Generative AI, particularly in the form of intelligent agents, has the potential to unlock over $340 billion in annual value for the banking sector.

Given the need to compete with FinTech and neo banks, financial institutions are opening up to innovation.

Replacing deterministic customer service chatbots with intelligent virtual agents is one of the ways banking teams can get their edge back. These AI-powered systems already enhance 24/7 accessibility and support asynchronous communication across channels.

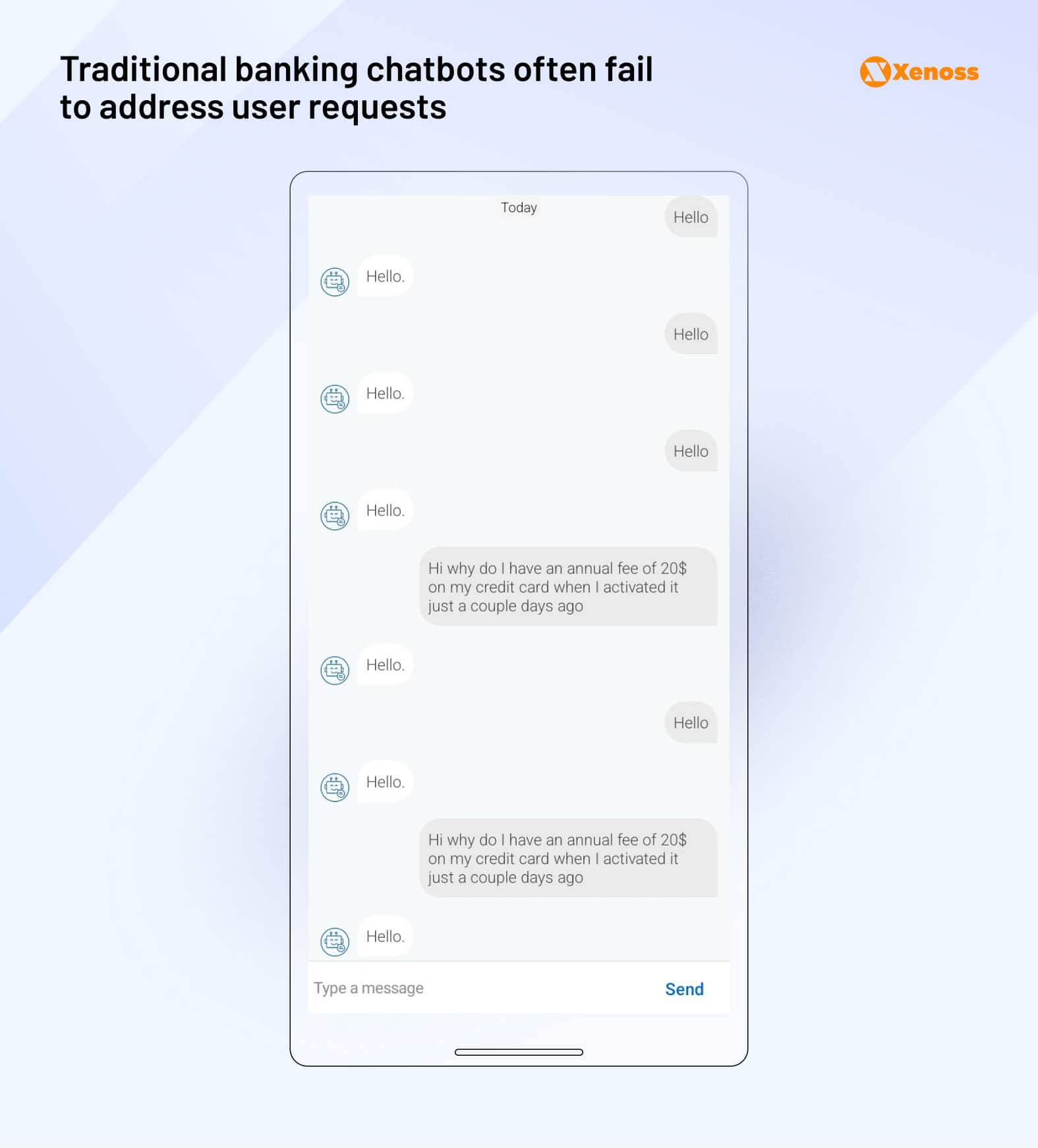

But standard chatbots come with limitations. They typically serve as triage systems, routing users to human agents, rather than fully autonomous assistants capable of resolving issues end-to-end.

In this post, we examine how AI agents improve upon a traditional banking chatbot, how teams can use them to raise the bar for personalization, process automation, and fraud detection, and what technical considerations CIOs should keep in mind.

Why now is the right time to adopt intelligent agents

A careful look at the macrotrends dominating banking in the last five years explains why CIOs see intelligent virtual assistants as a way to kill several birds with one stone.

AI agents drive hyperpersonalized banking experiences

With the surge of innovative, flexible, and nimble FinTech companies, banks no longer gatekeep financial services. Customers have more options as to how they handle financial operations, and many prefer highly personalized interactions.

74% of customers surveyed by Harris Poll would like to have more tailored services, and they stick to the institutions where they find them. Banks that succeed in creating personalized customer journeys report 72% higher total shareholder return (TSR) scores than the teams that were slow to adapt.

Personalization is becoming a competitive differentiator in finance, and CIOs believe Intelligent virtual assistants can help lead the race.

Advancements in generative and conversational AI

Chatbot adoption in banking has a long history of wins and losses. Early implementations offered modest gains in productivity and cost reduction but struggled with limitations like rigid decision trees, poor language understanding, and clunky user experiences.

Until recently, the inability to parse complex queries, lack of emotional intelligence, language barriers, and high implementation costs were legitimate concerns deterring CIOs from adopting intelligent virtual agents in banking.

Machine learning learning has come a long way. By 2025, AI agents can run multi-step tasks with minimal human supervision, and large language models are much better at gauging intent or reacting to unforeseen scenarios. A tighter competition in the space led to pricing democratization, and adopting an AI-enabled banking virtual assistant no longer comes at a high upfront cost.

AI agents for fraud prevention

While generative and conversational AI in finance have unlocked significant opportunities for banking, it has also introduced new risks. After synthetic voices started beating fraud detection systems, CIOs had to scramble for ways to protect themselves from AI-enabled attacks.

To counter this, banks are beginning to deploy agents as proactive fraud prevention AI finance tools. Equipped with agentic capabilities, these systems can monitor transactions in real time, detect anomalies, and flag suspicious behavior faster than traditional rule-based methods.

Although the landscape has just started to emerge, platforms like Rulebase or Feedzai have helped banks in developing markets like LATAM keep financial fraud under control.

Intelligent virtual agents vs. banking virtual assistants

Intelligent virtual agents draw upon the basic features of interactive virtual assistants, platforms that banks use to deploy to automate rigid workflows. That generation of chatbots was trained to respond to a set of pre-defined scenarios with a restricted number of available services.

While they helped reduce call volumes, they often left customers frustrated. In many cases, chatbots failed to understand user intent or didn’t provide a pathway to escalate the issue to a human representative, forcing users to abandon the interaction entirely.

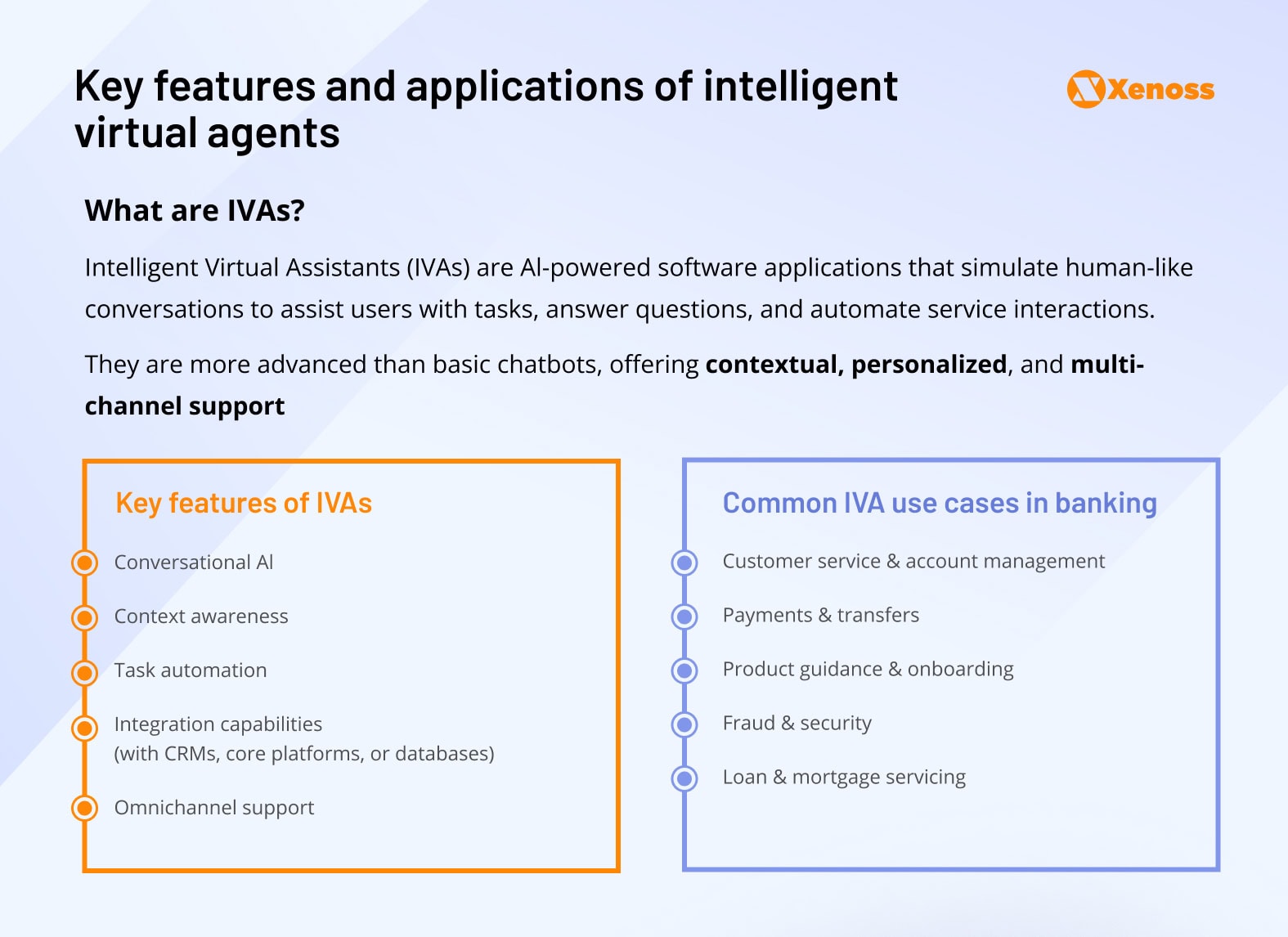

Intelligent virtual agents help address miscommunication challenges by relying on context-aware language-learning models that continuously analyze and adapt to the flow of interaction.

Beyond better communication, IVAs unlock powerful operational capabilities. They can directly access external tools and systems, such as CRMs, core banking platforms, or internal databases, to carry out complex tasks autonomously.

Besides improving call containment rates and automating internal operations, intelligent agents can build omnichannel customer experiences by memorizing and contextualizing interactions across all touchpoints: The bank’s website, social media, web interface, and mobile application.

Top use cases for finance AI agents

Customer service and account management

Customer service and account management remain the top-of-the-mind AI applications in finance.

To date, Bank of America’s virtual assistant Erica is the most successful pilot of customer support enhanced with conversational AI for banking. In 2024, the platform surpassed 2 billion interactions. It took four years to reach 1 billion engagements and only 18 months to repeat the milestone.

Now Erica is far more than a transactional tool. It helps customers analyze spending habits, initiate money transfers, and locate specific transactions. Just as important, it demonstrates emotional intelligence, sharing over 37,000 jokes with users and recognizing personal milestones with tailored messages.

Payments and transfers

AI agents’ ability to use tools outside of a browser and access data outside of the web enables a fairly new use case: AI-led transactions.

Recently, Visa released its Agent Interface and Mastercard shipped Agent Pay. Both platforms allow AI assistants to make payments on a payer’s behalf. The human stays in the loop by defining spending limits, setting preferences, and preferred merchant categories.

These systems strike a balance between automation and oversight, allowing banks to streamline transactions without sacrificing control or compliance. Visa’s tokenization-based privacy framework, for example, is specifically engineered to reduce security risks and prevent data exposure.

Product guidance and onboarding

Customer onboarding, especially in corporate and cross-border contexts, remains one of the most time-consuming processes in banking. According to McKinsey, onboarding a corporate client can take up to 100 days on average, with additional delays for multinational accounts.

On the other hand, streamlining global transaction onboarding can unlock trillions of dollars of added value.

AI agents have the potential to be at the heart of a more seamless and cost-effective onboarding process. Automating the processing of handwritten paperwork, report generation, and account setup can drastically reduce the time customers spend on KYC due diligence.

Since CIOs may be reluctant to commit to the use case due to the lack of successful large-scale pilots, it’s worth noting that AI-assisted onboarding is gaining momentum, with up-and-coming finance AI chatbot vendors like Glide and Lyzr.

Fraud and security

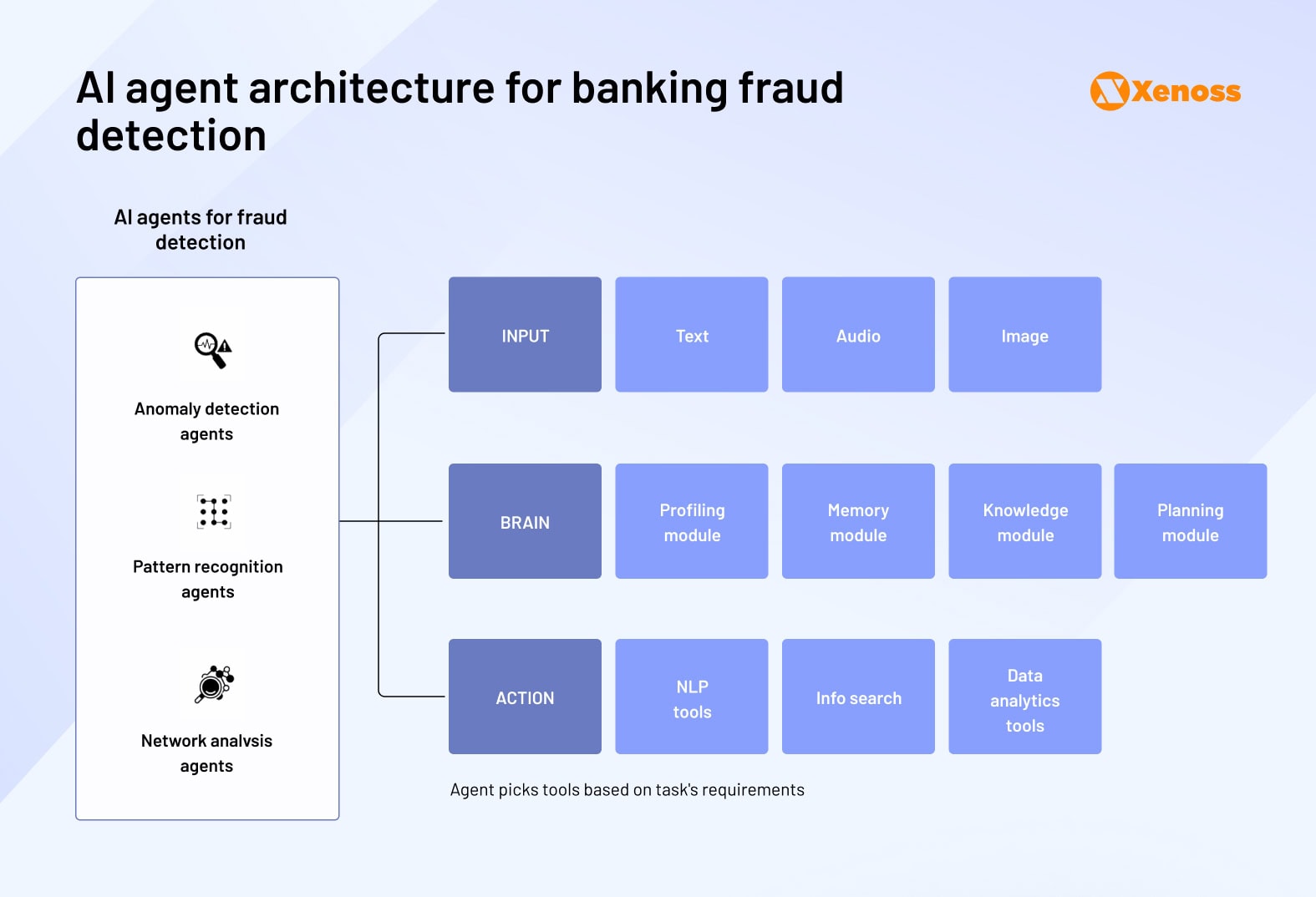

Better context awareness and the ability to draw upon higher volumes of real-time data make AI potentially superior to traditional statistics-based and anomaly-based fraud detection techniques.

Bans can build intelligent agents that go through a customer’s transaction data, on-site behavior, credit history, and other records to flag suspicious activity. What makes these systems especially appealing to CIOs is their capacity for continuous learning. As agents ingest more data and refine their models, their accuracy improves, translating into growing ROI over time.

A multi-agent fraud detection system, outlined below, shows how anomaly detection, pattern recognition, and network analysis agents can share data, exchange knowledge, A multi-agent fraud detection system, outlined below, shows how anomaly detection, pattern recognition, and network analysis agents can share data, exchange knowledge, build plans, and coordinate actions. This system closely mimics the actions of human investigators and can supplement fraud detection teams.

Loan and mortgage servicing

In a high-rate, low-demand lending environment, banks are competing for a shrinking pool of qualified loan applicants. At the same time, they’re contending with the growing influence of mortgage brokers, who now account for up to 70% of loan originations in key markets like Australia and the UK.

To keep their ground, companies need to both target applicants with a more seamless servicing experience and design new workflows for partnering with brokers.

Intelligent assistants can help banking teams reduce the strain of loan and mortgage servicing workflows. They help keep track of a borrower’s payments, send automated due date reminders, process payments, and manage escrow accounts to help bank customers make insurance and property tax payments on time.

Building omnichannel banking experiences with AI agents

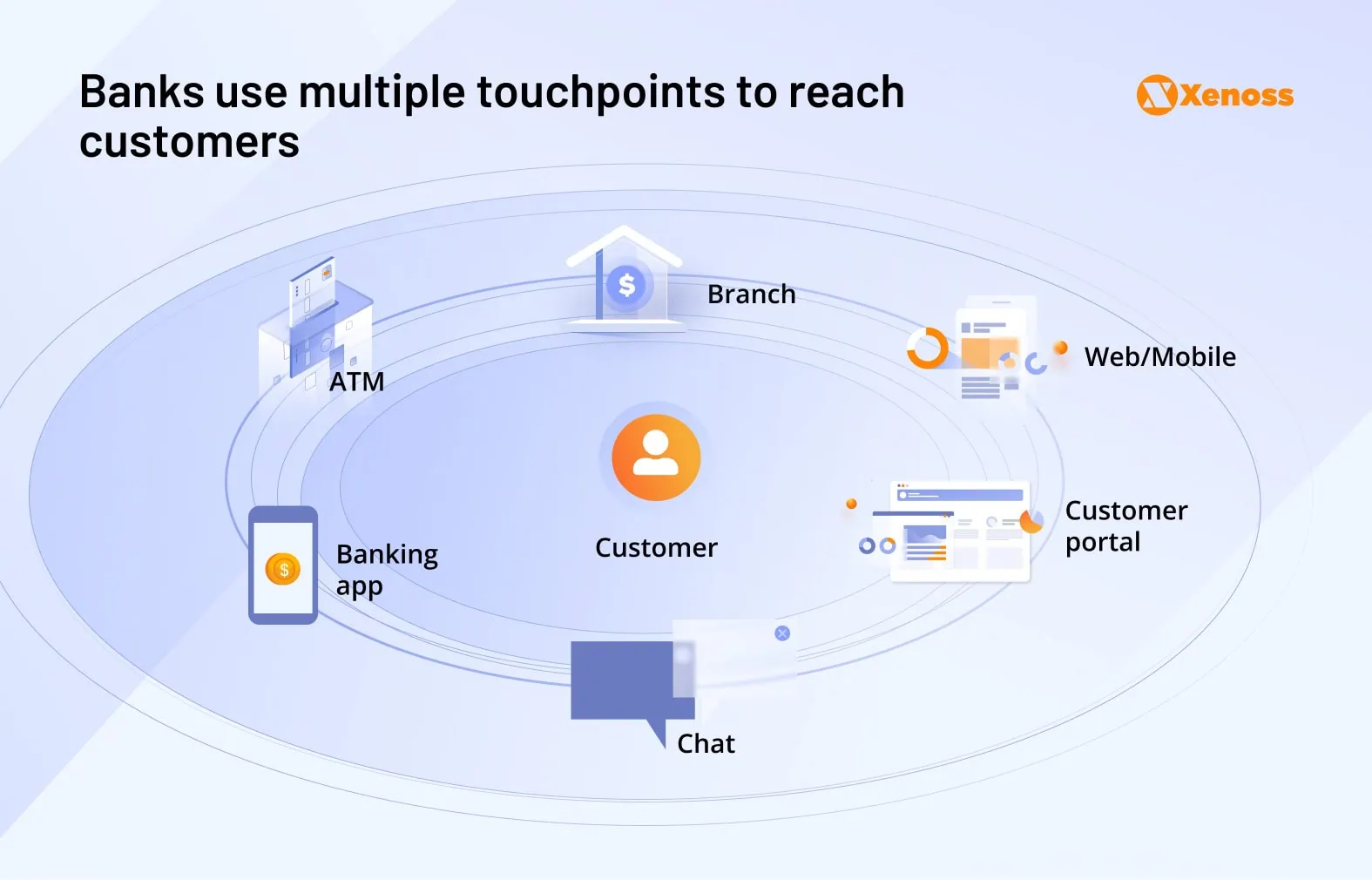

Fragmentation is a pain point for most banks, especially if they operate internationally and focus on meeting customers’ needs across multiple touchpoints.

A typical bank aims to engage customers in physical branches, ATMs, mobile apps, online banking platforms, call centers, and chatbots.

Yet, the lack of data sharing between these touchpoints adds friction to the user experience. For instance, if a customer starts a transaction via the online banking portal, there’s rarely a way to seamlessly continue it via a mobile app.

Strict guardrails make real-time data integration between touchpoints challenging for banks, but if successful, it could drive double-digit growth in transaction completion rates.

AI agents can serve as connective tissue across this fragmented ecosystem. Banks can orchestrate a truly unified customer journey by deploying dedicated agents on each platform, all tied into a shared, real-time knowledge base.

For example, if a customer initiates a transaction on the mobile app, the mobile agent immediately updates the central knowledge base. When that customer switches to a web interface, ATM, or speaks to a human operator, the interaction can resume exactly where it left off.

This level of continuity and engagement, ramped up with conversational AI in banking transforms isolated digital touchpoints into a fluid, intelligent network, ultimately driving higher engagement and loyalty.

How to keep cross-platform intelligent agents aligned with your brand

Banks planning to bring AI agents into their customer service should consider how the new platform fits the company’s broader strategy. Although large-language models are self-learning systems, they can “miss the beat” in conversation.

Early adopters of generative AI in customer support warned that large-language models can “be too chatty”, “overexplain”, or recommend products that are not part of the company’s portfolio.

Keeping virtual assistants on-brand requires an ongoing partnership between human designers and the AI. Prompt engineers and conversation designers play a crucial role in shaping how virtual agents speak, react, and represent the institution. They fine-tune outputs based on user feedback, business rules, and the brand voice.

Regulatory considerations for building an AI-first banking experience

In a heavily regulated domain like banking, a shift from fully deterministic assistants to blackbox generative AI in finance introduces new legal and operational complexities.

The inability to predict how the model handles every interaction and difficulties in reverse engineering the algorithm’s decisions call for external guardrails that would govern the model and the data it’s trained on (MIT research states that most genAI-related lawsuits in banking were data-focused).

Here are the key regulatory considerations for AI agent adoption that banking leaders should keep in mind.

- A screening program that validates if generative AI use cases in banking poses regulatory risks

- Protocols for overseeing and testing AI agents before launch

- Assessment and documentation of third-party agreements and vendor-associated risks

- A roadmap for ongoing oversight for deployed AI agents, with assigned accountability managers.

- Practices for keeping track of pending AI regulations and updated legislation.

Data sovereignty is another focus area banking teams should not gloss over when planning to implement AI in accounting and finance. To reduce risks, CIOs need to verify that the training data used by the model is not shared with other providers.

Building intelligent agents: In-house vs third-party vendors

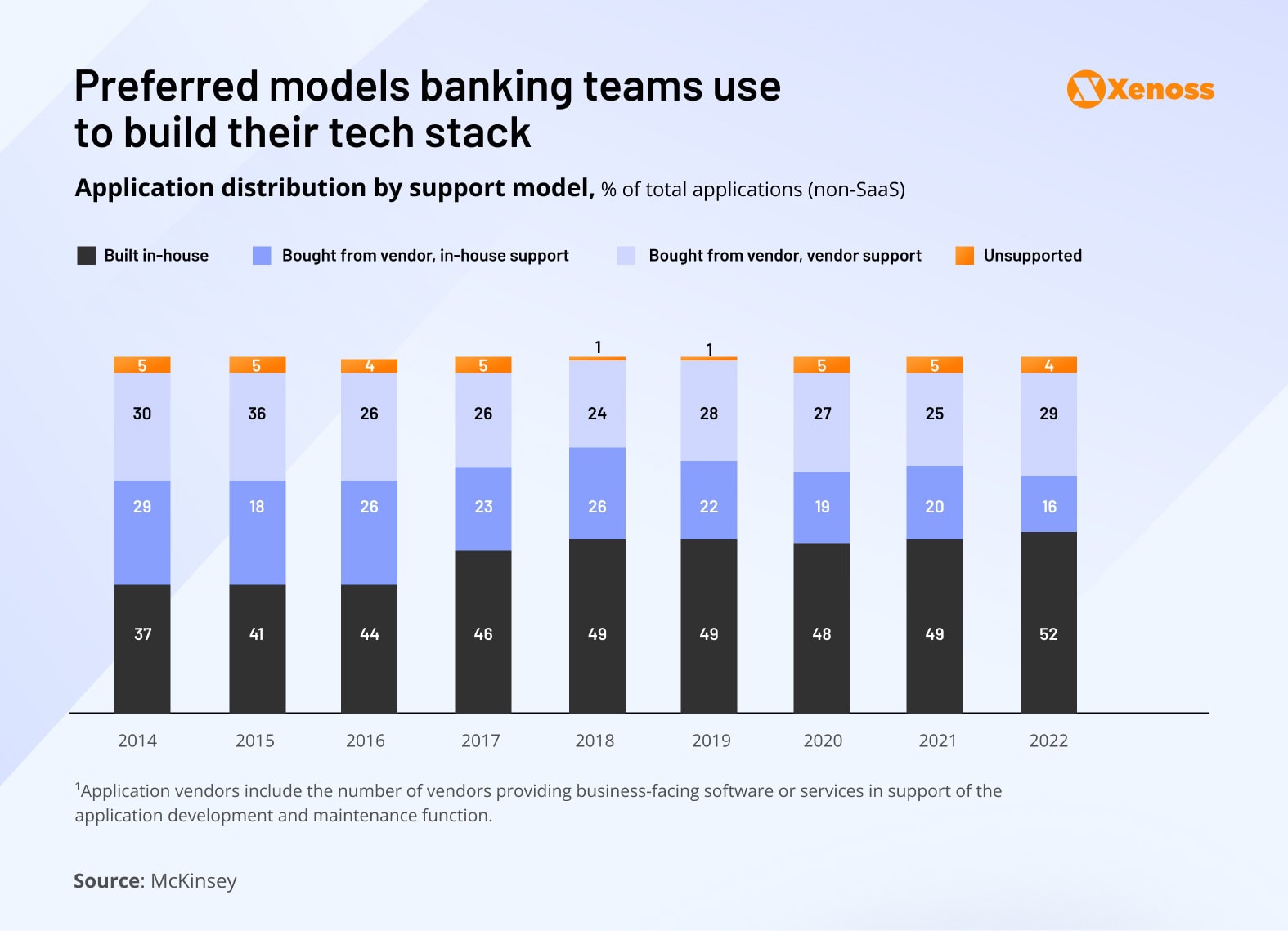

The “build vs. buy” dilemma is as relevant in AI agent adoption as it is in other areas of building a banking tech stack. In the last five years, banks have been shifting from implementing off-the-shelf solutions to building custom software.

For some banks, this shift is strategic. Proprietary platforms are increasingly seen not just as internal enablers but as potential revenue streams. Several institutions are exploring ways to monetize their internal tech stacks by offering them to other financial service providers.

Building proprietary technology is a logical strategic direction in a market where technology is becoming the main differentiator and success predictor. At the same time, managing in-house engineering teams requires building operations from the ground up. For banking teams, removed from best engineering practices, it may mean reinventing the wheel.

That’s why leaders are choosing the middle ground: Building business-critical features in-house and buying the rest of the tooling.

Scott Andrews, the COO of the Commercial Division at BOKF, told Deloitte: “When we make technology decisions for the Commercial Division, we generally ask whether this is impacting something that is unique to us and the way we do business, or is this something that we can buy and configure way that works for us?”.

For the former group of technologies, banks choose to build; for the latter, they hit the FinTech market to build partnerships or explore M&A opportunities.

Final thoughts: How AI agents reshape banking customer service

Using chatbots to automate the growing number of interactions has been the mainstay in banking for the last decade.

But it’s only after generative AI hit a growth spurt in the last few years that traditional virtual assistants can evolve into interactive agentic systems that can support customers across multiple platforms.

It’s essential that banking organizations do not run AI agent pilots by old chatbot adoption playbooks and recognize how much more versatile the technology has become. Understanding how to use the building blocks of agentic ecosystems in different scenarios (personalized experiences, faster onboarding, fraud detection, loan servicing) will help CIOs increase the impact of AI solutions for finance and drive meaningful change throughout the entire organization.