A month ago, Oracle decided to terminate the company’s robust AdTech business. The decision came as a sidenote in the data giant’s quarterly revenue report, yet it had a huge ripple effect on the industry.

At the time of writing, over 900 people were affected by Oracle layoffs in 2024, many of whom had been recruited by IAS, DoubleVerify, and other companies.

The company’s customers can use BlueKai, Moat, and other products only until September 30th. All customer support, affected by massive layoffs, is now outsourced to overseas contractors.

For brands that relied on Oracle for AdOps support, the following few months will be a whirlwind of shortlisting partners and building a platform migration strategy. The silver lining is that a drastic change is an excellent opportunity for reflection and reassessment.

We believe that advertisers, whether or not they are Oracle customers, can learn several important lessons from the company’s demise and strengthen their data stacks by analyzing what hindered Oracle’s AdTech growth.

This post will examine five takeaways advertisers should leverage from Oracle’s advertising exit.

Summarizing Oracle’s AdTech journey

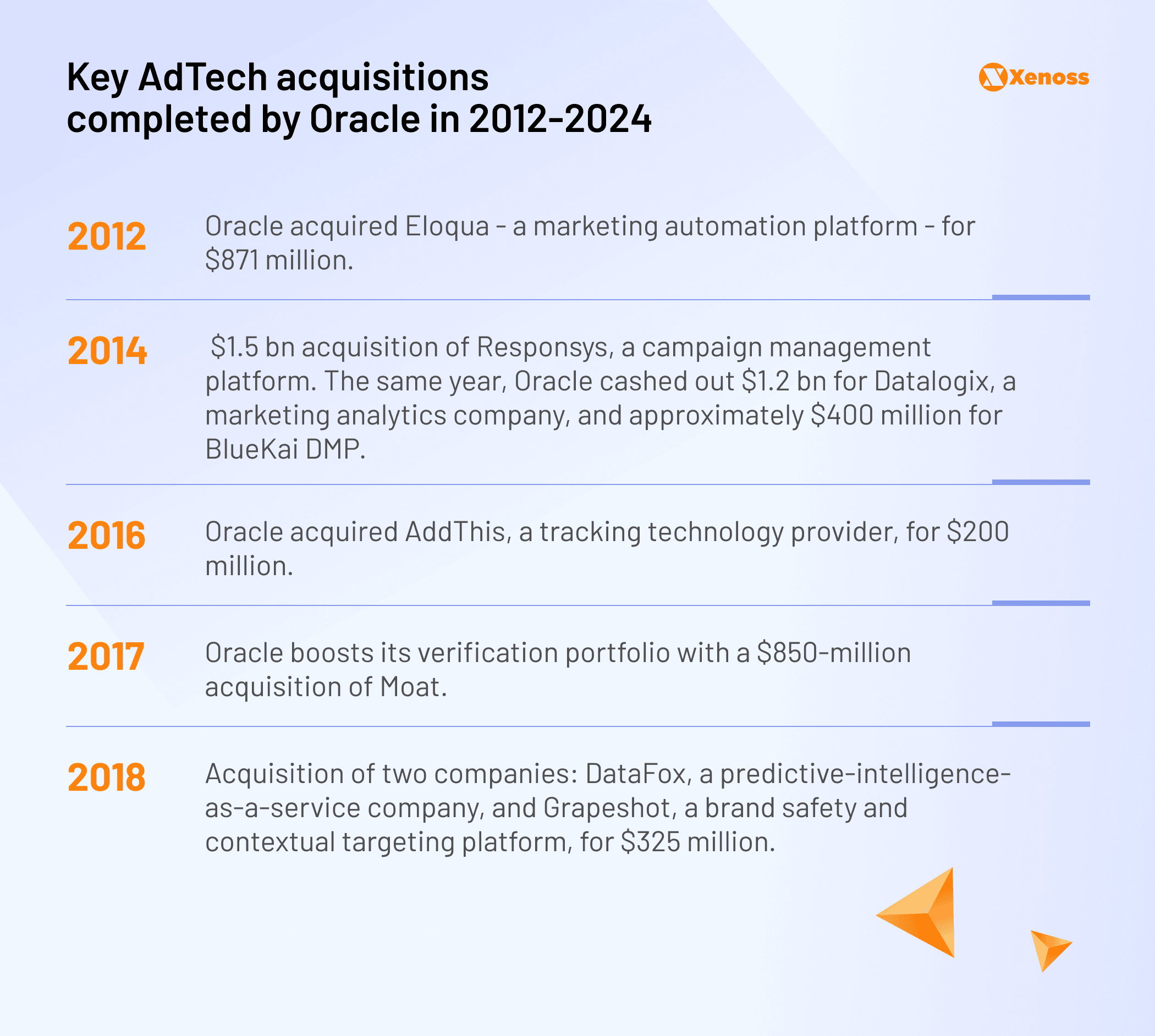

In 2012, Oracle started a “MadTech experiment” designed to bridge the gap between AdTech and MarTech. Over the next 10 years, Oracle continued building a MadTech portfolio:

- 2012: Oracle acquired Eloqua — a marketing automation platform — for $871 million.

- 2014: $1.5 bn acquisition of Responsys, a campaign management platform. The same year, Oracle cashed out $1.2 bn for Datalogix, a marketing analytics company, and approximately $400 million for BlueKai DMP.

- 2016: Oracle acquired AddThis, a tracking technology provider, for $200 million.

- 2017: Oracle boosts its verification portfolio with a $850-million acquisition of Moat.

- 2018: Acquisition of two companies: DataFox, a predictive-intelligence-as-a-service company, and Grapeshot, a brand safety and contextual targeting platform, for $325 million.

A few years ago, Oracle’s MadTech infrastructure was valued at $2 bn and seemed poised for success.

What went wrong?

The first red flags were obvious after the Cambridge Analytica meltdown.

To strengthen its privacy stance, Facebook cut off access to its data for third-party data sellers, including Oracle. GDPR did not help, making it harder to collect and process data from the EU. In 2019, Oracle shut down its AdTech business in Europe.

But the biggest setback was yet to come: third-party cookie deprecation. Oracle’s business relied on using third-party trackers to create customer profiles, and that tracking was not always consensual. In 2022, three plaintiffs filed a lawsuit against the company, dragging Oracle into a drawn-out legal battle.

As advertisers started shifting gears from third-party data to first-party data stacks, Oracle failed to catch up.

Eventually, the company began losing ground to competitors like Salesforce and Adobe, who were luring customers in more aggressively with discounts and new features.

So, while Oracle’s $2 billion revenue in 2022 looks impressive next to the $300 million generated in 2024, it pales compared to Salesforce’s $3.9 billion revenue two years ago.

In 2024, Oracle was sidelined by its competitors, regulators, and the turning tide of AdTech trends.

5 lessons advertisers can learn from Oracle’s AdTech retreat

Most reasons for Oracle’s departure from AdTech can also be obstacles to brands building their in-house stacks. In a rapidly changing landscape, brands must stay ahead of the curve, adjust their toolset to match regulations, and keep up with tech innovation.

Let’s examine the trends revealed by Oracle’s failed AdTech business and examine how brands can improve their AdTech stacks.

#1. Prioritize first-party data

In 2024, brands need to stop relying on second and third-party data signals enabled by tracking cookies and build their strategies around first-party data assets. Two widely accepted ways to do that—data clean rooms and retail media networks—are taking the market by storm.

One of Oracle’s biggest miscalculations was failing to adapt BlueKai to a cookieless world. That fueled customer churn, as brands preferred platforms that support alternative identifiers, cookieless data collection, or direct relationships with publishers to cookie-dependent DMPs.

Advertisers should choose partners who strongly focus on first-party data and cookieless data enrichment.

#2. Diversify partnerships (or build your stack)

As Oracle’s story shows, even the future of previously multi-billion dollar AdTech partners is not set in stone. For many of its customers, Oracle was a one-stop shop for all data capabilities. To replace these functions, teams must build a patchwork of partners. That, while cumbersome, can be a blessing in disguise.

Oracle’s failure to thrive proved the truth behind the adage about not putting all your eggs in one basket. Diversifying partnerships protects advertisers from relying on a vendor who might discontinue operations at any moment. It also encourages brands to choose specialized partners who might have a deeper understanding of specific functions than generalists.

For all its benefits, diversification still has a significant drawback: interoperability. To connect all the dots between the tools in their stack, brands must build integrations and connectors, which can be time-consuming and, most importantly, create vulnerabilities during data transfer.

Building their stack might be a better option for brands that want to have full control over their data. It eliminates vendor dependence, allows for ample customization, and solves interoperability issues.

#3. Reality check your MadTech ambitions

There has been much hype about MarTech and AdTech converging into a single ecosystem. However, Oracle’s failure to build a unified application layer for the two signals that the MadTech merge is yet immature.

According to Gartner analyst Eric Schmitt, “There are certainly key points of intersection between marketing and advertising, such as using first-party customer data as the seed for lookalike models, suppression lists or campaign measurement. However, the broader narrative that martech and adtech are converging has never held up especially well to scrutiny.”

The two industries share different business models and will take time to operate as a whole.

The takeaway from Oracle’s failure is not to discount MadTech convergence altogether—it still seems to be the industry’s focus. Rather, it’s important to acknowledge the unique specifics of each ecosystem and not see MarTech tools as a replacement for AdTech solutions.

#4. Focus on organic growth

Oracle’s AdTech growth was a mind-blowing acquisition binge. The urge to capture a hot market was understandable. Yet, it became equally clear that merging and connecting siloed AdTech pieces was resource-intensive and called for a high level of engineering and domain expertise.

Focusing on AdTech alone distracted the company’s core business, leaving Oracle products siloed until the company left the industry.

Advertisers aiming to build their AdTech stack should take Oracle as a cautionary tale.

While forming ready-to-deploy partnerships with white-label companies has benefits, integrating all disparate pieces of the data stack into a single system presents challenges.

Commenting on the topic, Jonathan Reeve, the VP of APAC at EagleEye, spoke to Techwireasia.

“There is also the technical challenge of merging the technology and processes with different systems, data formats, and workflows needing to be integrated to avoid operational disruptions for clients. As Oracle has found,“ he said, ”this can be expensive, time-consuming, and require significant technical expertise which distracts from the core business.”

A better approach would be prioritizing sustainable growth by identifying your first-line needs and gradually building an ecosystem to accommodate them.

AdTech expertise and know-how are equally important when building frictionless workflows. If your organization’s core activities lie outside of AdTech, you might need more bandwidth to hire and manage an AdTech engineering team. In these cases, hiring a team of experienced AdTech engineering consultants is an optimal way to get your AdTech stack off the ground.

#5. Stay ahead of the curve on tech innovation

Drawing the bottom line on Oracle’s exit from AdTech in the Marketecture newsletter, Ari Paparo notes that lack of innovation is the culprit.

“MOAT was once part of a verification triopoly with DV and IAS but didn’t continue innovating after the acquisition. Grapeshot should have been thriving given the rise of contextual, but not an area where we’ve heard any innovation.”

An Oracle ex-employee makes a similar statement about the company in an interview for Insider: “There hadn’t been any product innovation or development inside the core money-making products for a very long time.”

However, as Oracle stayed still, the industry did not. In the meantime, generative AI was becoming the next big thing in AdTech and MarTech, contextual targeting grew more powerful by the day, and marketers believed that innovation would be key to solving brand safety challenges.

Bottom line

Oracle’s exit from AdTech proves nothing is written in stone for the industry. The robustness of the company’s portfolio, resources, and customers could not prevent it from losing ground to competitors and failing to adapt to the turning tide of data and privacy AdTech innovations.

For brands exploring ways to build a future-proof data stack, the turn of events gives a better idea of where the industry is headed.

Investing in first-party data assets, avoiding vendor lock-in by diversifying or building a custom stack, and leveraging the potential of innovative technologies in building data pipelines are the concerns advertisers need to keep in mind to leverage data and manage campaigns effectively.