Mobile game monetization is a balancing act between choosing the highest-yield revenue channels and keeping a player-friendly gaming experience.

Mobile game companies that prioritize retention and engagement are often reluctant to maximize their titles’ monetization opportunities. Some might be open to exploring new revenue channels but lack awareness about alternative monetization approaches.

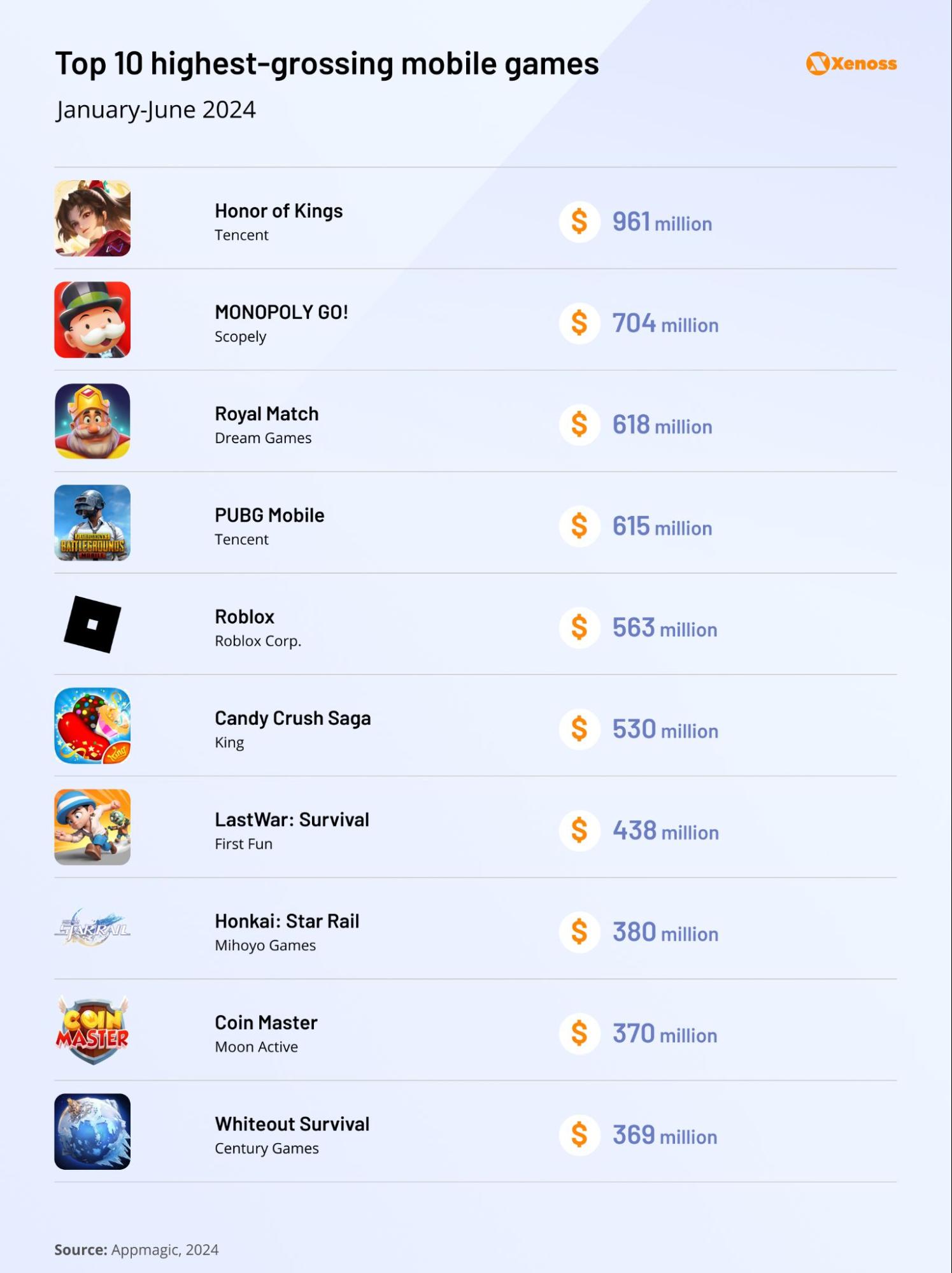

When examining the list of highest-grossing mobile games in the first half of 2024, we realized that publishers have drastically different approaches to monetization. Some rely exclusively on in-app purchases, which calls for an elaborate, multi-tier monetization system. Others keep IAPs simple but maximize earnings through in-app ads or native brand integrations.

In this post, we will explore mobile game monetization approaches adopted by the highest-earning publishers and share takeaways gaming studios can adopt when planning and testing app monetization strategies for their titles.

Highest-grossing mobile games of 2024 (so far)

As the mobile gaming market enters the second half of 2024, the highest-yielding titles are emerging.

Appmagic estimates are the industry’s gold standard resource for speculating about the revenue frontrunners of mobile gaming.

This data is based solely on the publisher’s payout and does not take into account the 30% cut claimed by Apple and Google. It also does not include webshop revenues or the revenue from the fragmented Chinese gaming ecosystem.

Appmagic’s estimates are useful for understanding the general state of mobile publisher revenue; however, inaccuracies are possible.

Some titles on the list—Honor of Kings, PUBG Mobile, or Candy Crush Saga—are long-time mobile game revenue frontrunners. Others, like Monopoly GO!, Royal Match. Honkai: Star Rail, and Whiteout Survival entered the top-10 for the first time.

There’s a slight genre preference for online battle games (Honor of Kings or PUBG Mobile) and puzzles (Candy Crush and Royal Match), but overall, the genres on the list are diverse.

With many new titles contesting market dominance, offering audiences innovative experiences is becoming an increasingly important driver of user acquisition and revenue.

To understand the tactics publishers use to drive revenue to the top 10 highest-grossing titles worldwide, we will examine game economics and mobile game monetization strategies publishers adopt to increase earnings.

Monetization strategies of the highest-grossing games in 2024

1. Honor of Kings

Key statistics

- Revenue since the beginning of 2024: $961 million

- Monthly active users (Q2, 2024): 137 million

- Number of downloads (January-August 2024): 42 million

Mobile game monetization strategies

In-game currency

Tencent uses a virtual currency that allows users to purchase weapons and powers. Honor of Kings launches limited gacha sales in seasonal festivals to create a sense of urgency. These limited offers create a sense of urgency among users and encourage in-app purchases (for example, the skin of Zhao Yun, an Honor of King’s character, generated over $22 million in one day).

Tencent’s ability to lean into the social game aspect of Honor of Kings through native WeChat integrations fuels the success of in-game purchases. Players emphasize that competing with friends and strangers motivates them to invest in paid items or skills.

Brand collaborations

In 2024, Honor of Kings expanded the list of brand partnerships, allowing advertisers to create unique in-game experiences to drive brand awareness and attract purchase-ready customers.

Honor of Kings collaborated with MAC Cosmetics for the brand’s launch in China, introducing a series of makeup products players could apply to in-game characters.

Tencent also created branded experiences for Adidas, Burberry, and Gilette.

For brands, partnerships with Honor of Kings are an excellent gateway to Asia-Pacific: Through highly-tailored experiences, advertisers can capture a highly diverse multi-million audience and improve brand recall.

E-sport involvement

Honor of Kings is highly valued in Chinese e-sports. The game is at the core of highly anticipated tournaments, such as The King Pro League and the Honor of Kings International Championship, which had the second-highest prize pool in global e-sports last year.

Tencent heavily relies on prominent e-sports athletes to boost its partnerships roster. In April this year, Pandora penned a deal with Honor of Kings and signed one of the game’s leading e-sports athletes, Yang “Wuwei Tao,” as a brand ambassador.

Besides using its dominance in China to attract global brands eager to boost brand awareness in Asia, Tencent is on track to expand its e-sports presence in the West.

In April 2024, the game company and Level Infinite, the publisher behind Honor of Kings, announced the plan to invest $15 million in building a global esports community around the game.

Takeaways for publishers

Aside from developing a robust IAP-based mobile game monetization, Honor of Kings appeals to advertisers as a gateway to APAC.

The company promises a highly engaged multi-million audience to brands who want to improve brand awareness in the region. Likewise, Tencent centers its offering on the demographics of its audience.

Most Honor of Kings players are 18-30 years old, allowing the company to differentiate itself from other channels in targeting Gen Z.

2. Monopoly GO!

Key statistics

- Revenue since the beginning of 2024: $704 million

- Monthly active users in 2024: over 8 million

- Number of downloads (Q3, 2024): 4 million

Mobile game monetization strategies

In-app purchases

Monopoly GO! offers users paid boosts and power-ups that improve the gaming experience.

Here are the key types of in-app purchases Monopoly GO! players make.

- Virtual currency users spend on game assets (e.g., houses or hotels). Game designers package these offerings in limited bundles to stimulate a sense of urgency.

- Powerups that help players increase the odds of acquiring a better property or protect them from financial losses in the game.

- Exclusive content. Monopoly GO! often releases paid-only content, such as special editions of properties or exclusive events.

Innovative AdTech

Scopely reportedly uses a custom AdTech stack for Monopoly GO! and other titles. The company’s engineers and analysts focus on designing and fine-tuning data models for granular targeting and A/B testing of the ways the inventory is displayed within the game to maintain high player engagement.

In an interview with AdExchanger, Ben Webley, Scopely’s CMO, shared his team’s strategies to thrive in a post-ATT landscape.

- Increased focus on data science adoption. Ben emphasized the importance of Scopely’s internal data team in triangulating available data and integrating disparate metrics, like installs or in-app purchases, into a large-scale view that sheds light on player habits and preferences.

- Going beyond programmatic ads with premium experiences and brand partnerships. By creating custom-fit brand partnerships and in-game experiences, Scopely engages users with non-intrusive creatives that add a touch of humor and satisfaction to the gaming experience.

Ad-free subscription tier

Monopoly GO! successfully implemented a subscription model that allows players to enjoy an ad-free experience and access exclusive packages with unique powerups (special dice, daily bonuses, etc).

The subscription tier is a strategic move for the company as a mobile game monetization channel and a first-party data collection engine. By collecting subscriber information, Scopely enriches its targeting capabilities and increases advertiser appeal.

Takeaways for publishers

With Monopoly GO!, Scopely hit the nail on the head in multiple aspects.

- Leveraging IP. Monopoly GO! is an undeniable leader in the IP gaming segment. Leveraging the mass appeal of a well-known brand game helped Monopoly GO! Improve name recognition and cut the costs of user acquisition.

- Going all in on mobile game marketing. According to recent data, the company spent approximately $500 million on marketing. The bet on luring first-time users with a familiar concept across all imaginable channels empowered Scopely’s success.

- Commitment to building a “sticky” game. Monopoly GO! strikes a balance between keeping its mechanics challenging and unpredictable and creating scenarios where a player gets seemingly “lucky” in a losing situation. The dopamine boost the company achieves encourages users to return to the game.

3. PUBG Mobile

Key statistics

- Revenue since the beginning of 2024: $615 million

- Monthly active users (Q2, 2024): 40 million

- Number of downloads (January-August 2024): 10 million

Mobile game monetization strategies

In-app purchases

PUBG Mobile owes a significant portion of its monetization to a fleshed-out Battle Pass feature.

PUBG Mobile introduced the Battle Pass in 2018, reportedly inspired by Fortnite’s success with BP adoption.

Over time, Lightspeed Studios took the battle pass concept up a notch by creating a complex underlying ecosystem.

- Stimulating consecutive Battle Pass purchases with the RP EZ Mission License. The powerup allows players to unlock new missions, get more RP points, and earn Mission Cards that auto-complete challenging tasks. The game’s economics grants users who bought three consecutive battle passes a free RP EZ mission license. This incentive drives long-lasting “battle pass purchase streaks.”

- Keeping players engaged with extra value through RP activity packs. An RP Activity Pack gives access to extra items and mission tiers. Still, the critical value of the feature lies in letting users convert all RP collected with a Battle Pass to premium currency, which can be traded for PUBG Mobile powerups. The feature makes players feel like they gained a lot of premium currency at the cost of a single Activity Pack, creating a sense of added value.

- Leveraging peer pressure with the RP Team. PUBG Mobile. Lightspeed Studios, a Tencent-owned publisher behind PUBG Mobile, leans into the game’s social aspect by adding peer pressure to the Battle Pass model. The players who purchased the season’s Battle Pass can form an RP team. The game calculates rewards based on the sum of the members’ Battle Pass rank. This setup creates peer pressure, encouraging players to buy BP to contribute to their team’s success.

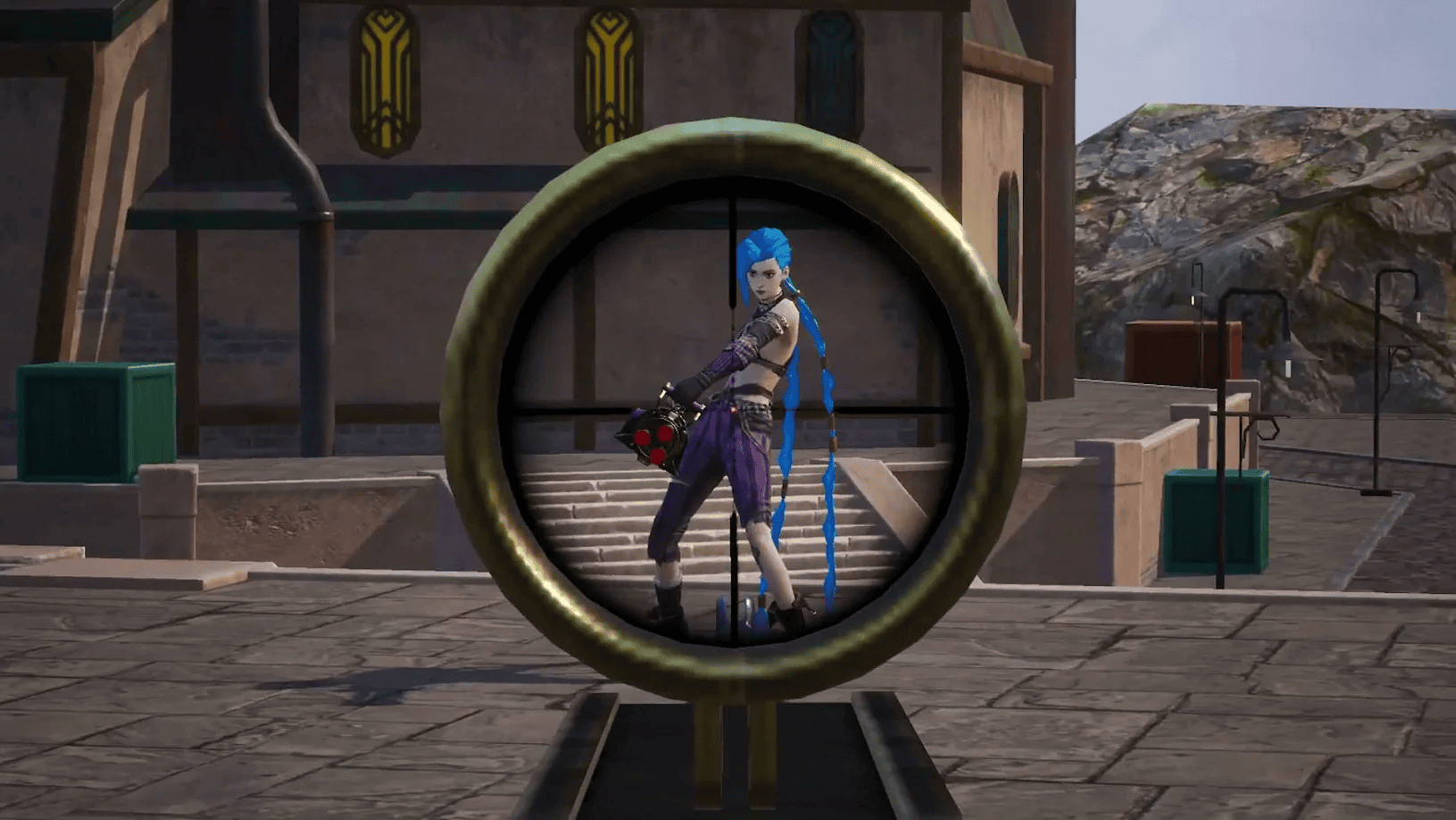

Partnerships with relevant titles and cross-promotion

The PUBG Mobile team explores different ways to acquire purchase-ready users. One such method is partnerships with titles loved by target player segments.

In 2020, PUBG Mobile partnered with Metro Exodus, a first-person shooter published by Deep Silver and developed by 4A Games. PUBG Mobile created a Metro-Exodus-themed season pass that brought popular Metro characters and outfits to the PUBG universe.

In 2021, Lightspeed Studios partnered with Riot Games, the studio behind League of Legends, to bring LoL-themed content to PUBG Mobile.

As both studios are Tencent subsidiaries, combining their audiences in a cross-promotional campaign is a logical game monetization strategy for the Chinese conglomerate.

On a global scale, Lightspeed Studios expressed its commitment to partner with more game studios to deliver authentic experiences to players and drive in-app revenue.

To bring top IP and authentic game experiences to global players, we are looking to build long-term partnerships with leading game developers and publishers worldwide.

Cilight Yang, General manager of global game strategy and development, Tencent

Takeaways for publishers

With PUBG Mobile, Tencent delved deep into the mechanics of the Battle Pass. The company used a BP to keep up with its number-one rival, Fortnite. Leveraging a tried-and-true monetization tactic allowed PUBG Mobile to take a low-risk stance on monetization.

PUBG Mobile does not run in-game ads but designs premium ad experiences for brands. This way, Lightspeed Studios can create viral campaigns that do not damage user retention.

Additionally, PUBG Mobile taps into reducing user acquisition costs through cross-promotion with other Tencent titles. LoL or Metro Exodus-themed crossovers were well-received by the community and drove first-time users to the game.

4. Royal Match

Key statistics

- Revenue since the beginning of 2024: $618 million

- Monthly active users: 55 million

- Number of downloads (June 2023-May 2024): 23.8 million

Mobile game monetization strategies

Dream Games does not use in-game ads in Royal Match and relies exclusively on virtual currency. Users can spend in-app coins in several ways.

- Continue/Retry microtransactions: Premium coins allow to continue playing a lost level.

- Boosters: Power-ups that give players an upper hand in clearing a level.

- Limited-time purchases: Royal Game offers limited bundles with premium coins or other items.

- Royal Pass: Royal Match’s version of the Battle Pass that gives players access to 30 tiers of in-game missions.

Takeaways for publishers

Royal Match’s mobile game monetization strategy lacks versatility and diversification compared to the titles leading the list.

The game’s large user base continues to yield high mobile game revenue. Still, when the novelty of the gameplay and creative mini-games wears off, it’s unclear whether Royal Match’s monetization strategy will be sustainable in the long term.

Introducing in-game ads would give Dream Games a new way to extract value from millions of Royal Match players who enjoy the game but lack the commitment to pay for gacha.

5. Roblox

Key statistics

- Revenue since the beginning of 2024: $563 million

- Daily active users: 79.5 million

- Number of downloads (Q2 2024): 54.86 million

Mobile game monetization strategies

Premium inventory

In 2023, Roblox expanded its range of in-game ads, offering advertisers a wide range of premium inventory. The company’s direct inventory comprises native display and video billboards.

Added features like contextual targeting and age restrictions that limit users under 13 give advertisers more control over their Roblox campaigns.

Strengthening the programmatic ecosystem

Roblox has announced its commitment to build an all-encompassing AdTech ecosystem by the end of the year. The publisher teased partnerships with SSPs, DSPs, and agencies. Roblox also plans to unveil a proprietary e-commerce platform to explore retail media opportunities.

Roblox Partnership Program

The Roblox Partnership Program is designed to help advertisers create branded experiences inside Roblox’s immersive worlds.

While the program does not offer advertisers additional data, it helps create campaigns that resonate with audiences and match Roblox’s visual style and identity.

After joining the program, brands will have a direct connection to the Roblox staff for game-related tips and assistance.

Takeaways for publishers

In the last few years, Roblox has shown a large-scale commitment to monetizing the platform programmatically. The company’s partnership with PubMatic can provide Roblox Inc. with a reliable mechanism for filling its inventory.

While not yet the critical mobile game revenue driver, advertising will probably have a higher impact on Roblox’s earnings by the end of the year and beyond.

6. Candy Crush Saga

Key statistics

- Revenue since the beginning of 2024: $530 million

- Daily active users: 79.5 million

- Number of downloads (Q4 2023): 28.24 million

Mobile game monetization strategies

In-game ads

According to Digiday’s interviews with the employees of King, the Activision-Blizzard-owned studio behind Candy Crush Saga, the company often debated introducing in-game ads.

Driving revenue for a free-to-play game required exploring in-game advertising, but the team had to ensure it did not go against players’ expectations.

Seamlessly embedding ads into the gameplay (e.g., players can watch 30-60-second videos to get in-game rewards) helped keep high satisfaction levels.

King also set up suitability filtering technology designed only to show players creatives that meet safety criteria.

Brand partnerships

In addition to programmatic ads, Candy Saga has a long track record of brand partnerships. Building native integrations into the game helps create non-invasive player experiences and generates high ROI for brands.

After partnering with Candy Crush Saga, Prada saw a massive spike in interest, with over 40,000 samples ordered in a day.

The company previously partnered with celebrities (Megan Trainor and the Jonas Brothers).

Leading up to the “Barbie” release, Candy Crush Saga created movie-themed in-game experiences.

In-app purchases

Candy Crush has a complex IAP model. Here are its key components.

- Life model. In Candy Crush, players have five lives, which they lose one by one for each failed level. If a player runs out of “lives” and wants to continue playing, the game charges 99 cents for a refill.

- + 5 moves. Candy Crush leverages its hard-to-pass levels and sticky nature to trigger an “I was so close” attitude and drive an impulse purchase. This feature, reportedly, is the game’s number-one conversion driver.

Freemium model

Candy Crush Saga uses a gated content model to monetize loyal users. The first thirty-five levels of the game are free; however, a user needs to pay to unlock the remaining content or invite three players to Candy Crush.

This model has two purposes: As a monetization tool and as a user acquisition engine.

Takeaways for publishers

A leader in the hyper-casual genre, Candy Crush Saga focused on expanding its audience beyond gamers. It was marketed as a consumer product rather than a gaming title like Call of Duty or League of Legends.

King’s monetization decisions reflect this strategy by keeping in-app purchases basic yet convenient. To keep Candy Crush Saga an enjoyable companion for commuters, the publisher intentionally limited the number of in-game ads and prioritized tailored partnerships over tread-of-the-mill ad placements.

7. Last War: Survival

Key statistics

- Revenue since the beginning of 2024: $438 million

- Daily active users: 79.5 million

- Number of downloads (Q2 2024): 54.86 million

Mobile game monetization strategies

In-game purchases

With Last War: Survival, FirstFun relies on in-app purchases. Although the title is technically free to play, users reported that it was difficult to make progress without purchasing paid items.

Like its number-one rival, Whiteout Survival, another hypercasual high-grossing title, Last War: Survival leverages social features to peer-pressure players into in-app purchases.

Takeaways for publishers

Last War: Survival did not aim for an innovative concept or revolutionary monetization tactics. The heavy influence of Whiteout Survival is evident in the gameplay and monetization alike.

Yet, Last War: Survival compensated for the lack of originality in stickiness. A wide range of in-game activities (building, combat, strategic planning) helps FirstFun keep players engaged.

Despite its global launch, Last War: Survival gets the highest return on investment in Asia. South Korea and other APAC countries collectively generate most of the publisher’s mobile game revenue and downloads.

8. Honkai Star Rail

Key statistics

- Revenue since the beginning of 2024: $380 million

- Monthly active users: 12.74 million

- Number of downloads (July 2024): 2.15 million

Mobile game monetization strategies

In-game currency

Users can purchase Stellar Jades, the company’s virtual currency, and trade them for Warps and Battle Passes.

According to HSR players, the pricing range is the same as that of HSR’s number-one inspiration, Genshin Impact.

Star Rail Pass

HSR’s version of a battle pass allows users to unlock Warps (the game’s gacha mechanics system), like Stellar Warp or Departure Warp. A warp unlocks a pool of characters and light cones (equipment that improves a character’s HP).

Honkai Star Rail offers several types of passes:

- Star Rail Pass that unlocks the Regular Warp.

- Star Rail Special Pass unlocks a time-limited Event Warp.

Monthly subscription

Honkai Star Rail offers players a monthly subscription, presented as a thirty-day Express Supply Pass. The subscription unlocks rewards (Oneiric Shards and Stellar Jades) each time a player logs in.

Brand partnerships

Honkai Star Rail leverages its multi-million user base to appeal to advertisers and create a unique activation experience using the game’s IP.

As such, MiHoYo Games partnered with a range of Singapore-based FMCG brands, LiHo Tea, a bubble tea brand, and Kith Food, a pastry brand, to create HSR-themed bubble tea flavors and desserts.

Takeaway for publishers

Revenue data shows that MiHoYo is not monetizing Honkai Star Rail as effectively as Genshin Impact. The title’s revenue per download in the West is not substantial compared to other turn-RPG titles.

Players noticed that Honkai Star Rail’s gacha mechanics focus on player-friendliness rather than maximizing LTV.

While MiHoYo’s first-rate portfolio gives the company access to a pool of engaged, purchase-ready players to sustain high mobile game revenue over time, the company should consider exploring other monetization opportunities (e.g., native brand integrations).

9. Whiteout Survival

Key statistics

- Revenue since the beginning of 2024: $369 million

- Growth rate (July 2024): 14% (Sensor Tower)

Mobile game monetization strategies

In-game purchases

Whiteout Survival has a versatile IAP system, capturing player interest on multiple levels.

- Extra builders. At the start of the game, players have one builder who helps upgrade their buildings. Whiteout Survival gives users a second builder for 15 minutes to show the value of an extra pair of hands. After the trial, players need to decide whether to continue upgrading buildings on their own or hire a second builder permanently through an in-app purchase.

- Battle passes. Whiteout Survival has a wide range of battle passes that unlock rewards across all areas of the game (building fortresses, collecting a team of heroes, etc.) For Century Games, diversifying battle passes is a user segmentation tool; the publisher gauges user preferences based on the BP they purchase.

- Custom Chest offer. Players can pay to choose the types of rewards they get in reward chests. This way, Century Games is customizing the gaming experience and giving users access to tools that meet their immediate needs. Understanding that users are more likely to buy bundles they created on their own, Century Games is tapping into players’ need for control and personalization.

Takeaway for publishers

Compared to other genres, 4X games statistically have highly engaged users and deeper spending. User acquisition for titles like Whiteout Survival is expensive and elaborate, but once the user experiences and commits to the game, the conversion rate is significantly higher than that for other genres.

Whiteout Survival does not rely on ads and monetizes solely on IAPs to minimize churn. So far, Century Game’s bet on a small pool of high-paying users is paying off.

10. Coin Master

Key statistics

- Revenue since the beginning of 2024: $370 million

- Daily active users: 2.9 million

- Number of downloads: 195 million

Mobile game monetization strategies

In-app purchases

Coin Master does not support in-game ads and relies exclusively on in-app purchases. Here is how the company maximizes IAP efficiency.

- Smooth integration of in-app purchases. In Coin Master, IAPs are part of players’ experience: Players pay to keep playing after failing a level or skipping wait times. To drive extra value, Coin Master offers paid players additional gacha mechanics, like exclusive pets.

- Granular user segmentation. Coin Master builds personalized IAP offers considering users’ in-game and spending habits. The more time a player engages with the game, the more personalized their premium bundle offerings become. Similarly, regular users have a higher frequency of paid feature pop-ups than first-time users, who get a relatively ad-free experience to get used to the game.

- Limited offers. Coin Master leverages seasonal trends to develop limited-edition premium bundles. For example, the game offers special Christmas and New Year’s Day offers. All premium bundles last from days to weeks.

Using social features to reduce the cost of user acquisition

To minimize direct monetization while continuing to maximize user value, Coin Master offers multiplayer features that encourage players to bring others to the game. This way, the title acquires zero-cost users, some of whom will likely commit to IAPs.

Takeaway for publishers

With Coin Master, Moon Active is exploring new ways to improve personalization in a stringent privacy landscape. With little behavioral data available, the company introduced a low-cost starter pack that helps quickly convert players and segment them.

Over time, Moon Active tailors the bundles to user preferences and upgrades the cost of their offers to drive monetization.

Personalizing starter packs over time based on historical data of player interaction is a promising spin on a common tool in the free-to-play toolbox that more mobile game companies should consider adopting.

Bottom line

Regarding in-game monetization, publishers are challenged to introduce ads and paid features non-invasively.

To retain loyal users, publishers often decide to avoid running in-game ads. In fact, of the highest-grossing titles, barely half run third-party ads.

At the same time, immersive integrations and partnerships with brands ultimately improve user experience, as demonstrated by PUBG Mobile, Roblox, or Candy Crush. To continue adding value to players even through in-game ads, publishers must build a tech stack that selects relevant advertisers and offers a wide range of user segmentation parameters.

The technical specifications of the SDKs are another important consideration for fueling a seamless ad experience. Publishers must check whether their Software Development Kit is lightweight and well-adapted to different environments.

Contact Xenoss engineers to build a custom in-game AdTech stack that taps into your titles’ monetization potential and keeps players downloading and engaging with the game.

Our experienced team of developers has helped leading mobile game companies like Voodoo and Activision Blizzard build first-in-class mediation platforms, personalization technologies, data solutions, and other monetization solutions.

Get in touch with Xenoss engineers to learn how our engineering expertise can help optimize the monetization of your titles.