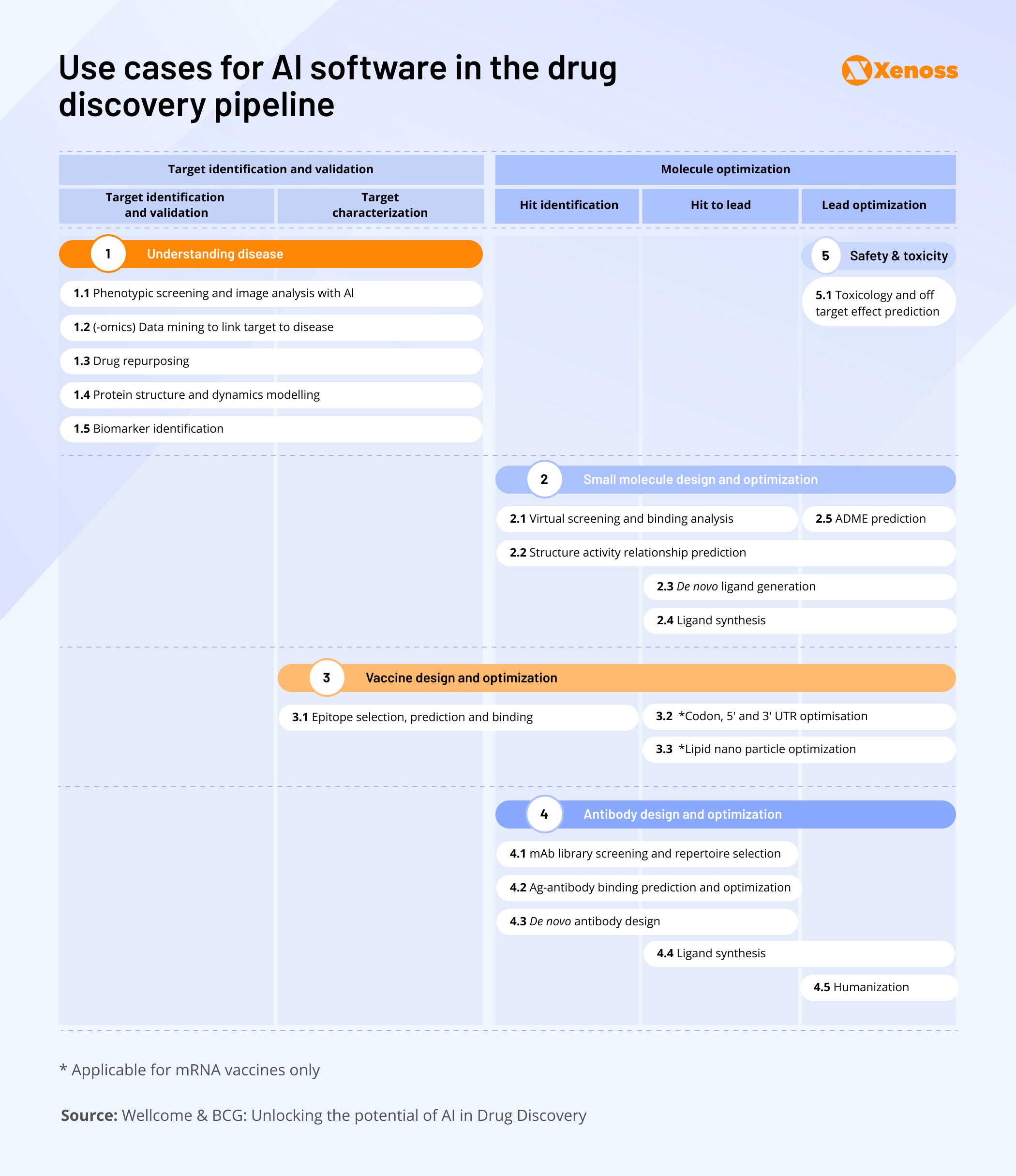

Currently, hundreds of AI-enabled platforms support the key steps of the discovery pipeline. Below is but a shortlist of rapidly-growing market players in some areas of drug discovery.

- Target identification platforms: BenchSci, Insitro, Owkin, Euretos, Valo Health, Healx

- Protein engineering platforms: Inceptive, Profluent, DeepCure, Arzeda

- AI molecular design platforms: Atomwise, Iktos, Deep Genomics

- Tools for cell and tissue analysis: Cellarity, Cytel, Deepcell, Phenomic AI

These tools help speed up high-throughput screening, improve model precision, and enable scientists to explore chemical spaces that were previously inaccessible.

The image below summarizes granular use cases for AI software in drug discovery, from image analysis to biological property prediction.

Venture capital investors are open to AI-driven drug discovery

AI-driven drug discovery has become one of the hottest sectors in biotech venture capital, though the scale of funding varies sharply depending on the company’s business model.

Discovery engines, which aim to deliver full therapeutic candidates into clinical trials, require massive investment due to the costs of preclinical and clinical development. In contrast, companies building point-solution AI software, such as molecular design platforms or target identification tools, require far less capital, as they provide modular tools rather than full end-to-end drug development.

This difference shapes market entry strategies: first-time biotech startups often find it easier to break into the market with software platforms rather than full-stack discovery engines.

From 2020 to 2021, funding spiked in step with the global VC market pattern, before tapering off in 2023. But 2024 marked a turning point—investment in AI drug discovery grew 27%, reaching $3.3 billion.

Much of that momentum came from a single player Xaira Therapeutics. This drug-discovery platform combines ML-powered search, multimodal data generation and protein-design technology to interact with proteins that were thought impossible to target.

Early 2025 data suggests that VC funding in the discovery space is on track to match 2024’s strong performance. Mirroring the previous year’s pattern, Q1’s funding was defined by large investments, with Isomorphic Labs raising $600 million.

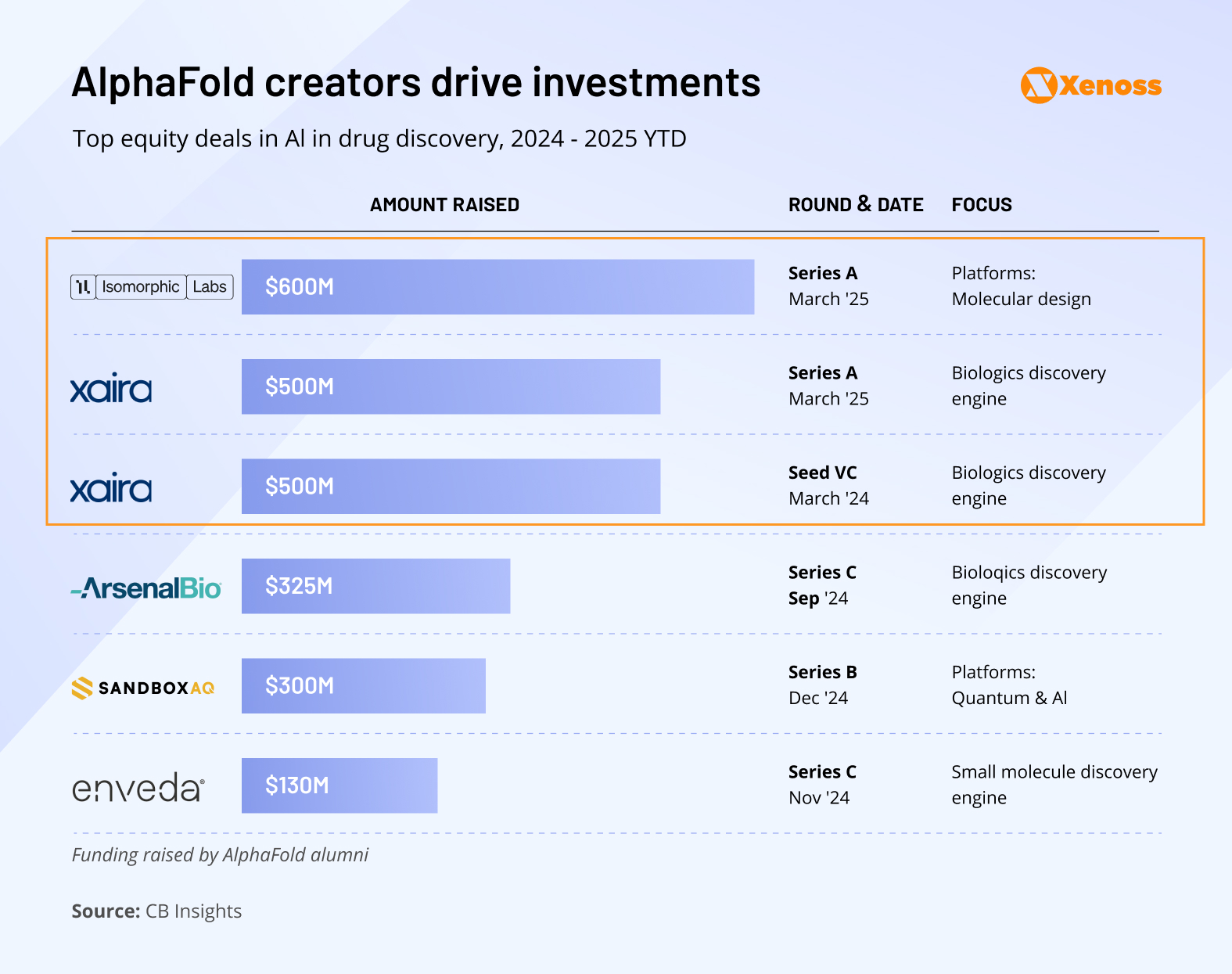

Two trends stand out if one examines the top deals in the AI drug discovery space since 2024.

Trend #1: The AlphaFold advantage

The largest recent funding rounds all trace back to the creators of AlphaFold, DeepMind’s revolutionary protein-structure prediction system.

Isomorphic Lab secured a record-breaking $600 million Series A in March 2025, and Xaira Therapeutics raised $200 million in 2024. Both companies were founded by AlphaFold’s creators.

These are not only the biggest deals in AI drug discovery, they’re among the largest biotech VC rounds overall, despite both companies having yet to publish clinical-stage assets.

Trend #2: Surge of interest in biologics

Between 2024 and 2025, three top deals were secured by companies making biologic therapeutics.

In 2024, for the first time in the history of drug R&D, biologic discovery engines outpaced small-molecule discovery engines in average funding round size.

There is a clear justification for the trend. Research and regulatory approval of biological drugs are significantly more unpredictable and costly than that of small molecules because biologics tend to produce highly varied responses in the host.

Thus, there is a pressing need to tap into emerging technologies to drive down the cost and time needed to bring these compounds to market.

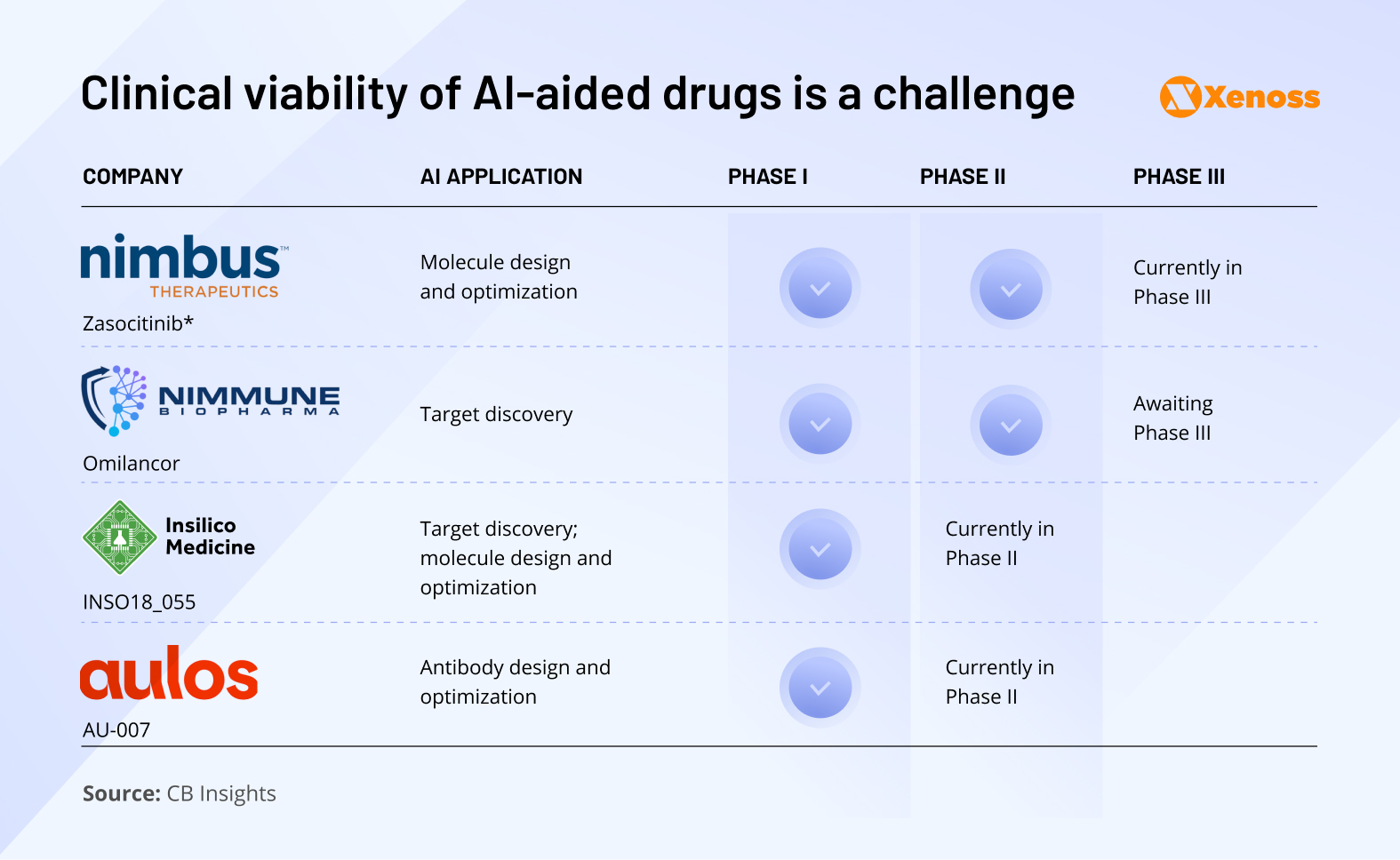

Clinical efficacy remains a challenge for AI-discovered drugs

Clinical viability is one of the most (if not the most) important hurdles to commercializing AI-derived therapeutics.

To date, no AI-derived therapeutic has been commercialized, though a number of molecules are going through clinical trials. Early results have shown that AI-discovered therapeutics have a high success rate in Phase I, but in the last few years, most have been disappointing in Phase II trials.

Exscientia, for one, stopped its first AI-discovered oncology drug due to therapeutic index concerns. If AI drug discovery is going to maintain all of the momentum it currently has, AI-based drug discovery needs to yield therapeutics that can hold their own in late-stage trials.

Nimbus‘s Zasocytinib, currently in a Phase III trial, may be the first AI-assisted drug to do so. The TYK2 inhibitor, aimed to address autoimmune disorders, like psoriatic arthritis, showed high promise in Phase II and was purchased by Takeda for $4 billion, which is a strong vote of confidence in its ability to complete clinical research.

Insilico’s Rentosertib, an AI-aided drug targeting fibrosis, also completed Phase II trials. It is considered one of the more advanced therapeutics to be discovered through the use of machine learning.

For instance, Insilico Medicine reported that its AI-driven platform accelerated fibrosis drug discovery by reducing the discovery-to-preclinical timeline from the industry average of 4 years down to just 18 months.

The outcomes of these trials will shape the future of AI in drug discovery. If frontrunners like Rentosertib succeed, they will validate the commercial potential of AI-designed drugs and likely trigger a surge in big pharma partnerships and investor confidence. Conversely, high-profile failures could slow the wave of enthusiasm and redirect attention back to more traditional discovery approaches.

Final pulse check on AI-guided drug discovery

Drug discovery is one of the highest-yield areas in machine learning as it would benefit from reducing the time needed to advance along the pipeline, has high volumes of data to train models, and relies on computationally-intensive tasks similar to those that got AlphaFold the 2024 Nobel Prize.

While AI adoption is still in early stages, drugs discovered with the help of machine learning are entering clinical trials at a much faster pace than their traditionally developed counterparts. Venture capitalists are also bullish on the applications of AI in drug discovery, especially in the biologics sector.

Progress notwithstanding, it may be too early to celebrate success. At the moment, attention to AI applications is unbalanced as it skews towards data-rich and commercially profitable areas of therapeutics. Less spotlight is placed on therapeutic areas with low data availability or smaller target populations. Ensuring an equal distribution of AI innovation should be an important focus area in the coming years.

Similarly, progress in AI-assisted drug discovery may not yield tangible therapeutic outcomes. It will likely take 2-3 years to gauge the real impact of machine learning techniques on drug design and optimization.

Yet, there is promise. Pharma leaders looking to de-risk their AI investments should explore Xenoss capabilities in machine learning for pharmaceutics.