Warehouse automation is surging. McKinsey reports that it’s growing at a 10% CAGR, with industrial robot shipments projected to increase 50% by 2030.

It is also an operational priority for executives. Up to 70% of warehouse operations leaders plan to invest over $100 million in automation.

This post covers the technologies driving ROI, successful implementations from leading retailers, and a framework for identifying the highest-yield automation opportunities.

Operational challenges that encourage warehouse automation

The push toward warehouse automation is driven by structural challenges that manual processes alone can no longer solve, and that tend to worsen as operations scale.

Three high-impact challenges are driving warehouse managers toward AI and robotics.

1. Talent shortage: warehouses don’t have enough operators

Warehouse labor shortages are intensifying as workforces age, turnover stays high, and retailers compete on ever-faster delivery.

To fill the gap, operations managers are hiring actively, with over 320,000 warehouse jobs posted in the US in 2025. But, as annual turnover reaches 40%, the talent shortage cycle persists.

What contributes to the warehouse talent shortage

Tight labor markets and employer competition

With U.S. unemployment at 4.4% at the end of 2025, fewer workers are available, and many are choosing retail, delivery, or manufacturing jobs that offer better hours, less physical strain, or more flexibility.

Skills mismatch as warehouses modernize

Automation, robotics, and digital systems now require technical skills that many traditional hires lack. In a 2025 workforce survey, most global employers reported difficulty finding workers who can operate in increasingly automated, data-driven environments.

2. Inventory visibility and control

Growing SKU counts and supply chain volatility make it harder for warehouse managers to track stock location and movement. Stockouts and excess restocking cost the industryup to $1.73 trillion annually.

Despite operations managers trying to address the challenge by investing over $172 billion in inventory tracking improvements, results remain poor. In 2025, average inventory accuracy was at just 83%, meaning 17% of SKUs were misplaced or unaccounted for in management systems.

What contributes to bottlenecks in inventory control

Location silos

For organizations with distributed warehouses, stockouts often stem from fragmented systems, delayed updates, and low record accuracy.

When WMS, ERP, supplier systems, and store data aren’t synchronized in near real time, stock that exists on paper is unavailable at expected locations. Infrequent cycle counts, manual exception handling, and inconsistent master data compound the problem, eroding trust in inventory records and generating false availability signals.

Outdated planning models don’t account for demand fluctuations

Traditional forecasting struggles with today’s demand volatility.

Promotional spikes, omnichannel fulfillment (buy-online-pick-in-store, ship-from-store), and shifting consumer behavior create sudden drawdowns that static safety-stock assumptions can’t cover. When forecasts miss reality, replenishment reacts too late, and potential sales opportunities become operational bottlenecks.

Poorly optimized processes inside the warehouse

Execution constraints also undermine inventory control. Receiving congestion, mis-slotting, labor shortages, delayed putaway, and inefficient pick paths prevent stock from being located, picked, or shipped on time.

At the scale of thousands of SKUs, even minor inefficiencies compound quickly, putting retailers at constant stockout risk.

3. Space constraints

The global property crisis has driven U.S. warehouse rents to over $8.3 per square foot, up from $7.96 in 2023. To cut costs, distributors are downsizing and pushing facilities to full capacity, creating new challenges for on-the-ground operators.

What contributes to space constraints

Difficulty making operational decisions

Beyond capacity constraints, managers face constant optimization choices: how to size storage bins, reduce worker travel time between pick areas, and manage SKU flow.

As supply chain specialist Ryan Dooley notes, there are hundreds of such decisions on the warehouse floor. Without real-time data and guided insights, managers get overwhelmed, and space optimization opportunities slip through the cracks.

Operational fragmentation across functions

Space problems tend to emerge when teams optimize for their own objectives without considering facility-wide impact:

- Receiving enlarges staging areas to avoid dock congestion

- Picking claims floor space to shorten travel paths

- Packing creates buffer zones to protect throughput

These changes are rational in isolation, but compete for finite space and gradually disrupt warehouse flow.

Without a single owner for end-to-end space management, ad-hoc decisions accumulate, creating overflow areas, exception zones, and project-specific setups. Space usage drifts from the original layout, even though no formal expansion has occurred.

4. Low productivity of order picking

Efficient order picking balances speed, precision, consistency, and scalability, and commands up to 75% of operational costs and 55% of labor time.

Yet automation is lagging. In 2024, 44% of order picking was still paper-based, creating productivity bottlenecks and high variability in picks per hour.

What contributes to the low productivity of order picking

High travel time

In most warehouses, pickers spend more time walking than picking.

Suboptimal slotting, long pick paths, and static batch sizes force excessive travel between picks. As orders become smaller and more fragmented, travel time dominates labor effort, capping the number of picks per hour.

Manual, cognitively intensive work

Order picking remains highly manual and mentally demanding, especially with paper-based instructions or basic RF scanning.

Pickers, operating under these conditions, have to constantly interpret locations, quantities, and exceptions while navigating busy aisles, slowing execution and increasing variability between workers. Over a full shift, fatigue, training gaps, and error recovery further erode worker productivity.

Process variability and interruptions

Productivity drops when workflows are disrupted by stockouts, equipment shortages, or priority changes.

These bottlenecks force pickers to pause, reroute, or wait for upstream tasks, breaking rhythm and reducing effective pick time. Over time, frequent micro-interruptions compound into significant productivity losses.

How AI technologies address warehouse management bottlenecks

AI technologies can help operations managers address inventory and order management bottlenecks and are emerging as core building blocks for modern warehouse operations.

Let’s look into key technologies bringing value to warehouse floors, selection criteria for platforms providing these capabilities, and the ways industry leaders are putting these tools into practice.

Predictive analytics

Predictive analytics for demand forecasting shifts warehouse management from reactive firefighting to forward planning.

By learning from historical and real-time signals (orders, inventory movements, inbound ETAs, labor productivity, returns), predictive models anticipate congestion, stock risks, and workload peaks in time to adjust before service levels deteriorate.

Capabilities to evaluate in predictive analytics systems

Data coverage and time-series readiness

The platform should ingest and align time-based data across WMS, ERP, and TMS systems. It should handle SKU churn, seasonality, promotions, and missing data without manual intervention.

Forecast granularity and actionable horizons

The solution should forecast at the execution level (SKU-location, carrier cutoff) across relevant horizons (next shift, next week, seasonal). and translate into staffing plans, replenishment triggers, and capacity decisions, instead of cluttering dashboards.

Closed-loop decisioning and workflow integration

Strong platforms pair predictions with triggered actions that range from auto-adjusting reorder points and recommending re-slotting candidates to flagging inbound risks directly in supervisors’ existing tools.

Real-world example: How More Retail improved warehouse productivity with predictive analytics

Approach: More Retail Ltd., one of India’s largest grocery retailers, operates over 600 supermarkets supplied by a network of distribution centers.

The company introduced predictive analytics to improve demand planning and replenishment for fresh and fast-moving products.

By modeling historical sales alongside store-level and supply chain data, they generated forecasts that directly drive ordering and replenishment decisions.

Outcome: After operationalizing predictive analytics, More Retail improved forecast accuracy from 24% to 76%. Planners could now rely on predictions rather than manual buffers.

Stable replenishment signals helped the retailer reduce fresh-produce wastage by up to 30%, easing pressure on write-offs and reverse logistics. Better demand-execution alignment raised in-stock availability from 80% to 90%. This demonstrates how inventory and supply chain optimization for retail directly impacts both operational efficiency and customer satisfaction.

Computer vision

Computer vision for warehouse operations applies image recognition and machine learning to interpret visual data from cameras and sensors.

By continuously analyzing visual inputs, computer vision systems can automate inspection, inventory verification, quality control, and material handling, reducing errors and accelerating workflows.

Capabilities to evaluate in a computer vision platform

Real-time object detection and classification

A warehouse computer vision system should accurately recognize and classify products, pallets, packages, and other objects in live camera feeds. High detection performance with few false positives or negatives is a way to ensure reliable automation of inventory counts and quality checks from visual data.

Integration with WMS and ERP systems

The platform should integrate vision outputs with core warehouse systems so that detected stock levels and quality exceptions update existing workflows and trigger automated actions. Seamless data flow minimizes manual reconciliation and supports closed-loop decision-making.

Edge and latency support

Use cases like automated sortation or robotic guidance require low-latency, on-device processing. That’s why a real-time computer vision platform should support edge computing with minimal lag to support real-time automation.

Real-world example: GXO Logistics adopted computer vision for automated inventory counting

Approach: GXO Logistics, a major U.S. contract logistics provider operating over 1,000 facilities globally, deployed an AI-powered visual inventory-counting system that uses cameras and sensors to scan and interpret pallets and packages throughout warehouses. The system collects 3D visual data and barcode information as it traverses aisles, creating real-time digital inventory records that feed back into operational processes.

Outcome: GXO can now automatically scan up to 10,000 pallets per hour, dramatically accelerating inventory audits compared with manual cycle counts. The new system allows warehouses to maintain up-to-date inventory positions with minimal human intervention.

Intelligent robotic orchestration

Intelligent robotic orchestration uses AI to coordinate fleets of autonomous mobile robots (AMRs), automated guided vehicles (AGVs), and other automated systems.

Instead of isolated actions, orchestration creates a system-level automation layer that improves throughput, reduces congestion, and ensures robots and human staff work in sync.

For manufacturers, this extends beyond the warehouse floor into supply chain visibility platforms for manufacturing, connecting production, inventory, and fulfillment.”

Modern systems also enable robots to adjust in real time to order volume variations, layout changes, and task interference, making fulfillment more resilient.

Capabilities to evaluate in a robotic management system

Real-time fleet coordination and task allocation

The system should assign tasks dynamically based on current demands, availability, and location. This ensures robots are not idle or duplicating work and can respond instantly to congestion or changing priorities without human intervention.

Integration with core warehouse execution systems

Orchestration systems should integrate with warehouse execution and management systems so robotic tasks align with broader workflows: inbound waves, picking schedules, and outbound consolidation. Deep integration enables robots to act on authoritative state data rather than isolated sensor feeds, reducing errors and idle time.

Adaptive path planning and congestion management

Coordinated fleets require advanced path planning that anticipates and reacts to congestion points. The system should balance throughput with safety, minimize deadlocks or collisions, and reroute robots optimally in real time.

Real-world example: How Amazon operates an intelligent fleet of 1 million robots

Approach: Amazon operates one of the world’s largest robotic warehouse fleets, with over one million robots deployed globally. In 2025, the company introduced an AI-based orchestration layer that coordinates robot movement and task assignment across facilities.

The system optimizes fleet-wide travel patterns and dynamically balances work between robots and associates to reduce congestion and idle time.

Outcome: AI-driven orchestration reduced robot travel distance by approximately 10%, improving fulfillment speed, lowering energy usage, and reducing operational costs at scale. Roughly 75% of customer deliveries are now assisted by robotics, highlighting how orchestration has become a core productivity lever rather than an experimental capability.

For operations leaders, the focus is shifting from “Does this technology work?” to “Where will it create the most value?”

Choosing high-yield use cases for AI adoption in warehouse management

Despite hundreds of successful implementations, most warehouse automation projects fail. McKinsey highlights three key pilot blockers:

- Lack of cohesive vision

- Leadership’s poor understanding of the technology

- Strategic misalignment within the organization

With a rapidly growing market of automation technologies and vendors, warehouse managers risk either committing to a drawn-out journey without assessing cost and benefit, or feeling overwhelmed and unable to decide.

To identify the most impactful areas for AI automation, follow the decision-making framework Xenoss engineers use to guide partners through AI adoption.

Define selection criteria for automation use cases

Before committing resources, operations leaders need a clear-eyed view of both upside and effort. To ensure success across the two dimensions, assess automation candidates by the operational value they can unlock and the technical complexity required to capture it.

Criteria for measuring operational gains

Cost leverage

Assess whether the use case directly reduces meaningful cost drivers, like labor hours, overtime, expediting, rework, or error-related penalties. High-yield use cases typically target large, recurring cost pools rather than marginal efficiency gains.

Questions to ask

- Which cost line item does this use case reduce, and by how much?

- Is the cost saving recurring or one-off?

- Would savings still materialize at lower volumes?

Service-level impact

Measure how strongly the use case improves customer-facing outcomes – order cycle time or fill rate.

Use cases with visible service improvements are easier to justify and defend at the executive level.

Questions to ask

- Which service KPI will improve, and is it currently a constraint?

- Can the improvement be measured within a quarter?

- Does better service reduce downstream penalties or churn?

Frequency of execution

Before automating a process, check how often it runs and how many decisions or actions it influences daily.

AI delivers the highest ROI when applied to high-volume, repeatable workflows rather than rare exceptions.

Questions to ask

- How many times per day or per shift does this decision occur?

- How many workers or orders does it affect?

- Is the process stable enough to benefit from optimization?

Risk of operational disruption

Before choosing a use case for automation, make sure it does not interfere with day-to-day operations during deployment.

It’s easier to start AI adoption by testing it on low-risk processes that can be piloted incrementally without changing physical layouts or core workflows.

Questions to ask

- Can this be deployed in parallel with existing processes?

- What happens if the model fails or underperforms?

- Who owns operational decisions during rollout?

Criteria for measuring technical complexity

Data integration complexity

Check how many systems must be connected and synchronized to support the use case.

Use cases that rely on a single WMS or a small number of well-defined data sources are significantly easier to implement than those requiring deep, bi-directional integration across multiple platforms.

Data engineering for WMS and ERP integration determines the complexity and reliability of your automation deployment.

Questions to ask

- How many source systems are required (WMS, ERP, TMS, robotics, sensors)?

- Are integrations read-only, or do they require write-back into operational systems?

Do stable APIs or event streams already exist?

Real-time and latency requirements

Use cases like labor forecasting and shift planning or pick-path optimization based on historical patterns can tolerate batch processing.

Effective computer-vision-based quality control or robotic fleet orchestration, on the other hand, require near–real-time decisions.

The stricter the latency requirements, the higher the engineering effort and operational risk.

Questions to ask

- Does the use case require sub-second, near–real-time, or batch-level responses?

- What happens if data or predictions are delayed?

- Can decisions be buffered or safely deferred?

Model complexity and explainability

Although it’s a common misconception that deploying a more advanced model will improve automation efficiency, simpler models often deliver sufficient value and are easier to validate, debug, and trust.

That’s why the lower complexity of the AI models actually increases the odds of automation success.

Questions to ask

- Would rules-based logic or classical ML be sufficient?

- Do users need to understand why a recommendation was made?

- How will incorrect or unexpected outputs be diagnosed?

Determine potential gains of an automation use case and its complexity by rating the use across each criterion on a 1 to 5 scale.

Thus, the highest-performing use cases should have the highest score on the impact assessment and the lowest score on the complexity scale.

| Slotting optimization | 5 | 4 | 5 | 5 | 19 | 2 | 1 | 2 | 5 |

| Labor forecasting and shift planning | 4 | 4 | 4 | 5 | 17 | 2 | 1 | 2 | 5 |

| Pick-path optimization (dynamic routing) | 4 | 4 | 5 | 3 | 16 | 3 | 4 | 3 | 10 |

| Robotic fleet orchestration and dispatch | 5 | 5 | 5 | 2 | 17 | 5 | 5 | 5 | 15 |

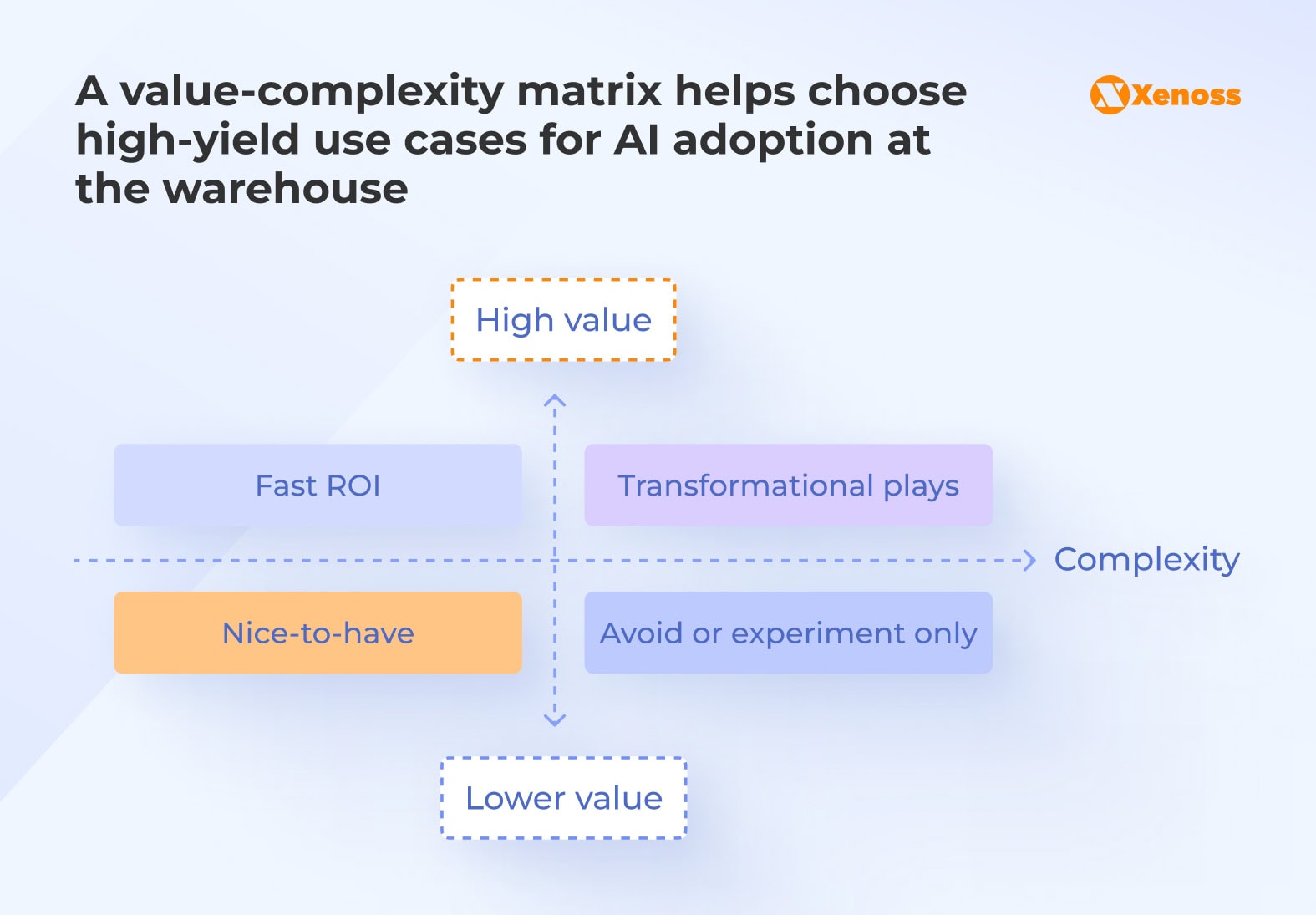

Map all use cases on a gains-complexity matrix

To understand how operational gains and technical complexity align, map use cases on a value-complexity matrix with four categories.

14:44

When prioritizing AI in your warehouse, focus on high-value, low-complexity use cases first

- Fast ROI: High-impact, low-effort use cases that deliver measurable value quickly. Prioritize these first: AI-driven slotting optimization, labor forecasting and shift planning, and basic pick-path optimization based on historical data.

- Transformational investments: High-impact, high-effort use cases with significant upside that require strong technical and operational maturity. This category comprises robotic fleet orchestration, real-time congestion management, computer-vision-based quality control, and end-to-end flow optimization across multiple sites.

- Nice-to-have optimizations: Low-impact, low-effort use cases offering incremental improvements that don’t materially move core KPIs, like automated reporting dashboards, minor rule-based exception alerts, or localized process tweaks that improve visibility but not throughput.

- Avoid or experiment only: Low-impact, high-effort use cases like fully autonomous warehouses or AI systems for rare edge cases. These rarely justify full-scale investment outside controlled pilots or R&D.

The build vs. buy decisiondepends on strategic value, integration depth, and internal capabilities.

AI platforms for warehouse management: build vs buy

Building and buying AI capabilities for warehouse automation are not mutually exclusive strategies. AI strategy development for warehouse automation helps operations leaders determine the optimal approach based on strategic value, integration requirements, and organizational maturity.

Leading organizations typically build proprietary solutions where operational knowledge creates advantage, while leveraging commercial platforms for standardized functionality.

Below, we offer a simplified framework for choosing the optimal approach, but decision-making is more granular, use-case specific, and tailored to the value, integration requirements, and the infrastructure maturity needed to complete a specific AI pilot.

When to build AI capabilities

Build your own AI when the capability is a core competitive advantage, encoding proprietary operational knowledge that materially affects cost, throughput, or service levels.

Building makes sense when the use case requires deep integration with your WMS, robotics, or execution systems, depends on unique internal data, and must operate under customized real-time constraints. It’s also the right choice when the solution will scale across many sites, and long-term control outweighs speed to market.

When to buy AI capabilities

Off-the-shelf solutions work best for standardized use cases where speed to value matters more than differentiation. If batch or advisory decisions are sufficient, integrations are well defined, and you need to minimize operational risk during rollout, buying is the pragmatic path.

Limited internal AI maturity, constrained scope, or predictable licensing costs at scale also point toward buying rather than building.

The table below breaks down more decision-making factors that determine whether you should build custom AI capabilities for automating warehouse operations or choose a software vendor.

| The use case is a core differentiator that materially impacts cost, throughput, or service levels. | The capability is table stakes and widely available across the industry. | |

| The logic is tightly coupled to your layouts, flows, and operating constraints. | The problem is broadly standardized and generalizable. | |

| Value depends on proprietary, high-granularity internal data. | Inputs are mostly generic and easy to abstract. | |

| Deep, bidirectional integration with WMS or execution systems is required. | Integrations are light, read-only, or API-driven. | |

| Real-time or near-real-time decisions are business-critical. | Batch or advisory decisions are sufficient. | |

| The organization can invest longer for a durable advantage. | Fast results are required to justify the initiative. | |

| Strong data, ML, and operational ownership exist in-house. | Internal AI capabilities are limited or stretched. | |

| Long-term scale makes licensing economically unattractive. | Usage is limited, and predictable subscription pricing is acceptable. |

Bottom line

Warehouse automation offers a reliable solution to pressing operational challenges: talent shortages, inefficient space use, and poor inventory control.

Advances in AI and robotics now make it possible to digitize complex workflows and minimize human involvement in picking and sorting. But friction remains since teams struggle to choose the right use cases and decide between software vendors or building AI capabilities internally.

None of these hurdles is insurmountable, but operations leaders should be prepared to rewrite the playbook.

Understanding how to select high-yield use cases, whether to build or buy, and how to scale beyond the pilot helps teams drive tangible value across multiple distribution centers.