| Getting your Trinity Audio player ready... |

December marked the end of 2024 with a series of noteworthy developments in AdTech and MarTech. OpenAI continued to refine its advertising strategy with high-profile hires, while HubSpot expanded its AI capabilities through strategic acquisitions. Meanwhile, key players like AWS and Nielsen rolled out updates that could reshape how data and attention metrics are leveraged in the industry.

This month also highlighted challenges for standalone CDPs as major acquisitions signaled ongoing consolidation in the market. From advancements in personalization tools to shifts in programmatic advertising strategies, the industry closed the year with clear indicators of what to watch in 2025.

Let’s take a closer look at the stories and trends that will influence the months ahead.

Stay with us for insightful recaps, expert analyses, and strategies driving the industry forward. Follow Xenoss MadTech Insider and stay in tune with the trends that matter!

Let’s dive in!

As OpenAI shifts towards a for-profit model, it has been methodically strengthening its advertising and creative departments through key hires. Among them are adam koppel, joining as a creative director from 72andSunny, alongside Dane Vahey, previously of NexHealth, who now oversees strategic marketing. Furthermore, Carrie Lorenzo, another NexHealth alumnus, is leading enterprise marketing initiatives. These appointments are augmented by Varun Shetty, formerly with Meta, as head of media partnerships, and Shivakumar Venkataraman , ex-leader of Google’s search advertising team, now serving as vice president.

Further bolstering their executive team, OpenAI has appointed Sarah Friar as CFO, who brings extensive experience from her previous executive roles at Salesforce, Square, and Nextdoor. Kevin Weil has joined as the chief product officer, leveraging his background in developing ad-supported products at Instagram and X. Moreover, Kate Rouch, the former CMO of Coinbase, has also been hired, adding significant marketing expertise to the team. These strategic hires underscore OpenAI’s serious commitment to expanding its advertising capabilities.

Despite this robust buildup, OpenAI’s approach to advertising is marked by caution and deliberation. CFO Sarah Friar has noted that while the company is exploring the integration of ads, there are currently no active plans to pursue this avenue. Instead, OpenAI remains open to exploring various potential revenue streams that could complement its growth without undermining the trust and engagement of its users.

One potential avenue for OpenAI is to adopt advertising models similar to those used in custom chatbot technologies, where companies like Microsoft and Adzedek have shown that ads can be integrated in a way that is distinct and non-intrusive. This approach ensures that advertisements do not detract from the functionality of chatbots, maintaining the integrity of user interactions as seen in traditional search engine ads.

However, maintaining a clear distinction between ads and chatbot responses is crucial. Any ambiguities in this area could compromise the reliability of the chatbots and, by extension, erode user trust. With its strengthened advertising team, OpenAI is well-positioned to innovate within this domain, potentially setting new industry standards for how ads are integrated into AI platforms, aiming to enhance the user experience rather than disrupt it.

HubSpot to acquire Frame AI, unlocking the power of conversational data with AI

HubSpot augments its capabilities with Frame AI, a conversational intelligence platform that transforms unstructured interactions—emails, calls, and meetings—into actionable customer insights. This acquisition strengthens HubSpot’s AI-powered Breeze suite, delivering smarter tools for uncovering sentiment and behavior.

Hightouch has announced a new integration with LG Ad Solutions

Hightouch ‘s integration with LG Ad Solutions enables precise targeting and suppression for over 40M LG Smart TVs. Advertisers can build audiences directly in their data warehouse and onboard them to LG, ensuring campaigns are accurate, privacy-safe, and aligned with the latest audience data.

NIQ finds AI ads annoying and boring to consumers

Research from NielsenIQ reveals that consumers find AI-generated ads annoying, boring, and cognitively taxing, creating a “negative brand halo” effect. These ads struggle to activate memory, reducing impact, while their low-quality visuals often distract from key messages, risking brand equity.

Experian enhances identity and activation capabilities with Audigent acquisition

Experian acquires Audigent, a part of Experian, enhancing its marketing data and identity capabilities. Audigent’s first-party publisher data and inventory boost Experian’s audience targeting with sell-side distribution. This move strengthens privacy-forward, audience-based marketing across all channels.

ActionIQ to be acquired by Uniphore

Uniphore’s acquisition of ActionIQ and Infoworks.io highlights the evolving role of CDPs in the enterprise data landscape. ActionIQ, known for its warehouse-native and real-time data capabilities, faced stalled growth despite a solid enterprise customer base. Infoworks, focused on cloud data migration, complements Uniphore’s strategy to integrate AI systems directly with enterprise data. Uniphore’s “Zero Data AI Cloud” vision, while ambitious, still relies on data processing and storage, making a true zero-copy approach unlikely.

This move underscores the challenges standalone CDPs face as they adapt to a market increasingly dominated by cloud ecosystems and AI-driven platforms. Businesses continue to demand unified customer data solutions, pushing CDPs to innovate or align with larger players.

Contentstack acquires Lytics, the leading real-time customer data platform powering hyper-personalization

Source: Contentstack

The acquisition of Lytics by DXP Contentstack marks another chapter in the evolving CDP landscape. This isn’t just about a merger; it’s a reflection of shifting industry priorities and the challenges standalone CDPs face in staying afloat. Lytics, despite its technical brilliance—offering real-time features, composable options, and integrations with content management systems—fell short of scaling its vision. Its $58 million funding pales in comparison to competitors like ActionIQ, and a dwindling headcount hinted at internal struggles.

On the flip side, Contentstack appears to have made a smart move. With over 500 customers and a composable architecture that aligns perfectly with Lytics’ capabilities, the synergy is undeniable. The integration could pave the way for more intuitive and efficient personalization, something every marketer craves in today’s experience-driven world.

But let’s not gloss over what this deal says about the broader CDP ecosystem. For all the hype around composable solutions, neither Lytics nor ActionIQ could leverage this trend into independent success. The reality? Component-based pricing might be too low to sustain growth, especially when market competition keeps it tight. Vendors like Hightouch and Census are diversifying their offerings to maximize revenue per client, but it’s clear that survival often depends on being scooped up by larger ecosystems.

While this acquisition isn’t the long-predicted consolidation of CDP vendors merging with each other, it does signal a thinning of independent players. Instead of vanishing, advanced tech like Lytics finds new life within broader platforms. This trend will likely accelerate as customer experience vendors seek embedded CDPs to power their personalization engines.

The takeaway? The definition of a CDP is evolving, and the ability to integrate seamlessly with external systems remains the gold standard. In a market where no single vendor can own every customer touchpoint, collaboration and interoperability are more critical than ever. Lytics may not have reached the top solo, but as part of Contentstack, its technology has a chance to shine.

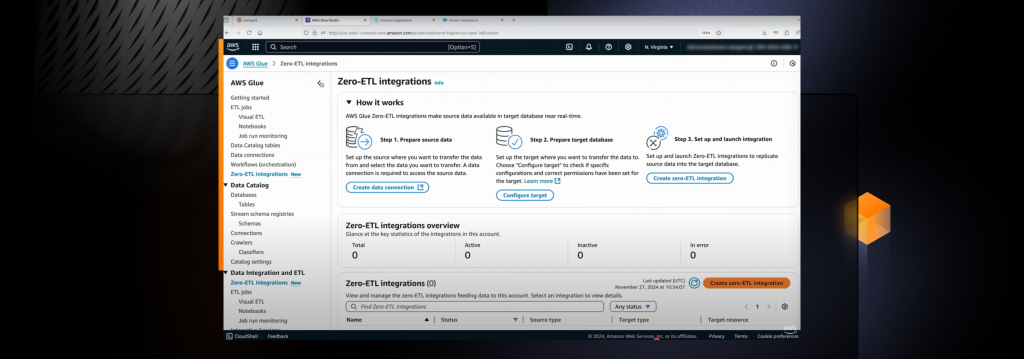

AWS enables seamless access and management of enterprise data across lakes and warehouses

Amazon Web Services (AWS) introduced Amazon SageMaker Unified Studio, allowing seamless access to data across lakes, warehouses, and applications without duplication. SageMaker’s Zero ETL feature eliminates complex pipelines, enabling direct analytics on application data. The new SageMaker Lakehouse offers an open, unified platform for managing data, with Apache Iceberg API support for easy integration with third-party tools.

Nielsen expands its measurement suite with Realeyes – Vision AI, introducing AI-driven attention heatmaps to pinpoint what captures viewer focus. This integration transforms ad evaluation, linking creative engagement directly to sales outcomes, setting a new standard for precision in advertising analytics.

Integral Ad Science launches its Quality Attention Optimization tool, in collaboration with Lumen Research , to enhance ad campaign performance using attention metrics. This AI-driven solution integrates eye-tracking and media quality data, offering advertisers up to 130% better conversion rates by focusing on high-attention impressions. The tool aims to streamline both programmatic and social campaigns, providing a more precise measure of consumer engagement and ad spend efficiency.

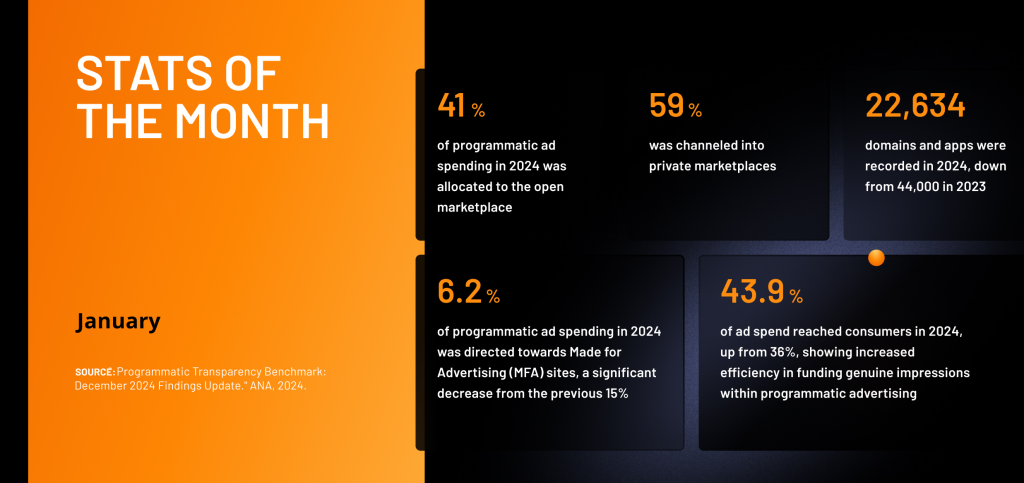

As 2024 wrapped up, the programmatic advertising world ended on a high note, revealed in the insights from the Programmatic Transparency Benchmark. Authored by the teams at Association of National Advertisers and TAG , the report captured an industry in evolution, showcasing a strategic pivot towards premium advertising spaces and a boost in ad spend efficacy. With a sharp decline in investments in low-value sites and a leaner, more focused approach to platform use, the landscape is shifting towards a higher caliber of engagement and efficiency. This positive momentum, crafted by leading industry experts, not only crowned the year with success but also set the stage for an exciting trajectory into 2025.

This wraps up our newsletter. We’ll keep you informed every step of the way, so be sure to follow Xenoss MadTech Insider to stay updated.